Summary:

- GameStop has held up relatively well in the meme stock group despite extremely poor fundamentals.

- The recent results once again showed that you cannot extract blood from a stone.

- High short interest did not save Carvana and won’t save GameStop.

Spencer Platt/Getty Images News

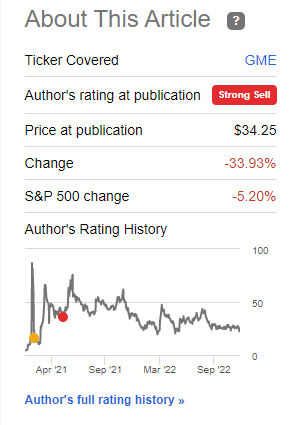

When we last covered GameStop Corp. (NYSE:GME), we called the situation for what it was. One of the worst fundamentals coupled with extreme euphoria. Of course having seen how bad the short side case could go, we decided to play it safe with ratio spreads.

Our short technique has very limited risk and good potential if the shares dive as expected. While we have chosen the $40-$20 ratio spread as we have zero desire to be long GME shares at absolutely any price, this strategy can be tailored to your individual views about the outcome.

Source: Seeking Alpha

That was a small calculated gamble with a limited risk and a defined loss. That did not work out, as the stock continued to levitate for some time after that. But things have broken down and anyone who heeded our warning to stay away is not looking too shabby.

Returns On GME Since Last Article

We look at the recently released results and tell you why this headed to the low single digits.

Q3-2022

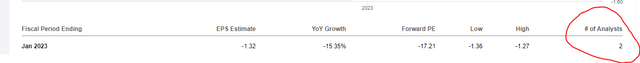

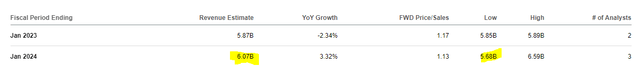

The number of analysts covering this stock has dwindled over time with only the dynamic duo offering views for 2022.

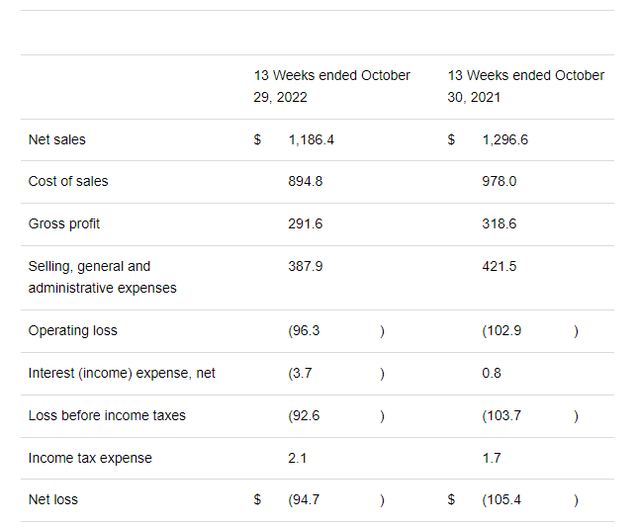

This makes sense as there was little to gain by analyzing pure fundamentals only to see the stock move up 50-fold on the back of the logic that “others are short”. Nonetheless, there were some estimates out there for the quarter and GameStop missed them by a mile with revenues coming in $160 million below estimates. Sales were down 8.5% year over year.

This follows two bad quarters where GameStop could not get any traction despite hype being placed on its turnaround strategy.

Commentary from management suggested that they were hunkering down and hoping for cost control to work its magic.

Today, we’re in the process of aligning corporate costs through our go-forward needs after completing the majority of necessary upgrades to our systems, fulfillment capabilities and overall foundation.

Source: GME Q3-2022 Transcript

The physical store turnaround has pretty much been abandoned.

Capital expenditures for the quarter were $13 million, up $0.5 million from last year’s third quarter. We anticipate CapEx will remain at similar or reduced levels now that the Company has largely completed its period of heavy investment.

Source: GME Q3-2022 Transcript

The conference call did not have a single question from anyone and this fits with our view that people are throwing in the towel.

Outlook

Consensus remains too optimistic on sales for the next year in our opinion.

