Summary:

- The past few months have been amazing for shareholders of Facebook parent Meta Platforms, with shares roaring higher after previously crashing.

- The market is finally coming to terms with how to think about the business, though analysts are still quite bearish.

- The company has risen materially, but META shares are still very cheap and offer attractive upside from here.

Justin Sullivan

After the market closes on Wednesday, February 1st, the management team at Facebook parent Meta Platforms (NASDAQ:META) is expected to announce financial results covering the final quarter of the company’s 2022 fiscal year. Leading up to that time, analysts seem to be quite bearish. Having said that, it is also true that shares of the company have roared higher in recent months after previously falling in excess of 70% at one point last year. Given the volatility the company has experienced, many investors may be worried about hopping in. This is especially true given the expectations analysts have set. But when you look at just how cheap the company is and can mentally separate the core of the business from the most problematic portion of the firm, the company seems to me to be a no-brainer at current levels.

Weak expectations for META

Truth be told, I never thought that I would come to buy shares of Meta Platforms. Really just known as Facebook for much of its life, the firm seemed to me to be a social platform where investors were paying a lofty premium for the growth prospects the firm offered. But late last year, after seeing shares of the company plunge around 70%, I finally bit the bullet and bought in. I purchased my very first shares in the company on October 27th, just as the stock dipped below $100. Around that time, on October 31st, I wrote an article detailing why I came to consider the company a ‘strong buy’.

In that article, I acknowledged how painful 2022 had been for the firm up to that point. There were two main points that I made that bears could resonate with. The first, and most significant, involved the tremendous amount of money the company burned on its metaverse operations. Up to that point, for the first nine months of the year, the company generated a loss of $9.4 billion. That was in spite of the fact that total revenue for those operations came in at $1.4 billion. Management was also pointing out that spending for the company would increase moving forward and the overall expenses for 2023 would be higher than if they were chalked up to be for 2022. For 2022, expenses were slated to be between $85 billion and $87 billion. For 2023, management was forecasting between $96 billion and $101 billion. This was the main driver of the pain the company experienced, with shares plummeting as investors lost confidence in management.

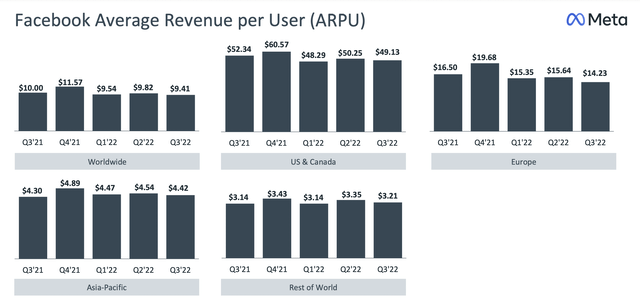

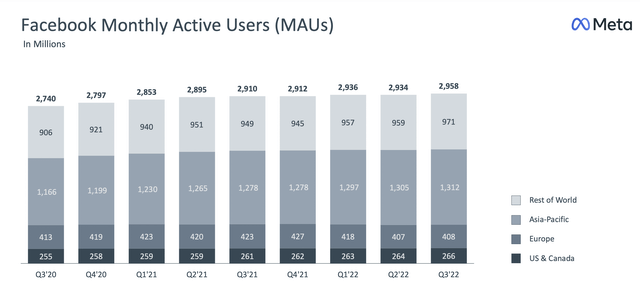

The second, far more minor, problem involved a decrease in revenue that the company experienced. This was largely associated with a weak market for advertising. However, overall ARPU generated by the company were still within historic norms. Globally, ARPU for the company came out to $9.41. This was down from $10 reported one year earlier. Some of this decline was due to more rapid growth in the Asia/Pacific region, as well as in its Rest of the World operations. While MAU (monthly active user) count for the company slowed to a crawl in the US and Canada, and experienced a decline throughout Europe (largely due to the war in Ukraine), MAU count for the company shot up. To put this in perspective, ARPU in the Asia/Pacific region in the third quarter for the company it was $4.42. This was actually up from me $4.30 reported one year earlier. This all compares to $49.13 in the US and Canada, and $14.23 throughout Europe. As growth in developing regions continues to outpace developed regions, overall ARPU can be expected to drop. Having said that, it unnerved investors that it also declined in the company’s developed markets. In the US and Canada, the aforementioned $49.13 was down from the $52.34 reported one year earlier, while in Europe it had fallen from a point of $16.50 one year earlier.

