Summary:

- It is important for any CEO to be able to navigate challenges and maintain the support of the company’s board, employees, and stakeholders.

- The Walt Disney Company Board’s firing of Bob Chapek was due to nonfinancial reasons. Chapek demonstrated the ability to lead the company to success.

- Walt Disney is a “sell” due to weak fundamentals and uncertainty around returning CEO Bob Iger, competition, and future financial results.

- Disney’s financial performance has been highly variable, Iger’s results beat that of Chapek’s overall.

- Chapek made several mistakes that ultimately contributed to his termination.

FelixCatana

Background

On March 13, 2005, the board of directors of The Walt Disney Company officially announced that Robert Iger, Disney’s president and chief operating officer, would succeed Michael Eisner as the company’s chief executive officer.

February 25, 2020-The Walt Disney Company (NYSE:DIS) Board of Directors announced that Bob Chapek has been named Chief Executive Officer, The Walt Disney Company, effective immediately.

In November. 20, 2022, Disney’s board of directors, the Board, fired its CEO Bob Chapek (Chapek, hereinafter) and replaced him with his predecessor, Robert Iger (Iger hereinafter).

The decision by Disney’s board of directors to replace Chapek with Robert Iger has been the subject of much scrutiny and speculation that received significant attention. To understand the reasons behind that decision, it is important to consider the various factors that may have contributed to Chapek’s dismissal.

Bob Chapek, CEO of Disney, DIS was terminated by the company’s board of directors for a variety of reasons. One factor contributing to his dismissal was the presence of former CEO Bob Iger as Executive Chairman, which created confusion and undermined Chapek’s authority. Additionally, Chapek faced criticism for his handling of the COVID-19 pandemic, including his plan to lay off thousands of workers, and struggled to effectively communicate and sell his vision for the company to internal and external stakeholders. This included his plans for cost-cutting and layoffs, as well as his handling of the Florida Parental Rights in Education bill.

Chapek also had strained relationships with key executives, including the Chief Financial Officer, Christine McCarthy, who played a role in his firing by acting as an intermediary between Chapek and Iger. To address these issues and potentially avoid his dismissal, Chapek could have focused on improving relationships with stakeholders, effectively communicating and selling his vision, and effectively managing the impact of external events. He could also have taken decisive action to address internal challenges, such as insubordination from the CFO.

I first look into historical financial results below, and second offer fundamental challenges facing Iger, that lead me not buy DIS stock now.

I. Iger vs. Chapek: Who delivered better financial results

II. Fundamental forward-looking factors that make Disney stock unattractive

I. Financial Results – Comparative Analysis of Financial Results under two CEOs

Iger’s tenure as CEO of Disney was relatively more successful in terms of stock performance and revenue growth compared to that of Chapek’s. However, Chapek’s tenure was marked by the unprecedented challenges of the Covid-19 pandemic, which undoubtedly had an impact on Disney’s financial performance.

It is worth noting that Iger was with Disney for a longer period of time and had the opportunity to put his long-term strategies in place, while Chapek’s tenure was shorter, and he did not have the same level of time and opportunity to implement changes and see their full impact.

In evaluating whether the board was justified in their decision, it is important to consider the financial performance of the company under Chapek’s leadership. The board maybe believed that the financial profile of Disney was not expected to improve under Chapek, leading them to make the decision to replace him with Iger. DIS financial results, however, started to deteriorate before Chapek.

For the fiscal year (FY) of 2019, Iger’s last year as the CEO, even though revenues increased 17.13%:

- SG&A expenses increased over 30% in 2019, compared to 8% in 2018.

- Operating income declined -20% in 2019, compared to 7% increase in 2018.

- Operating margin declined to 17% from 25% in 2018.

- Income from continuing operations declined -17% vs. 40% increase in 2018.

- EBITDA growth declined to 4% in 2019 from 7% in 2018.

- EBITDA margin declined to 27% from 31%.

- ROE declined from 28% in 2018 to 16% in 2019.

Operationally Disney was on decline before Chapek took over and before Covid issues dominated the global economy.