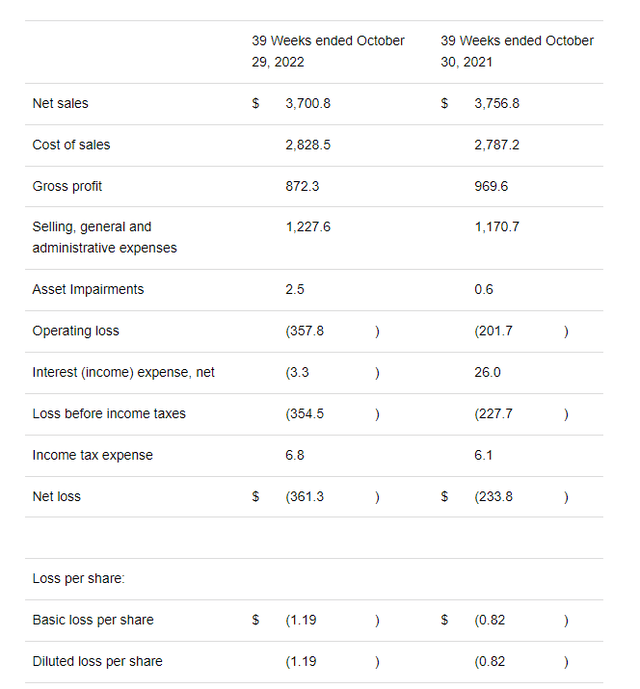

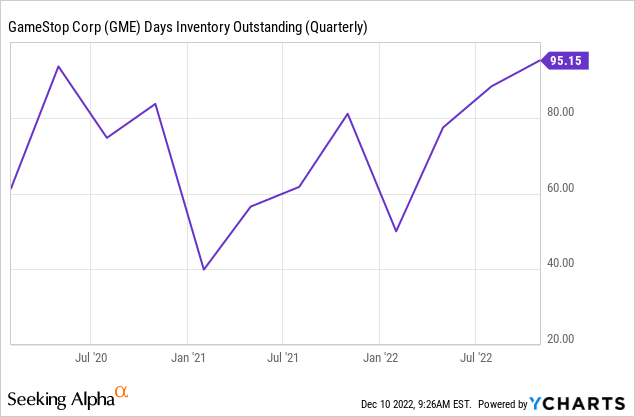

In fact, we doubt that even the low end of $5.68 billion will come to pass. GameStop is currently servicing the last hardware cycle in the gaming business and sales drop should really accelerate once we go past the fourth quarter (ending in January 2023). A lot rests even on that quarter to give the company time to survive. Inventories have bloated up and you can see in terms of sales, they are way higher than they were last two years at the same point.

This is critical as GameStop will likely drop its margins substantially to clear this in a period of weak holiday sales. The $2.17 billion estimate for the next quarter, once again, looks decoupled from reality.

Verdict

Over the last 39 weeks, GameStop burnt through $460.4 million in cash. Thanks to the meme crowd’s efforts, the company had issued stock at a very high price and it had a lot of buffer. Still, cash has dwindled from $1.32 billion to about $860 million. GameStop still sports a $6.8 billion market capitalization. So if you gave credit for the cash, you were still left with nothing but losses to support the additional $6 billion of market capitalization. We give the cash about 5 quarters before it runs out, 8 if we dodge the recession.

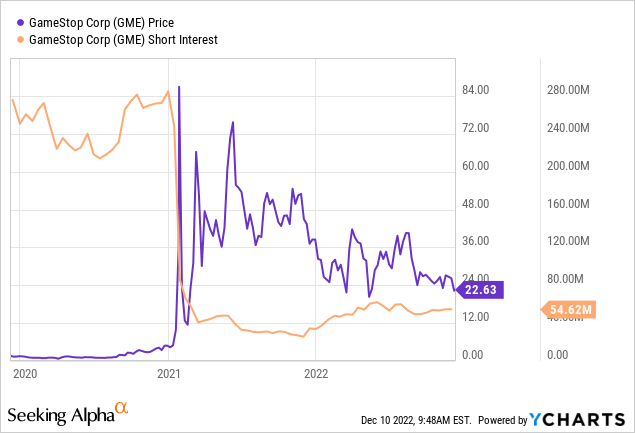

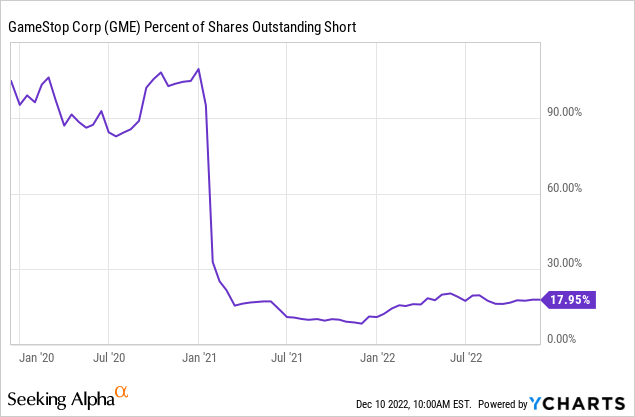

The meme crowd still has visions of a 2021 revisit. That was powered by dual thrusters of unbridled fiscal stimulus and clueless monetary pumping. Both forces are long gone. The focus has been on the short interest for delivering a rescue. The amount is minuscule relative to the fundamentals.

This is just 18% of the float.

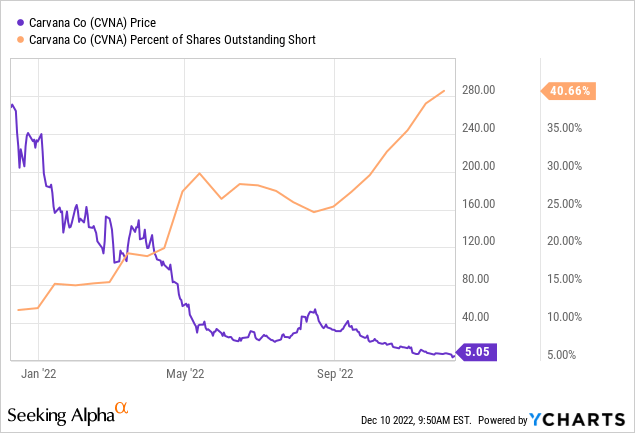

High short interest is not necessarily a contraindicator either. Carvana Co. (CVNA), another darling of the meme crowd, is a testament to that. Short interest hit 20% of float in May 2022.

The stock dropped 96% after that.

So reality is coming for GameStop too. It may be the last meme stock hanging on to a substantial portion of its gains, but that will change. Every trail has its end, and every calamity brings its lesson.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio.