Meta Platforms: Wait Until It Dips Again

Summary:

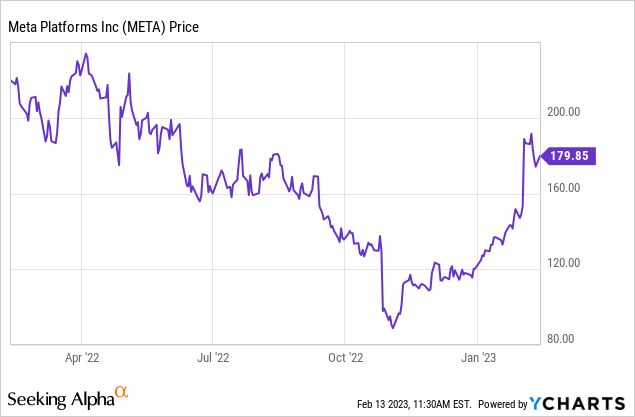

- Shares of Facebook parent company Meta have skyrocketed more than 40% this year.

- Revenue growth has turned negative amid a very challenging advertising market, hamstrung by the tightening macroeconomy.

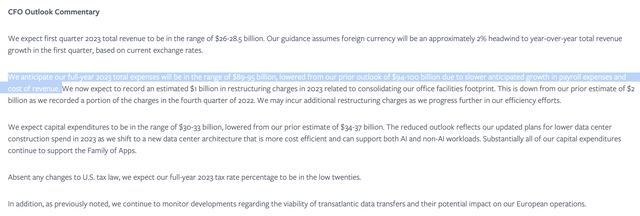

- Meta is turning its focus to cost, and has lowered its total cost guidance to $89-$95 billion from a prior view of $94-$100 billion. This still implies y/y growth.

- Trading at a ~19x forward P/E multiple, Meta is no longer cheap. The stock should see volatility this year and create a cheaper buying window.

grinvalds/iStock via Getty Images

I’ll cut to the chase here: I’ve enjoyed the sharp rebound in Meta Platforms (NASDAQ:META) stock since the start of the year, and it’s refreshing to not have the market be completely doom-and-gloom on all tech names. But in my view, META stock’s recovery rally has extended past its actual fundamental potential, and I’m locking in gains here and cutting the position from my portfolio.

So far year to date, shares of Meta have bounced back more than 40%. The bulk of these gains came in after Facebook’s fourth-quarter earnings release on February 1. Top-line performance here was dismal, as to be expected; and user metrics were decent but not altogether encouraging. Instead, what investors cheered most was Meta’s commitment to drop its cost base.

There are now more red flags to watch

I am now bearish on Meta Platforms, at least in the near term. To me, I am worried about a number of red flags heading into 2023:

- Advertising recovery will be a multi-quarter struggle. In my view, while we may not necessarily have a long recession on our hands, we are just at the beginning of a long stretch of belt-tightening by major companies. Executives are feeling the pressure to trim costs (every analyst and investor is now watching the bottom line, which is a huge change from the pandemic era where growth at all costs was acceptable), and marketing spend – especially large campaigns that are difficult to measure in ROI – is one of the most obvious and easiest spend categories to axe. Meta may have to turn to increased ad load to make up for the decline in ad rates, which may come at a risk to its platform.

- Earnings growth won’t come from cost cuts alone. Meta was not shy in trimming down its staff. Last November, the company laid off 11,000 workers, and reports speculating that more layoffs are incoming are common. But even underneath this cost-trimming, Meta’s cost guidance for 2023 isn’t substantially lower than the cost base in 2022, and so earnings growth won’t come from these cuts alone.

- Meta’s cost initiatives may come at the risk of its “moonshots”. Let’s face it: Facebook, Instagram and WhatsApp, though wildly popular, are what we could consider “sustaining” businesses in the tech industry. As we’ve seen from the rapid ascent of rival platform TikTok, it doesn’t take much for a new upstart to rapidly go viral and steal the spotlight from the existing social media giants. To defend against this, Meta really needs its innovation arm – particularly in the Metaverse, which has long been Mark Zuckerberg’s vision for the internet – to thrive. But in a cost-down environment, these unprofitable and multi-year efforts may see big delays, which in the long run may serve to accelerate Meta ceding ground to competitors.

