Summary:

- AWS’s elongated sales cycle was not unique in the cloud provider market, since peers such as GOOG and MSFT reported a similar phenomenon.

- Cloud margins were similarly impacted at a time of tightened corporate spending, implying discounted rates to retain consumers.

- However, AWS continued to record market-leading cloud performance obligations of $110.4B, compared to GOOG at $64.3B and MSFT at $15.82B.

- This suggested that AMZN might be able to weather the uncertainty exceptionally well over the next few quarters, particularly when considering the Fed’s dovish commentary.

Umesh Negi/iStock via Getty Images

We previously covered Amazon (NASDAQ:AMZN) here in November 2022. At that time, we had encouraged investors to buy the stock at the $90s levels, due to the notable recessionary discount on its stock price. Despite the short-term profitability and debt issues, we reckoned things may improve by FY2025, attributed to the normalization of the macroeconomic environment and the projected improvement in its balance sheet.

For this article, we will be focusing on AMZN’s slowing growth in the AWS segment, which was one of the reasons why the stock tumbled post FQ4’22 earnings call. We think the pessimism has been overdone since multiple cloud providers similarly experienced elongated sales cycles, which impacted margins. In addition, the e-commerce giant continued to post excellent top line growth with normalizing operating income, suggesting a potential turnabout soon.

AMZN’s AWS Investment Thesis Remains More Than Stellar

AMZN over expanded its workforce, leases, and capital expenditures during the height of the pandemic, which triggered notable headwinds in its profitability since FQ4’21. In FY2022, the company recorded total operating expenses of $212.9B, growing by 23.3% YoY from $172.59B and 111.9% from FY2019 levels of $100.44B. Meanwhile, the growth of its top-line was notably slower at 9.4% YoY to $513.98B in the latest fiscal year, but grew by 83.2% from FY2019 levels.

The event coincided with the drastic normalization of the hyper-pandemic valuations, similarly affecting AMZN’s investments in Rivian Automotive, Inc. (NASDAQ:RIVN). By FQ4’22, the company had recorded an eye-watering $16.8B in writedowns related to the automotive stock, impacting its GAAP net income profitability and GAAP EPS at the same time.

Combined with the slowing growth for AMZN’s bottom line driver, Amazon Web Services [AWS], it was unsurprising that Mr. Market had grown similarly pessimistic about the company’s forward execution.

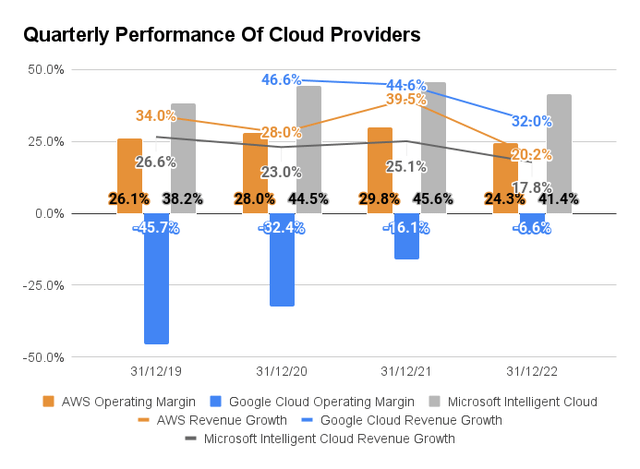

While we understood Mr. Market’s uncertainty, it was important to highlight that Alphabet’s Google Cloud (NASDAQ:GOOG) (NASDAQ:GOOGL) and Microsoft’s Intelligent Cloud (NASDAQ:MSFT) similarly reported a deceleration in top-line growth in their latest quarters.

AMZN reported YoY growth of 20.2% for AWS related revenues in FQ4’22, against the 39.5% in FQ4’21. GOOG’s cloud segment similarly decelerated to 32% and MSFT’s to 17.8%, opposed to 44.6% and 25.1% a year ago, respectively.

It was apparent that the peak recessionary fears resulted in longer sales cycle impacting cloud spending, as similarly witnessed in multiple sectors, including PC demand, cybersecurity, and headcount hiring. Perhaps this was why AMZN had reported lower AWS operating margins of 24.3% by FQ4’22, implying discounted rates, as hinted in the recent earnings call. Brian Olsavsky, CFO of AMZN, said:

Some of the key benefits of being in the cloud compared to managing your own data center are the ability to handle large demand swings and to optimize costs relatively quickly, especially during times of economic uncertainty. Our customers are looking for ways to save money, and we spend a lot of our time trying to help them do so. (Seeking Alpha)

Nonetheless, we remain upbeat, since the cloud and e-commerce giant continues to record expanding unearned revenues and performance obligations thus far. By FQ4’22, AMZN reported unearned revenues of $16.1B (+15% YoY) related to the AWS services and Amazon Prime memberships. At the same time, the company recorded stellar AWS performance obligations of $110.4B (+5.8% QoQ from $104.3B & +37.3% YoY from $80.4B) with an average remaining life of 3.7 years.