Explanation of Data:

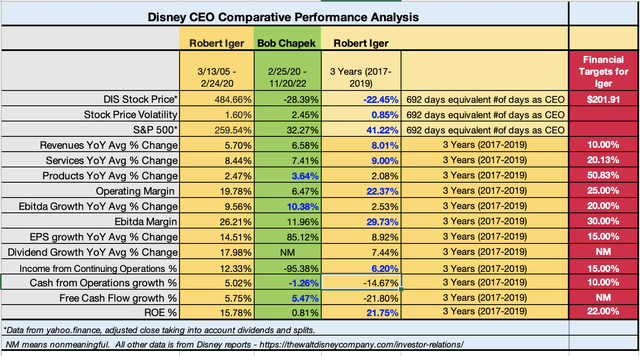

The Table – 1 below shows Disney CEO Comparative Performance Analysis.

Table – 1: Disney Website and yahoo.finance

Disney stock price percent change is from the date Iger and Chapek became CEO respectively. Data comes from yahoo finance, and it is the “adjusted closing price,” taking into account dividends and stock splits.

Third column shows Disney’s financial results for 2017, 2018, and 2019, 3 years (2017-2019), even though Chapek became CEO on 2/25/2020. Chapek was the CEO for 692 trading days.

Revenues row shows average annual percent change in revenues for fiscal years from 2005 to through 2019 for Iger, fiscal year 2020 thorough 2022 for Chapek. Disney’s fiscal year ends at the end of September.

Similarly, each category shows, average annual percent change where it says “growth,” and or applicable.

Operating margin is the average annual operating margin achieved during each CEO’s tenure, same as the EBITDA margin and ROE. It is not annual percent change, in ROE but the average level of ROE.

Services and products revenues is only from 2013 through 2022. But total revenues are from 2005 through 2022.

The last column shows the “financial targets” that I recommend for Iger to achieve based on the Disney’s best historical results from 2005 through 2022. This is explained later in the analysis.

Disney stock performed better under Iger’s tenure, rising 484.66%. During the comparable period of about 692 trading days, DIS shares declined -22.45% under Iger vs. -28.39% for Chapek.

The stock price volatility as measured by the standard deviation was also higher under Chapek, with 2.45% standard deviation, vs 0.85% during Iger’s term for the comparable 692 days.

Average annual percent increase in revenues was 5.7% during Iger’s full term, and 8.01% for the three years, 9/30/2016 to 9/30/2019. It is impossible to divide the financial numbers by the number of days, as they are reported only quarterly. Average revenue increase during Chapek’s full tenure was 6.58%, about 1.5 percentage point lower than Iger’s (8.01%) for the comparable period. Iger never achieved double digit revenue growth, except once, 17.44% in 2019. Chapek achieved 22.69% revenue growth in 2022.

I realize Chapek was appointed on February 25, 2020, in the middle for Disney’s fiscal second quarter of 2020. I use the full fiscal year of 2020, that started 10/1/2019 as Chapek’s tenure to compare apples to apples.

In Table -1, the winner’s percentage number is highlighted. For example, -22.45% for Iger, 8.01% for Iger, etc. is highlighted to indicate the winner for that variable.

Disney’s overall revenues declined -6.06% in 2020, mostly due to a -32.18% decline in “products” revenue. Services revenue in 2020 declined by -2.11%. Iger achieving better average revenue growth might be due to the revenue decline because of covid taking a stranglehold in the U.S. economy in 2020 and part of 2021. Otherwise, Chapek revenue generation numbers were as good as that of Iger’s.

I understand these numbers are also supposed to be compared to the industry averages, but that is a different analysis. I wanted to just compare Iger vs. Chapek to see if Chapek’s termination was mainly due to financial performance.

Iger achieved a superior average annual operating margin level 19.78% average vs. Chapek’s average of 6.47%. For the comparable period of three years, Iger’s operating margin was 22.37%.

Average % increase in income from continuing operations was 12.33% for Iger, and -95.38% for Chapek. For the comparable period, approximately three years, Iger’s percentage was 6.2%. Disney’s operations however began to decline way before covid started in early 2020. Income from continuing operations declined -16.6% for the full fiscal year of 2019. Chapek had really two bad years due to Covid, when income from continuing operations declined -122% in 2020, and -204% in 2021. Income from continuing operations increased 40.1% for Chapek in 2002.

For the return on equity, for both the full tenure and comparable periods, Iger beats Chapek significantly. Average annual ROE for Iger was 15.78%, compared to 0.81% for Chapek.

As for EBITDA, Chapek achieved average annual EBITDA growth of 10.38%, whereas Iger’s result was 9.56% from 2005 through 2019, and 2.53% for the comparable three years, 2017 through 2019.

