Summary:

- Capital One Financial Corporation is one of the financial firms that are highly sensitive to economic trends and monetary policies due to its exposure to subprime borrowers.

- A 34% drop in its fiscal year 2022 earnings demonstrates that tight market conditions make it difficult for a consumer finance company to generate lofty earnings.

- COF’s earnings may suffer in the coming quarters as economic uncertainty and interest rate increases could potentially lead to a recession.

- The recent uptrend in its shares appears to be a bear market rally, as falling earnings and economic headwinds are expected to weigh heavily on its shares in the coming days.

JHVEPhoto/iStock Editorial via Getty Images

In one of the most difficult macroeconomic environments in a decade, Capital One Financial Corporation (NYSE:COF) does not appear to be a good stock to buy. Its stock, which has already lost nearly a quarter of its value in the past year, is expected to fall further because the larger-than-expected decline in the fourth quarter and fiscal 2022 earnings show that its business model is vulnerable to deteriorating credit conditions. Indeed, larger-than-expected growth in key indicators such as credit card delinquency, net charge-offs, and provision for reserves, which were largely responsible for 2022 earnings declines, is expected to worsen in 2023. This implies that Capital One’s earnings potential is likely going to suffer a serious setback in 2023, which could have a significant impact on its share price performance. Therefore, investing in a stock that is more likely to be negatively impacted by deteriorating market fundamentals doesn’t seem like a wise choice.

Consumer Finance Outlook Weakening in 2023

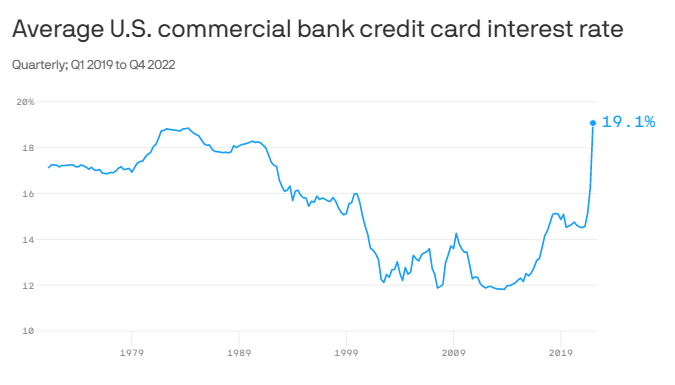

Average U.S. commercial bank credit card interest rate (axios.com)

Consumer finance has been hit the hardest in the financial sector due to its sensitivity to the economic environment. In 2022, credit card interest rates rose at the fastest rate in history, reaching an all-time high of more than 19%, with further increases expected in 2023 as the Fed seeks to raise the federal funds rate to more than 5%. A high-interest rate could potentially affect both the demand for new credit and the risk of defaults. Aside from high-interest rates, slow economic growth, rising unemployment, and declining disposable income are all likely to have an impact on consumers’ repayment ability. This was clearly visible in the fourth-quarter results. The higher-than-expected decline in earnings for banking goliaths like Goldman Sachs (GS), Morgan Stanley (MS), and numerous others were caused in part by consumer finance. Goldman recorded a $972 million provision for credit losses, which was 50% higher than analysts expected, due to the risk of potential losses in its credit card and point-of-sale loan portfolios. Denis Coleman, Goldman’s CFO, stated during an earnings call that the bank is seeing “early signs of consumer credit deterioration.”

I think the credit market is just starting to deteriorate, and things could get worse for consumer finance lenders in the upcoming quarters given that the cost of credit is probably going to increase by at least 1% in 2023. Meanwhile, slower economic growth and a recession mean higher delinquencies, charge offs, and provisions for credit losses. In the fourth-quarter earnings call, Discover Financial (DFS), one of the biggest credit card companies, warned of difficult times to come and projected that its full-year net charge-off rate could increase to 3.5%-3.9% from 1.82% in 2022.

Where Does Capital One Financial Stand?