Because of broader economic conditions, I’m not surprised to see ARPU fall in the markets in which the company operates. It would be surprising if it didn’t. What matters to me is that, across every region except Europe, we do continue to see growth. Even in the most developed market for the company, the US and Canada, growth from the third quarter of 2021 to the third quarter of 2022 totaled roughly 4 million MAUs. It’s important to separate this healthy portion of the company from the cash-hemorrhaging metaverse business that, frankly, management could shut down tomorrow. If they did so, it would have little impact on the company’s top line and would increase cash flow and profits materially overnight.

Author – SEC EDGAR Data – Analysts

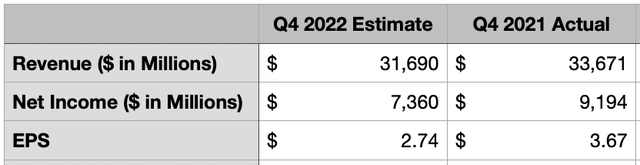

With the company about to report results for the final quarter of 2022, it’s important to note that analysts are rather bearish. At present, they are forecasting revenue of roughly $31.69 billion. If this comes to fruition, they would translate to a year-over-year decline of 5.9% compared to the $33.67 billion reported the same time one year earlier. The drop in activity from Europe, combined with the lower ARPU numbers anticipated will very likely be responsible for this pain. This revenue estimate is within the range that management previously forecasted of between $30 billion and $32.5 billion. On the bottom line, analysts are forecasting earnings per share of $2.74. That compares to the $3.67 reported one year earlier. Overall net income would then come in at around $7.36 billion. That stacks up against the $1.19 billion reported in the final quarter of 2021.

Obviously, investors should be keeping a close eye on these expectations and how the company actually performs. However, there are some other things that investors should be wise to pay attention to. The company has already parted ways with 11,000 employees in a bid to cut costs. It’s unclear the timing of these cost cuts, but they could result in a revision to the prior expense forecast the company provided that I already discussed above. Naturally, investors should also continue to pay attention to all things metaverse. So far, the company has invested a tremendous amount of money with little in the way of return. It would be amazing for shareholders if the company’s efforts finally started to bear fruit. But almost as good would be if the company announces some sort of scaling back of the initiative or a shuttering of it entirely. I suspect that shares of the company would move materially higher in response to such a development.

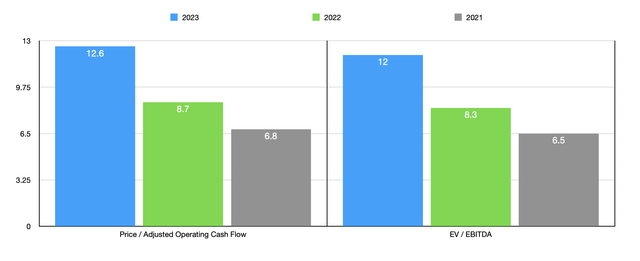

Since I wrote about the company back in late October and rated it a ‘strong buy’, shares have generated upside of 49.7%. This compares to the 3.5% experienced by the S&P 500. The big question some investors might have is whether or not it still makes sense to buy into the company. In my opinion, the easy money has been made. But shares are still cheap enough to warrant the rating I assigned it previously. Following the same methodology that I did in my prior article on the firm, I estimated that operating cash flow for 2023 should be around $30.71 billion, while EBITDA should come in at around $29.49 billion.

Based on these figures, the company is trading at a forward price to adjusted operating cash flow multiple of 12.6 and at a forward EV to EBITDA multiple of 12. Already, these numbers are low. But in the event that the company can return back to the levels of profitability, it experienced in prior years, whether that be through ditching metaverse or turning it into a financial success, then shares get even cheaper very quickly. For instance, using estimates for the 2022 fiscal year, with adjusted operating cash flow pegged at $44.24 billion and EBITDA of $42.48 billion, I calculated a price to adjusted operating cash flow multiple of 8.7 and an EV to EBITDA multiple of 8.3. And should the company ever return back to the levels of profitability seen in 2021, these multiples would be 6.8 and 6.5, respectively.

Takeaway

I understand why investors might be worried about Meta Platforms leading up to the fourth quarter earnings release. There has been a significant loss of confidence by investors in the company and shares are more expensive than they were previously. Many view the metaverse investment as having failed or likely to fail. There are also broader economic concerns that are having some impact on the company. But when you take a step back and realize that metaverse is not needed and that management can always hit the reset button if things don’t work out, and consider that broader economic conditions will eventually improve, shares of the company look very cheap. Because of this, I do plan to continue holding the stock, likely with the goal of getting another 20% or more of upside. I recognize that, in the near term, we could see tremendous volatility. But if the stock drops further again, I would just buy more. After all, my big regret in all of this so far has been not purchasing more than I did.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!