It is clear from the data that Iger outperformed Bob Chapek in several key financial metrics. Iger had a higher average percentage increase in revenues and a higher average operating margin, EBITDA margin, and ROE. compared to Chapek. In terms of income from continuing operations, Iger also outperformed Chapek.

It is worth noting that the performance of any company is influenced by a variety of internal and external factors, and it is not always possible to predict the exact financial results that a CEO will achieve. However, the comparative analysis of Iger and Chapek’s performance provides valuable insights into the potential direction of Disney’s financial performance going forward. It is important for the company to continue to monitor and assess its financial performance to ensure that it is meeting its goals and objectives.

It is clear that Bob Chapek faced numerous challenges during his tenure, including financial challenges due to covid that impacted his overall financial results.

II. Financial Targets for Iger – Not likely to be achieved in the next two years!

What should Iger do? A.G. Lafley is a former CEO of Procter & Gamble (PG) and suggests five lessons for Iger. Mr. Lafley is also a graduate of my own alma mater.

Mr. Lafley suggested five. I suggest the following targets for Iger:

Despite these challenges, Disney has shown strong signs of recovery 2022 with overall revenues increasing by 22.69% in 2022 and income from continuing operations showing strong growth. This suggests that the company may be well-positioned for future success, provided it can continue to navigate the challenges of the current economic climate and maintain a focus on financial performance.

To achieve this success, it may be necessary for Disney to set clear financial targets and work to consistently meet or exceed these goals. This could involve focusing on key metrics such as revenue growth, operating margin, and return on equity, while also keeping a close eye on other factors such as cash flow and income from continuing operations.

Ultimately, the key to sustained financial success at Disney will be the ability to balance the need for strong financial performance with the need to respond to the changing needs of consumers and the broader market. By focusing on these goals and working to continuously improve performance, Disney may be able to achieve the consistent financial growth that it has been seeking in recent years.

Theoretically I asked the following question. If Iger were to achieve highest financial results that were ever achieved since his tenure began in 2005 through the firing of Chapek in November 2022, what target financial numbers would he have to reach? To make these targets more meaningful, I adjusted the numbers for outliers.

If Iger were to achieve maximum level of financial performance in the next two years or beyond, the results would look like shown in the last column in Table -1, under “Financial Targets for Iger.” Maximum value is the highest value Disney reached for any given year from 2005 through 2022 fiscal year, adjusted for outliers, and my analysis of historical annual average results.

It is important to note that these targets do not take into account industry averages or other external factors that may impact Disney’s performance. Achieving these targets would require a strong strategy and execution, as well as the support of the entire organization.

For example, highest stock price DIS traded was $201.91 on March 18, 2021. DIS closed at $91.80 when Chapek was fired. You can check the current price as of today on the day you are reading this article to make your own comparison. Iger needs to more than double the DIS stock price to reach $201.91, which was reached during Chapek’s tenure.

One area where Iger can focus on driving growth is revenue. The highest annual revenue growth ever achieved by Disney was 22.69% in 2022, Chapek’s last year as CEO. The next highest value was 17.13% in 2019, Iger’s last year before overthrowing Chapek. To reach that level, Iger will need to deliver annual revenue growth of around 17-22% in the next two years. If he can do that, Disney’s revenues could increase to anywhere between $95-$100 billion by 2025. I suggest a target revenue growth of 10%. Disney however never achieved a double-digit revenue growth, except in 2019 and 2022.

Operating margin is another key area where Iger will need to excel. The highest annual operating margin ever achieved by Disney was 25.81% in 2016. Iger will need to delivering high operating margin of somewhere between 21-25%. While this may seem like a tall order, it is important to remember that Iger was the CEO during the high-growth period of 2009 to 2018, when high margin levels were achieved thanks to continuous cost of goods sold (COGS) decline. 2009 through 2018, Disney’s average annual operating margin was higher than 21% for each year. If Iger can replicate the strategies that led to those strong margin numbers, he should be able to reach the target operating margin.

EBITDA growth is another important metric for Iger to consider. The highest EBITDA growth ever achieved by Disney was 73.90% in 2021, which is likely an outlier due to the impact of the COVID-19 pandemic. However, even taking that outlier out the next highest EBITDA growth years were 29.71% in 2022 and 28.83% in 2006. In all the other years, EBITDA growth was below 20%. It seems that achieving EBITDA growth of over 20% is a significant challenge for Disney, so Iger should aim to reach a target of 20% in the next 2-3 years.

