Summary:

- AYI has market dominance in the Electrical Lighting and Wiring Equipment Industry.

- AYI has excellent fundamentals and is fairly priced through Discounted Cash Flow Analysis.

- AYI continues to beat quarter expectations.

- AYI is investing in growth through new technologies, R&D, and PP&E.

- AYI is buying back shares and paying dividends.

Vera Kornienko/iStock via Getty Images

Thesis

Acuity Brands is a Strong Buy for five reasons:

- They have market dominance in the Electrical Lighting and Wiring Equipment industry.

- They have excellent fundamentals and are fairly priced through conservative DCF analysis.

- They continue to beat quarter expectations.

- They are investing in product line growth through new technologies, R&D, and PP&E.

- They are buying back shares and paying dividends.

Business Overview

Acuity Brands (NYSE:AYI) leads the Electric Lighting & Wiring Equipment Market in the industrial sector. They are a designer and manufacturer for many lighting applications. Stated in their 10-K, their product lines include lighting for indoor, residential, industrial, and outdoor applications. They also manufacture controls, components, building management systems, and location-aware applications. During the fiscal 2021, they separated their product lines into the ABL segment and ISG segment. The ABL segment is primarily lighting solutions and comprises of 95% of revenue streams. ISG delivers products and services aimed around smart, safe, and green technologies, which is about 5% of revenue streams. AYI’s product line is a necessity. Lighting in all forms has been essential to humans since the discovery of fire and I don’t see this changing anytime soon.

Market Dominance

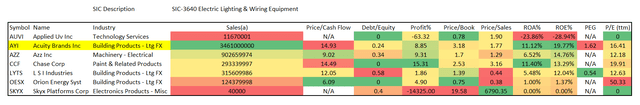

One reason I have AYI rated as a Strong Buy is they have competitive market advantage and are fair valued comparatively. I first compared AYI’s financials and fundamentals to the total US Electrical Lighting and Wiring Equipment industry using the Finviz stock screener. The purpose of this analysis was to see how well AYI’s product line competes in the Lighting and Wiring Equipment industry, and if AYI is fairly priced.

AYI’s sales are about 3.8 times that of the next company, AZZ Inc. (AZZ). They have competitive profit margins and their return on equity numbers are outstanding. Because of these metrics, I believe AYI truly is a market leader in the Electrical Lighting and Wiring Equipment Industry.

AYI’s valuation ratios look competitive as well. Their P/E is in line with the rest of the companies. They are one of the only companies with a positive PEG. They also have competitive values for Price/Book and Price/Sales. Because of these values, I believe AYI could be fairly priced.

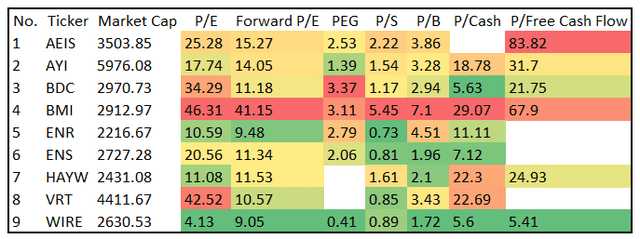

While comparing AYI’s financials and valuations to the Electrical Lighting and Wiring Equipment Industry provided a sense of confidence for their market dominance, and current fair price, a second comparative analysis was performed. I compared AYI to other businesses of similar market cap in the overall Electrical Equipment Industry using Barchart stock screener. The purpose of this analysis was to understand how well AYI’s product line compared to other product lines in a more widespread industry.

If I had to rank where AYI sits strictly by this analysis, I would put them in the number two spot, behind Encore Wire (WIRE). They have competitive valuations on all fronts, including a positive Price/Free Cashflow, that many of the businesses struggle with. Based on this information, I believe AYI’s product line could be fairly priced compared to a broad range of completely different products in a similar industry.

