GameStop: Cash On Hand, But Questions Remain

Summary:

- GameStop reported disappointing Q1 earnings, highlighting the need to reset its business model.

- With the recent offerings in May and June, I’m projecting GameStop’s cash balance to be more than $4 billion, which I believe can be used to transform its declining business.

- I expect GameStop to use its cash to launch a new digital game store, transform into a holding company, or potentially announce a share buyback program.

- I’m downgrading my buy rating for GameStop to a hold, preferring to take a wait-and-see approach until management shares how they intend to use the company’s cash hoard.

DanBrandenburg/E+ via Getty Images

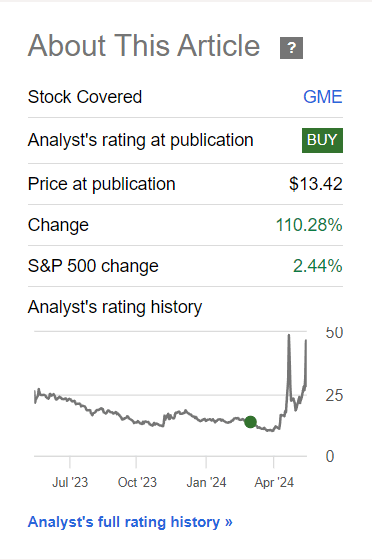

Last March, I initiated my coverage of GameStop Corp. (NYSE:GME) ahead of its Q4 2023 earnings with a buy rating, predicting the video game retailer to beat estimates. While GameStop’s actual results fell below my expectations, its stock is up more than 110% since then, largely due to the resurgence of its “meme” status.

Seeking Alpha

On June 8th before market bell, GameStop unexpectedly reported disappointing Q1 2024 earnings highlighted by a steep 29% decline in revenues, indicating that its core business is deteriorating rapidly. These disappointing results overshadowed a major catalyst for the stock which was a livestream by Keith Gill, a.k.a Roaring Kitty, his first in almost 4 years.

Moreover, GameStop announced a plan to sell up to 75 million shares to capitalize on the recent “meme” rally by further bolstering its balance sheet, which was rejuvenated by nearly $1 billion raised in May through the sale of 45 million shares. With the company exiting Q1 with nearly $1.1 billion in cash, equivalents, and marketable securities, I’m estimating its current cash balance after the latest 2 offerings to be around $4.27 billion. These funds, if managed properly, could substantially improve GameStop’s bleak outlook as I’ll discuss in this article. Despite this, I’m downgrading my rating for GameStop to a hold until management announces how they intend to use this potential war chest.

Q1 Overview

In my opinion, GameStop’s Q1 earnings show that the company is in a dire need to reset its business model. The video game retailer reported $881.8 million in revenues, down 29% from $1.24 billion in the prior year. And although SG&A costs declined 15% YoY from $345.7 million to $295.1 million, its percentage of revenues increased to 33% from 28% in the prior year due to the aforementioned revenue decline. Despite this, GameStop reported a net loss of $32.3 million compared to $50.5 million in the prior year as a result of posting an improved gross margin of 27.7% compared to 23.2% in the prior year period.

|

Quarter |

Q1 2023 |

Q1 2024 |

Difference |

|

Revenues |

$1,237,100,000 |

$881,800,000 |

-28.7% |

|

CoR |

$949,800,000 |

$637,300,000 |

-32.9% |

|

Gross Profit |

$287,300,000 |

$244,500,000 |

-14.9% |

|

Gross Margin |

23.2% |

27.7% |

|

|

SG&A |

$345,700,000 |

$295,100,000 |

-14.6% |

|

% of Revenue |

27.9% |

33.5% |

On the other hand, GameStop remains sitting on a huge cash pile as its cash, equivalents, and marketable securities were nearly $1.1 billion at the end of Q1. Since then, the company raised $933.4 million from the sale of 45 million shares last month, and announced a plan to sell up to 75 million shares. Assuming the company sold the 75 million shares at an average price of $30, it might have raised an additional $2.25 billion, bringing its total cash balance to around $4.27 billion, in my view.

