Summary:

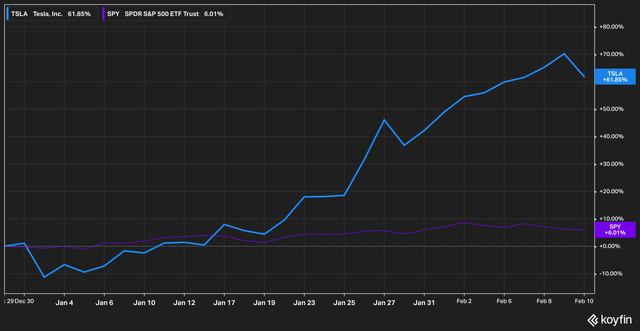

- Tesla shares have experienced an enormous rebound in 2023.

- However, questions about demand have been raised by recent registration numbers in China.

- The company appears to have scrapped plans for an expansion of the Shanghai plant.

AdrianHancu

As The World Turns

Well, it’s certainly a whirlwind few weeks for Tesla (NASDAQ:TSLA) bulls and bears alike. After bottoming out near the $100-$110 range, the stock has mounted an incredible rally in 2023 with share prices topping the $200 mark.

The rally seems to have been sparked by comments made by Tesla management on the Q4 earnings call, where Elon Musk made comments about a surge in vehicle demand in January 2023 that far exceeded production capacity. This, along with an estimate that the company could produce 1.8 million vehicles in 2023 gave bulls all that they needed to pile back in.

Given that the stock has had quite a run already in 2023, we have questions that we think investors may want to ask themselves as a counterweight to the lofty estimates provided by the company.

Happy New Year

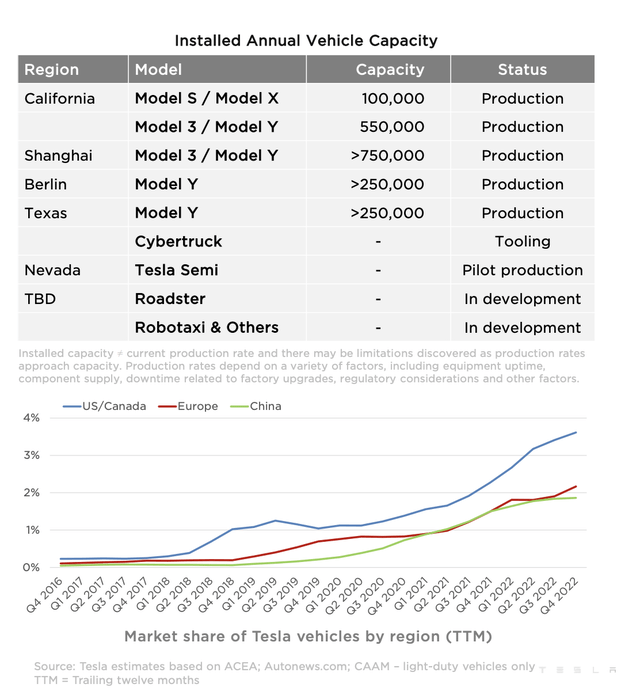

One of the major questions that we have regarding the comments made by management regarding production have to do with Tesla’s Shanghai plant.

The factory in Shanghai has a greater production capacity than any other Tesla plant, and it has been a source of major speculation among investors who track each and every thing that happens there. Given that China provides a large chunk of Tesla’s current and future growth, this scrutiny is warranted.

On the question on demand versus supply, here is what Elon Musk had to say:

The most common question we’ve been getting from investors is about demand. Thus far — so I want to put that concern to rest. Thus far in January, we’ve seen the strongest orders year-to-date than ever in our history. We currently are seeing orders at almost twice the rate of production. So it’s hard to say that will continue twice the rate of production, but the orders are high.

At first glance this appears to be incredibly good, and somewhat expected, news. After all, Tesla in December cut its prices on some models, a move that frustrated some Tesla owners but was expected to generate a spike in demand.

The relationship of demand versus production capacity, however, is less clear. Given that the Shanghai factory was set to be closed for a portion of January due to the Chinese New Year, it’s perhaps not surprising that demand would outpace production.

It’s not unreasonable to expect, after all, that as a result of your highest-production capacity factory could be closed for roughly one-third of a month that your demand would outpace production capacity in the near-term.

Demand?

All of this is further complicated by the fact that Tesla has apparently scrapped plans to expand the Shanghai factory with a second assembly line. This raises questions about how robust demand actually is for premium-priced electric vehicles in the Chinese market.

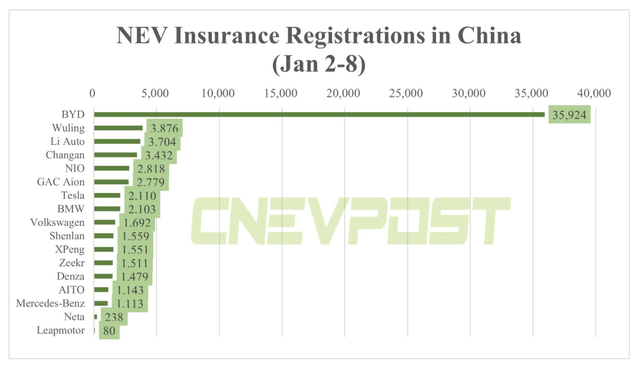

One way that investors can gauge demand in China for vehicles in a relatively quick manner is to assess weekly vehicle insurance registration data.

