Micron: No Rebound In Sight

Summary:

- Micron has reported a very weak Q1 FY 2023, with revenue and profitability declining rapidly.

- Its guidance was also quite weak and management’s expectations for a rebound during mid-2023 is highly uncertain.

- Micron’s valuation is not cheap compared to its historical pattern, thus its share price weakness may continue.

vzphotos

Micron Technology (NASDAQ:MU) reported another very weak quarter and guidance for the coming quarter is also weak, plus its valuation is not cheap enough. This means that further share price weakness may lie ahead and investors should avoid its shares for the time being.

As I’ve analyzed in previous articles, even though I’m bullish on the semiconductor industry’s growth prospects over the long term, Micron has not been one of my favorite plays in this investment theme. While I owned this stock for a few months at the end of 2021 as a tactical play, when cyclical conditions started to weaken I rapidly sold my position, as Micron’s business is highly cyclical and share price downside was likely ahead.

Indeed, since the beginning of 2022, Micron’s share price is down by some 45% and more pain may lie ahead, as Micron’s recent earnings and guidance was clearly weak, which means a rebound isn’t very likely in the short term.

Q1 FY 2023 Earnings Analysis

Last night, Micron reported its financial results related to first quarter of fiscal year (FY) 2023, which were slightly below expectations both at the top and bottom lines.

In the last quarter, its revenue amounted to $4.1 billion, down 39% from the previous quarter and 47% YoY, as challenging market conditions continued in recent months. This revenue was at the bottom of its guidance range provided at the end of Q4 FY 2022, when Micron was expecting to generate revenue in the range of $4-$4.5 billion in the following quarter.

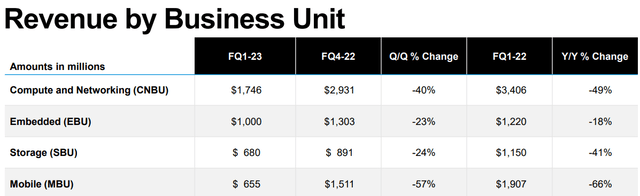

According to Micron, the industry is facing a severe imbalance between supply and demand, in both DRAM and NAND, which is leading to a weaker pricing environment than the company was expecting some months ago. This explains to a large extent Micron’s revenue collapse, with weakness coming from all business segments, even though compute and networking and mobile were particularly weak.

Revenue (Micron)

While this weak operating environment was not a surprise, inventory levels at customers remain at high levels and is impacting demand and pricing, a situation that Micron only expects to improve by mid-2023. This means that the next two quarters should continue to be weak for the company’s operating trends, while a rebound is quite uncertain as economic prospects aren’t particularly good, thus a rebound may take longer to happen compared to Micron’s current expectations.

As I’ve analyzed in previous articles, pricing risk is mainly on Micron’s side because its customers can change pricing conditions from the moment of order to delivery. This means that Micron is highly exposed to the supply-demand situation in the industry, which can change dramatically in a relatively short period of time, as shown during the past few quarters.

Due to this profile, Micron’s pricing power is quite weak, leading to a very volatile revenue stream and wild swings in its profitability, in just a matter of months. Indeed, during a down cycle like the company is experiencing now, beyond lower revenues, the company also reports significant declining margins.

While its gross margin was resilient in FY 2022, reported at 46% for the full year and 40.3% in Q4, in the current quarter its gross margin plunged to only 22.9%, the lowest level since the last quarter of FY 2016. This is another signal that Micron is highly exposed to economic cycles and that its pricing power is rather low, as business margins can change dramatically from quarter to quarter.

Beyond lower revenue and business margins, another negative factor for the company’s earnings were rising expenses, given that operating expenses amounted to $1.1 billion in the quarter, representing an increase of close to 18% YoY. This also contributed to an operating loss in Q1 of $209 million (vs. profit of $2.6 billion in Q1 FY 2022), and a net loss on the bottom-line of $195 million, or loss of $0.18 per share.

Due to this rapid collapse in profitability, Micron is taking steps to reduce costs in the next year, of which the most important one is the reduction of about 10% of its global workforce. It aims to achieve quarterly operating expenses by the end of this fiscal year of around $850 million, or about 22% below the current quarter expenses.

In addition to operating expense cuts, Micron is also slashing its capital expenditures (capex) for the next couple of years, on top of previous reductions announced in the previous quarter. While previously expecting capex to be about $8 billion in FY 2023, its capex guidance is now expected to be between $7-$7.5 billion (vs. $12 billion in FY 2022), and even lower in 2024. While Micron will continue to construct new factories, its wafer fab equipment (WFE) production is expected to reduce by some 50% YoY in FY 2023, which is quite negative for WFE suppliers, such as Applied Materials (AMAT) or ASML (ASML).

