Summary:

- Like many SPACs, Opendoor has seen its stock get obliterated amidst the tech stock crash.

- The stock is trading just around $1 per share – the original SPAC price was $10 per share and the stock previously traded higher than $30 per share.

- Unlike most SPACs, Opendoor had been crushing its initial SPAC estimates heading into this year.

- The tough macro environment has significantly elevated the risk for the real estate i-Buyer.

- Opendoor has already launched its third-party Marketplace offering in select cities – that represents a sizable long term opportunity.

onurdongel/E+ via Getty Images

Amidst a rising interest rate environment, Opendoor (NASDAQ:OPEN) has found its stock price and its fundamentals thrashed left and right. This is a name which had previously distinguished itself as one of the few SPACs to materially outperform SPAC projections after coming public. Yet with mortgage rates at the highest they’ve been in a decade, OPEN has seen both transaction volume and home values fall. While management expects to work through the troubled inventory in due time, there is clearly great risk to the business model as the company has still not yet fully rolled out its marketplace platform. Yet OPEN may still offer great upside if it can execute on its long-term marketplace vision. The price is right to own a small position in this name, but volatility is pretty much guaranteed.

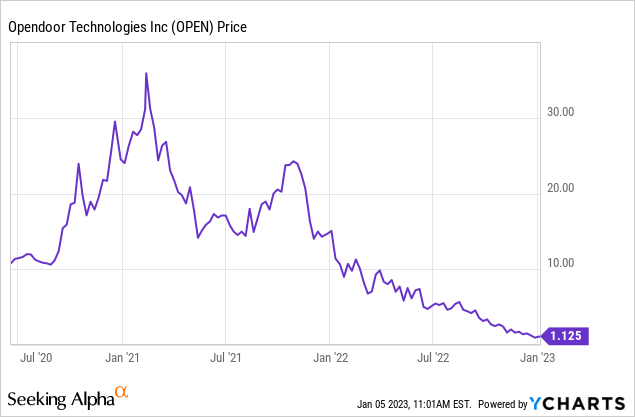

OPEN Stock Price

OPEN is a stock which I first bought in the mid-teens when it crashed from all-time highs, eventually building the majority of my position at a high-single-digit price. The stock now trades as a penny stock.

The stupendous growth rates that the company was generating prior to this year ended up being driven mostly by the pandemic as well as low interest rates. As interest rates rose, growth – and profits – disappeared. Investing so much into this name at higher prices was a painful mistake – but valuations have been completely reset courtesy of the tech stock crash.

OPEN Stock Key Metrics

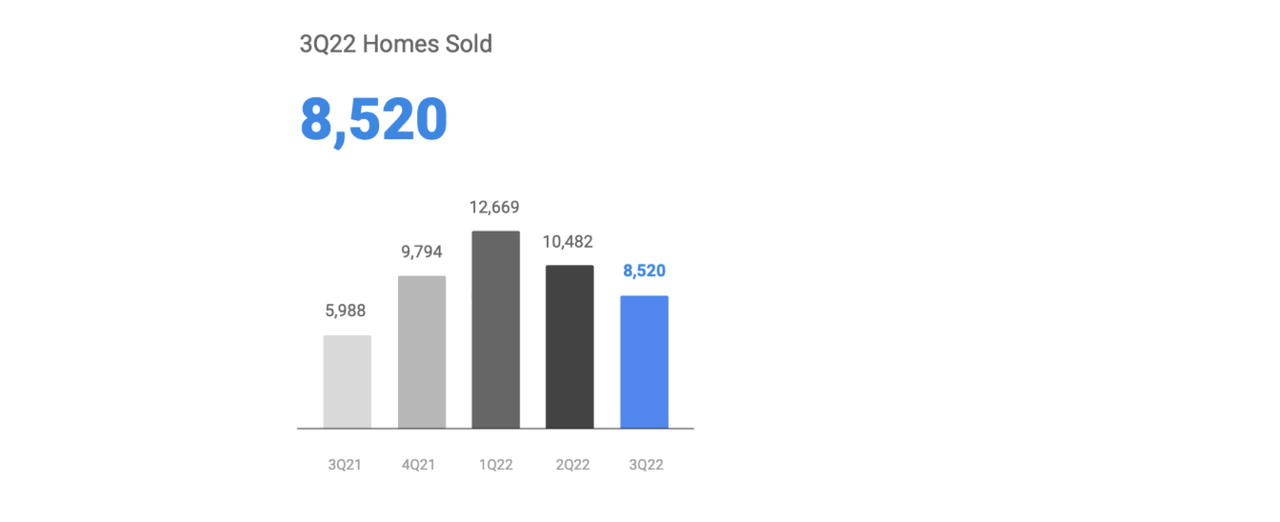

The latest quarter saw OPEN generate $3.4 billion in revenue, representing 48% YOY growth. While that may sound good, the company was aggressively reducing inventory amidst the tough macro-environment. We can see that OPEN still sold more homes on a YOY basis.

