Summary:

- AWS continues seeing robust growth with a 20% revenue increase during the fourth quarter.

- AMZN financials were significantly impacted by employee severance payments, impairment charges, and loss of value in its Rivian Automotive investment.

- AMZN keeps investing heavily in Prime Video, reaching $7 billion in investments during 2022.

georgeclerk

Business Overview and Investment Thesis

Amazon (NASDAQ:AMZN) is one of the world’s largest technology companies, operating in various segments, with the company’s business model centered around generating revenue through its North America and International e-commerce segments. Further to this, AMZN has a growing and highly profitable cloud computing business. Finally, the company has a strong and growing presence in the streaming video market.

AMZN is a company with solid fundamentals, a leading e-commerce platform, a rapidly growing and highly profitable cloud computing business and an important growth opportunity in the streaming video market. Given these opportunities combined with strong fundamentals I believe the company continues to present a compelling long-term investment opportunity and in my opinion a buy.

Amazon Q4-22 Results

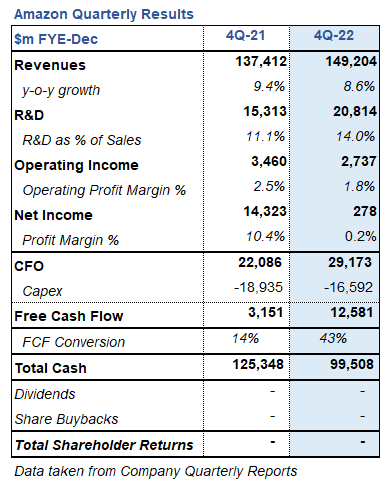

Amazon Quarterly Results (Company Quarter Report)

During the fourth quarter of FYE 2022 AMZN recorded a robust revenue growth of 8.6% to $149 billion driven by its North America segment and AWS which both saw year-on-year growth rates of 12% and 20%, respectively. Revenue growth was modestly offset by the International segment which saw a decline in revenues of 8%. The decline in the International segment was to a large extent due to foreign exchange fluctuations. AMZN had trouble every quarter during 2022 with foreign exchange fluctuations reducing net sales by $15.5 billion on a yearly basis.

Operating expenses increased by 9% during the quarter driven by $2.7 billion of costs due to employee severance payments, impairments charges, and operating leases and changes in estimates related to self-insurance liabilities. Furthermore, AMZN also saw an increase of $5 billion in technology and content expense (R&D). For reference AMZN spent $20.8 billion or 14% of total sales in technology and content during the fourth quarter alone. To understand how big this expense is, this amount is ~$3 billion more than the total capital invested in R&D by its rivals Alphabet (GOOGL) and Microsoft (MSFT), combined! As a result of higher expenses, operating income decreased to $2.7 billion compared to $3.5 billion during the same period last year. It should be mentioned that if AMZN had not incurred employee severance payments, impairment charges, etc. during the fourth quarter, its operating income would have been approximately $5.4 billion.

AMZN also incurred a significant decrease in valuation of $2.3 billion in its investment in Rivian Automotive (RIVN). Important note here that this is not an actual cash out flow, nonetheless it impacts the company´s balance sheet. As a result the net income posted by AMZN during the fourth quarter stood at $278 million compared to $14.3 billion during the fourth quarter last year.

Despite recording a much lower net profit compared to the previous year, AMZN was still able to generate a robust cash flow from operations standing at $29.2 billion. This enabled AMZN to generate a free cash flow of $12.6 billion for the period. This is a nice increase compared to the free cash flow of $3.2 billion during the fourth quarter of 2021.

AWS

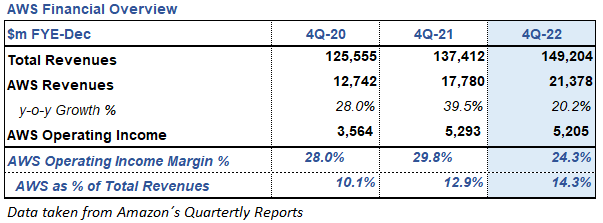

AWS Financial Overview (Company Quarter Report)

AWS continued seeing robust growth in revenues with a 20% increase to $21.3 billion compared to the same period last year. AWS has almost doubled revenues within 2 years, this is a testament of how important this business is for AMZN growth. As for operating income, it remained largely flat compared to the same period last year at $5.2 billion. Management keeps making solid investments to set up AWS for success with the launching of AWS in new regions including Spain and Switzerland as well as a second region in India. We can expect management to continue expanding AWS infrastructure footprint across the globe. It should be noted that as of the end of 2022, AWS has 96 availability zones within 30 geographic regions globally. Furthermore, the company has announced plans to launch 15 more availability zones and five more AWS regions.

As a final note, during 2022 AWS sales increased by 29% year-over-year to $80.1 billion. AWS operating income also saw a nice increase to $22.8 billion, compared with operating income of $18.5 billion in 2021.

Guidance

During the investor call, management stated it expects revenues to be between $121 billion and $126 billion, which equates to growth rates between 4% and 8% compared with first quarter 2022. As for operating income, management expects it to be between $0 and $4 billion, which would be in the same range compared to the same period last year at $3.7 billion.

As far as AWS, it seems that cost cutting remains a priority for many companies, as such slowdown in expenses remains. Management mentioned that during the first month of the year, AWS saw a year-over-year revenue growth in the mid-teens. This would mean we could see AWS revenues to the tune of $20 billion during the first quarter of 2023.

International E-commerce

Amazon CEO Andrew Jassy mentioned that management remains very enthusiastic about the business AMZN is building. He also mentioned that the compounded annual growth rate AMZN saw from 2019 to 2021, in the U.K., stood over 30%, while in Germany and Japan it saw increases of 26% and 21%, respectively. It should be mentioned here that the International segment has been greatly impacted by foreign exchange fluctuations. If AMZN management is able to control these fluctuations we could see the International segment with much better results in the coming quarters.

Prime Video

Prime Video keeps experiencing robust growth, with the company investing approx. $7 billion in Amazon Originals, live sports, and licensed third-party video content. This is $2 billion more than the $5 billion spent during 2021. These investments are clearly paying off, for example “The Rings of Power” was the most watched Amazon original series in every region of the world reaching 100 million viewers. Amazon has already confirmed the second season of this show, which will probably continue driving subscribers to Prime Video.

Prime Video should not be overlooked as it is contending with companies such as Disney (DIS) and Netflix (NFLX) for market share in the streaming video market. For reference this market is forecasted to grow to $125 billion by 2025, giving Prime Video a nice runway ahead.

Bottom Line

The company saw mixed results with its net income standing at $278 million as it was impacted by impairment charges, employee severance payments, reduction in investment valuation, etc. However, AMZN also posted a strong free cash flow of $29.2 billion during the period. This provides comfort that the company was still able to generate substantial amounts of cash despite a difficult market environment.

AMZN is a company with solid fundamentals, a leading e-commerce platform, a rapidly growing and highly profitable cloud computing and an important growth opportunity in the streaming video services market. Looking at the bigger picture, AMZN is primed to continue its growth path in all its relevant markets. As such I continue considering this company a buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.