Summary:

- Intel posted very disappointing earnings in the last quarter.

- Both PC and Data Center operating margins were severely depressed.

- Management has once again shown a blind spot for controlling inventory, something which is entirely within its control.

Justin Sullivan

Fool Me Once

Alright, we’ve seen this one before. We know how the movie ends. We know who the villain is long before Scooby and the gang pull off the mask.

We know Intel (NASDAQ:INTC) is in a bad spot.

And yet, like someone hanging onto a relationship that isn’t going to turn around, investors continue to hold on. On the heels of Texas Instruments’ (TXN) disappointing earnings, it only made sense that Intel would follow suit.

But this bad?

Investors can be forgiven for a feeling a bit of optimism in the lead up to the earnings announcement. After all, it was only in early December that Bloomberg reported that Intel was on course to regain its place as the leading chip-producing company. “We’re completely on track,” Intel Vice President Ann Kelleher stated in the article.

The New York Times featured a more-or-less gushing article which recounted the torturous development of Sapphire Rapids, the two-year delayed data-center-brain chip that was supposed to serve as an Intel flagship product.

This is all not to mention that Intel gladly served as the face of the CHIPS Act. While the stock market of years ago had the Fed put, investors were seemingly led along a path to believe that, much like Boeing (BA), the United States government now had a degree of vested national security interest in Intel’s success as it reckoned with the rise of Chinese chip makers.

Mea Culpa

It’s not often that a CEO of a Fortune 500 company is forced to throw himself at the mercy of the analysts, and yet that’s what happened when CEO Pat Gelsinger addressed listeners on the call. He admitted that the company fell short, and, strikingly, said he would not provide guidance for the coming year given the uncertainty that the company faced.

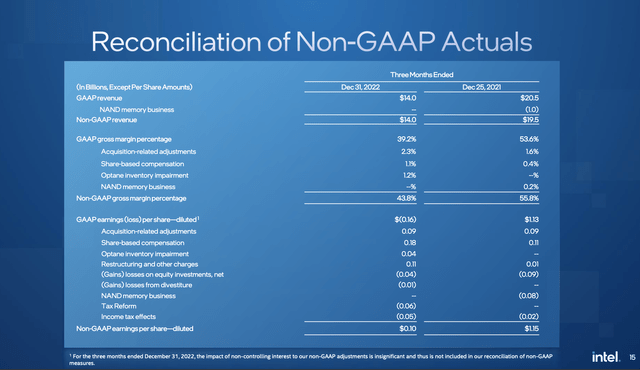

It’s not hard to understand his choice. The company posted $14 billion in revenue for the quarter against Wall Street’s expected revenue of $14.5 billion.

When reconciled to GAAP accounting, these results added up to a loss of $0.16 per share for the quarter. To be fair, analysts were expecting a loss–just not such a large one.

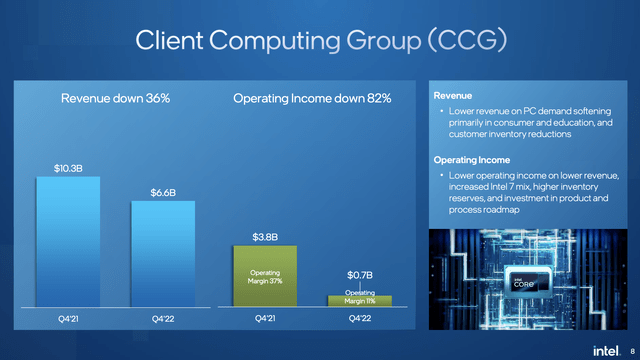

The chief culprit for these losses? Continued softness in the PC market.

‘Continued softness’ feels a bit too easy, though. Based on the results, it feels like devastation. Revenue was down 36% year-over-year, while operating income was down an eye-watering 82%.

This is now where we turn to management, because the slowdown in the PC sector is not new. In fact, weak demand in the PC market was what drove down profits in the previous quarter. And yet, on the slide above, management attributes a lower operating income margin in part to “higher inventory reserves.”

What?

Now, management can be forgiven for an unseen macro headwind that batters the business. After all, they don’t have a crystal ball. But failing to manage inventory in the quarter following very, very disappointing results in the PC sector seems… sloppy, and especially so when during the last quarter leadership were giving interviews (the Bloomberg article referenced above) stating that, effectively, things were going swimmingly.

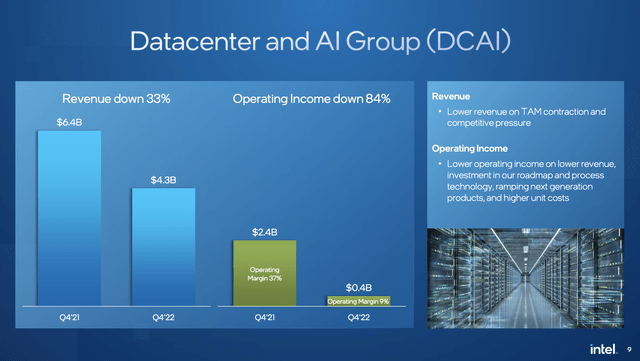

Progress on the data center front wasn’t much better.

In this segment, revenue was down 33% while operating income was down 84%. Now, remember, this was the business segment where Intel has routinely had its lunch eaten by Advanced Micro Devices (AMD). This is also the business segment where Sapphire Rapids (the subject of the above referenced New York Times article) was supposed to create a meaningful difference.

Now, we don’t expect that a product launch in the middle of the last month of the quarter would massively move the needle, but we hope that it would help somewhat. Certainly the launch of a two-year delayed chip that is supposed to be a boon for the business would warrant some type of guidance for the next year, a bright spot amidst a sea of disappointment. But, no.

All of this makes management’s promises on the call to slash costs ring hollow, a bit like the arsonist returning to the scene of the crime offering tips on how to put out the fire.

The Bottom Line

Those of us expecting management to make the right moves and produce even green shoots of a turnaround were sorely disappointed. After a previously bungled quarter with bad results, management has once again failed to deliver.

While we have not previously covered Intel, we have followed it closely over the last several months. This latest failure from management shows that investors should steer clear until trust is re-earned.

Thank you for reading our article.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.