Of course, there are some bright nuggets to look at. On the metaverse front, I do believe that Meta is best-positioned to be the innovator and first mover behind the infrastructure of a virtual world. I also continue to believe that Facebook’s core apps (Facebook, Instagram and WhatsApp) have at least another decade of dominance in social media, and these applications are incredibly popular and profitable. Advertising rates is more of a short-term worry – eventually, advertisers and ad budgets will return back to normal levels, and Meta will regain its share.

This all being said: I think for Meta’s current price, there are more risks than rewards to be wary of.

Valuation – no longer a safe entry

I’m wary of the fact that Meta is no longer exactly cheap as it was in 2022. At current share prices of $180, and with Wall Street consensus predicting FY23 pro forma EPS of $9.59 (+11% y/y) on 5% y/y revenue growth, the company has a valuation multiple of 18.8x FY23 P/E.

If we look ahead to FY24, consensus is projecting $11.48 in pro forma EPS (+20% y/y versus FY23!) on 11% y/y revenue growth (data from Yahoo Finance). To me, that represents a pretty heady two-year expansion in earnings for such a large and established business, but taking consensus at face value, Meta’s forward-year valuation is 15.7x FY24 P/E.

While not exactly a premium multiple, I do think estimates bake in a lot of flawless execution despite a lot of unknowns (will Meta be able to grow revenue in FY23? So far Q4 turned in negative y/y performance, and Q1 looks to be the same).

I’d be a buyer of Meta stock again if it tipped below $150 (a 15.5x FY23 P/E ratio is the maximum I’m willing to spend for this stock), but not before then.

Solid user metrics

We will acknowledge that Meta did report solid user metrics that are more reassuring (though this was to be expected; though the macroeconomy certainly impacts advertisers’ behavior, we did not expect social media usage to go down. After all, it’s free!)

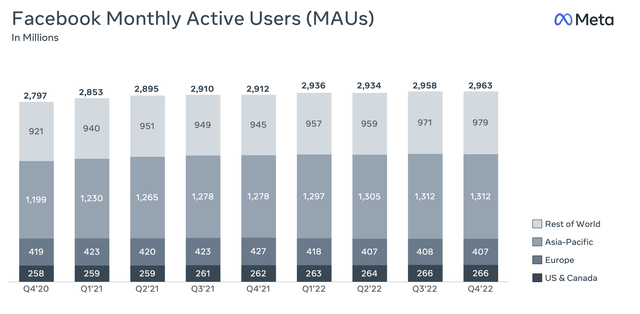

Facebook grew its MAUs by 5 million in the quarter to land at 2.96 billion, up 2% y/y:

Facebook MAUs (Meta Q4 earnings deck)

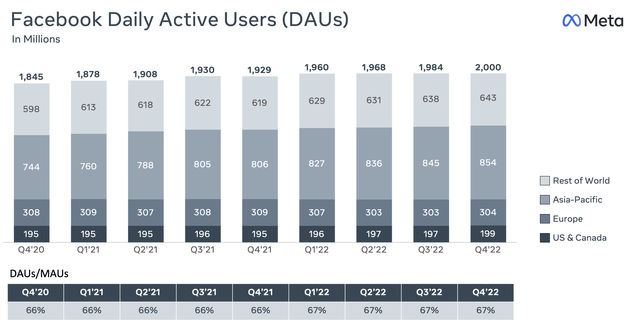

More appealing than MAUs, however, were its DAU trends – and after all, it is Facebook/Instagram’s daily users to rack up ad impressions and deliver ad dollars. DAUs grew 4% y/y to 2.00 billion, notably with 2 million in net gains in the relatively more stagnant U.S. and Canada space – which is incredibly important given these users generate the highest ARPU.

Facebook DAUs (Meta Q4 earnings deck)

The ratio of DAUs to MAUs hit an all-time high of 67.5%, versus 66.2% in the year-ago quarter.

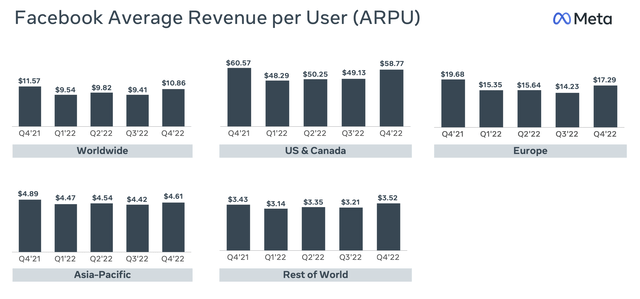

ARPU, of course, is down. ARPU declined -6% y/y to $10.86 (though it’s up from Q3), driven by a -3% y/y decline in the U.S. and Canada (the company’s highest revenue-generating region, by far).