It should be noted that this figure isn’t official as GameStop hasn’t announced the closure of the latest offering yet, but it is a projection based on the assumption that the company sold the 75 million shares at an average price of $30.

|

Cash at End of Q1 |

$1,082,900,000 |

|

May Offering |

$933,400,000 |

|

June Offering |

$2,250,000,000 |

|

Total Cash |

$4,266,300,000 |

The company stated in the 8-K filing announcing the stock sale plan that it intends to “use the net proceeds from the offering, if any, for general corporate purposes, which may include acquisitions and investments in accordance with the Company’s investment policy.”

GameStop, since Ryan Cohen’s appointment as CEO, hasn’t held an earnings call and didn’t provide any guidance. In my opinion, this lack of transparency has been detrimental to the stock’s valuation, as the company’s direction isn’t clear at all.

With a cash balance of more than $4 billion, per my estimates, will GameStop continue operating as a brick-and-mortar video game retailer that is rapidly losing market share? Or will it expand its digital presence to keep up with market trends? Or will GameStop turn into a holding company in similar fashion to Warren Buffett’s Berkshire Hathaway Inc. (BRK.A) or Carl Icahn’s Icahn Enterprises L.P. (IEP)?

Possible Cash Uses

With so many unanswered questions regarding the company’s future direction, one can only speculate about what GameStop plans to do with its cash hoard that I’m projecting to be around $4.27 billion. As is, such a financial cushion could allow the company to explore several ventures to reinvigorate its declining business model. Accordingly, I’ve outlined 3 possible scenarios for GameStop’s future that I’ll be discussing in this section.

A New Digital Game Store?

The first scenario I see, and the most likely one in my opinion, is GameStop developing its own digital game store, competing with the likes of Steam and Epic Games in the process. GameStop could be able to achieve this feat due to 2 factors. Its cash pile and its existing partnership with Microsoft Corporation (MSFT). How the company can utilize both factors is easy to contemplate.

Using its cash resources, GameStop can invest in building up a user-friendly platform where gamers can easily buy and download video games. At the same time, the company can utilize its partnership with Microsoft by using Azure for cloud services to help it handle traffic and data securely and efficiently. In addition, using Microsoft 365, the company can streamline its backend processes leading to fast load times, easy transactions, and top-notch customer support.

Another way GameStop could make such an offering a major hit is by utilizing its stash to secure exclusivity deals with game developers under which these game developers would only offer their titles for sale on GameStop’s store. In my opinion, such an endeavor would be pivotal to attracting users to the possible platform from the main players in this space, Steam and Epic Games. GameStop’s brand recognition will also have a major role in attracting users to this potential platform.

In this scenario, GameStop would be venturing into the rapidly growing PC gaming market. According to Statista, there are nearly 1.86 billion PC gamers worldwide that are expected to generate $90.4 billion in 2024. This figure is forecasted to reach $213.6 billion by 2032, growing at a CAGR of 11.34%. As such, if GameStop successfully utilizes its cash balance, brand name, and Microsoft partnership, I believe it can easily secure a substantial market share, which could help it to stop the trend of declining revenues and return to posting revenue growth.

GameStop Holding Company?

The second scenario I see possible is for GameStop to become a holding company managed by Ryan Cohen in similar fashion to Warren Buffett’s Berkshire Hathaway or Carl Icahn’s Icahn Enterprises. To that point, GameStop’s board approved a new policy last December allowing Ryan Cohen and the rest of the management team to invest in equity. This policy replaced the prior policy where management was only permitted to invest the company’s cash balance in investment-grade short-term income securities. The policy also allows Cohen to invest personally in the same securities as the company.

While the new policy raises some questions over possible conflicts of interest, Cohen could make all of his personal investments through GameStop in a similar way to Buffett with Berkshire Hathaway, rather than his personal account to alleviate those concerns. In turn, doing so would make investing in GameStop a way for retail investors to track Cohen’s investments.