In the meantime, MSFT’s unearned revenue for the Intelligent Cloud stood at $15.82B by the latest quarter, declining by -8.5% QoQ from $17.29B while increasing by 8.8% YoY from $14.54B. GOOG’s remaining performance obligation got Google Cloud was more impressive at $64.3B in FQ4’22, expanding by 22.7% QoQ from $52.4B and 26% YoY from $51B.

Therefore, the stellar AWS backlog, post reopening cadence, might support AMZN’s financial performance through the next few quarters of uncertainties. This was despite the mixed FQ1’23 revenue guidance of $121B – $126B and operating income of $0B – $4B, against the consensus estimates of $125.13B/ $3.7B and FQ1’22 levels of $116.44B/ $3.66B, respectively.

So, Is AMZN Stock A Buy, Sell, or Hold?

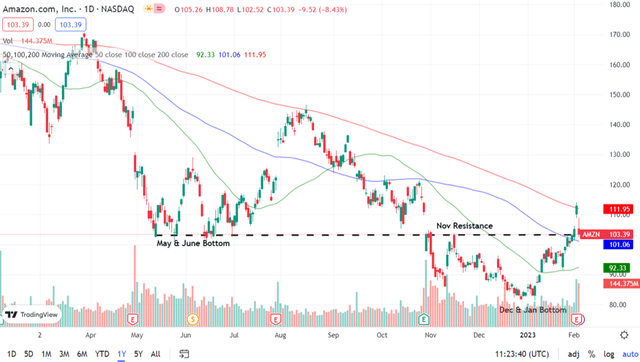

AMZN 1Y Stock Price

AMZN stock has recorded an impressive 26.3% recovery since the December 2022 bottom of $81.82, likely attributed to the market optimism surrounding the Q4’22 earnings season in January 2023 and the Fed’s projected 25 basis point hike in early February.

The FAANG/ FAAMG stocks similarly experienced tremendous recoveries, with Meta Platforms (NASDAQ:META) rallying by 61.3%, Apple (NASDAQ:AAPL) by 22.5%, Netflix (NASDAQ:NFLX) by 32.1%, MSFT by 10.1%, and GOOG by 21.8%, along with the S&P 500 Index (NYSEARCA:SPY) by 9.3% thus far.

Naturally, the recent mixed results from FAANG and tech companies alike suggested that corporate cloud and advertising spending remained tight moving forward. A number of factors might have contributed to this downtrend, including the worsening macroeconomic outlook, the prolonged interest rate pains through 2023, and the tougher YoY comparison.

However, AMZN has proven itself as highly resilient, through the excellent AWS performance as discussed above. Furthermore, the company delivered impressive FQ4’22 top-line growth to $127.82B (non-AWS segment), increasing by 19.9% QoQ and 6.8% YoY at a time of rising inflationary pressures and reduced discretionary spending.

This mashed-up segment comprising e-commerce, prime memberships, advertising, fulfillment, and commissions, amongst others, remained unprofitable, with operating incomes of -$2.46B and margins of -1.9% in FQ4’22. However, it was primarily attributed to the $2.7B one-time charge related to the employee severance and impairments of property/ equipment/ operating leases, amongst others.

Therefore, based on the adjusted numbers, we would have been looking at FQ4’22 operating incomes of $0.24B and operating margins of 0.18% (non-AWS segment). While these numbers might look dismal, it represented massive improvements from FQ3’22 levels of -$2.87B/ -2.6% and FQ4’21 levels of -$1.83B/ -1.5%, respectively. Considering that most impairment charges were already front-loaded in FQ4’22, things might be much better by FQ1’23. Only time will tell.

In the meantime, since the AMZN stock is trading above its 50-day moving average and is likely to bounce off the November resistance levels in the $100s, we reckon patience may be more prudent now. Investors will be well advised to wait for another $80s to $90s entry point, depending on their dollar cost averages. More opportunities may arise, since it is still early in the year.

Disclosure: I/we have a beneficial long position in the shares of AMZN, AAPL, META, NFLX, MSFT, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.