Facebook ARPU (Meta Q4 earnings deck)

Management reported here that the average price per ad has declined -22% y/y in the fourth quarter, versus -16% y/y for the full year FY22. Combating this has been a 23% y/y increase in ad impressions served in the fourth quarter. The company additionally noted that the heaviest drags on advertiser demand were in the financial services and technology industries.

CEO Mark Zuckerberg noted on the Q4 earnings call that he expects roughly flat revenue in FY23 (perhaps not reaching flat until early FY24); which I interpret as language that is more conservative than consensus estimates at 5% y/y revenue growth for the year.

In terms of the revenue headwind, we are still on track to be roughly neutral by the end of this year or maybe early next year. And then after that, we should be able to profitably grow Reels while keeping up with the demand that we see. In our broader ads business, we are continuing to invest in AI and we are seeing our efforts pay off here. In the last quarter, advertisers saw over 20% more conversions than in the year before. And combined with the decline in cost per acquisition, this has resulted in higher returns on ad spend.”

Unless Meta acquires a huge new raft of users or its users suddenly become far more active (both unlikely due to how massive the Facebook core apps already are), Meta is going to need advertiser demand to rebound in order to return to revenue growth.

Cost cuts may not be enough

Zuckerberg has labeled 2023 as the “Year of Efficiency”. Per his opening remarks on the Q4 earnings call:

Now before getting into our product priorities, I want to discuss my management theme for 2023, which is the Year of Efficiency. We closed last year with some difficult layoffs and restructuring some teams. And when we did this, I said clearly that this was the beginning of our focus on efficiency and not the end. And since then, we have taken some additional steps, like working with our infrastructure team on how to deliver our roadmap while spending less on CapEx. Next, we are working on flattening our org structure and removing some layers of middle management to make decisions faster as well as deploying AI tools to help our engineers be more productive.”

My question, however: will it be enough?

We have yet to see the compound impact of Meta’s layoffs last November, many of whom remained on the payroll until the end of the fourth quarter in December. Post these employees rolling off, Meta will have its ~86k global headcount shrink by 11k.

Still, the company’s outlook calls for $89-$95 billion in total costs in FY23 (excluding capex).

Meta outlook (Meta Q4 earnings release)

This is better than the company’s prior outlook of $94-$100 billion. But will it be meaningful enough to drive bottom-line expansion as consensus is hoping?

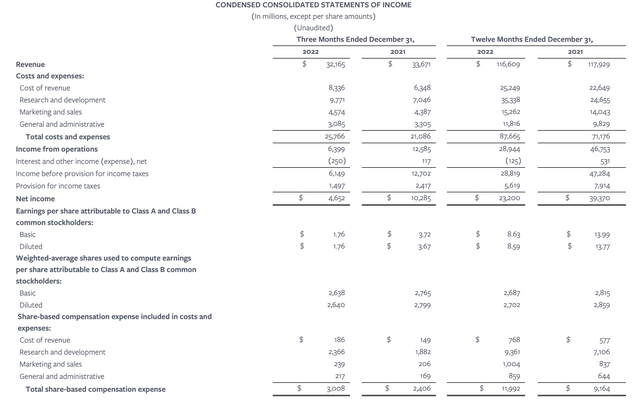

Meta’s full-year results for FY22, shown below, shows $87.7 billion in total (non-capex) cost for the prior year:

Meta Q4 and FY22 results (Meta Q4 earnings release)

This means that Meta is still expecting cost to grow at a range of 1-8% y/y; in spite of laying off ~13% of its staff. Alongside expectations of flattish revenue growth in FY23, I’m expecting operating margins to retreat this year.

Key takeaways

I’m not bearish on Meta in the long run, but I do think the markets got overly excited on Facebook’s lowered cost guidance for FY23 (even though, in my view, it’s unlikely to drive meaningful EPS growth). We’ll have a chance to buy Meta at a lower price at some point this year; until then, move to the sidelines.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.