Summary:

- Beyond Meat shows little evidence of any ability to recover as it continues to see declines in points of sale.

- Despite higher trade discounts in the U.S. retail channel (roughly half of total revenue), the company continues to see high teens revenue declines.

- Gross margins remain under 5% as the company experiences dis-economies of scale from lower volumes.

- Beyond Meat has a tight balance sheet with limited cash and convertible debt maturing in 2027.

Alexander Farnsworth

One of the quickest fads to come and go was the trend of plant-based meats, briefly popular in the now long-forgotten era right before the pandemic. At one point Beyond Meat, Inc. (NASDAQ:BYND), the flagship brand in the space, was a hot startup worth billions; and today, it’s a company struggling to survive.

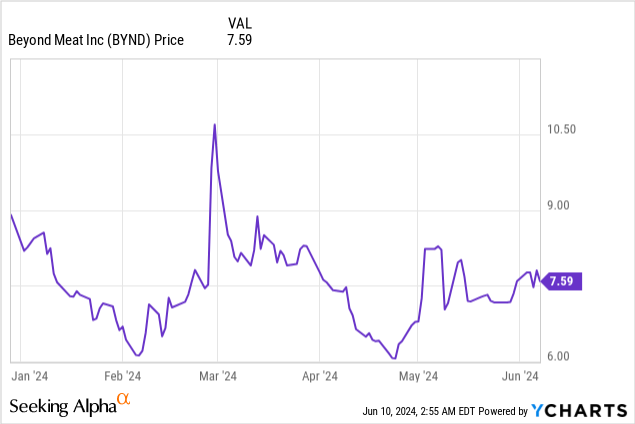

Year to date, Beyond Meat has lost ~7% of its value. The stock has seemed to stabilize in the ~$7-$8 range over the past few months, even though fundamentals continue to look precarious. In my view, there’s plenty of downside remaining here.

I last wrote a bearish article on Beyond Meat in April. Since then, the company has released yet another disappointing Q1 earnings, which showed continued contraction across all of the company’s key channels, despite the company pushing across more sales and pricing incentives in the U.S. retail channel. With the latest quarter showing an even grimmer picture of the company’s reality, I’m reiterating my sell rating on Beyond Meat.

Here are the key red flags that investors should be watching out for:

- Points of sale continue to decline- As we’ll discuss in more detail in the next section, the fact that fewer consumers are opting for plant-based meats means that the number of restaurants and grocers carrying Beyond Meat’s products are also shrinking. After all, sitting on an inventory of edible items is a terrible decision.

- Dis-economies of scale- Beyond Meat generates a paltry ~5% gross margin, as it continues to suffer from dis-economies of scale by producing lower volumes and killing off certain products such as Beyond Jerky, which failed to generate any customer interest and was quickly eliminated.

- Very tight balance sheet. The company has only $0.16 billion of cash remaining (roughly a year’s worth of cash at current burn rates) on top of $1.1 billion of convertible debt that is maturing in 2027.

All in all, there’s substantially more risk than opportunity in Beyond Meat, and with demand for plant-based meats shrinking, it’s difficult to envision an acquirer stepping in to save Beyond Meat either. Continue to steer clear here.

Q1 download

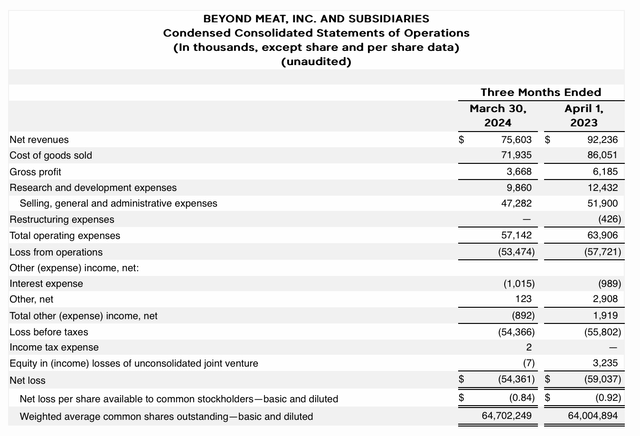

Let’s now go through Beyond Meat’s latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Beyond Meat Q1 results (Beyond Meat Q1 earnings release)

Revenue declined -18% y/y to $75.6 million, essentially in line with Street expectations of $75.5 million.

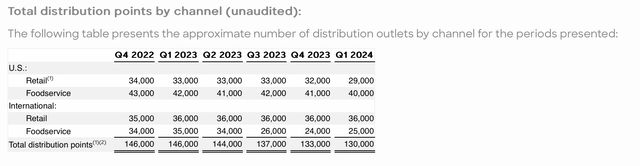

As shown in the chart below, the company lost 3k net points of sale in the quarter. In particular, note that the company lost 3k U.S. Retail distributors, which is the company’s largest sales channel – amounting to 49% of Q1 revenue.

Beyond Meat POS count (Beyond Meat Q1 earnings release)

The company notes that this decline is in spite of running higher trade discounts in the retail channel. Management is banking its hopes on recovery on a product refresh, as it brings out the fourth iteration of the Beyond Burger and the Beyond Beef products. Per CEO Ethan Brown’s remarks on the Q1 earnings call:

As Beyond Burger IV and Beyond Beef IV approaches full distribution, we will launch our 2024 marketing program, which highlights their strongly validated helpfulness, built with protein from yellow peas, red lentils, brown rice, and fava beans, together with heart healthy avocado oil, Beyond Burger IV and Beyond Beef IV provides consumers with 21 grams of clean protein with only two grams of saturated fat per serving.

As the Beyond IV platform rolls out to more stores, we are pleased with the positive though still anecdotal feedback is receiving from consumers as well as members of the health and wellness community, including nutritious and dietitians.”

Still – as the company itself acknowledges, the brand faces an uphill battle against perceptions that plant-based meats aren’t especially healthy (with high sodium content to replace the taste of meat).

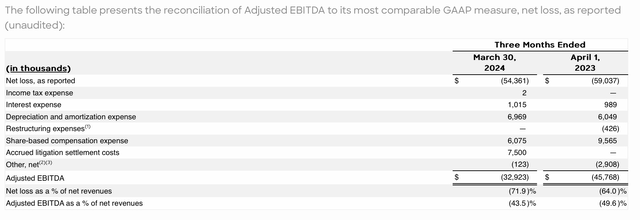

Gross margins in the quarter were a poor 4.9%, which was 180bps worse than 6.7% in the year-ago quarter. Adjusted EBITDA losses also came in at -$32.9 million in the quarter – though this was slightly better from both a margin and nominal dollars perspective relative to the year-ago Q1.

Beyond Meat adjusted EBITDA (Beyond Meat Q1 earnings release)

We should be most mindful of Beyond Meat’s cash burn. Operating cash flow in Q1 was -$31.8 million; and after including $1.2 million in capex, total free cash flow burn was -$33.0 million.

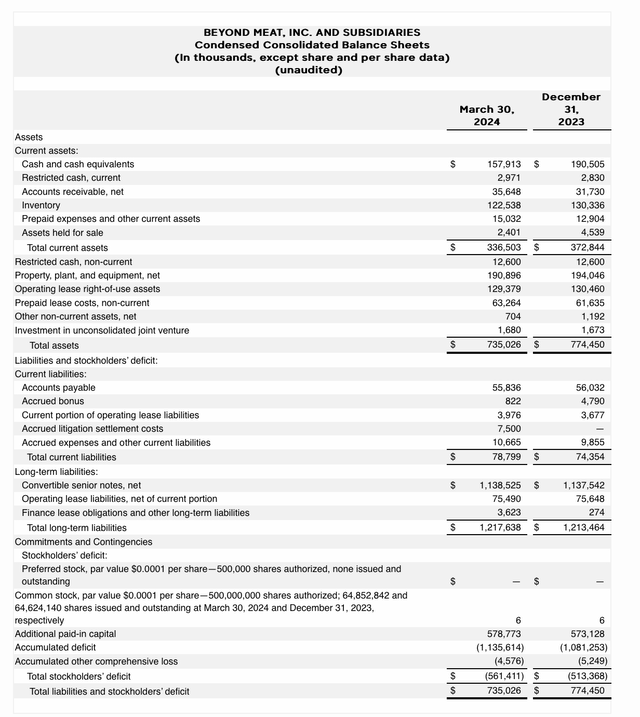

Meanwhile, as shown below, the company has just $157.9 million of cash remaining on its books – and that’s still burdened by the $1.14 billion of convertible debt that will mature in 2027.

Beyond Meat Q1 balance sheet (Beyond Meat Q1 earnings release)

This indicates that at Beyond Meat’s current burn rates, it has only a year’s worth of liquidity left on its books.

Raising additional capital seems like an uphill venture for Beyond Meat. With its existing indebtedness, it’s difficult to imagine anything other than a speculative debt lender (at extraordinary interest rates) willing to finance additional loans for the company. And with the stock already at multi-year lows, raising equity capital will also be tremendously dilutive for Beyond Meat shareholders.

The glimmer of good news is that Beyond Meat expects second half gross margins to improve relative to the first half, as it is expecting a mid-to-high teens margin in 2H. It’s unclear, however, how the company intends to hit this target when its largest channel continues to see declining volumes, declining points of sale, and declining revenue per pound from higher trade discounts. In other words, I find it highly unlikely for Beyond Meat to be able to solve its liquidity problem from a profitability turnaround. It needs economies of scale to thrive and to justify its manufacturing base: and yet the company has limited funds available to undergo a marketing push and re-educate its customer base on its products.

Key takeaways

To me, Beyond Meat is beyond saving. With shrinking points of sale, paper-thin gross margins, an unenthused customer base, and a giant mound of debt that will mature in less than three years, this company’s survival is far from a certainty. Continue to steer clear here and invest elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.