Summary:

- Meta Platforms repurchased shares at the exact wrong time in FY 2021.

- Excessive metaverse investments should be stopped and resources directed into stock buybacks in FY 2023.

- META has an attractive risk-reward profile long term.

Kelly Sullivan

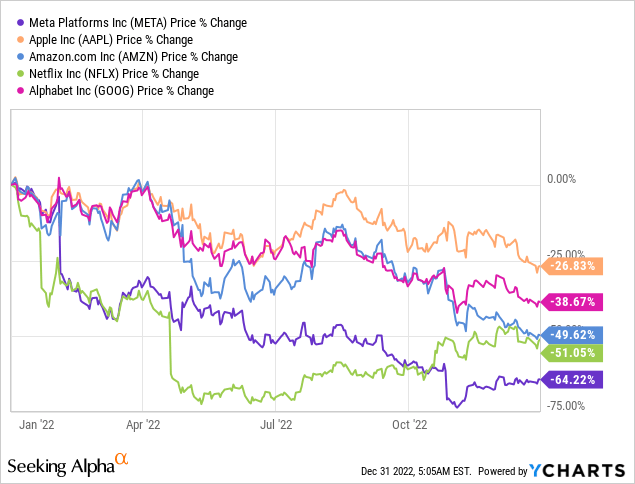

Meta Platforms (NASDAQ:META) is ending an exceptionally bad year: the company’s share price has declined 64% in 2022 due to a broad down-turn in the digital advertising business and increasing investor concerns about the company’s ability to compete with the likes of TikTok. Meta Platforms is heavily reliant on ad spending to drive free cash flow (and to finance its investments in the metaverse), and the down-turn in the advertising market has had great consequences for META: the social media company has been the worst performer in the FAANG group of stocks this year.

I believe Meta Platforms has a lot of value as an advertising platform for marketers long term, but the company is misallocating its capital. With the stock trading at just 15.2 X forward earnings and considerable free cash flow prowess, Meta Platforms should buy back stock instead of throwing money at its languishing metaverse business!

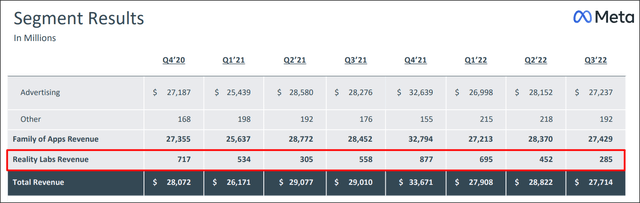

Misallocation of capital

In “Meta Platforms’ Q3: The Bad, The Ugly And The Disaster” I explained why I changed my rating on the social media firm: I believe that the company is overspending on the metaverse opportunity (read more about the metaverse potential here). Metaverse-related revenues are included in the company’s Reality Labs segment which, despite significant investments made by the company this year, generated only $285M in revenues in Q3’22… 51% less than in the year-earlier period. Reality Labs also had a total revenue share of only 1% in the third-quarter.

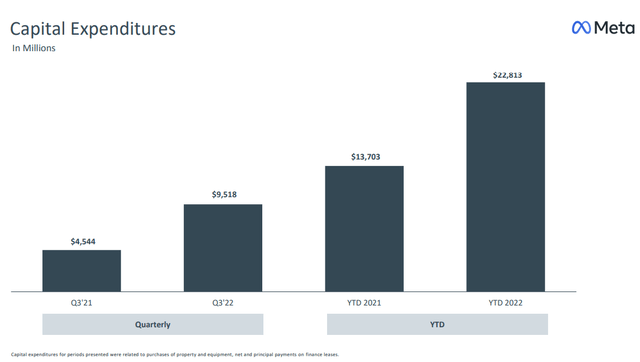

Meta Platforms is making a mistake, I believe, in investing so heavily in the metaverse opportunity because the level of adoption just doesn’t support the amount of investments the tech firm is making, at least for now. Meta Platforms has funneled billions of dollars in the development of its metaverse platform and so far has very little to show for it. In Q3’22, Meta Platforms invested a total $9.52B into its business, but those investments have not resulted in a material improvement of free cash flow.

