Summary:

- ‘Apple Business Connect’ encourages business listings within the Apple ecosystem, paving the way to monetize Apple Maps through advertising solutions.

- Apple has partnered with some major commerce platforms to better facilitate commerce transactions through Apple Maps, such as ordering groceries via Instacart.

- Given the prowess of Google Maps, Apple faces a tough competitive battle to induce greater commercial use of Apple Maps, and subsequently generate advertising revenue through the service.

pressureUA/iStock Editorial via Getty Images

Apple (NASDAQ:AAPL) has been striving to find new avenues to boost services revenue, and digital advertising has been a key area of growth over the years. The tech giant is stepping up its game to monetize the built-in apps on its hardware devices. Its latest move is the introduction of ‘Apple Business Connect’, encouraging business listings within the Apple ecosystem, and moving a step closer to selling advertising solutions through Apple Maps.

Apple’s advertising business is growing rapidly, and is expected to have reached $5 billion in 2022, according to Evercore ISI. While Apple’s main advertising property is the Apple App Store, the tech giant has been offering ad spaces in various other locations across its suite of built-in apps. More recently, Apple has been making strides towards better monetizing Apple Maps. The tech giant has already been internally testing search ads within Apple Maps. While it hasn’t officially launched Apple Maps ad solutions, the company is certainly moving in that direction with the introduction of ‘Apple Business Connect’, inducing business listings within Apple Maps, and the Apple ecosystem more broadly.

Apple Business Connect

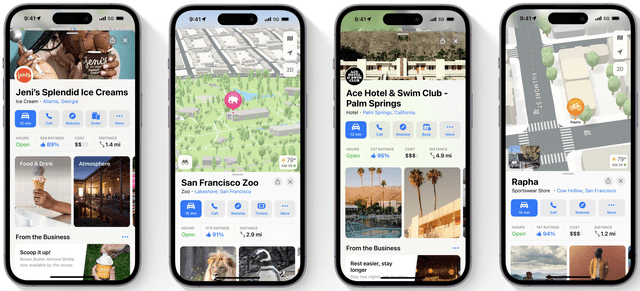

In January 2023, Apple introduced ‘Apple Business Connect’, enabling businesses to create ‘place cards’ to get discovered among Apple device users through Apple Maps and other built-in apps.

Businesses are able to offer certain commercial actions within their place cards, including “order food, book a reservation, schedule an appointment, purchase tickets, and more”, to help boost conversion rates upon discovery. Apple is seriously stepping up its game to encourage business listings on its platform, in the interest of spurring more commercial activities through its apps, conducive to improving the advertising potency of its services.

In fact, Apple has partnered with some major commerce platforms to better facilitate commerce transactions through Apple Maps, including “ordering groceries via Instacart, making a hotel reservation through Booking.com, or reserving a spot for dinner with OpenTable, and more, with just a tap”.

If Apple can successfully encourage users to increasingly take commercial actions (e.g. book a reservation) through Apple Maps, it would subsequently encourage even more merchants to create business listings and ‘place cards’, in turn further boosting commercial activity among users. More importantly, it would augment the appeal of Apple’s presumed advertising solutions through Apple Maps, as merchants seek to become more visible to Apple device users that show high-intent to engage in commercial activities.

Apple Business Connect also allows businesses to “share limited-time offers and announcements”. The pronouncement of special promotions and deals through Apple Maps further augments it as a discovery/ commercial activity tool among users. This strategy can prove particularly fruitful if users develop a habit of checking Apple Maps (and other Apple apps) for special offers, further enhancing the appeal of Apple’s advertising solutions going forward.

Competition from Google Maps

Google (GOOG) also offers merchants the ability to highlight special offers and deals to Google Maps users. Moreover, Google benefits from access to other lucrative user data, particularly search history data, which feed into its algorithms to display more relevant products/ services to users when they discover businesses through Google Maps, thereby improving chances of conversion for advertisers.

Furthermore, while Apple Business Connect is a step in the right direction to encourage more business listings within the Apple ecosystem, Google is already well ahead in terms of drawing business listings through its own platform. Not just through the dominance of Google Maps, but also through search engine tools like Google Search Console, as merchants seek to understand and enhance the digital visibility of their businesses.

Additionally, Google allows merchants to sync their inventory with ad products across the platform. So with Google Maps, when a user searches for/ discovers a business, they would see relevant product listings for items in-stock, aimed at improving conversion rates for merchants. Google has also delivered notable innovations in the area of business discovery. For instance, people can use Google Lens to take a picture of an item and search for nearby stores/ places selling that item through Google Maps, offering a new avenue for business discovery.

Given the prowess of Google Maps, Apple faces a tough competitive battle to induce greater commercial use of Apple Maps, and subsequently generate advertising revenue through the service. Nevertheless, Apple has been making its own advancements to induce more commerce activity through the Apple ecosystem.

Apple commerce, advertising and privacy

Apple will be launching ‘Apple Pay Later’ this year, its own ‘Buy Now, Pay Later’ service. ‘Buy Now, Pay Later’ platforms are increasingly shifting towards becoming e-commerce destinations, and are leveraging users’ purchase history data to offer targeted advertising solutions to merchants.

