Summary:

- The Home Depot stock has significantly outperformed the S&P 500 since its September lows. However, with the Fed expected to stay hawkish in 2023, is there still upside from here?

- The housing market has continued to pull back as home affordability has been impacted.

- Some investors are concerned that the company’s earnings and demand risks have not been reflected accordingly.

- Still, it didn’t stop HD from recovering more than 30% through its December highs, defying the bearish sentiments.

Justin Sullivan

The Home Depot, Inc. (NYSE:HD) has significantly outperformed the S&P 500 (SPX) (SP500) (SPY) since our previous update, urging investors to ignore the fear as mortgage rates surged.

As such, we think it’s opportune for us to update whether investors who missed HD’s September lows could still find attractive entry levels to partake in its recovery.

The company delivered a robust Q3 earnings release in November, corroborating the strength of its execution. As such, we assessed that the market had correctly anticipated its strong performance, as most of its recent gains were posted pre-earnings.

While the company maintained its FY22 guidance, it’s noteworthy that it didn’t upgrade its outlook. As such, we believe the company is likely expecting significant macro headwinds that could persist through 2023, impacting its transaction and, therefore, its same-store sales momentum as consumers potentially pull back their spending.

However, investors would be remiss to think that The Home Depot had not considered such a possibility, even though it declined to update its forecasts for 2023. Notably, CEO Ted Decker articulated that the company’s full-year guidance had contemplated “fourth quarter comps will be the lowest for the (FY22), albeit positive, and (HD) had tougher comps from (FQ4’21).”

Hence, we assessed that the company remains confident in the strength of its execution to tide through the macroeconomic headwinds that could impact its Pro and DIY business in 2023.

Despite that, it’s reasonable for investors to be cautious after its remarkable recovery from its September lows. Accordingly, HD recovered more than 30% through its December highs, well above its 10Y total return CAGR of 20.6%. Hence, we believe a consolidation phase should be expected, given the uncertainties from a hawkish Fed through 2023, as investors parse the impact on consumer discretionary spending and home improvement retail.

Hedgeye highlighted in November that the investors could have overstated a potential Fed pivot, worsening the potential downside risks to HD’s demand outlook and earnings projections. It accentuated that “home turnover, home prices, consumer discretionary spending, and lumber prices are all slowing in an alarming trend for home improvement players.”

Hedgeye’s observation is valid, as sales of existing homes have declined for a “record 10th straight month.” As such, it demonstrated that the rise in household formation had moderated markedly, with worries of a “pulled forward” demand impacting the housing demand outlook further.

Moreover, home affordability remains a concern, as housing starts and permits also fell in November. While the 30Y mortgage rate has pulled back sharply to 6.27% (from October highs of 7.08%), it remains historically high.

Notwithstanding, the critical question investors need to address is whether HD’s September lows have contemplated these challenges as the market looks ahead.

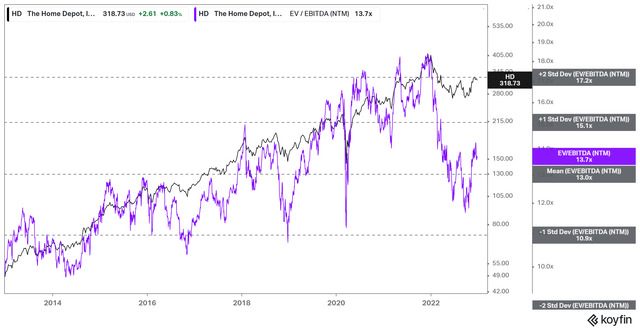

HD NTM EBITDA multiples valuation trend (koyfin)

As seen above, we parsed that HD’s NTM EBITDA fell below its 10Y average at its September lows, even though it didn’t reach the depths seen in March 2020.

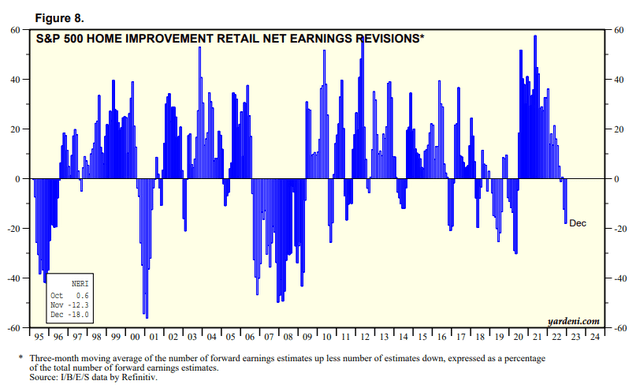

S&P 500 Home Improvement Retail net earnings revisions % (Yardeni Research, Refinitiv)

We also gleaned that analysts have turned increasingly pessimistic on The Home Depot’s industry through December, as they downgraded their earnings projections given a possible recession.

Hence, HD bulls could justifiably argue that the market has likely factored earnings and execution risks through 2023. Furthermore, we also discussed management’s outlook for FY22 should have baked in considerable weakness, given the Fed’s hawkish stance. Hence, we don’t think the market is so “dumb” to ignore these known risks, as it’s forward-looking.

But does HD’s price action justify a September bottoming?

HD price chart (weekly) (TradingView)

We gleaned that HD formed a very subtle bear trap at its September lows, based on its previous June bottom. It barely crossed the line for a double-bottom bullish reversal but still met the mark, nonetheless.

However, its recovery toward its December highs also formed a bull trap, which coincided with November’s CPI release, aptly rejected by the bears who correctly anticipated the Fed’s hawkish stance.

Hence, investors shouldn’t be stunned by the remarkable rejection. However, the critical question is whether HD could revisit its September lows?

We don’t think so. As discussed, we are confident that the market has anticipated significant pessimism at its September lows. Coupled with de-risked analysts’ estimates, HD should have an easier time clearing the bar in 2023, in line with management’s more prudent outlook for FY22.

But note that our thesis is predicated on a mild-to-moderate recession. Hence, if Tesla (TSLA) CEO Elon Musk’s prediction of a severe recession were to occur, then HD’s September lows are unlikely to hold.

As such, investors should remain nimble and patient, waiting for meaningful pullbacks to add more exposure, leading to improved reward/risk.

Rating: Revise from Buy to Hold for now.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!