Summary:

- A short squeeze may happen for Lucid Motors.

- A takeover by Saudi Arabia would likely yield huge gains for investors and has a strong strategic rationale.

- Lucid Motors has a short ratio of 34% based on float.

David Becker

After falling out of favor for much of 2022, Lucid Motors, Inc. (NASDAQ:LCID) returned with a vengeance at the end of January, when speculation grew that Saudi Arabia might buy out the electric-vehicle company.

Even though the stock has recently given up some of its gains, I believe the assumption that Saudi Arabia could buy out Lucid Motors is not as far-fetched as it appears, and a multi-billion dollar offer would not only make strategic sense for Saudi Arabia, but it could also result in a large windfall for existing shareholders.

Saudi Arabia Would Have A Strong Strategic Rationale In Buying Remaining Stake In Lucid Motors

The stock of Lucid Motors rose at the end of January on speculation that Saudi Arabia’s wealth fund PIF might make a buyout offer for the electric-vehicle company.

Stock prices typically skyrocket when buy-out rumors spread, whether justified or not, and this is exactly what happened with Lucid Motors’ stock price.

Lucid’s market price increased by more than 40% at the end of January, but it has since paired some of the gains. Having said that, a week after the rumors were first reported, the stock is still trading significantly higher than it was before the market considered the possibility of Saudi Arabia making a buy-out offer for the electric-vehicle company.

There are a couple of reasons why I think a buy-out offer would make perfect sense for Saudi Arabia’s PIF.

The fact that Saudi Arabia’s PIF already owns a controlling stake in Lucid Motors is obviously the most compelling reason for a takeover attempt.

The PIF owns 61% of the electric-vehicle company, and the fund has regularly invested in preferred stock issues in recent years to assist Lucid Motors in scaling up production. Indeed, the PIF has provided capital not only for the purposes of scaling production, but also for the funding of R&D expenses and prototype development on multiple occasions.

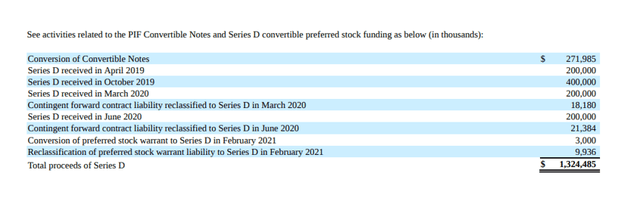

In recent years, the PIF participated in investment rounds that included convertible notes and Series D convertible preferred stock, resulting in the fund providing more than $1 billion in capital to support the development of Lucid Motors as a legitimate EV company in the industry.

Lucid Motors would not be where it is today without the deep financial pockets of Saudi Arabia’s PIF. According to the most recent Lucid data, the company produced more than the 6-7K electric-vehicles it forecasted for 2022. This ramp-up is made possible in large part by the PIF’s consistent provision of capital over time.

But let me return to my main point. The PIF has been a major supporter of Lucid Motors in recent years, funding much of its R&D, manufacturing facility construction, and current production ramp-up. Given the PIF’s stake in Lucid Motors, it makes sense for the company to acquire 100% of the company’s outstanding stock and fully control the upside.

The second reason why Saudi Arabia would benefit from a Lucid Motors acquisition is that the country already plays an important role in Lucid Motors’ manufacturing footprint and is critical to its international expansion plans. Lucid Motors signed an agreement with the Saudi Ministry of Investment, the Saudi Industrial Development Fund, and other entities in February of last year to build its first production facility outside of the United States.

The annual capacity of AMP-2, Lucid Motors’ Saudi Arabia production plant, is estimated to be 155K electric-vehicles. As a result, Saudi Arabia is critical to Lucid Motors’ Middle Eastern expansion, and the company is using the market as both an export springboard and a manufacturing hub. Lucid Motors also recently opened its first Lucid Studio in Riyadh, where the EV company will showcase its future electric-vehicles.

Why Could A Short Squeeze Appear?

Because more than a third of Lucid Motors’ float is shorted. As a result, if Saudi Arabia makes a formal buy-out offer, there may be a strong rush to the exits, with short sellers scrambling to close out their short positions.

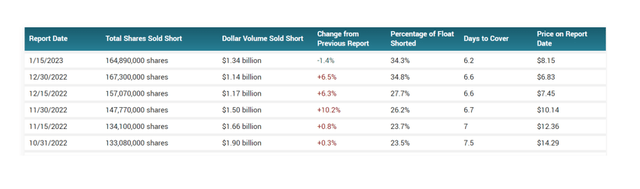

According to Marketbeat, as of 15 January 2023, 165 million shares of Lucid Motors had been shorted, resulting in a 34.3% short ratio based on the company’s float.

Total Shares Sold Short (Marketbeat)

Production And Sales Ramp-Up

Lucid Motors’ sales are expected to increase in 2023 as the company builds on its recent success in scaling production.

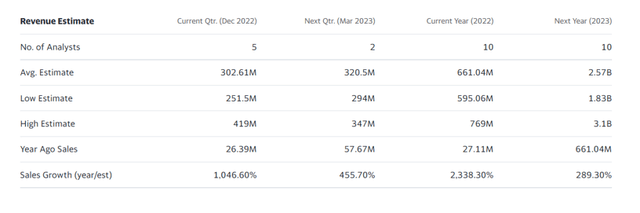

The EV company is expected to generate $2.57 billion in sales this year, representing a stellar 289% increase in sales YoY. Since Lucid Motors recently announced production figures for 2022 that exceeded expectations, I believe the EV company is well positioned to double production in 2023.

The market may or may not value Lucid Motors’ potential sales growth this year, but it would almost certainly value a formal buy-out offer from Saudi Arabia’s PIF.

Revenue Estimate (Yahoo Finance)

Lucid Motors’ sales forecast of $2.57 billion equates to an 8.6x sales multiple. Investors should keep in mind, however, that the EV company is still in its early stages of development and that successive YoY increases in sales will result in a lower sales multiple.

For example, if Lucid Motors doubles its sales to $5.14 billion in 2024, the sales multiple will be cut in half to just 4.3x.

Considering Lucid Motors’ potential in the EV market (it had 34K reservations as of November 2022), I believe the valuation has significant upside potential, buy-out or not.

Why Lucid Motors May See A Lower/Higher Valuation

In light of recent buy-out speculation, Lucid Motors is vulnerable to an official denial on the part of PIF that the investment fund is not interested in taking over the electric-vehicle company. In this case, there is a chance that Lucid Motors’ stock price will fall significantly.

A genuine buy-out offer, on the other hand, could result in a significant increase in Lucid Motors’ stock price.

My Conclusion

It won’t take much for a short squeeze to occur in a stock with a 34% short ratio (based on float). The situation is especially compelling (and supportive of a short squeeze) because a controlling shareholder has a strong strategic reason to make a formal buy-out offer.

Saudi Arabia has made significant investments in Lucid Motors, and it would make sense for the company to purchase its remaining stake.

Given the short ratio and the fact that PIF already owns 61% of Lucid Motors, the short squeeze is not as far-fetched as many investors may believe.

Disclosure: I/we have a beneficial long position in the shares of LCID either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.