Summary:

- Palantir’s shares declined by -15% after an earnings beat-and-raise, opening up an opportunity for investors to build a position in their high-quality business.

- I expect that the company’s high-touch AIP boot-camp strategy will drive higher growth and margin expansion than Wall Street estimates.

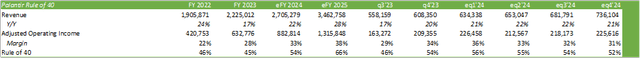

- Palantir far outpaced the Rule of 40 in their Q1’24 earnings release with the stat reaching 56%. Free cash flow experienced a y/y decline due to changes in working capital.

hakule/iStock via Getty Images

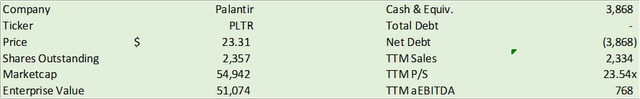

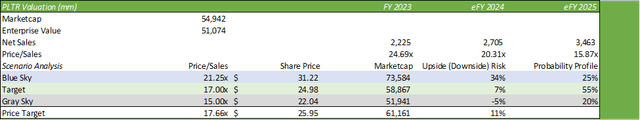

Palantir (NYSE:PLTR) reported a major beat-and-raise in their Q1’24 earnings release on May 6, 2024, and was met with a surprising -15% decline in their share price immediately following. Despite the near-term price action, I remain adamant in Palantir’s growth story and believe that with their high-touch AIP boot-camp strategy, the firm will realize significantly higher growth and margin expansion than what Wall Street consensus estimates suggest. I reiterate my STRONG BUY recommendation for PLTR shares, with a price target of $25.95/share at 17.66x eFY25 price/sales.

Be sure to review my previous reports covering Palantir:

Palantir-Oracle Partnership Brings Both Firms Tremendous Upside

Palantir: This Is Just The Beginning

Palantir Operations and Financial Forecast

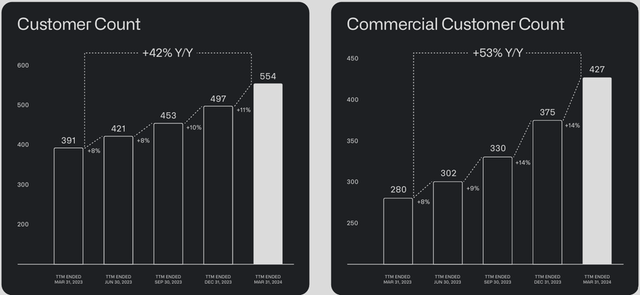

Palantir reported a strong Q1’24 with a beat-and-raise to revenue guidance and adjusted operating income as the firm realizes strength in their AIP boot-camp program. Management came into their Q1 earnings call confident of Palantir’s ability to continue to take on market share for AI applications beyond GenAI, suggesting that the firm’s platform has the ability to automate operations beyond competitors’ capabilities. One example management provided on the call was that General Mills was saving $14mm annually with a partial deployment of Palantir’s platform. It has become quite clear that Palantir’s software platform isn’t just a chatbot, but a software package that provides firms the ability to save materially on opex and improve business processes. I believe that with management’s hands-on approach, AIP boot camps have proven themselves effective in both showcasing the applications and building a baseline for what firms can expect from AI applications. Given the novelty of leveraging LLM data, this level of touch should provide Palantir continued growth in revenue generation, whether the enterprise purchases the product outright or continues through their POC process. I believe that this factor alone is a major contributor to Palantir’s success in growing their commercial customer base, as well as drive their ability to cross-sell and expand their TCV across enterprises. Another factor that plays a huge role in the customer acquisition and expansion process is that Palantir’s engineers work with enterprises in exploring use cases that can ultimately save the firm in costs, optimize and automate business processes, and ensure there are no missed sales opportunities.

Management remained exceptionally optimistic of their platform’s ability to outperform competing platforms, suggesting that Palantir’s software outpaces other firms to the point that they’re not considered competitors.

I don’t believe we have competitors. So, I don’t believe in the US commercial market we have competition. I don’t believe in the US government market we have competition. I don’t — I think that’s the reason Ukraine and Israel bought our product. We are differentiated because in order to actually make AI work, you need an ontology. No one has an ontology.