Highest EBITDA margin of 31.91% was achieved in 2016. Historically Disney’s EBITDA margin has been greater than 25% in good years. It fell below 20% only one time in 2005 during Iger’s tenure and jumped from 8% to 14% during Chapek’s three years. It is on an increasing trajectory, and even though 25% of EBITDA margin is achievable, Iger should really achieve at least 30% EBITDA margins, as he had done during five years of 2014 through 2018. So, the target I give to Iger, of EBITDA margin of 30% in Table – 1.

Disney has seen fluctuations in its earnings per share, EPS, growth percentage over the years. In 2021, Disney experienced an EPS growth rate of 315%, which was the highest during the period. This outlier can be attributed to the impact of the COVID-19 pandemic on the economy in 2020. Excluding this outlier, Disney’s EPS growth rate has generally been within the range of 10-20% during the tenure of CEO Bob Iger from 2005 to 2020. This suggests that a target growth rate of 15% over the next two to three years may be more reasonable. One notable exception to the fluctuating EPS growth rate at Disney is the period from 2010 to 2016, during which there was more consistency in annual EPS numbers.

Return on equity (ROE) is a measure of a company’s profitability that compares the amount of net income generated to the amount of shareholder equity. It is an important indicator of a company’s financial health and performance.

At Disney, the highest ROE was achieved in 2018, with a value of 27.97%. In contrast, the ROE for CEO Bob Chapek’s three-year tenure has been relatively low, ranging from -3% to +3%. This is significantly lower than the average ROE of 15.78% achieved by Iger during his tenure from 2005 to 2020, which included years with ROE values of over 20% in 2016, 2017, and 2018. Given this historical performance, it seems reasonable to set a target ROE of 18% for Disney in the coming years. However, in order for Iger to be considered a success in his return to Disney, he will need to achieve an ROE of at least 20%, and preferably closer to the maximum value ever achieved, which was 27.97% in 2018.

Disney’s free cash flow, FCF, growth has fluctuated significantly from year to year, making it difficult to use for comparison purposes. Cash generated from operations, on the other hand, is a more meaningful metric for setting targets. The highest annual percent change in cash from operations occurred in 2006 with 41.9%, but this was balanced by a -51.38% decline in 2019. During his tenure, CEO Bob Iger has achieved an average annual growth rate of 5.02% in cash from operations, which can be impacted by changes in working capital. A weak target growth rate of at least 5% could be argued, but based on historical performance in good years, a growth rate of 10% is achievable for Disney.

Income from continuing operations does not show an average annual percentage change consistency. During Iger’s tenure it fluctuated from -4% to 40%. And Chapek’s tenure was marred by covid. A consistent period was 2010 through 2016, with 16% annual average. A good target would be consistent 15-20% growth in income from continuing operations.

If Iger must achieve the highest financial results ever reached again during his current tenure, he would need to target the maximum target values I suggest for each variable as shown in the last column of Table – 1.

It is important for any CEO to have a strong strategic vision and the ability to effectively lead and manage the company. As the new CEO of Disney again, Iger has a lot to live up to. Iger has the advantage of having a good track record of his own, having served as Disney CEO from 2005 to 2020. During that time, the company saw respectable growth, with the stock price rising 484.66%, which is what matters for the shareholders.

The company has faced challenges in recent years, with overall revenues declining in 2020 due to the impact of the COVID-19 pandemic. Chapek, who took over as CEO in 2020, has led the company through these difficult times and has seen overall revenues increase in 2022.

Iger needs to set ambitious but achievable financial targets to lead the company to success. By focusing on these key financial targets, I outlined, Iger could help Disney return to rewarding its shareholders again. Many companies have turned to their former CEOs in times of need, but the results are mixed.

When comparing Iger’s performance to that of his successor, Bob Chapek, the results favor Iger. While Iger’s stock performance was slightly better than Chapek’s over a comparable period, Chapek increased the overall revenues significantly in 2022, indicating that he was able to turn the company around after the negative impact of COVID-19.

While Iger’s financial performance as CEO of Disney was stronger overall, but Chapek has also demonstrated the ability to lead the company to success. The decision to replace Chapek with Robert Iger was made by Disney’s board of directors and had been influenced by a variety of factors beyond just financial performance. It will be important for any future CEO to embrace targets that can lead to consistent growth and strong shareholder returns.