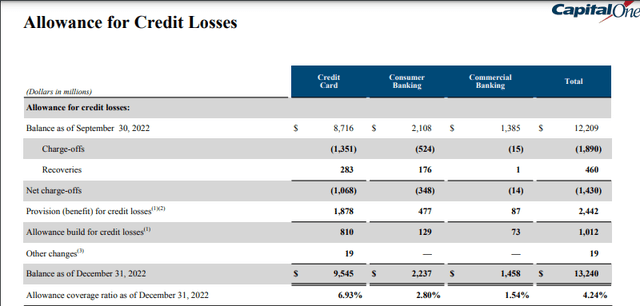

Capital One’s allowances for credit losses (investor.capitalone.com)

One of the largest credit card companies, Capital One Financial, has struggled to keep up its earnings growth rate in rotting market conditions. The company earned $17.91 per share in 2022, down from $27 per share the previous year. It also fell far short of fourth-quarter revenue and earnings estimates due to a larger-than-expected provision for credit losses. COF’s adjusted EPS of $2.82 in the fourth quarter declined sharply from $4.20 in the previous quarter and $5.62 in the year-ago period. Provision for credit losses increased to $2.42 billion, up from $1.67 billion in the previous quarter and $381 million in the previous year’s period. According to data from Seeking Alpha, 14 analysts have lowered their 2023 earnings projections for Capital One. The median earnings per share target is now $14.71, representing a 16% decrease from 2022.

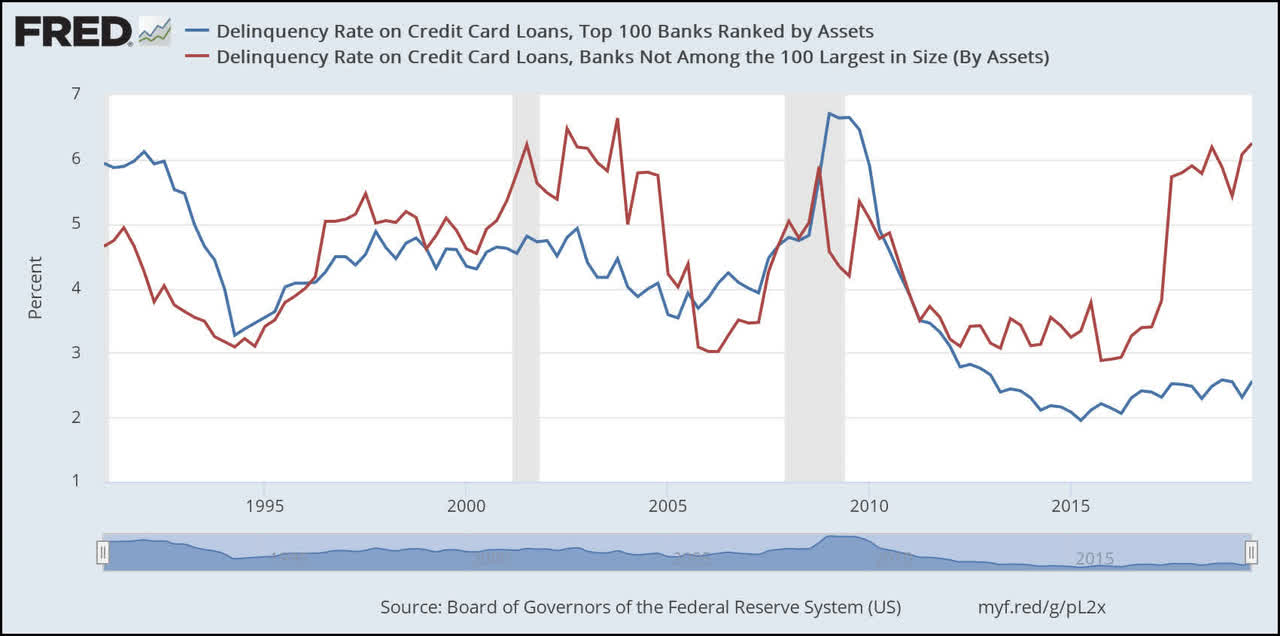

Credit card delinquency rate (fred.stlouisfed)

