Summary:

- We preview Apple’s upcoming quarterly report with a bullish case for the stock.

- There’s a parallel between conditions today and the events from the start of 2019 defined by deep pessimism at the time.

- Macro trends, including a weaker Dollar and easing inflationary pressures, should support higher earnings going forward.

Justin Sullivan

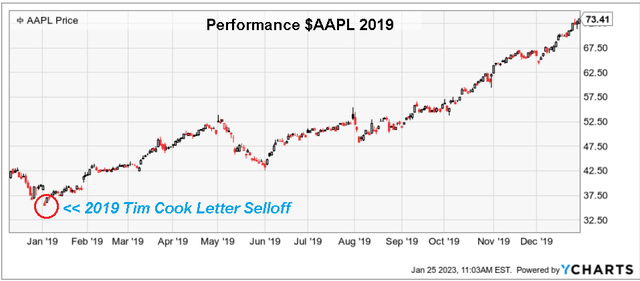

In the annals of stock market history, a footnote to Apple Inc (NASDAQ:AAPL) deserves to be remembered as an important lesson for all investors. It’s been a little over four years since the infamous “Tim Cook Letter“, which created a debacle in early 2019, but now stands as just an embarrassing moment for one of the most successful companies in the world.

As a recap, Apple took the unprecedented step of revising sales and earnings guidance sharply lower just weeks ahead of its fiscal Q1 report. The unusual letter cited “the magnitude of the economic deceleration” related to uncertain conditions in China. The updated targets were well below market consensus and accompanied by a somber tone.

The news on January 2nd, 2019 was devastating for the stock and worked to bring down the entire market. Shares dropped by 10% in one of the largest selloffs of the last decade and referred to at the time as Apple’s “Darkest Day“.

That being said, a funny thing happened from that point onward. Shares of AAPL turned around into a massive winner, climbing nearly 100% through 2019. In fact, the low of the year for the stock happened precisely on the day of the doom and gloom announcement.

The repercussions of the poor timing by CEO Tim Cook and the circumstances around the event remain the subject of an ongoing lawsuit considering it likely spooked investors into selling prematurely. Keep in mind that AAPL has returned more than 250% in the period since.

Take Guidance With A Grain Of Salt

The point we’re making is to maintain a level of skepticism regarding any company guidance and analyst estimates, where even the most respected of management teams can sometimes get it wrong. To be clear, the Q1 results that year were pressured by conditions in China and emerging markets, but it was clearly just noise in the bigger picture.

In hindsight, Apple’s messaging that year was likely poorly devised based on backward-looking trends more than anything else. Conditions simply evolved more favorably, allowing the company to ultimately outperform expectations sending shares higher. Specifically, iPhone sales in 2019 proved to be much more resilient than feared while the company gained traction with services.

With that, here’s a list of considerations investors should be making when thinking about guidance and corporate actions in general, in our opinion.

- Management teams have the implied incentive to keep publicly announced targets conservative, leaving some room to later over-deliver.

- Companies are often reactive, taking steps after the fact or too late.

- C-suite executives are typically not trained economists and sometimes fail to accurately interpret high-level macro trends.

- Forecasts by companies (and Wall Street analysts) often discount the probability of tail risks, including both negative and positive surprises.

- Things can change quickly.

Of course, it goes both ways. Every time a company beats estimates, there is also the possibility of a big miss which is a risk to consider. Still, it’s far more important for investors to not lose track of the long-term outlook.

Upside To AAPL Estimates In 2023

We bring all this up because there is a good parallel here to not only the outlook for Apple but the broader stock market narrative which has been particularly gloomy at the start of this year.

Curiously, that same Tim Cook letter noted a “strong Dollar” and “supply chain constraints” as key factors in its challenging macro backdrop. Those headwinds are also recognized as major themes companies faced in 2022, even if for different reasons.

The connection is that much like Apple at the start of 2019, we sense that the market is placing too much emphasis on trends last year, while not recognizing the path for better-than-expected conditions going forward.