Alex Karp, CEO

Though this is a very bold statement to make, it appears to be true to a certain degree. While the majority of conversations over AI revolve around GenAI, Palantir’s platform is going beyond GenAI across their platforms and engaging in broader data analysis and business process enhancement. AIP is not only a platform for builders to develop on, but provides prebuilt solutions that can be applied to a business’s data. Though C3.ai (AI) provides a competing platform to Palantir’s AIP, C3.ai’s AI platform is customized more on a per-customer, per-industry basis. I believe this provides Palantir an edge in which the firm can more broadly target new customer acquisitions while allowing for the platform to be tailored to the company’s specific industry needs, and not the other way around.

Corporate Reports

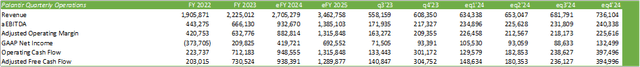

The deal flow during Q1’24 was exceptionally strong, with 87 deals closing with a value of at least $1mm, 27 over $5mm, and 15 of these deals over $10mm. This performance translated to a growth rate of 21% year-over-year at the top line that drove substantial adjusted operating income margin expansion to 36%, up from 24% a year ago. This high level of growth and margin expansion drove the firm’s Rule of 40 to 56%, up 2% sequentially, and 15% from the previous year.

Corporate Reports

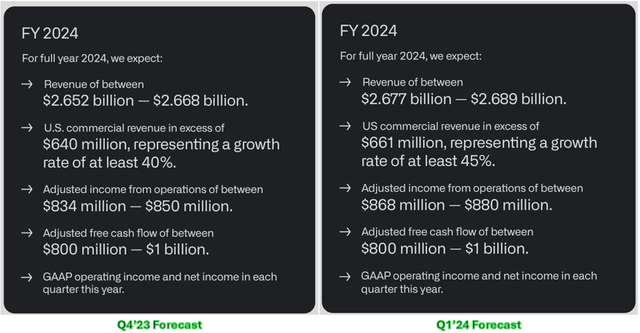

Despite the strong operating performance, working capital led to a year-to-year decline in cash flow from operations and adjusted free cash flow, which appears to only be a near-term headwind. Management forecast a major upswing in adjusted free cash flow generation through the duration of FY24 in the range $800-$1,000mm, a 10-37% improvement from FY23 cash flow generation.

Looking to Q2’24, management forecasts revenue growth in the range of $649-$653mm with an adjusted operating margin in the range of $209-$213mm. Though this is a sequential compression to the operating margin, the forecast calls for 55-58% growth with year-over-year margin expansion in the range of 32-33%, up from 25% a year ago.

Corporate Reports

Management also upped their FY24 forecast across the operating statement and expects a higher commercial engagement rate for the year. Given Palantir’s ability to help enterprises save on costs while optimizing operations, the firm may likely realize continued growth no matter the macro environment. Though AIP is a large capital investment for firms to take on during times of cash preservation, AIP may provide enterprises the ability to save in opex well beyond the cost of using the platform.

Corporate Reports

Forecasting out through FY25, I do anticipate operations to scale with sales experiencing modest margin expansion. I believe that Palantir’s technology provides firms with the bandwidth to expand operations with minimal capital investments going forward. Despite management’s initiative to expand their sales and marketing team, I do believe that they will remain prudent in scaling with revenue and not overshoot growth. One thing that sticks out to me is Palantir’s proactive approach to sales with their hands-on boot camps. Even if this does not drive an immediate sale, it will create a baseline for expectations for what an AI-enabled platform should be capable of. I believe that this is a long-term strategy that will pay off in both the near-term and long-term as firms realize the cost-saving capabilities Palantir’s platform has to offer.

Looking at revenue growth, I do anticipate Palantir to grow over consensus estimates given these factors. I believe that Palantir’s high-touch sales approach will drive stronger growth than what Wall Street consensus has baked into their estimates. Palantir isn’t just simply bringing their platform to the AWS marketplace; the sales team is using potential customers’ live data to provide real use cases, not just hypothetical models and applications. Though I stress this for the majority of my investment thesis on Palantir, I do believe this factor is a major differentiator for the firm in their ability to bring in more customers.

Valuation & Shareholder Value

Corporate Reports

PLTR shares took a modest beating after the Q1 earnings release, with shares declining -15% following the release. Shares have recovered since the decline but still remain below their pre-earnings price level. Despite the challenging shareholder support following earnings, I do believe PLTR shares can offer investors significant value going forward as the firm continues to grow both their top-line and margins beyond their competitors. I maintain my STRONG BUY rating for PLTR shares with a price target of $25.95/share at 17.66x FY25 price/sales.

Corporate Reports

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.