Summary:

- AMZN reported its Q4 numbers on February 2nd after the close.

- AWS is the only engine of profitability for AMZN. It’s the primary reason that the stock market assigns a high valuation to the Company.

- AMZN retested its 200 dma on the day of its Q4 earnings and failed.

HJBC

The commentary below is from a recent issue of my Short Seller’s Journal. I have covered Amazon (NASDAQ:AMZN) for many years and thus did not do a “deep dive” into the Company’s 10-K. It’s not necessary at this point. I put my money where my mouth (or keyboard, as it were) is and provide ideas for using options to express bearish bets. Currently, I’m sitting AMZN June $105 puts.

AMZN reported its Q4 numbers on Thursday, February 2nd after the close. Net sales increased 9% YoY, with the North America products segment (e-commerce + Whole Foods) up 13% YoY, the international segment was down 8% YoY and AWS (cloud services) up 20% YoY. The 20% increase marked a substantial slowdown in its growth rate, as it was down from a 27% YoY growth rate in Q4 and a 39.3% YoY rate of growth in Q4 2021. AMZN’s operating income in Q4 declined 20.8% YoY for the quarter and 50.7% YoY for the trailing twelve months (TTM).

The North America products segment showed a $240 million operating loss, up from a $206 million loss a year ago Q4. The international products segment’s operating loss was $2.2 billion, up from $1.6 billion a year ago. For the TTM, the operating loss in North America was $2.8 billion and $7.7 billion for international. AWS’s operating income was flat in Q4 YoY, while it was up 23.2% for the TTM YoY.

These numbers suggest that AMZN implemented large price cuts in Q4 to move product inventory and generate revenues. AWS’ sales growth appears to be slowing considerably. Based on the fact that revenues grew in Q4 but operating income was flat, it appears that AWS is experiencing rising costs and increased price competition from the likes of MSFT, GOOG, ORCL and IBM.

The stock price dumped 8.4% on Friday (Feb 3rd) on very heavy volume. The slowdown in AWS growth is likely the biggest reason for the stock price hit. However, the market was also disappointed by AMZN’s outlook, which was weaker than expected, with management forecasting a 6% growth rate in revenues, which would be the lowest growth rate in the company’s history. Furthermore, AWS’ operating margin is eroding. For the full year 2022, AWS’s operating margin was 28.5% vs 29.7% in 2021. But the Q4 operating margin was 24.4% vs 29.9% in Q4 2021.

AWS is the only engine of profitability for AMZN. It’s the primary reason that the stock market assigns a high valuation to the Company. On a TTM basis, AWS generated $22.8 billion in operating income. With the products business generating a big operating loss, this implies that the market is paying 44.8x operating income for the AWS business. However, annualizing Q4’s operating income, which would be roughly 8.9% below the TTM operating income, the market is paying 49x operating income for AWS. Either metric represents an insane overvaluation for the cloud business. Especially considering that AWS’ growth is rapidly slowing and its profitability is declining. With big companies cutting back on capex, the market should not expect a turnaround in AWS’ growth rate. AMZN’s EPS was 3 cents in Q4, or 12 cents annualized. It generated a net loss for the full year. But the Q4 annualized P/E ratio is an absurd 858x.

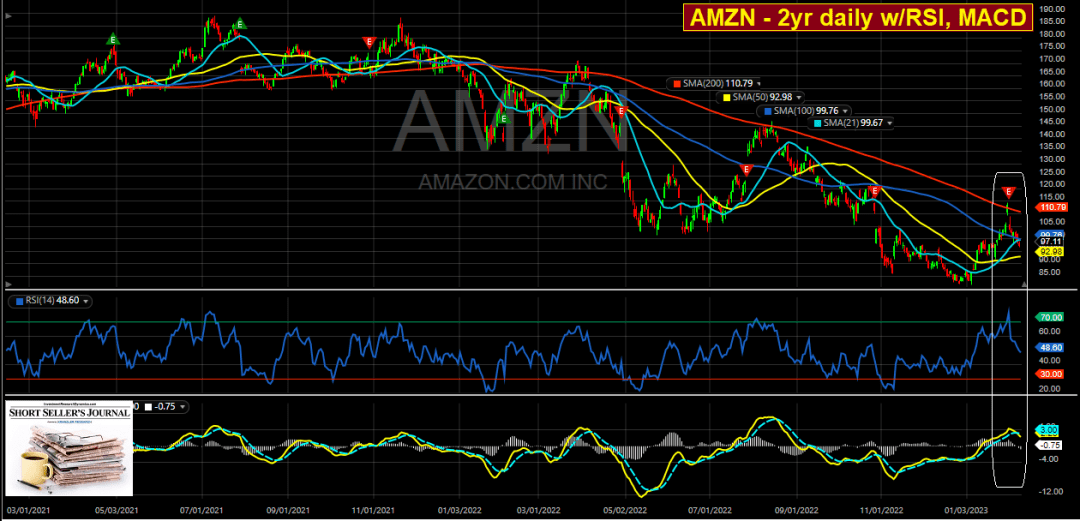

While AMZN’s share price will be tied to the fate of the overall stock market, particularly the Nasdaq, it looks like the stock is headed back to the 2-yr low just below $85:

Since dropping below its 200 dma at the beginning of 2022, the 200 dma has been a consistent level of resistance. AMZN retested its 200 dma on the day of its Q4 earnings and failed. Based on the movement and positioning of the RSI and MACD, it looks like the stock price is headed lower, especially if the stock market rolls over here. Not shown is a long-term (10-yr) chart, on which I base my view that AMZN is headed eventually down to the $40-$50 area, or a 50% haircut from the current level. I believe the catalyst will be mounting losses in the Company’s Products segment and the continued deceleration and margin compression of the AWS business.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.