With that in mind, Cohen is considered by many to be a savvy investor thanks to his history of successful investments. This reputation started when he founded Chewy, Inc. (CHWY), which I have previously covered twice here and here, in 2011 where he turned it into the pet industry’s biggest success story. Under his leadership, Chewy grew exponentially and then was sold to PetSmart for $3.35 billion, setting a record for the biggest e-commerce acquisition ever.

Following his success with Chewy, Cohen acquired a 9 million share stake in GameStop in 2020, initially valued at $76 million. By early 2021, his stake was worth around $1.4 billion, representing a more than 1700% return.

Then in 2022, Cohen acquired 7.78 million shares and options to buy another 1.67 million shares of the now-bankrupt retailer Bed Bath & Beyond for $121.2 million between mid-January and early March. Cohen then went on to sell all of his position in August for $189.3 million, representing a profit of $68.1 million or a 56% gain on his investment.

In light of Cohen’s history of successful investments, if GameStop indeed becomes a holding company, its stock has the potential to grow exponentially due to the potential returns on its stash that I’m projecting to be worth nearly $4.27 billion. In Q1, GameStop reported an interest income of $14.9 million due to its investments in investment-grade short-term income securities. As such, if GameStop is able to generate a return on investment higher than the risk-free market rate, the potential return could offset the core business’ operating losses, which was $50.6 million in Q1.

Share Buybacks?

The least likely scenario in my opinion would be GameStop using its cash balance to buy back shares whenever its stock price plunges. Assuming the company sold all of the 75 million shares under the most recent offering, its outstanding shares would be 425.9 million. At the current share price of $28.22, GameStop’s market cap would be around $12 billion.

|

Outstanding Shares |

|

|

End of Q1 |

305,900,000 |

|

May Offering |

45,000,000 |

|

June Offering |

75,000,000 |

|

Total |

425,900,000 |

As such, the company’s cash balance, which I’m estimating to be around $4.27 billion, could buy 35.5% of its current outstanding shares at the current valuation. While a share buyback program could help boost GameStop’s valuation in the short term, I don’t believe it would be the wisest action since it doesn’t help solve GameStop’s biggest problem which is its declining business model. It is for this reason that I believe GameStop launching a new digital game store or shifting into a holding company are more likely scenarios than this one since both actions address the company’s core issues.

Valuation

In my previous coverage, I set a price target of $21 per share based on GameStop’s EV/Sales multiple. That said, given that the company may be on the verge of transforming its whole business thanks to its cash balance that I’m projecting to be more than $4 billion, focusing more on its cash balance would be the way to reach a fair value for the stock, in my opinion, since it could potentially have around $10 in cash per share.

|

Total Cash |

$4,266,300,000 |

|

OS Post Offerings |

425,900,000 |

|

Cash Per Share |

$10 |

By factoring in the recent cash raises in May and June, GameStop would be trading at a 2.68 P/B multiple compared to a sector median of 2.12 which indicates that the stock is fairly valued at the current valuation despite the slight premium.

|

Total Assets |

$5,770,500,000 |

|

Total Liabilities |

$1,279,800,000 |

|

Book Value |

$4,490,700,000 |

|

BVPS |

$10.5 |

|

P/B |

2.68 |

That, combined with the uncertainty around GameStop’s future direction, is why I’m taking a wait-and-see approach at current levels in anticipation of updates from management regarding the company’s future direction.

Conclusion

Following the recent offerings in May and June, GameStop may be sitting on a war chest of more than $4 billion, according to my estimates. These funds, if managed properly, could completely transform the company’s outlook in different ways, including launching a new digital game store, transforming into a holding company similar to Berkshire Hathaway or Icahn Enterprises, or announcing a share buyback program.

In my opinion, the first scenario would be the best-case scenario due to its potential to reinvigorate GameStop’s outlook thanks to the large size of the PC games market. The second scenario could also boost GameStop’s valuation in the long term given Ryan Cohen’s history of profitable investments.

Meanwhile, I believe the third scenario would be the worst use of this potential $4 billion cash pile as it doesn’t address GameStop’s biggest problem which is its declining business model. Given that management has yet to share any updates regarding how they intend to use this war chest, I’m downgrading my rating for GameStop from buy to hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.