Summary:

- Apple has faced revenue headwinds in its product segment, due to macroeconomic issues. However, its high margin Services business has continued to grow at solid levels.

- Its Technical Charts indicate the stock has broken through a resistance line and its moving averages indicate a “buy”.

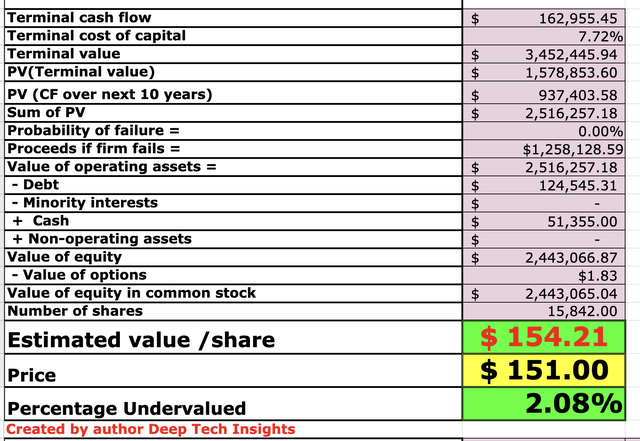

- My discounted cash flow model indicates Apple is slightly undervalued or “fairly valued” intrinsically.

Nikada/iStock Unreleased via Getty Images

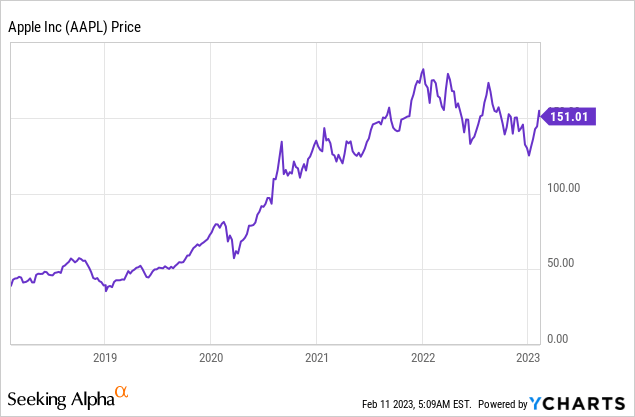

Technology powerhouse Apple (NASDAQ:AAPL) recently reported mixed financial results for the first quarter of fiscal year 2023. The company missed both revenue and earnings expectations. A positive for Apple is was mainly driven by macroeconomic issues (foreign exchange rate headwinds) and the company still reported solid growth in its Services business which reached a record high. In addition, Apple’s market position looks to be still strong and the company captured ~24.1% of the smartphone market in Q4,22. This is an increase from the 17.2% in the prior quarter and the 23.4% in Q4,21, according to data from Statista. In this post I’m going to breakdown Apple’s recent earnings report as well its technical charts and valuation, let’s dive in.

Technical Analysis

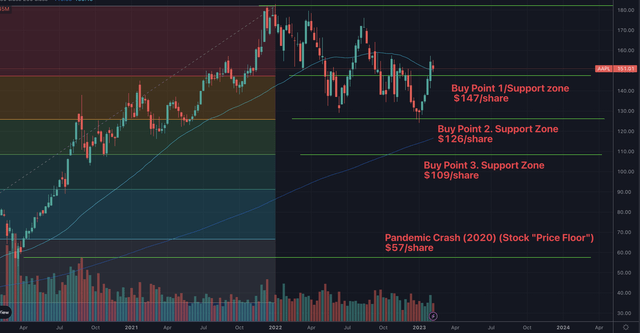

Generally when analyzing a stock I generally review only the fundamentals, but in this post I will also cover the technical charts. If you haven’t read technical charts before don’t worry I will walk you through step by step. Starting on the left side I have added a “Fibonacci Retracement” indicator (the colored boxes/lines), this helps to identify previous “support” and “resistance” lines related to Apple stock. There are areas in which investors/traders had previously seen value. Starting at the bottom right, the stock plummeted to its “pandemic crash” low of ~$57/share in 2020, thus I have labeled this as the stock price “floor”, if we have a major crash again. However, moving up the right side of the chart we can see multiple support lines the stock would need to break through at both Buy Point 2 (support line) at $126/share and Buy Point 3 at $109/share.