Fundamental forward looking factors that make Disney stock a “sell”

For those seeking income through dividends, the company is not the most convincing buy. In 2019, Disney paid out $2.9 billion in cash dividends, but the pandemic forced the suspension of this dividend in 2020 in order to conserve cash and ensure the company’s survival. The ability to pay dividends is often seen as a positive signal to investors, as it suggests that the company is generating strong cash flow, profitable, and not over leveraged. However, Disney’s free cash flow has declined significantly in recent years, with a -44.7% drop in 2021 and a -46.8% drop in 2022. As a result, it is unlikely that Disney will reinstate its dividend in the next couple of years.

In fact, among the stocks in the Dow Jones Average Industrial index, only three have a zero dividend. Disney’s is one of the three. The lack of a dividend may make Disney a less convincing buy for those investors looking for a steady stream of income.

The streaming industry is a highly competitive space, and both Netflix (NFLX) and Disney+ have faced slowing subscriber growth in recent years. In 2021 and 2022, Netflix is expected to see growth rates of just 2-3%, and Disney+ is likely to experience a similar slowdown after its impressive early growth, reaching 164 million subscribers in 2022, after just three years. Both companies are working to improve their financial performance in this segment, with Netflix already profitable and Disney+ targeting profitability in fiscal 2024. However, they face significant competition from other players in the market, including YouTube (GOOG, GOOGL), which recently secured the rights to the NFL Sunday Ticket franchise for the next seven years. This move is indicative of YouTube’s push into streaming and represents a direct threat to Disney, which was also in the running for the Sunday Ticket package. As competition continues to increase, it could further erode the growth of Disney’s streaming segment.

The end of China’s zero covid and quarantine policy, which has allowed for increased travel within the country, could have significant implications for the spread of COVID-19 globally. As more people travel out of China, there is a risk that the virus will be introduced to new areas. This was seen recently when nearly half of the passengers on two separate flights from China to Italy tested positive for COVID, prompting Italian health officials to announce that they will test all travelers coming from China. The Biden administration has also taken steps to mitigate this risk, announcing that travelers from China, including Hong Kong and Macau, will be required to present negative COVID-19 tests before entering the United States. If there is an increase in the number of Chinese tourists visiting Disney parks around the world, the company may be forced to bring back some of the COVID-19 restrictions that were in place earlier in the pandemic in the event of a resurgence. This could have a negative impact on Disney’s park revenues in the coming quarters.

Pricing Strategy Needs Fixing

It’s possible that Disney’s pricing strategy, has led to some customer confusion and dissatisfaction. It’s important for a company to understand its target customer segment and to offer products and services that appeal to that group. Additionally, it can be beneficial to have an executive focused on customer experience, as the emotional aspect of a customer’s interaction with a company can be just as important as the practical aspects.

It’s not uncommon for theme parks, especially those as popular as Disney, to have higher prices for food and beverages. These types of attractions often have captive audiences who may be willing to pay a premium for convenience and the overall experience.

That being said, it’s important for a company like Disney to carefully consider its pricing strategy and ensure that it is fair and aligned with the value it provides to its customers. It’s also important for the company to consider the different segments of its customer base and tailor its pricing accordingly. Disneyland charges $185 for a tiny shot of booze served in waffle cup. Drinks at Disney land is more expensive than the price of glass of wine at a rooftop Manhattan hotel. It does appear that implicitly implied in its pricing strategy, Disney is trying to increase its margins through pricing at an economically challenging time. Anyone who has been to a Disney Park mentions cleanliness, friendliness, and some amazing rides, and immediately then talks about pricing and how expensive everything was. People need to come back from a Disney experience and talk about their emotions, feelings, and experience, not how expensive everything was. That is why Disney needs an “Experience Executive” to study behavior and emotions and devise profitable pricing and awesome Disney experience strategies catering to everyone.

Another uncertainty surrounding Disney’s future is the question of what CEO Bob Iger will do differently in the next two years to drive the company’s success. Iger has a track record of delivering volatile but respectable financial results at Disney, but some investors believe that the company needs to do more to achieve consistent shareholder returns. There have even been predictions that Disney could be broken up in 2024, with the sale of its cash cow ESPN assets being suggested as a possibility. However, activist investor Daniel Loeb eventually abandoned this idea after appointing an ally to the Disney board in September 2022.

It remains to be seen what the future holds for Disney and its leadership, but it is clear that the company has the potential for strong financial performance if the right targets, as I suggested, are set and achieved. While Iger has had successes in the past, some investors may be hesitant to invest in Disney if they do not believe that he will be able to deliver these financial results in the next two years. As a result, it is possible that investors may rightly view Disney as a “sell” at this time.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.