Summary:

- The company is seeing good demand from commercial and institutional customers as the economy reopens.

- As supply chain constraints ease, the company should be able to convert its pending backlog orders into revenue.

- The company’s margin should benefit from the higher price realization and stabilization of higher input costs.

- Valuations are attractive.

monsitj

Investment Thesis

Acuity Brands (NYSE:AYI) has been experiencing strong demand for its products, leading to good volume growth over the last few quarters. The strong demand also benefited the company’s order book, resulting in elevated order backlog levels, which are higher than historic levels. The company has higher inventory levels of unfinished products due to supply chain constraints. Looking forward, I believe that as the supply chain constraints ease, the company should be able to convert its pending orders into revenue. The higher order backlog levels should support the company’s revenue growth prospects even if there is a slowdown in the economy. The company’s margin should also benefit from the higher price realization and stabilization of input costs. The stock looks attractive, trading at 14.15x FY22 consensus EPS estimate and 13.65x FY23 consensus EPS estimate.

Revenue Outlook

Over the last few years, AYI has been making significant improvements in its execution, which has benefited its revenue growth even during times of supply chain constraints. The company improved its service levels, made changes to its manufacturing processes to ensure consistent production, worked with its suppliers to help find the necessary components, and made engineering changes in its products based on the supply of components that were available to ensure minimum disruptions from component unavailability. The company has been able to post double-digit Y/Y revenue growth over the last five quarters due to strong end-market demand, higher price realization, and volume growth. AYI’s strategy to focus on investing in product vitality and services and using technology to differentiate its products is getting reflected in the company’s performance. The volume growth of the company over the last few quarters has been driven by the company’s product vitality efforts in both the lighting and intelligent space businesses. Product vitality includes improvements to the existing products and the introduction of new products to the market.

AYI’s end markets include both non-residential and residential construction customers. While there are some concerns about residential end market, particularly on the new construction side, I believe non-residential growth should more than offset it as the economy continues to reopen. The company is experiencing strong demand in its non-residential end market, particularly in commercial offices, education, and industrial facilities. The renovation and retrofit market is also proving to be strong, and the revenue from the corporate account channel increased 34% Y/Y in the last quarter. The revenue for this channel primarily depends on renovations done by its commercial customers. Because of the strong demand in the market, the order backlog at the end of the third quarter of FY22 was above the company’s historic levels.

In the last quarter, the company’s inventory levels increased Y/Y in terms of dollar basis and days. This was due to the increased lead times of Asian finished goods, increased inventory from the OSRAM DS acquisition, inflationary costs of materials, and increased levels of inventory to mitigate the impact of shortages. To address the higher level of inventory, the company has lowered its purchase of Asian finished goods as the lead times are improving, is controlling the purchase of components, and manufacturing products in line with demand.

Looking forward, I believe that even though the new construction activity is softening due to the rising mortgage rates and higher home prices, the company should benefit from the strong demand in the retrofit and remodel industry. The investments made by the company in product vitality and services should also help its growth. Additionally, the elevated order backlog and the easing in supply chain constraints should benefit revenue in the fourth quarter of FY22. The higher order backlog levels should support the company’s revenue growth prospects even if there is a slowdown in the economy. I believe the company should be able to achieve revenue growth for FY22 in between the low double digits and mid-teens, which is above the company’s guidance of high single digits.

Margins

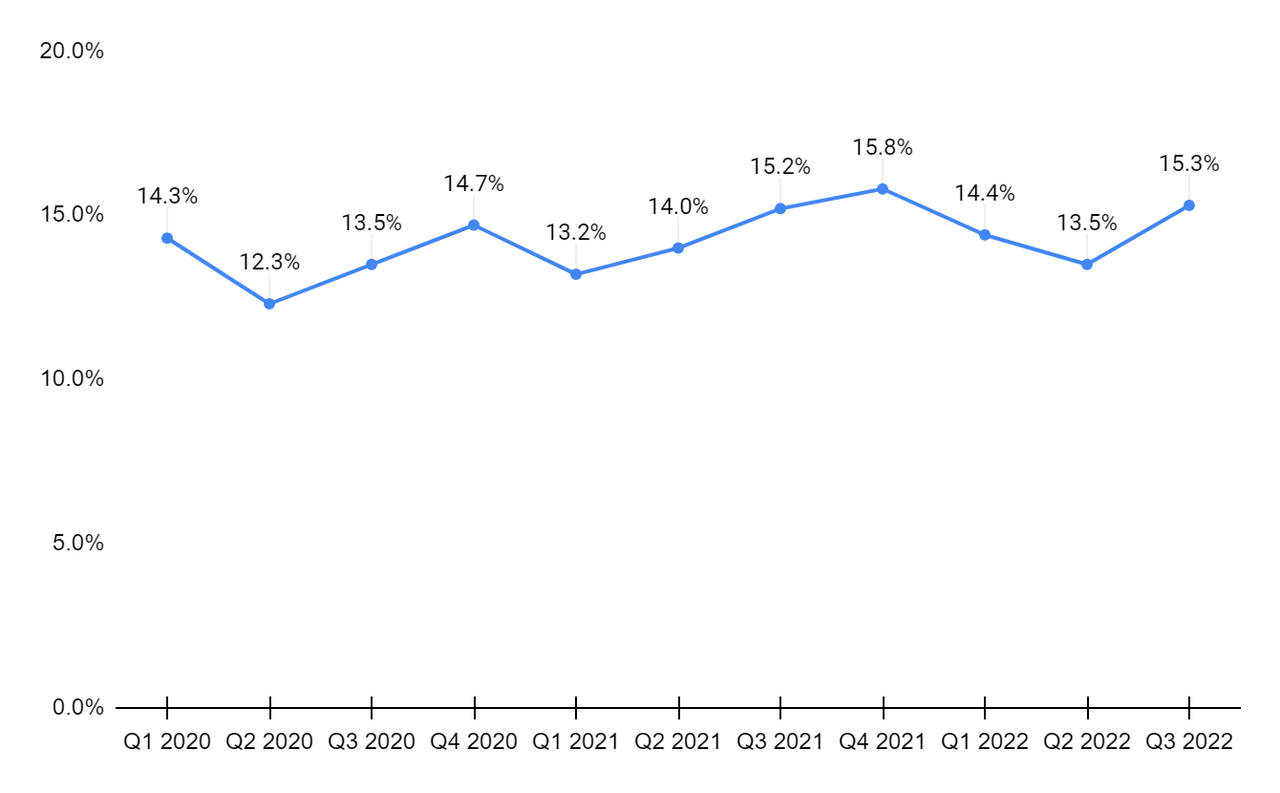

The adjusted operating margin of the company dropped in the first half of FY22 due to rising inflationary pressure on components and freight. However, the company was able to improve its margin sequentially and Y/Y in Q3 FY22 by leveraging operating expenses and implementing price hikes to offset higher input costs. The company took another price hike at the end of June and plans for future price hikes if inflation continues.

AYI’s adjusted operating margin (Company’s data, GS Analytics Research)

Looking forward, I believe higher price realization, operational leverage, and stabilization of higher input costs should improve the company’s margin.

Valuation & Conclusion

The stock is currently trading at 14.15x FY22 consensus EPS estimates of $12.63 and 13.65x FY23 consensus EPS estimate of $13.08, which is a discount to its five-year average forward P/E of 15.04x. The company also has a good track record of share buybacks and has repurchased approximately 17% of its shares since May 2020 helping create shareholder value. I have a buy rating on the stock given its attractive valuation and good revenue and margin growth prospects.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.