Summary:

- T has quietly partnered with multiple market leaders to address the growing 5G connectivity needs in the automotive industry over the next decade.

- The early success of T’s ambitious endeavor is undeniable, with 55M connected vehicles under its network by FQ3’22, suggesting 44% of the global market share.

- A multi-year partnership with GM may also provide the critical tailwind for T’s growth and 5G adoption, as the automaker dreams of producing only EVs from 2035 onwards.

Tom Merton/iStock via Getty Images

The 5G Automotive Investment Thesis

AT&T Inc. (NYSE:T) has big dreams indeed, after aggressively shedding its media segments thus far. The company aims to conquer the automotive industry next, which may be its golden ticket to sustainable growth over the next decade as one of the leading US telecoms offering 5G products. The management has been investing in new technologies, such as 5G edge computing, to enhance the capabilities of its network and improve the customer experience across multiple end-market. Specifically, we will be discussing its market opportunities in the automotive segment.

Fun fact, this is what ChatGPT has to say about the potential applications of 5G in the automotive sector, which T & the author thoroughly concur with:

ChatGPT

In an interesting turn of events, T, General Motors (GM), and Microsoft (MSFT) quietly announced a partnership in August 2021 to bring 5G cellular and cloud connectivity to millions of GM vehicles in the US over the next decade. The dream of launching the world’s largest fleet of 5G-enabled vehicles is the culmination of a 2Y collaboration in 5G-connected vehicles. This also builds on the fact that the next decade’s automotive industry requires high-performing and expanded-capacity cellular networks to meet the needs of real-time autonomous EVs.

Furthermore, the partnership with GM may encompass future opportunities across the automaker’s strategic partners for interoperability and scale across e-commerce, smart city, and vehicle-to-electric grid. Santiago Chamorro, GM VP of Global Connected Services, said:

As an in-vehicle connectivity leader, this rollout demonstrates our commitment to growth through software-enabled services and reimagining every customer touchpoint by enabling faster connectivity speeds to power in-vehicle voice-enabled services, navigation and apps that our customers have grown to love. (General Motors)

T already boasts 55M connected vehicles under its network by FQ3’22, suggesting 44% of the global market share then. There are also immense opportunities over the next few years, since market analysts project up to 2.5B of globally connected vehicles by 2030. The multi-year partnership may also be successful, since the automaker plans to produce 1M electric vehicles annually by 2025, while producing only EVs from 2035 onward. The company delivered 6.27M vehicles in FY2021, with 4.37M completed YTD. Assuming a similar delivery cadence by 2025 and an exclusive contract with T, it is not too ambitious to assume an additional 6M 5G-connected users on the road by 2030.

In addition, GM’s Cruise received the permit for autonomous robotaxi, with paid service already rolled out in multiple cities, including San Francisco, Phoenix, and Austin. According to the Cruise CEO, the company may generate $1B in revenue by 2025, though still a considerable distance from consensus estimates of $51.44B for Uber (UBER) at the same time. Nonetheless, this first significant step of autonomous vehicles has demonstrated how crucial connectivity and innovation are to automakers and 5G telecom providers alike.

Qualcomm (QCOM) is also one of T’s key partners for its innovative Snapdragon® 5G Modem-RF System, which supports high-performance 5G connections on Ford’s (F) 2023 Super Duty. It is important to note that QCOM reported a robust automotive pipeline of over $30B by FQ4’22 across connectivity, digital cockpit, and Advanced Driver Assistance System. These represent an excellent 57.89% and $11B QoQ growth, otherwise, a staggering 300% and $20B YoY, despite the peak recessionary fears.

T is also developing next-generation customized network services based on specific use cases. For example, the company is developing different applications based on unique requirements of network performance, such as rapid response times for self-driving tractors, high bandwidth for streaming HD video in passenger vehicles, or enhanced cybersecurity and precision location capabilities. As a result, the company may potentially create its own niche in the automotive industry moving forward, by leveraging its expertise in 5G technology.