Apple Technical Chart (Created by author Deep Tech Insights)

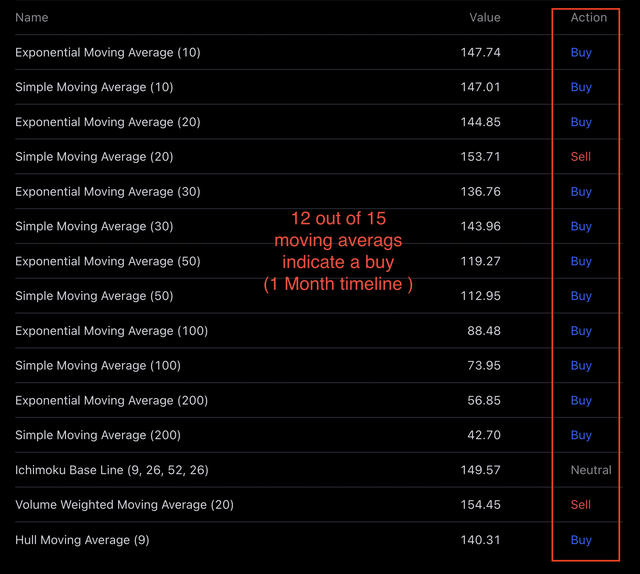

In this case, since April 2022 Apple’s stock has effectively moved sideways between Buy Point 2. $126/share and Buy Point 1. at $147, with a “breakout” in August 2022, in between. As its stock price has now broken through “Buy Point 1”, this “resistance” has turned into a support and the stock is likely to move higher to ~$172/share, assuming now major negative news in the short term. If anything a positive catalyst would help with this move. Below I have also anaylzed a variety of moving average indicators, from the simple moving average (10 day) to a 200 day exponential moving average. In this case, 12 out of 15 moving averages indicate Apple stock is a “buy”, based upon a 1 month timeline.

Moving Averages (Author calculations/annotations, trading view)

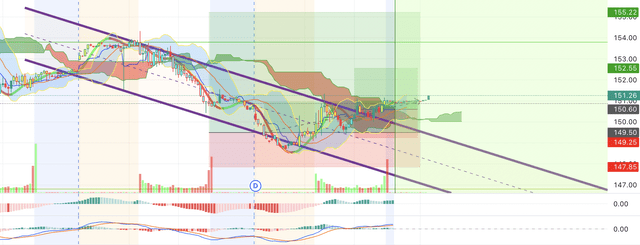

For extra information, I have added another chart below which includes the “Ichimoku Cloud” indicator. When translated from Japanese this means a “one look equilibrium chart”, because in just a single “look” an investor or trader can see a combination of information. In this case, we can see Apple’s stock price was in a declining channel (which is slightly misaligned). However, recently it has broken through this negative channel, and the green Ichimoku cloud indicates positive/bullish momentum. Now it must be noted, that technical analysis is not an exact science but just an “indicator” or datapoint which can assist us in making solid decisions, assuming other datapoints such as the fundamentals are solid, which I will dive into next.

Apple Technical Chart (tradingview/Valvofolife)

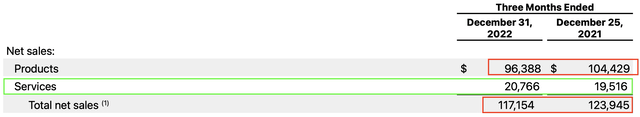

Mixed Financials

Apple reported mixed financial results for the first quarter of fiscal year 2022. Its revenue was $117.15 million which missed analyst expectations by $4.5 billion and declined by 5.48% year over year. This was the first revenue decline Apple has reported since its negative 2.4% growth reported in 2019 and negative 7.7% reported in 2016. This result for Apple was mainly driven by the tepid macroeconomic environment, which impacted Product revenue by negative 7.6% year over year. A positive is Apple’s high margin Service revenue continued to grow by 6.4% year over year, and reached a record high. Earnings per share [EPS] of $1.88 missed analyst expectations by negative $0.07. This was mainly driven by the aforementioned revenue decline, as well as a 2% increase in operating expenses as a percentage of sales to 12%.

Apple Revenue (Author annotations, Apple Income statement)