History shows that delinquency rates significantly increase whenever the economy experiences a recession. In 2008, the delinquency rate jumped to around 7%, and it was above 5% in early 2000. In December, COF’s delinquency rates jumped to 3.43% from 3.32% in November and 2.22% in the year-ago period. The net charge-off rate also rose to 3.57% from 3.14% the previous month and 1.76% the previous year. If the US economy experiences a recession in 2023, which is highly likely, the delinquency rate could rise significantly from current levels. In this scenario, COF earnings could fall significantly short of analysts’ expectations. This is because COF is offering credit cards to nonprime borrowers with credit scores ranging from 601 to 660, which exposes the company to high risk of defaults during a period of macroeconomic uncertainty.

Moreover, with 26% of the loans held for an investment made up of that asset class, COF’s exposure to the auto lending sector of the card industry presents additional difficulties. The company slowed its auto lending in the fourth quarter in response to competitive pricing dynamics that have pressed industry margins. In the fourth quarter, its auto originations fell 32% year over year and 20% from the previous quarter.

COF’s Shares are likely to Remain Under Pressure in 2023

COF price chart (Seeking Alpha)

Market analysts have lowered their price targets for Capital One due to the high risk of credit decline. Wells Fargo and JPMorgan Chase both lowered their price targets for COF to $115 and $120, respectively. The 20 analysts who are providing 12-month price projections for Capital One Financial have a median price target of $112. There isn’t much room for COF stock to rise from its current level since it is currently trading close to the median estimate. In addition, the stock is currently trading at a significant premium to its $81 per share tangible book value. Despite a favorable valuation in the financial sector, the stock appears overpriced when compared to its closest industry peers. The Seeking Alpha quant system assigned it a negative B grade on valuations, while its competitors received a negative A grade on earnings. Aside from price target estimates and valuations, the company’s stock may fall significantly in the coming months due to general market trends and declining earnings potential. The US stock market has had one of the most pessimistic outlooks in more than 20 years, with a median S&P 500 year-end price target of 4000 points for 2023. If the S&P 500 continues to fall in 2023, high-beta stocks like COF may fall faster than the broader market index. COF has a twenty-four-month beta of 1.22 and a sixty-six-month beta of 1.44.

Quant Ratings

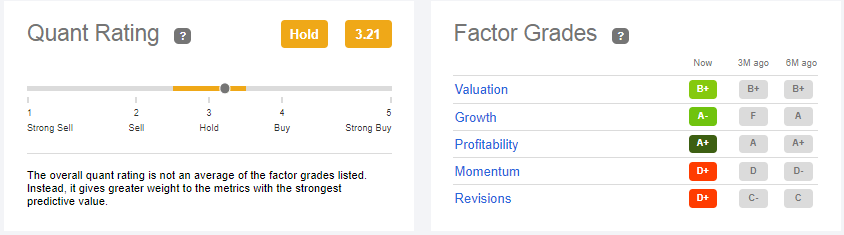

Quant ratings (Seeking Alpha)

Seeking Alpha’s quant ratings paint a picture that is similar to what I argued above. The company was rated as a hold with a quant score slightly higher than 3. The D+ grade for the earnings revision factor indicates that analysts have reduced their earnings forecast for the company due to economic uncertainty and a large provision for credit losses. A low stock price momentum score also suggests that COF shares have limited upside potential and will require strong fundamental and financial support to establish a consistent upward trend.

In Conclusion

Capital One Financial appears to be a risky bet in the short term, as its business model is heavily sensitive to economic uncertainty and high-interest rates. The company reported a 34% year-over-year drop in fiscal 2022 earnings, with another high double-digit drop expected in 2023. Increasing delinquency rates, high charge-offs, and a sizable provision for credit losses are expected to have a negative impact on its earnings and investor sentiment during fiscal 2023.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.