Lastly, the global EV market is expected to grow from 8.15M units in 2022 to 39.21M units by 2030 at a CAGR of 21.7%, while the global robotaxi market may expand from 617 units in 2021 to 1.44M by 2030 at an accelerated CAGR of 136.8%. Due to its growing partnerships and massive tailwind for growth through the next decade, it is not overly bullish to assume that T may similarly enjoy accelerated growth through the next decade.

So, Is T Stock A Buy, Sell, Or Hold?

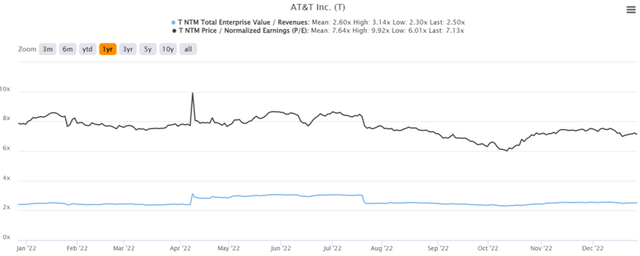

T 1Y EV/Revenue and P/E Valuations

T is currently trading at an NTM P/E of 7.13x, lower than its 3Y pre-pandemic mean of 10.74x and 1Y mean of 7.64x. Based on its projected FY2026 EPS of $2.90 and current P/E valuations, we are looking at a moderate price target of $20.70. This mirrors the consensus estimates price target of $20.88 as well, suggesting a minimal 14.6% upside potential from current levels. On the other hand, its projected dividend payout of $1.13 by FY2026 represents a more than decent yield of 6.2% for those who choose to add here, against its 4Y average of 6.79% and sector median of 3.37%.

T 1Y Stock Price

With the divestitures of DirecTV in August 2021 for $16.3B (including debt) and WarnerMedia in April 2022 for $43B, it is apparent that T was looking to shed its media businesses rapidly. The former had cost the company a handsome price of $67.1B (including debt) back in July 2015, with the latter costing another $85.4B in 2018, naturally representing massive losses.

These over-expensive acquisitions also contributed to T’s growing debts by $44.57B to $121.98B in FY2015 and another $39.65B to $166.94B by FY2018. As of FQ3’22, the management reported a final sum of $123.85B in long-term debts, with $9.62B due within the year and an annual interest expense of $5.68B. The process was indeed painful, however, we are highly encouraged by the management’s decision to refocus the company on its core wireless and broadband services.

While conquering its 5G automotive dreams, T also decided to launch Gigapower LLC with BlackRock Inc, to expand its fiber-optic network beyond the 21 US states it currently serves. The joint venture may aid the former in reaching over 30M fiber locations by 2025, increasing tremendously by 62.1% compared to current levels of 18.5M. The company has also embarked on strategic cost-cutting measures by improving its operating efficiencies. By the last quarter, it reported gross margins of 59.4% and EBIT margins of 27.8%, improving YoY by 2.3 and 2.5 percentage points, respectively, partly attributed to its price hikes as well. AT&T COO, Jeff McElfresh, said:

I’m confident our teams have made the necessary operating changes to our cost structure and the way we manage through our growth or our service elements with our customers such that we can kind of overcome some unexpected inflationary pressure and input cost or wages or things of that nature. (Seeking Alpha)

Combined with the abovementioned factors, investors with higher risk tolerance and long-term investing trajectory may consider nibbling here indeed. We may see a notable upward rerating of T’s top and bottom line growth through FY2026, once market sentiments lift and macroeconomics improve. On the other hand, bottom-fishing investors may consider waiting a little longer, since the company is also to report its FQ4’22 earnings call by mid-Jan 2023. When there is a 70% chance of a recession in 2023, the patient may witness another decline to the mid $15s. However, we must highlight the folly of attempting to time the market, since one might also miss these rock-bottom levels.

Disclosure: I/we have a beneficial long position in the shares of MSFT, QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.