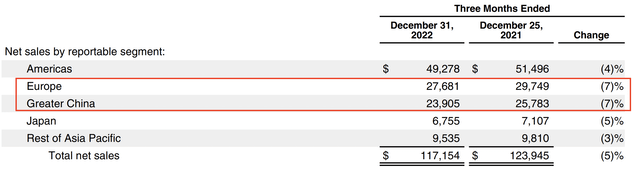

Breaking down the negative headwinds against Apple in the quarter. Foreign exchange rates, from a strong U.S dollar resulted in an 800 basis point negative impact on Apple’s international revenue. A positive for Apple is on an FX neutral basis the company would have grown year over year, so it’s not necessarily all bad and the FX headwinds can be mitigated against through local investments and hedging. From the chart below you can see Europe and China saw the most revenue decline of 7% year over year. As Russia-Ukraine war began, the Euro sold off, as many feared volatility and an energy crisis. However, as I have forecasted in prior posts the currency markets tend to be cyclical by nature and the Euro has rebounded by ~9%, despite the Russia-Ukraine war approaching its one year anniversary and a major invasion of Donbas by Russia is expected. Over in China, a “hard” CV19 lockdown policy impacted the supply of the new iPhone 14 Pro Max, which lasted through December. A positive for Apple is I believe the majority of these issues are short term and economic cycles tend to be cyclical by nature.

Apple revenue by region (author annotations income statement)

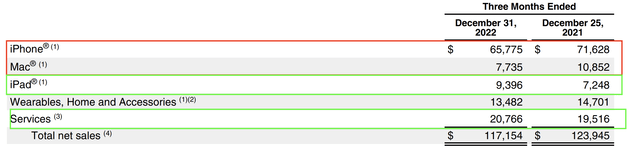

Breaking down Apple’s product revenue by type, its flagship iPhone still continues to dominate Apple’s revenue and contributed to 56% of its total sales in Q4,22. iPhone sales declined by 8% year over year to $65.78 billion, despite the launch of its latest iPhone 14 in September 2022. Part of this decline was driven by the aforementioned foreign exchange headwinds, as Apple reported “flat” revenue on an FX neutral basis. However, I believe management may be sandbagging the fact that the iPhone 14, demonstrates only “iterative” improvements over the iPhone 13, according to a leading technology review website. I tend to agree with this review and see a slightly faster chip (4 core A-15 vs 5 core A-15) and minor/differentiated camera improvements such a super zoom lens. Therefore I believe given these factors, Apple users won’t be rushing to upgrade especially given the macroeconomic environment. However, I believe eventually users will upgrade especially if they are already used to using Apple products and indoctrinated into the Apple ecosystem.

Apple Revenue by Product (Author annotation Q4,22 financials)

Apples Mac revenue declined by an eye watering 29% year over year to $7.7 billion, but this was partially driven by a difficult comparison given a strong relaunch of its M1 MacBooks in 2021. Apples latest M2 Pro and M2 Max, should help to entice new users to purchase as they offer higher performance, ~20% faster than the M1 GPU, which is substantial. In addition, these chips offer longer battery life than its predecessors.

Surprisingly Apple’s iPad revenue increased by 30% year over year to $9.4 billion. However, this was mainly driven by a weaker Q4,21 (due to supply chain constraints) which made for a more positive comparable. For completeness, Wearables, Home and Accessories reported $13.5 billion which declined by 8% year over year. Apple has announced plans to launch its next generation of “HomePod” smart speaker. New features will include the ability to detect smoke or even carbon monoxide, making the product a safety first home feature. I personally like the angle Apple is trying here, as Amazon has previously reported layoffs in its “cash burning” Alexa business.

Metaverse Opportunity?

A game changing product in Apples wearable segment, is its long overdue and rumoured Virtual Reality [VR] headset which has now been virtually confirmed for the fall of 2023. This will signal Apples movement into the Metaverse and could be a major game changer for the industry, along with the related Apple glasses for Augmented Reality [AR]. In my previous posts on Meta, I discussed that in an Interview with Mark Zuckerberg, he revealed that these headsets could be the “next computing platform”, which would be a major deal. Therefore this is not just a Metaverse opportunity for Apple, but also the protection of its iPhone which effectively is the number one mobile “computing” platform in the world. Apple owns the Appstore and is effectively the gatekeeper onto its computing platform. Therefore as a new wave of apps are born for VR/AR devices, Apple would be left in the dark if it didn’t release a competitor. The global Metaverse industry is forecast to grow at a rapid 39.8% compounded annual growth rate, reaching just under $1 trillion by 2030.

Apple unofficial headset example (Antonio De Rosa)

Super Services

As mentioned prior, Apples services revenue is my favorite part of Apple businesses for a few reasons. Firstly, it is still growing up 6.4% year over year to $20.7 billion. In addition, this business has a super high gross margin of 70.8%, versus products at “just” a 37% gross margin. This makes complete sense as Apples services business is effectively software and related cloud services [iCloud] which is often more scalable. I personally have found myself needing to purchase greater iCloud storage recently (despite not increasing my photo/video taking rate) so I believe Apple, may be squeezing extra revenue out of consumers in this way. As a user of Apple products, I don’t like the lack of control with regards to memory and backups, but from a business standpoint they cannot be faulted. Its paid subscriptions for services. have increased by over 150 million over the past year to 935 million. For its Apple TV business, the company has recently scored an historic 10 year partnership with Major League Soccer [MLS]. I believe this is positive timing for Apple, given the recent World Cup which was the most watched sporting event in the world. Sporting rights is a great way streaming providers can differentiate themselves from Netflix and entice a new cohort of fans to sign up.