Due to this combination of lower earnings and still considerable capex ($2.5 billion in Q1 FY 2023), Micron’s free cash flow was negative by $1.5 billion in the past quarter, a worrying trend regarding cash flow generation. While the company still has a net cash position of $1.8 billion, if operating trends don’t improve markedly in the coming quarters, its balance sheet position will rapidly deteriorate.

Therefore, while for the time being Micron can maintain its shareholder remuneration policy, both through dividends and share buybacks, if it continues to burn cash, this capital return policy is likely to be suspended. This would represent another blow to its share price, and the likelihood of this happening has clearly increased during the past quarter.

Regarding its guidance for the next quarter, it expects revenue to be between $3.6-$4.2 billion, gross margin to decline even further to 6-11%, and it expects to report a net loss for the quarter of $0.52-$0.72 per share. This guidance is quite poor after a terrible quarter, showing that the current downturn is much more severe than expected and is lasting longer than previously expected (as Micron was recently saying that a rebound was likely in the first months of calendar 2023). Investors should note that market dynamics remain quite uncertain at this time, especially regarding demand, and forecasting a rebound in the second half of 2023 should be taken with a grain of salt.

Medium-Term Estimates & Valuation

Micron has reported another negative set of results and expectations for the near future are not much better, thus it is quite difficult to forecast how its business will evolve over the medium term. As I’ve said before, its business is highly cyclical and financial figures can change dramatically on a quarterly basis, thus medium-term estimates are quite prone to revisions in the coming months.

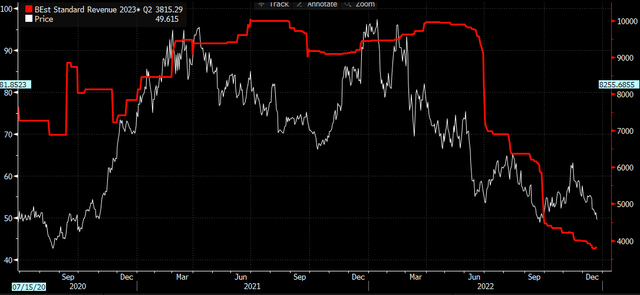

For instance, revenue estimates for Q2 FY 2023 are now in-line with the company’s guidance at about $3.9 billion, but they were around $10 billion just six months ago (red line in the next graph), showing how rapidly Micron’s operating trends have deteriorated over the past couple of quarters.

Revenue revision (Bloomberg)

Nevertheless, according to analysts’ estimates, Micron is expected to generate some $17 billion in revenue during FY 2023 (-45% YoY), while in my previous article the market expectation was for revenue to be about $21 billion. The street is currently expecting 2023 to be the bottom of this down cycle, as revenue should rebound to $24 billion by FY 2024, followed by growth to $29 billion of revenue by FY 2025.

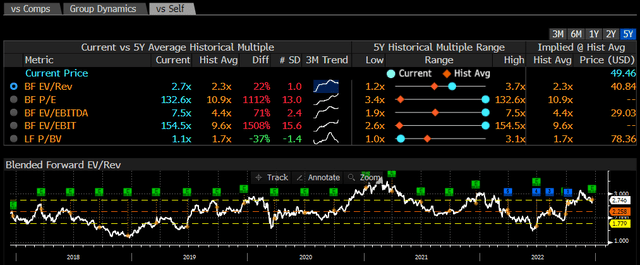

Regarding its valuation, as Micron is now expected to report losses in FY 2023, its forward price-to-earnings ratio is now not meaningful. Therefore, the best metric currently to value its shares is EV/revenue, which is now trading at some 2.7x forward revenue, which is above its historical valuation over the past five years (2.3x forward revenue).

Valuation (Bloomberg)

Considering that Micron is reporting very weak financial figures and prospects in the short term are not particularly good, its valuation doesn’t seem to be justified and should trade at a discount to its historical average. Therefore, its shares appear to be overvalued and further downside may lie ahead.

Conclusion

Micron’s operating momentum continues to be quite weak and should not improve rapidly, while the company’s expectations of better conditions by mid-2023 are highly uncertain. Moreover, its valuation is not very attractive considering that Micron is facing a severe down cycle, this stock should be avoided for the time being.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you are a long-term investor and want to be exposed to several secular growth trends, check out my marketplace service focused on different secular growth themes, namely: Digital Payments / FinTech, Semiconductors, 5G / IoT / Big Data, Electric Vehicles, and the Metaverse. If this is something that you may be interested in sign up today.