Even from the number of high-profile tech companies announcing layoffs and soft guidance at the start of the Q4 earnings season, there is a case to be made that those views are based on looking in the rearview mirror. It would have been more impressive for the visionary leaders at companies like Microsoft Corp (MSFT) or Alphabet Inc (GOOGL) to start cutting headcount back in 2021 expecting a slowdown, or have never made those excess hires in the first place.

Fast forward, one of the most positive developments for the market entering 2023 is easing inflationary pressures and improving supply chain conditions. Similarly, the strong dollar trend that impacted earnings across various sectors in recent quarters has reversed as an encouraging development.

Going back to Apple’s last quarterly report and earnings conference call in late October, the company chose not to issue specific revenue guidance but instead just “directional insights”.

Apple CFO Luca Maestri made a point of expecting a significant negative FX hit, likely resulting in a nearly -10% hit to the top line this quarter. Similarly, with official guidance for the gross margin between 42.5% and 43.5%, this level incorporated the backdrop of the ongoing Dollar pressure.

Another big theme in 2022 that has essentially made a complete 180 is the Covid disruptions and rolling lockdowns in China, a strategically important market for the company. It was only in December that the Chinese government began rolling back its “zero-Covid” policies and easing travel restrictions.

Our thinking here is that Apple may have benefited through the end of the quarter with an impulse as consumer spending got a boost in the Asia-Pac region. This would be tied to better-than-expected retail sales reported in China for December.

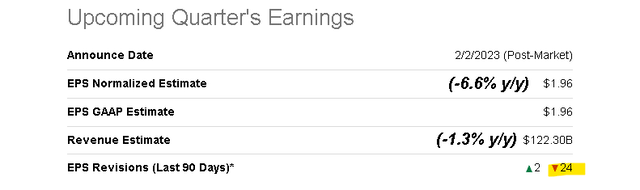

Putting it all together we see room for Apple to beat expectations for its upcoming fiscal Q1 report set to be released on February 2nd and also the rest of the year, with a view that the current consensus is too conservative. There’s a path for Apple to come in at the higher end of forecasts considering an improving macro picture including the weakening Dollar even through the last Holiday shopping season.

The Q1 consensus is for EPS of $1.96, representing a year-over-year decline of -6.6%. The context here is the comparable period last year which was exceptionally strong during the early post-pandemic reopening fueled by stimulus efforts in the United States.

By this measure, the trend is still impressive considering earnings against the EPS of $1.25 during the period in 2019 as a pre-pandemic benchmark. That’s also the case with revenue forecast this quarter at $122.3 billion, down by a modest -1.3% y/y, which incorporates a major FX hit, but up 38% from the December 2019 quarter.

More telling for us looking at this report is the trend in EPS revisions lower, with 24 negative updates compared to just 2 increases. This goes against, the favorable FX dynamic over the quarter that directly balances the soft guidance Apple offered in late October.

