Summary:

- The strong dollar was a headwind in ’22, although its real impact is on KO margins from cost-of-goods-sold (COGS) impact.

- The valuation on KO is always rich, i.e., fully-valued.

- No question, free-cash-flow generation has improved, possibly as a function of the bottling ops divestiture.

- KO’s quality of earnings could be better.

Georgiy Datsenko

Coca-Cola (NYSE:KO) the soft-drink giant is scheduled to report its calendar Q4 ’22 financial results prior to the opening bell on Tuesday, February 14th, 2023.

Wall Street consensus is expecting $0.45 in earnings per share on $9.9 to $10.0 billion in revenue for expected flat EPS growth ($0.45 actual EPS in Q4 ’21) on 6% revenue growth.

Since September ’20, Coke has put up some nice EPS “upside surprises” – between 10% and 20% – but that has begun to moderate the last two quarters, as the EPS surprise was just 4% – 8%.

For full-year ’22, it’s expected if the Q4 ’22 consensus is met that KO revenue will grow 14% y.y while EPS will grow 6% y.y.

Longer-term look:

KO vs SPY total return 2000 through 2022 (YCharts)

Warren Buffett bought Coca-Cola in the late 1980s when its case volume growth was quite robust, and the stock was the darling of the 1980s and 1990s secular bull market.

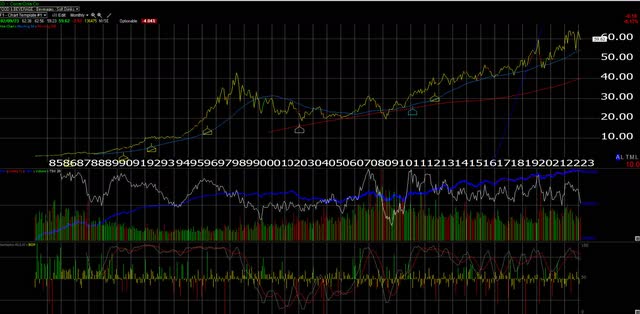

KO’s stock actually peaked or hit an all-time-high in July ’98 just prior to the LongTerm Capital Management crisis, when then-Fed Chairman Alan Greenspan had to recruit the banks to bail out Wall Street firms. KO was trading around $47 – $48 in late July ’98, and it then didn’t make a new all-time-high until 2019. (See monthly chart below.)

The stock hasn’t broken out in the traditional sense from that 1998 high, but has meandered back and forth from the high $50s to mid $40s over the years, after divesting the bottling operations re-focusing the business on case volume and new product growth.

The fact is after the stock got crushed on the shutdown of sporting events around Covid, Coke has rebounded smartly with better case volume and even pricing growth: I thought I read after Q2 ’22 or Q3 ’22 (in the quarterly notes) that Coke had pushed through 12% price increase and case volume still remained positive.

Forward EPS and revenue estimate revisions:

KO forward EPS estimate revisions (IBES Data by Refinitiv)

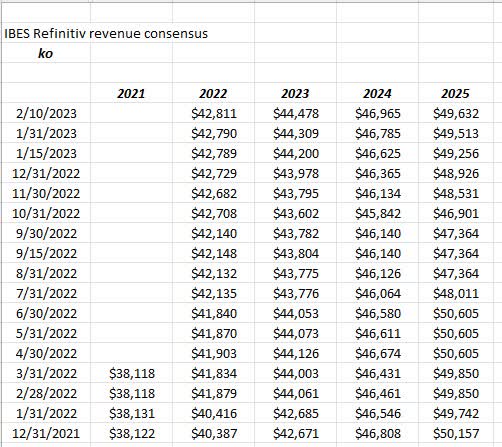

KO forward revenue est’s and revisions (IBES data by Refinitiv )

While EPS estimates are more “mixed” the 2023 and 2024 revenue stopped declining and started to rise in October ’22 when the dollar began to reverse its record strength.

Is it enough to move the valuation needle – probably not – but a small wind at your back is never a bad thing.

Coke is trading at 20x average “expected” EPS growth over the next few years of just 5%, and 20x cash-flow, so it’s unlikely readers will never get a chance to add to Coke at a screamingly-cheap valuation.

One clear positive: free-cash-flow growth

| Trailing free-cash generation | FCF | growth |

| 4 qtr (1-yr) avg | $11.9 bl | 8% |

| 12 qtr (3-yr) avg | $11.0 bl | 15% |

| 20 qtr (5-yr) avg | $9.6 bl | -1% |

| 40 qtr (10-yr) avg | $9.7 bl |

Source: valuation spreadsheet, from earnings reports and 10-Qs

Readers may wonder why focus on the geeky stuff like free-cash-flow generation, but this has a big impact on KO’s return-of-capital to shareholders and also the buyback capability.

The valuation spreadsheet on KO goes all the way back to June 1997, and from March 2015, through early 2021, KO was paying out more than 100% of its free-cash-flow on just dividends alone.

Today, partly due to the improvement in the business post-Covid and partly due to the lack of the capital drag from bottling, as a percentage of free-cash-flow, KO’s dividend (in total dollars) is now 75% and still falling.

In terms of quality of earnings, KO should really be generating cash-flow and free-cash-flow that is more than 100% of net income, but it’s not and although it’s improved, it could still be better.

Here are the numbers on cash-flow and free-cash-flow vs net income:

KO’s quality of earnings test (Valuation spreadsheet )

Summary/conclusion:

Since being named CEO in 2017, James Quincey has done a good job and gotten the important metrics moving in the right direction, but there is more work left to do.

The stagnation in the CSD (carbonated soft drink) market has forced KO to look elsewhere for growth and while they are making strides, the legacy business still dominates.

James Quincey tried to branch into cannabis, but I thought Mr. Buffett and Mr. Munger pushed back on that (or at least that was my impression), so KO has tried to develop some alcoholic-beverage offerings, which is a sizable market, but the pace at which KO moves, I’ll probably be dead before that is ever a material part of the brand (if ever).

Coming into Tuesday’s earnings release, consumer staples have cheapened up considerably – KO is down 4% in the last 30 days per our technical software.

The stock is about 1% position in client accounts (not all accounts either) and its consistency and stability of earnings growth, not to mention its lower beta, can offer comfort in uncertain markets.

A trade down to $55 or the 200-week moving average would be a good place to add to the position, but it may never get there.

Some of the fundamental improvements, I’d like to see KO continue to improve upon are free-cash-flow growth as a percentage of net income, continue with the consistent return of capital (both dividends and share repo’s) and continued revenue and case-volume growth.

Coke has shown some life after Covid ended and the US economy has reopened. Would love to see that continue.

Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.