Because of aggressive investments in the company’s metaverse product, Meta Platforms’ free cash flow collapsed in Q3’22 to just $173M, showing a decline of 98%. If Meta Platforms spent in Q3’22 just as much on CapEx as it did in Q3’21, the company would have reported a $5B higher free cash flow.

|

in mil $ |

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

Q3’22 |

Y/Y Growth |

|

Revenues |

$29,010 |

$33,671 |

$27,908 |

$28,822 |

$27,714 |

-4.5% |

|

Operating Cash Flow |

$14,091 |

$18,104 |

$14,076 |

$12,197 |

$9,691 |

-31.2% |

|

Purchases of Property/Equipment |

($4,313) |

($5,370) |

($5,315) |

($7,528) |

($9,355) |

116.9% |

|

Payments on Finance Leases |

($231) |

($172) |

($233) |

($219) |

($163) |

-29.4% |

|

Free Cash Flow |

$9,547 |

$12,562 |

$8,528 |

$4,450 |

$173 |

-98.2% |

|

Free Cash Flow Margin |

32.9% |

37.3% |

30.6% |

15.4% |

0.6% |

-98.1% |

(Source: Author)

Now is the time for stock buybacks

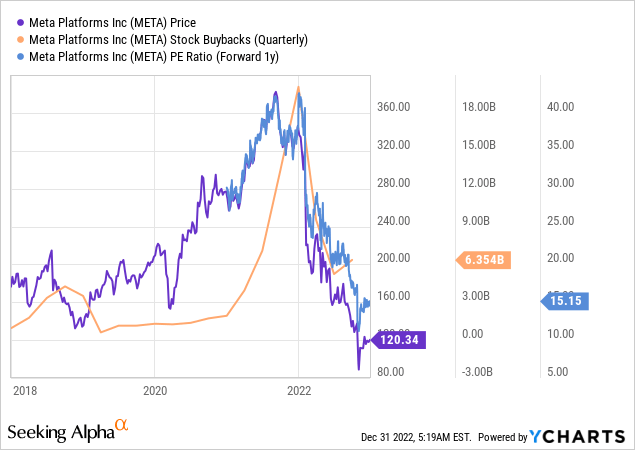

Meta Platforms could fairly easily afford to repurchase $10B of its shares each quarter, especially if the company were to recalibrate its investments in the Reality Labs business. Based off of Meta Platforms’ Q3’22 cash flow statement, the company spent $6.35B on Class A stock buybacks in the third-quarter and $21.09B in the first nine months of FY 2022.

In FY 2021, however, Meta Platforms repurchased $44.54B of its shares and the company did so at a significantly higher valuation. The tech company paid an average of $330 per-share in FY 2021 and therefore paid a massively inflated price to buy back a ton of its own stock just when the stock price peaked.

Plotting Meta Platforms’ stock buybacks against the P/E ratio shows that Meta Platforms repurchased a ton of its shares at the exact wrong time: when the pandemic and advertisers temporarily inflated the firm’s revenue growth, Meta Platforms’ market cap was at an all-time high… and when the stock was historically expensive.

Meta Platforms is trading at $120 right now and the share price hasn’t been this low since the start of 2017 (with the exception of the October/November 2022 draw-down) and, at a P/E ratio of 15.2 X, I believe Meta Platforms is at an attractive valuation level to warrant a material up-size in its stock buyback. At the end of the September-quarter, the tech company had $17.78B in its stock authorization remaining, and Meta Platforms could very well exhaust this program in FY 2023. Right now is possibly the best time since 2017 for Meta Platforms to reevaluate its capital allocation strategy and buy back more of its stock while reducing its investments in the Reality Labs business.

Risks with Meta Platforms

Meta Platforms has revenue and free cash flow risks since there is no clear sign that the advertising market has bottomed yet. In FY 2023, investors must therefore expect that marketers continue to lower their ad-spend which may cut into Meta Platforms free cash flow margins. The US just banned the use of TikTok on government devices and a complete ban could help Meta Platforms boost monetization of its TikTok rival Reels.

Final thoughts

I am generally not a supporter of stock buybacks because I personally prefer dividend payments or the reinvestment of capital. However, a company like Meta Platforms that previously spent significantly more money on buybacks at a much higher valuation and has more than enough free cash flow, should consider buying back more shares in FY 2023 which could give Meta Platforms’ bruised valuation a boost.

Meta Platforms’ valuation is very compelling based off of earnings right now and if the company diverted resources away from its metaverse business and into stock buybacks, then META would have a strong chance of revaluing higher in FY 2023… even if the company suffered from a continual down-turn in the advertising market!

Disclosure: I/we have a beneficial long position in the shares of META, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.