Fundamentals

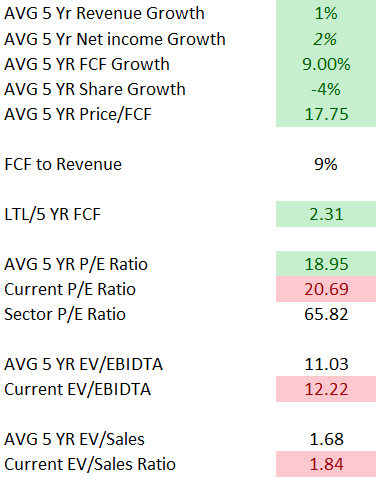

Five Year Valuations and Comparisons (Author)

Further analysis was done regarding their own fundamentals over the last five years. They have an excellent FCF to revenue value and their liabilities seem to be paid off in about 2.31 years, which is favorable. Their P/E, EV/EBIDTA and EV/Sales all seem in line as well. They show growth in revenue, net income, and cash flow despite a horrible 2020 during the pandemic and battling other supply chain issues. They are also buying back shares over the years and plan to continue so long the stock is cheap. Through the market analysis and fundamentals, I feel AYI is a market leader, and most likely fairly priced in the market.

Quarterly Performance

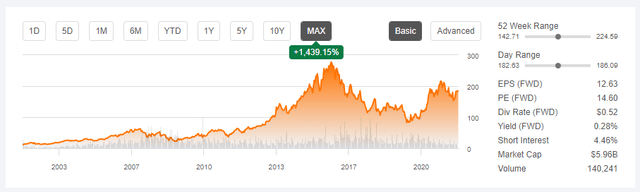

Another reason I have AYI as a Strong Buy is they continue to beat quarter expectations. Investors were willing to pay $215 per share just a year ago and almost $280 six years ago and the stock still sits well below these even with excellent Q2 results.

AYI Share Price (Seeking Alpha)

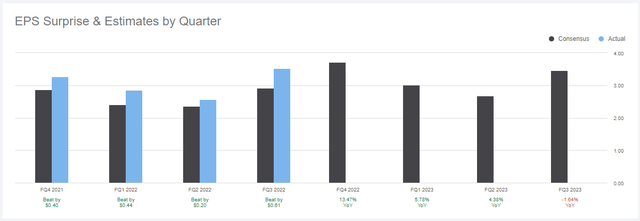

EPS Expectations (Seeking Alpha)

AYI has continued to beat analysts’ predictions for the last four quarters. I believe analysts are not giving this company enough credit for the incredible market advantage they have and are being too conservative on valuations.

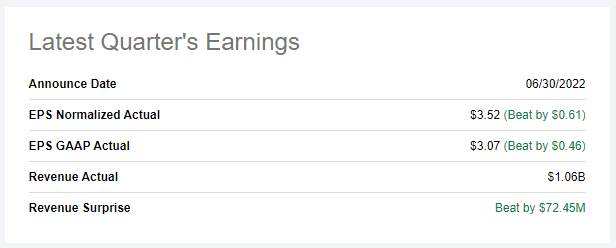

Q2 Earnings (Seeking Alpha)

AYI performed well last quarter beating all fronts as well. After a dismal 2020 due to COVID-19, supply chain shortages, and the lack of new building/renovations for new lighting products, AYI has really turned around their efforts. Overall, I believe a trend of continuing to beat expectations provides a sense of confidence that this company is deemed undervalued.

Company Growth

I also have AYI as a Strong Buy because they continue to invest in company growth. As mentioned, AYI has dedicated 5% of revenue streams to their ISG segment. This includes products and services aimed around smart, safe, and green technologies. Furthermore, they continue to increase Research and Design funding. Stated in their 10-k, AYI has increased expenses from $74.7 million to $82.0 million to $88.3 million in 2019, 2020, and 2021 respectfully. In a competitive and ever-changing industry, such as lighting solutions, it’s good to see this business continuing to fund research and design to ensure continuous improvement. Additionally, AYI continues to invest in growth with $38 million and $36 million in PP&E in nine months ended in 2022 and 2021 respectfully with a plan to invest 1.5% of net sales during fiscal 2022, along with increasing inventory to help growth and mitigate supply issues. For a product line that may receive flack for being unexciting, AYI is funding the correct segments to ensure they capture and retain market share moving forward.