2023 started off in relatively rocky fashion for Tesla:

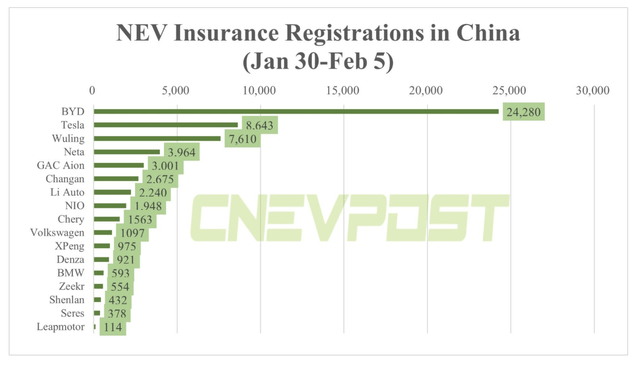

Following the end of the Chinese New Year, however, things rebounded a bit:

Critics will rightly point out that since several Tesla models skew to the more premium side of things, that a whole-batch count of insurance registrations likely doesn’t tell the whole picture.

However, the Model 3, which retails for below 300,000 RMB in China, is not considered to be a high-end sedan. Here are the monthly figures for January’s total registrations.

In January, the best-selling non-premium EV sedans in china were: the BYD Dolphin with 17,582 registrations, the Hongguang Mini EV with 16,416, the BYD Qin with 14,185, followed by the Tesla Model 3 with 12,659.

A typical bull argument for Tesla’s market-lagging position behind BYD (OTCPK:BYDDY) is that Tesla typically runs at a higher price point. The Model 3, however, competes at a more mass-scale price point than the Y or S, so we would expect that sales there would be more indicative of Tesla’s mass appeal within China.

A Risky Road Ahead?

Tesla’s latest 10-K release provided us with an opportunity to review changes to its risk factor disclosures. This section of a company’s SEC filings are often dismissed by investors as boilerplate or unimportant, but we believe that attitude to be a mistake.

While some risk factors certainly are boilerplate, the language surrounding them is typically fraught with internal debate at a company. Occasionally, very important disclosures and changes to prior risk assessments are made, and so we believe that scanning company filings for changes in risks is a good use of investor’s time.

Here are a few risks that were added to Tesla’s disclosures in its recent 10-K filing which were absent from 2021’s 10-K.

Warranty Coverage

Our current and future warranty reserves may be insufficient to cover future warranty claims. [p.22]

This is, in our opinion, anything but boilerplate. Warranty claims can quickly eat into a company’s bottom line, and if they are not budgeted for correctly, can be hefty.

We believe Tesla’s warranty risk to be quite high. The National Highway Transportation Safety Administration keeps a log of vehicle recalls as well as consumer complaints about vehicle safety and performance. The Tesla 2022 Model 3 listing posts 9 recalls, 4 investigations, and 469 submitted complaints.

Of course, these ratings can’t be assessed in a vacuum. To that end, we looked up a 2022 Honda Accord, which, despite being an ICE vehicle, is similar in size and cost. That vehicle’s page has 0 recalls, 0 investigation, and 25 complaints.

For a more apples-to-apples EV comparison, the 2022 Hyundai Ioniq SUV has 1 recall, 1 investigation, and 18 complaints. (For the record we selected 2022 models to allow for more market time.

When you compare the 2022 sales data, this works out to 1 complaint for every 6,184 Honda Accords sold, 1,276 Hyundai Ioniq SUVs sold, and every 512 Tesla Model 3s sold. This is, to put it mildly, a pretty large statistical variance.

At least a portion of these complaints have the ability to be converted into warranty claims, and we think that the disclosure about warranty accounting is important in light of the volume of complaints received by the NHTSA.

Further Tesla Stock Sales?

If Elon Musk were forced to sell shares of our common stock, either that he has pledged to secure certain personal loan obligations, or in satisfaction of other obligations, such sales could cause our stock price to decline. [p.28]

Following the purchase of Twitter, Elon Musk publicly pledged to not sell any more Tesla stock for roughly two years. However, this new disclosure in Tesla’s 10-K does not have any timeline stipulation. The disclosure covers the fact that Elon Musk has pledged a certain amount of Tesla shares as collateral to banking institutions.

All of this is well known. However, it’s the last sentence of the disclosure that we’d like to focus on. It reads:

Further, Mr. Musk from time to time may commit to investing in significant business or other ventures, and as a result, be required to sell shares of our common stock in satisfaction of such commitments.

While Elon Musk has pledged publicly that he will hold off for a certain amount of time, this new disclosure does not subject his sales to any time frame – indeed, it appears to be up to his discretion.

What’s The Takeaway?

As we assess whether the rally in Tesla stock is warranted, we have turned to the figures and operations of Tesla in China and come away with a few questions. What we want to know, ultimately, is whether or not our question about high demand versus production capacity was limited to January – i.e., a completely normal disruption of the supply-demand relationship due to the Chinese New Year.

Second, with Tesla for now shuttering its plans to expand production capacity at its Shanghai factory, is the current demand for the company’s vehicles at a near-term peak? These are questions that we hope to have answered on the next earnings call.

Lastly, a review of recent risks added to the 10-K give us some new contours with which to assess Tesla. The fact that the company is thinking about its warranty reserves and has disclosed that its warranty coverage may not be sufficient under certain circumstances, should at least be something investors are aware of. This disclosure, combined with the comparably high level of NHTSA complaints, puts our antennae up about possibly rising warranty claims just over the financial horizon.

So, given that the current rally seems to have been sparked by excessive optimism following the last earnings call, we have concerns that the rally is unsustainable and could snap back on investors quickly should negative news emerge. For now, these questions are enough for us to remain on the sidelines when it comes to Tesla.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.