Summary:

- Exxon Mobil Corporation Q4 earnings were strong, but note the declines in sales and margins.

- Exxon Mobil Corporation is very shareholder-friendly.

- Oil prices really drive everything, and given where we see them going in conjunction with volumes, we think you need to take profit on Exxon Mobil Corporation.

naratrip boonroung/iStock via Getty Images

Is it just us or is Exxon Mobil Corporation (NYSE:XOM) a battleground-type stock? Go back to the comments sections and review them on the many opinion and analysis pieces here on Seeking Alpha. There are some lively debates between ardent bulls and perennial bears. One thing is undeniable: Exxon Mobil stock’s returns have been astounding.

We pushed our members to buy XOM stock hand over fist in 2020, and only started lightening up on energy in late fall 2022. Astounding returns. The returns have been solid. But now the question is where are we going from here? Can we really continue to melt up? The stock may look cheap on valuation, but really a bet on XOM stock here at the all-time highs is a bet that oil prices rebound. They will be absolutely fine at $80 oil. But to keep going higher, you are betting on oil rising. That is, in our opinion, undeniable as well.

For many, XOM stock was a winner, and quite obviously oil pricing has helped tremendously. While demand is coming back with China reopening from COVID, recessionary pressure and moves to get away from oil products could offset said demand. The supply side of the equation is subject to powerful oil-producing nations flooding the market even more, or restricting it. As of now, oil prices are a touch below our 2023 target of $83. We think it will trade around this range.

For the thousands of traders that follow our work, Exxon Mobil Corporation stock is a winner. But should you hang on here? We think a pullback is likely from all-time highs. The stock is not expensive, but if pressure remains on oil, XOM stock is coming down, despite the amazing operational metrics. Like it or not, oil companies had a huge windfall from inflation. That is a fact. We are starting to turn bearish here because we do not see massive upside for oil in this market environment. We see a little upside from here, but we also have a stock market that has exploded higher on hope that recession will be averted, while many companies are giving pretty downbeat guidance for 2023.

Translation? We think markets are heading lower in coming weeks and months, and XOM will get dragged down with them. You do not have to sell all of your shares, but it certainly makes sense to take 15-20% off, then sell some upside calls if you wish to remain long and capture that juicy dividend. Lets check in on the Q4 performance and talk about the strengths and weaknesses you should be aware of. You may be surprised to learn that despite the oil rebound, Exxon Mobil Corporation is still a loser if it doesn’t keep expenses managed.

The price of oil still matters

Oil is well off its 2022 highs. But make no mistake, XOM stock is obviously still a levered play on oil prices, its just that operationally the company is very efficient right now after so many years of low oil prices. Cash flow is solid. Production is sound. These are very strong times for the company and there is very little to debate there. So, of course, as the price of oil and gas rises, so do revenues for the company, and vice-versa. At the same time, volumes also impact revenues, but you have to watch the pricing above all else. It is likely that we see a lighter 2023 unless oil explodes above our base target.

The bountiful dividend will continue to be paid, and will be covered by cash flow quite easily at these price levels We think that oil prices do stay above the $70 mark on the downside this year, and the company is now using all this extra cash to fund more huge buybacks. The just-reported Q4 2022 revenues reflect the strength in oil prices, though pricing has moderated. Revenues rose to $95.4 billion, up 12.3% from last year.

Revenue drivers were not all positive

So no surprise, Exxon Mobil Corporation revenues jumped from last year as expected, but crushed consensus by $5.2 billion. We expected revenues of $92.5 billion and we were also too conservative. So, we know oil prices were still strong in Q4 even if there was some moderation form highs. What about volumes? Production upstream rose to 3,822 koebd, up 6 koebd from a year ago, and up 106 koebd from Q3. Average realizations for crude oil down 15% however, and realizations in gas were down 13%. This led to upstream earnings falling hard from the sequential Q3 to $8.2 billion versus $12.4 billion. Production in Q4 was 3.8 million oil-equivalent barrels per day.

When turning to the energy products, we saw sales fall to 5,423 kbd from 5,537 kbd in Q3, but up from 5,373 kbd a year ago. This segment’s Q4 2022 earnings totaled $4.1 billion compared to $5.8 billion in the sequential quarter, but rose $3.2 billion from a year ago.

Chemical products saw decreased sales, hitting 4,658 kt, down 2 kt from Q3 and down 175 kt from a year ago. Earnings here were $0.3 billion compared to $0.8 billion in Q3, on weaker margins as a result of continued supply additions, and what was viewed as softening demand in North America and Europe.

Specialty product sales also fell. They hit 1,787 kt in Q4, down from 1,917 kt and 1,835 kt in Q3 2022, and last year’s Q4, respectively. There were much better margins this quarter, and so Exxon Mobil Corporation earnings here were in line with Q3 despite much lower sales.

Earnings, as expected, followed revenues higher from last year

Right now we are seeing the impacts of lower oil prices from earlier in 2022, and reduced sales volumes. Exxon Mobil Corporation Q4 earnings hit $12.8 billion, or $3.09 per share, and full-year earnings of $55.7 billion, or $13.26 per share. That is strong. But the Q4 number was well below Q3’s earnings, and this is what happens when oil prices are normalizing, in conjunction with moderating production in sales. Make no mistake, these are extremely healthy numbers.

But the point we wish to make is Exxon Mobil Corporation growth cannot continue unless oil prices strengthen. While XOM stock can meander along and you can collect that 3.2% dividend yield, do not expect growth without support from oil, even though this is still a very favorable energy market.

Looking ahead

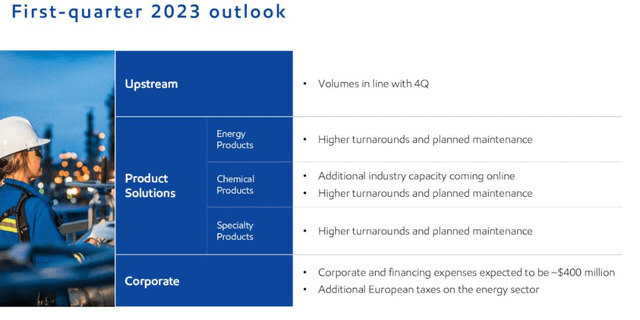

Our target for 2023 is for $81-$85 oil. We are below that range now. The outlook for Q1 is as follows:

As you can see, Exxon Mobil Corporation expects better turn arounds in all product solutions along with upstream volumes in line with Q4. So far, oil prices have crept higher, only recently giving some back, so keep an eye on the movement there.

Given where oil is now, and our belief oil remain around these levels, we are now targeting Exxon Mobil Corporation Q1 2023 revenues of $87-92 billion. We also expect non-GAAP EPS $2.50-$3.00. This depends heavily on where pricing goes and expense management, as well as volumes. While these are strong results and the energy market is favorable, we do not see Exxon Mobil Corporation strong growth continuing and think you need to take something off the table here.

Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We make winners. Come make money with us

Like our thought process? Stop wasting time and join the traders at BAD BEAT Investing at a 60% off sale!

Our hedge fund analysts are available all day during market hours to answer questions, and help you learn and grow. Learn how to best position yourself to catch rapid-return trades, while finding deep value for the long-term.

- Available all day during market hours with a vibrant chat.

- Rapid-return trade ideas each week from our hedge fund analysts

- Crystal clear entries, profit taking, and stop levels

- Deep value situations

- Stocks, options, trades, dividends and a MONEY BACK GUARANTEE