Valuation and Forecasts

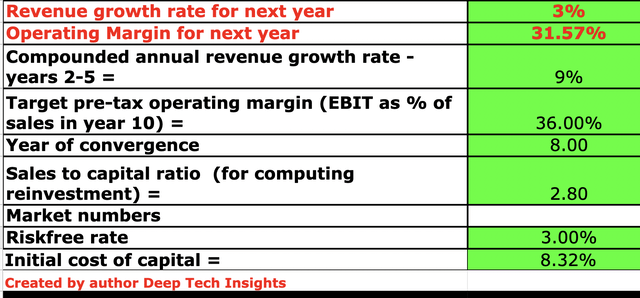

In order to value Apple I have plugged its latest financials into my discounted cash flow valuation model. I have forecast just 3% revenue for “next year”, or the next four quarters in my model. I expect this to be driven by continued foreign exchange headwinds, in addition to a tough macroeconomic backdrop which will likely impact product demand. However, in years 2 to 5, I have forecast a recovery to 9% growth per year. I forecast this to be driven by continued growth in the Services business, as well as a new iPhone model (rumoured in late 2023/2024), as these tend to launched be on an annual/biannual cycle. I expect improving economic conditions and foreign exchange rate improvements in years 2 to 5, as both these macro factors tend to be cyclical. Apple has previously grown its revenue between 53% in the March 2021 quarter to ~8% in the September 2022 quarter, thus I don’t deem a 9% growth rate to be unrealistic.

Apple stock valuation 1 (Created by author Deep Tech Insights)

In an attempt to increase the accuracy of the valuation I have capitalized Apples R&D expenses which has lifted net income. In addition, I have forecast a margin expansion from 31.57% to 36% over the next 8 years. I forecast this to be driven by growth in the higher margin Services business, which benefits from scalable operating leverage. Apples balance sheet is also in a solid position to continually invest with $51.355 billion in cash and short term investments. The company does have high long term debt of $99 billion, but “only” $9.7 billion of this is current debt, due within the next 2 years and thus manageable.

Apple stock valuation 2 (created by author Deep Tech Insights)

Given these factors I get a fair value of $154/share, the stock is trading at ~$151 per share at the time of writing and thus is 2% undervalued or “fairly valued” in my eyes, given the quality of the company.

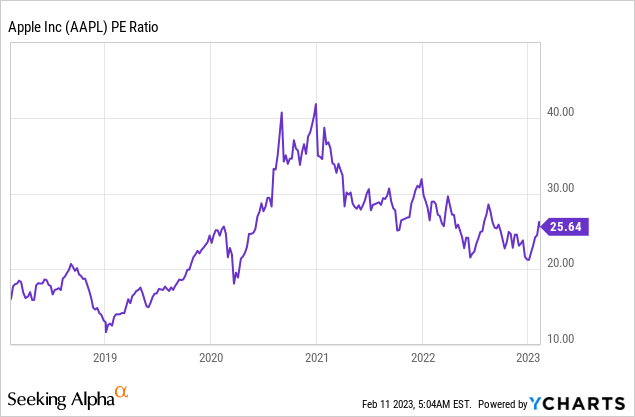

Interestingly enough, Apple also trades at a P/E ratio = 25.71x, which is ~5% higher than its 5 year average. Thus you could also say this is “fair value” for a highly profitable, leading business with a strong brand etc.

Risks

Recession/Lower Product Demand

Given many analysts have forecast a recession in 2023, and the latest iPhone is not significantly better than the current iPhone 13 (according to the aforementioned reviews). It wouldn’t be a surprise is the company experienced lower demand for its products in the short term.

Final Thoughts

Apple has continued to produce steady financial results despite a tough economic backdrop. Its high margin Services business is especially enticing and I believe its product business will bounce back as future economic and foreign exchange rate cycles alter. The technical charts are looking positive, as its moving averages indicate a “buy” and the stock has broken through a resistance barrier. In addition, the stock is slightly undervalued or “fair value” in my eyes, given its leading market share in smartphones and its solid brand with “pricing power”.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.