2022 Q3 Shareholder Letter

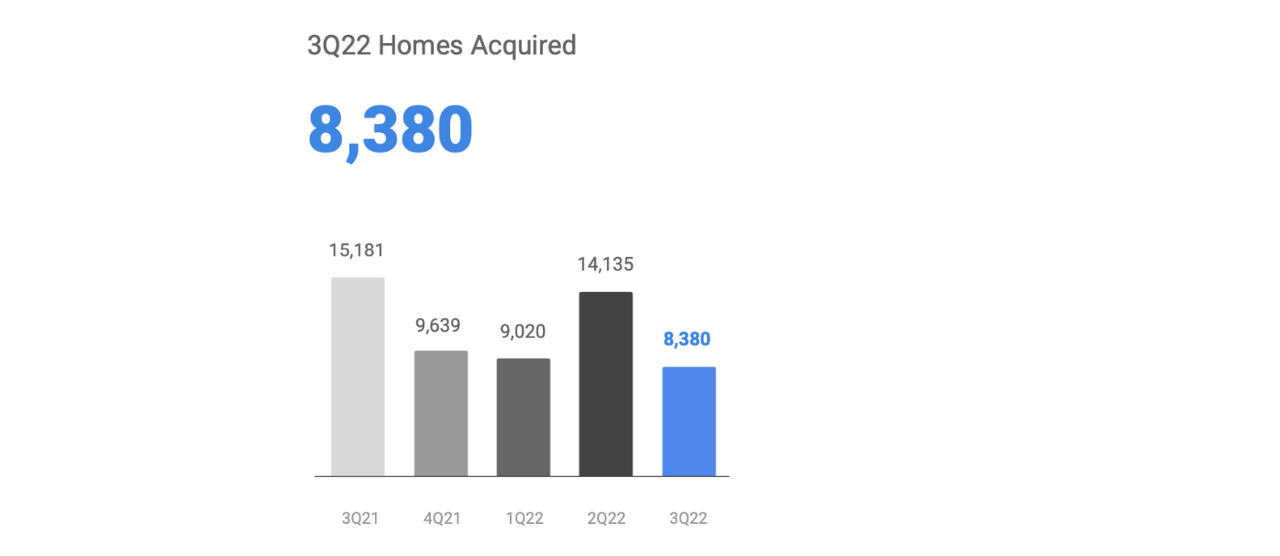

In contrast, OPEN acquired far fewer homes on a YOY basis, being a net seller in the quarter.

2022 Q3 Shareholder Letter

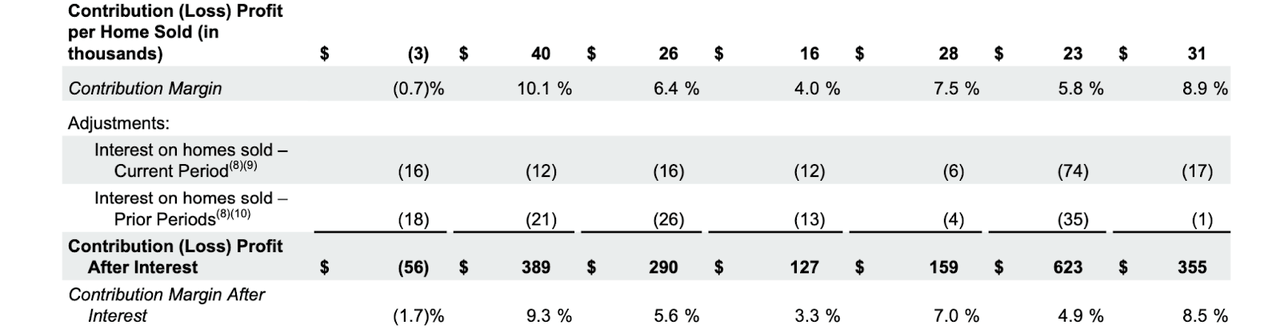

Adjusted gross margin was 3.3% as compared to 10.3% in the prior year’s quarter. Inclusive of inventory writedowns, gross margin was negative 12.6% – down heavily from positive 8.9%. After accounting for preparation costs and other unit-level expenses, contribution margin was negative 0.7%, down from positive 7.5% in the prior year. Contribution margin after interest was of course even more negative.