Apple could follow suit. The more Apple device users conduct shopping activities through the use of Apple Pay/ Apple Pay Later, the more commercial activity data the company will be able to collect, which could potentially be leveraged for targeted advertising. Moreover, Apple could combine the commercial power of Apple Pay (Later) and Apple Maps to offer more targeted advertising solutions to merchants, and thereby encourage businesses to list and advertise through Apple Maps over Google Maps.

That being said, Apple leveraging user data to facilitate its digital advertising ambitions would inevitably contradict the Cupertino-based company’s long-standing privacy-centric stance. In fact, on its ‘Apple Business Connect’ webpage, the tech giant re-iterated its focus on privacy.

Apple’s continued emphasis on user privacy is a key component of its brand value, and could indeed encourage greater use of Apple devices and applications over the long-term, potentially even encouraging people to choose Apple Maps over Google Maps. On the flip side, Apple’s user-privacy protocols counteracts its digital advertising ambitions, as it hinders targeted advertising potential.

Nevertheless, the company’s privacy-centric approach has not stopped it from showing targeted ads to iPhone users, in places like the News and Stocks apps. User activity on Apple’s built-in apps is first-party data for the tech giant, which it subsequently uses for targeted advertising. Given Apple’s growing digital advertising ambitions, it would be unsurprising to witness the company find work-arounds to its own privacy protocols to justify targeted advertising efforts. Note that iPhone users have the option to opt out of targeted ads, and “78% of iOS 15″ users have in fact disabled this feature, which is a significant impediment to Apple’s advertising initiatives. Nonetheless, Apple is unlikely to give up, and could indeed keep asking users in future iOS updates in its endeavor to grow advertising revenue.

Apple’s ability to consider activity on built-in apps as first-party data is a key advantage it holds over other advertising platforms like Facebook, which rely on the Apple App Store to reach iPhone users, and therefore have to play by Apple’s rules. In April 2021, Apple introduced App Tracking Transparency [ATT], a privacy feature allowing Apple device users to opt out of third-party apps tracking their behavior. With majority of users opting out of being tracked by apps, it has thrown a spanner in third-party advertising platforms’ ability to deliver targeted ads and offer meaningful attribution data to ad buyers.

Moreover, Apple had released its own attribution measurement tool, ‘SKAdNetwork’, amid the privacy policy changes, though advertising platforms have complained about the inadequacy of the tool. In the interest of fending off anti-trust litigations, Apple has been making advancements to its ‘SKAdNetwork’ to help third-party advertisers better measure ad attribution.

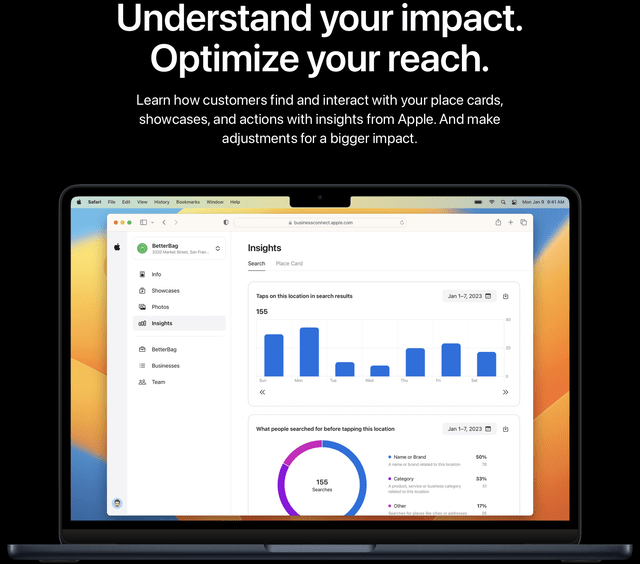

Nevertheless, it is clear that Apple’s privacy policy changes have hurt advertising rivals, which the tech giant is using to its advantage. As part of Apple Business Connect, merchants will receive discovery insights, including “how customers find and interact with [their] place cards”.

Apple’s own attribution insights are possible due to the data being first-party data, as the activity is happening on its own app. With this advantage in mind, Apple is likely to develop more commercial activity within its own Apps more broadly to enable it to collect more lucrative first-party data with high advertising potency.

Summary

Apple Business Connect brings the company a step closer to monetizing Apple Maps through selling advertising solutions. As more businesses list themselves and make their products/ services accessible through Apple’s apps, and more device users engage in commercial activities through those apps, the better positioned the Cupertino-based company becomes to sell high-conversion ad solutions. That being said, the tech giant faces tough competition in this space, particularly from Google/ Google Maps, which possesses a well-established directory of business listings, and is well-positioned to facilitate commerce activity/ discovery through features like inventory syncs, and leveraging users’ Google search histories to show the most relevant product/ service listings for businesses.

More broadly, Apple’s growing advertising ambitions will inevitably be at loggerheads with its privacy-centric approach. While the company continues to emphasize its focus on privacy, it has already been utilizing users’ in-app activity data to show ads across its ecosystem, and will likely amplify its targeted advertising endeavors going forward by leveraging its treasure of first-party data.

Any investment decisions in Apple stock should take into consideration all business divisions in aggregation. Given that this article solely focuses on the company’s digital advertising endeavors, a neutral ‘hold’ rating will be assigned to the stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.