Dividends and Share Buy Backs

AYI is a Strong Buy because they are increasing their dividend and plan on buying back shares as well. AYI paid $0.39 per share in 2021 and 2022 for dividends. It sits at 0.28% quarterly. They have also repurchased 2.3 million shares in the first 9 months of 2022 with a maximum of 3.5 million directed by the board’s share repurchase program. If the stock remains cheap in the board’s eyes, I expect them to continue this effort. Buying back shares at a discounted price rewards the investor by reversing shareholder dilution. I attribute the dividend and buy backs to a couple cherries on top. Though they may not be as powerful as the market advantage, product line, and fair valuation, but combining dividends and buybacks could result in an extra 2% a year for the investor.

Discounted Cash Flow

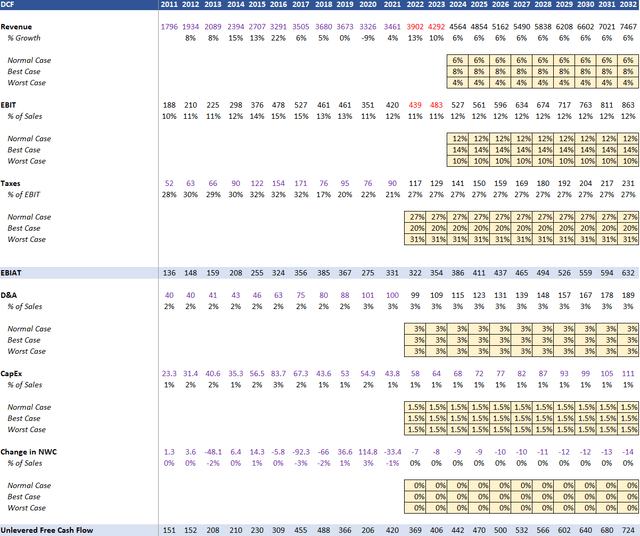

A fair value of $171 per share was calculated by a 10-year Unlevered DCF analysis using CAPM and averaging a worst case, best case, and normal case scenarios. Revenue and EBIT projections were used from average results of (13) analysts for 2022 and 2023 from Financial Modeling Prep. Personal projections were used thereafter with the following conservative assumptions:

Revenue

- Normal Case Scenario: 6% YOY

- Best Case Scenario: 8% YOY

- Worst Case Scenario: 4% YOY

EBIT

- Normal Case Scenario: 12% YOY

- Best Case Scenario: 14% YOY

- Worst Case Scenario: 10% YOY

Taxes

- Normal Case Scenario: 27% YOY

- Best Case Scenario: 20% YOY

- Worst Case Scenario: 31% YOY

D&A: 3% YOY

CapEx: 1.5% YOY

Change in NWC: 0% YOY

WACC: 10%

Terminal Growth Rate: 2.5%

Margin of Safety: 10%

Judgement Day: 2032

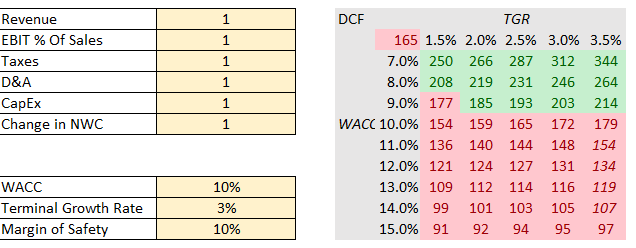

Discounted Cash Flow Assumptions (Author)

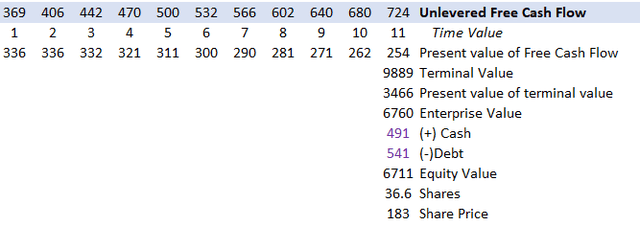

After the assumptions were made, Unlevered Free Cash Flow was calculated and discounted to find a fair value.