2022 Q3 Shareholder Letter

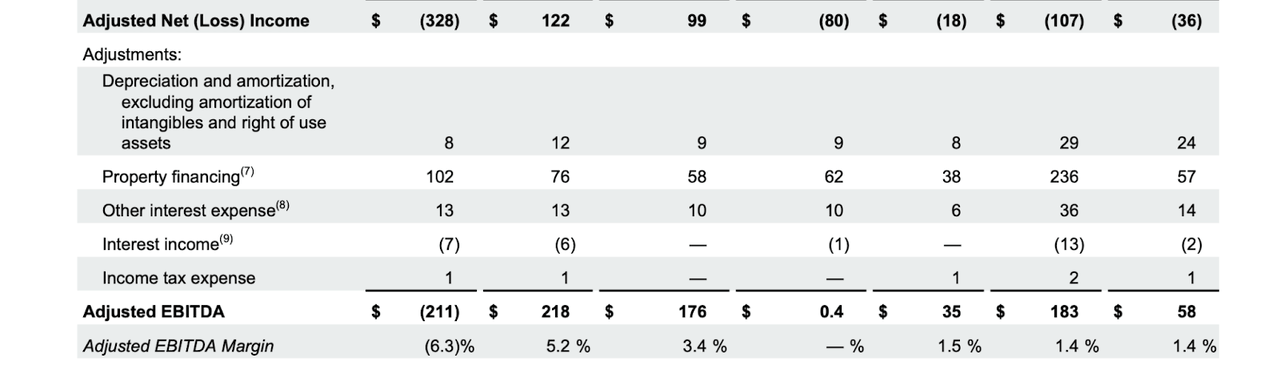

It goes without saying that poor unit-level margins would lead to steep operating losses. OPEN lost $328 million in adjusted net losses (that is excluding the inventory writedown) and also lost $211 million in adjusted EBITDA. The company had previously been generating positive adjusted net income sporadically – and I note that net income would have remained positive even if one took out stock-based compensation. The problem is that OPEN was benefitting temporarily from soaring real estate prices.

2022 Q3 Shareholder Letter

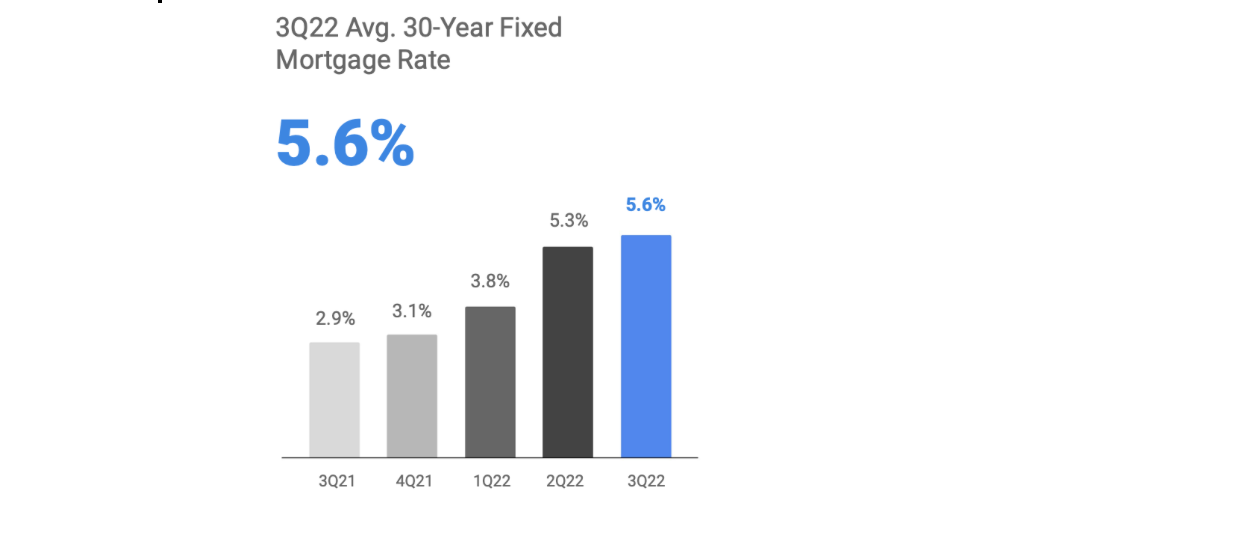

What happened? As interest rates rose, the average mortgage rate also rose, hovering at 5.6% in the quarter.

