Summary:

- Visa is levered to the trend toward a cashless society, and we like that the firm doesn’t take on credit risk like that of a few of its peers.

- The firm generates operating margins north of 60%, while it converts roughly half of every dollar generated as revenue into free cash flow.

- Visa’s dividend yield isn’t as large as that of the average S&P 500 company, but the firm’s dividend growth prospects are phenomenal, in our view.

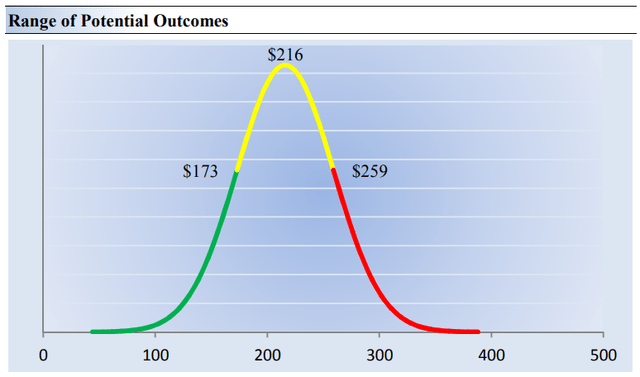

- At the high end of our fair value estimate range, we value shares of Visa at $259 per share, and that implies potential upside to where shares are currently trading (~$227 per share).

damircudic

By Valuentum Analysts

The trend toward a cashless society is inevitable, and there are a number of companies where one can gain exposure to this dynamic, but our favorite is Visa (NYSE:V). Many investors know Visa as a credit card company, but its business model is a bit different than one might expect. For example, Visa generates a fee every time someone uses one of its cards, and it stays away from the credit risk that may complicate the business models of other operators. We like this a lot because it significantly reduces Visa’s risk profile.

Another tremendous attribute of Visa is its huge levels of profitability. Visa, for example, puts up operating margins and free cash flow margins that are as strong, if not stronger, than any other company in our coverage universe. We’re talking about operating margins north of 60%, and free cash flow margins that approach 50%. These levels of profitability are incredible. Not only is the firm income-statement rich, but the firm is free cash-flow rich, too. It doesn’t need to plow back a lot of its operating cash flow into the business to keep things moving in the right direction.

Visa’s Latest Quarterly Results

Let’s see how things have been going at Visa recently. The company reported awesome first-quarter fiscal 2023 results on January 26. Its sales advanced 12% in the period, and Visa translated that top-line expansion into a 17% increase in non-GAAP net income. The company’s operating margin for the quarter was a solid 64.1%, a step back from levels of last year’s quarter but still impressive. Visa’s non-GAAP earnings per share advanced 21%, to $2.18, which came in better than what consensus was looking for. Shares of Visa have jumped nearly 10% so far in the new year, and while the company’s share price has surpassed our point estimate of its intrinsic value, we could see shares run to the high end of our fair value estimate range of $259 per share, in our view.

Our fair value estimate range for Visa’s shares. (Image Source: Valuentum)

As we noted above, Visa isn’t exposed to credit risk like other credit-card companies, so while delinquencies and charge offs are expected to rise materially at entities such as Discover Financial (DFS) and Capital One Financial (COF), for example, Visa is largely protected from credit risk in this regard. It gets paid every time a card user swipes a Visa card, not on the interest charged on the outstanding balance itself. During the first quarter of fiscal 2023, Visa’s payments volume jumped 7%, total cross-border volume advanced 22%, and processed transactions increased 10%. We maintain our view that Visa is in a sweet spot as the company benefits from the trend toward a cashless society as well as e-commerce proliferation.

Asset Light and Free Cash Flow Rich

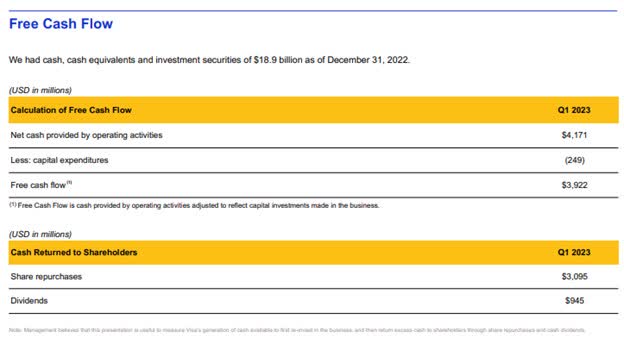

Visa is a free cash flow generating powerhouse and is insulated from rising delinquency and charge offs, unlike others in the credit card space. (Image Source: Visa)

Let’s now dig into its financials. Visa is a capital-light entity, meaning that its capital expenditures are quite small relative to its revenue and cash flow from operations. We’re huge fans of companies with these types of qualities as they are able to generate a significant amount of free cash flow. As it relates to Visa, free cash flow came in at $3.92 billion during the fourth quarter, about 49% of total revenue. Visa’s business model is so cash-rich that for every $1 generated in revenue, roughly half of that turns into free cash flow. Very few businesses have the profitability characteristics (i.e. operating margin and free cash flow profile) as that of Visa, and we like the company and its dividend growth prospects.

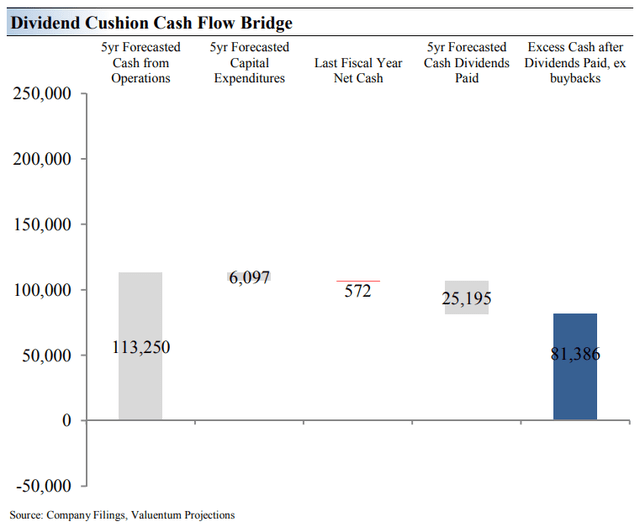

Visa’s dividend growth potential is fantastic. (Image Source: Valuentum)

As we outlined previously, Visa is a free cash flow powerhouse, and as our cumulative five-year forecasts for cash flow from operations and capital spending show in the image above, we expect the company to have significant financial flexibility to either grow its dividend or return shareholders via buybacks in the coming years. The big drawback of Visa as a dividend growth idea, however, is that its dividend yield is rather small at 0.8%. This compares to the average S&P 500 company’s dividend yield of ~1.6%. Though it’s hard to like Visa solely for a dividend yield that currently comes up short relative to other large multinationals, long term, the company has tremendous capacity to keep raising its payout.

Concluding Thoughts

Visa has been one of our favorite companies for a long time. It is levered to the secular growth trend toward a cashless society, and it benefits from e-commerce proliferation. The firm’s operating margin is simply a sight to see, and its free cash flow margin is awesome. We expect Visa to generate a considerable amount of free cash flow in the coming years, and its dividend growth prospects to benefit as a result. Shares could have meaningful upside potential on the basis of the high end of our cash-flow-derived fair value estimate range ($259 per share), too. We like Visa a lot, and we think it’s one for your radar, at the very least.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.