Fair Value Calculation (Author)

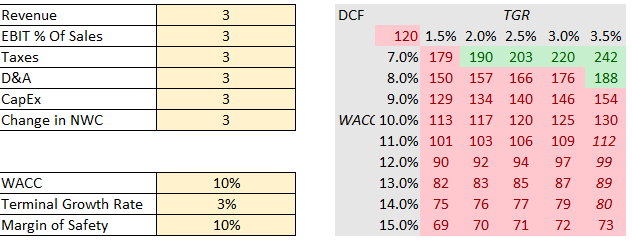

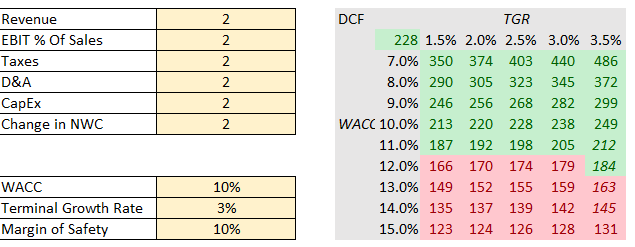

This was repeated for the three different cases and shown in each sensitivity table.

Normal Case (Author)

Worst Case (Author)

Best Case (Author)

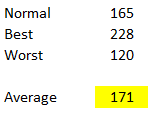

An average of the three cases was taken to find a fair value of $171.

Final Fair Value (Author)

AYI seems to be in a buy range even with very conservative values for revenue growth and a margin of safety. This doesn’t even include the share buybacks, or the quarterly 0.28% dividends. Overall, these analysis’ provided enough confidence to determine AYI is market dominant and fairly valued.

Risks and Mitigants

There are a couple risks that may affect the investors opinion moving forward. The first is that AYI’s sales are significantly dependent on new construction, renovations and retrofits. Simply put, if the market is not building new facilities or updating old ones, then the demand for lighting solutions is not present, other than spare parts. Long term investors should not be worried about these risks as there will always be a market for construction and retrofitting of new buildings and facilities. However, short term investors should be wary as this market is cyclical in nature and one could see losses by investing during high years and selling during low years.

The second risk is related to their supply chain. As stated in their 10-K, AYI plans to reduce the number of suppliers to improve the cost effectiveness of their bought materials and products. Though turning one positive, this could generate a new problem in reliance of a single supplier for a specific product. With AYI’s product line being so vast and diverse, I do not expect this to be a problem. However, if they have single suppliers for one specific material or electronic that is implemented in most of their products, then I would expect AYI’s margins to dip. Detrimental changes related to these risks may turn the investor away.

Conclusion

It is a culmination of the reasons discussed why AYI would be a great addition to someone’s value focused portfolio. Being a market leader in a product line that will be in demand provides a moat and a sense of security in the business itself. They continue to invest in their company growth and new product line technologies, to stay ahead of the market. These reasons alone don’t mean it’s at a discount, but it shows the business outlook is very promising. When we dig deeper in the fundamentals, DCF, and comparing valuations to other competitors, we see that AYI is at a great price as well. There are also rewards with share buybacks, and a a growing dividend to make the stock even more favorable. As mentioned, there are some short term and cyclical risks, but I believe these are mitigated through long term holding. Finding value stocks in the current market is a bit tricky, but I believe AYI is one company that provides light at the end of the tunnel.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AYI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.