2022 Q3 Shareholder Letter

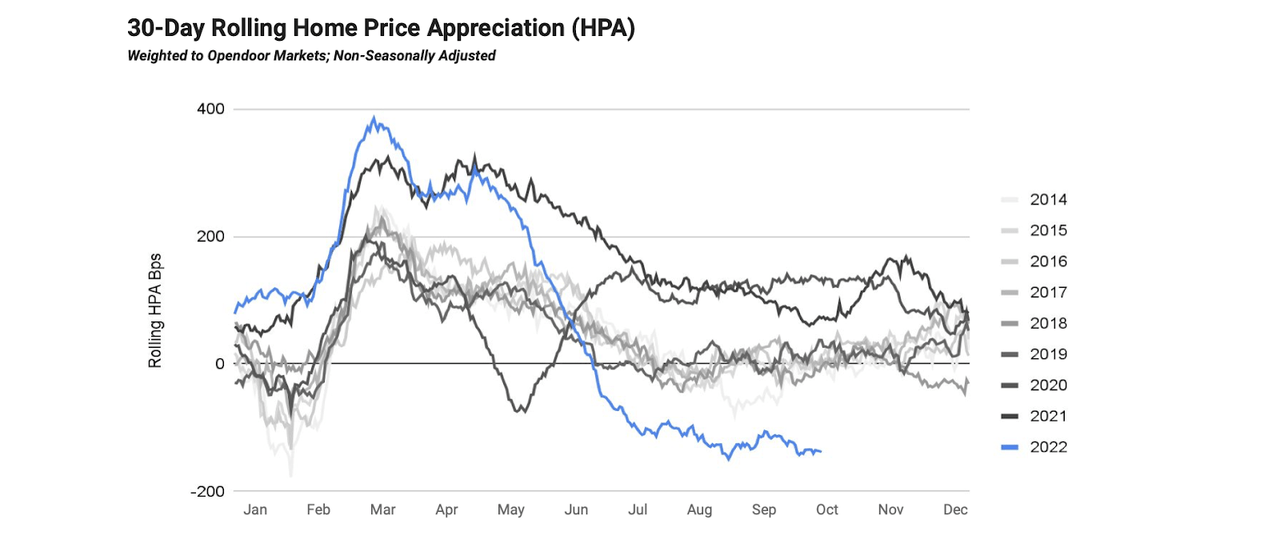

That in turn led to home property values taking a hit. While the real estate market typically sees negative home price appreciation in the back half of every year, 2022 has seen HPA decline at a far more aggressive rate than in years past, as seen below.

2022 Q3 Shareholder Letter

OPEN ended the quarter with adequate liquidity, highlighted by $11.8 billion of borrowing capacity. $8.6 billion of that was already committed by lenders. OPEN also ended the quarter with $1.5 billion in unrestricted cash versus $957 million in convertible notes. The $540 million net cash position represents over 60% of the market cap. I note that there was also $1.8 billion in restricted cash, but that cash may be locked up to secure financing.

Investors should not expect share repurchases any time soon, however. Besides the fact that the company is not yet profitable, the $6.1 billion of inventory is dwarfed by $7 billion in mortgage debt. The large net cash position may be needed to make up for the difference in the event of a liquidity crisis – not to mention to fund ongoing operating losses.

Looking ahead, OPEN expects up to $2.5 billion in revenue, representing a 34% decline YOY. OPEN expects to lose $335 million in adjusted EBITDA. Those are ugly numbers. But on the bright side, OPEN expects to have sold or have under resale contract 65% of the “Q2 Offer Cohort,” which refers to the houses purchased right before the rapid rise in interest rates. On the conference call, management noted that houses purchased in the third quarters are doing quite well within their contribution margin target of 4% to 6%. Management does note that inclusive of a projected ugly fourth quarter, the full year is expected to see over $530 million in contribution profit, representing a 3.5% margin and just shy of their long term target of 4% to 6%.