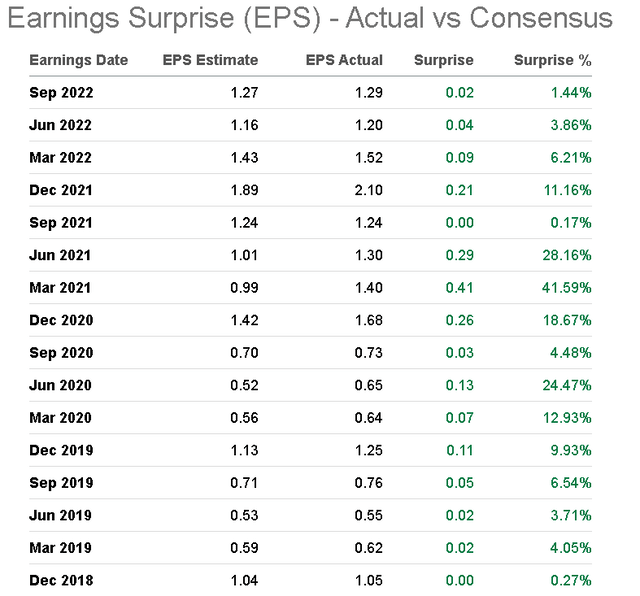

Here’s another doozy. Apple hasn’t missed in a long time. With data going back five years to 2018, Apple has surprised the consensus EPS estimates every single quarter over the period by an average of 9% above the estimate. Yes, in the quarter where Tim Cook decided to sandbag the guidance, the company came in above the target, barely. There’s no reason to expect anything different next week.

What’s Next For AAPL?

Among the largest and most important companies in the world, it’s clear that Apple faces exposure to macro trends including consumer spending dynamics. There are some legitimate concerns that global growth is slowing under the weight of high-interest rates and still stubborn inflation.

On the other hand, the bullish case for the stock starts with the premise that the U.S. avoids the fate of deep recession and remains resilient in a “soft landing scenario”. We mentioned the cooling inflationary trends and the pullback in the Dollar, but the setup here goes further into the implications of stabilizing interest rates and a potential shift in Fed policy.

Connecting the dots, a rebound in indicators like consumer sentiment and even trade activity could be very bullish for the operating environment of tech and consumer discretionary names where Apple sits at the intersection.

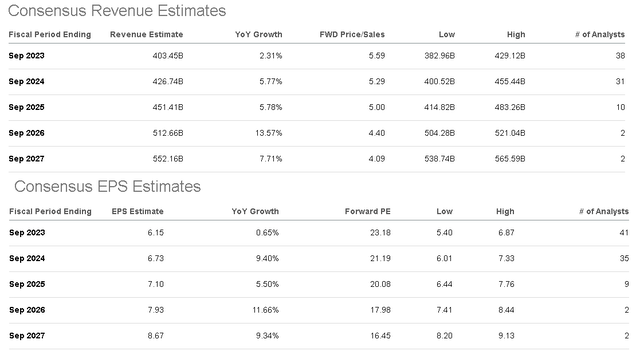

With a current forecast for full-year top-line growth of just 2.3% and nearly flat EPS for 2023, our takeaway is that expectations are too low, pricing in a poor backdrop. An evolving narrative over the next few quarters could set the stage for something similar to what occurred in 2019 when Apple surprised everyone.

As it relates to valuation, it’s true that AAPL currently trading at a forward P/E of 23x is above the historical average for the stock. At the same time, recognize that Apple today is transformed from what it looked like even three or five years ago. The key has been its push into services including momentum in digital products that have marked a major momentum towards structural margins. The company is more diversified with a higher quality of cash flows.

This effort justifies a higher premium for the stock today compared to when it was simply a “hardware ” name, dependent on the iPhone. Separately, few companies have the type of brand loyalty as Apple, with that particular dynamic supporting a positive long-term outlook. By all accounts, the company is doing more than well and will continue to innovate with the next generation of products and services.

Final Thoughts

We’re bullish on the stock market and view Apple as well-positioned to lead the market. We rate shares as a buy with a price target for the year ahead at $175 implying a forward P/E of 28x on the current 2023 consensus EPS. The way we get there is to assume the company can piece together a string of strong quarterly reports accompanied by a broader rally in tech stocks including the Nasdaq 100 (QQQ). Notably, even within the current EPS consensus which is an average of 38 Wall Street estimates, the range goes as high as $6.87. Our forecast sees the company approaching $6.50 in earnings as part of the bullish case.

In terms of risks, a sharp deterioration to the macro backdrop defined by a surge of unemployment or a resurgence of new inflationary pressures would force a reassessment on our side. Significantly weaker earnings would also open the door for a leg lower in the stock. It’s not going to be a straight line higher, so an assumption of continued volatility makes sense.

Disclosure: I/we have a beneficial long position in the shares of QQQ, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.