Is OPEN Stock A Buy, Sell, or Hold?

As of recent prices, OPEN was trading at 1x trailing contribution profits (after interest). That is a very cheap valuation for a name that I can see growing at a high double-digit clip annually for a long time. Assuming 20% long term growth, 30% net margins (based on contribution profits after interest), and a 1.5x price to earnings growth ratio (‘PEG ratio’), fair value could be around 9x contribution profits after interest. Based on that target, there’s considerable upside here.

But the issue isn’t valuation, at least not at this point. The main issue is whether or not OPEN can survive this difficult macro-environment and even if it does, would it be able to do so without significant shareholder dilution?

OPEN has plenty of net cash on its balance sheet but its recorded value of inventory is less than the mortgage debt taken to finance it. OPEN will likely sustain heavy losses in the near term as it works through troubled inventory. Due to its continued access to financing, the company may be able to eventually offset those losses with profitable transactions from newer inventory, but there is no guarantee that the company will be able to generate profitable transactions in such a volatile environment.

From a valuation perspective, there is a real risk that OPEN stays at very low valuations until the risk of a housing crash is all but gone. That may be a painful overhang for investors looking for a quick exit.

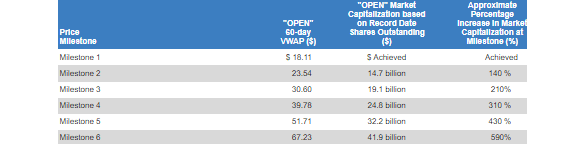

It is also worth noting that the company recently saw the CEO and co-founder Eric Wu step down from its role, being replaced by CFO Carrie Wheeler. Eric Wu previously was awarded a performance stock plan in which he would receive most of the award only when OPEN traded at prices of $23.54 per share and higher.

2022 DEF14A

Yet in connection with the resignation, Eric Wu forfeited those stock units, among other forfeited plans. He also would no longer serve on the Board. According to the press release, he would not be leaving the company entirely but instead leading the development of the third-party Marketplace offering. Yet his exit cannot be viewed as a positive from shareholders who were hoping to invest in an owner-operator kind of business.

It is not all negative, however. My original investment thesis (and I suspect many other OPEN investors as well) was not for the i-Buying part of the business but instead the long-term potential for OPEN to become a two-sided marketplace with a more asset-light business model (the Marketplace offering that Eric Wu will be leading). That would make it the “Amazon (AMZN) of Real Estate.” In connection with their earnings release, OPEN officially launched that marketplace in Dallas-Fort Worth and Austin in Texas, under the brand Opendoor Exclusives. OPEN plans to charge a 5% service fee for each third-party transaction which is in addition to any additional services such as captive title and escrow. Management is guiding for having over 30% of their overall transactions coming from third-party sales by the end of 2023.

OPEN has crushed their initial SPAC estimates – being one of the few de-SPACs to do so. Yet I don’t blame investors for retaining a dose of skepticism that OPEN will be able to guide for anything in the current macro-environment. Perhaps the best takeaway is that the long term vision – that being the Marketplace – is a lot closer than one may think.

There remains great risk here. Absent a quick recovery in the housing market, there is great likelihood that OPEN will need to raise capital – most likely through an equity offering. That may feel like a gut punch considering where the stock is trading at today – but based on the projected adjusted EBITDA loss run-rate, OPEN has less than a year’s worth of net cash on its balance sheet. There is also the possibility that things continue to get worse as interest rates continue to rise. An investment thesis in OPEN can be phrased as the long term value proposition from the Marketplace offering, but offset by volatility along the way. As discussed with subscribers to Best of Breed Growth Stocks, investing wide across beaten-down tech stocks is in my view the best way to capitalize on the crash in tech stocks. OPEN fits right in such a basket with its high risk, high reward profile. I rate OPEN a buy but cite the large risks and emphasize small position sizing.

Disclosure: I/we have a beneficial long position in the shares of OPEN, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks portfolio.

Growth stocks have crashed. The time to buy is when there is blood on the streets, when no one else wants to buy. I have provided for Best of Breed Growth Stocks subscribers the 2022 Tech Stock Crash List, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!