Summary:

- Amazon is facing its toughest operating environment since the dot-com crash.

- CEO Andy Jassy stated that, essentially, after rocket-ship growth in its fulfillment network, Amazon has a lot of optimization work to do.

- The company needs to work on expanding its margins and improving its return on capital.

georgeclerk

Don’t Forget Where You Come From

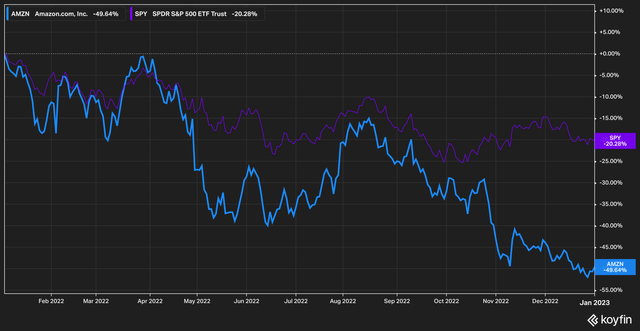

CEO Andy Jassy and the rest of Amazon’s (NASDAQ:AMZN) management are likely ready to put 2022 squarely in the rearview mirror. The company was swept up in the vast tech-wreck that defined the year, with its share price being shaved by almost 50% compared to the S&P 500’s (SPY) loss of 20%.

Koyfin

Amazon shareholders are certainly tired, too (we know we are), and are ready for a return to better days. The question is, what do those days look like? And how do they compare to the past? In this article we dive into what we think the company needs to do to turn the ship, so to speak, in a year that is likely to hold more pain for tech and growth companies.

Revenue Is Not The Problem

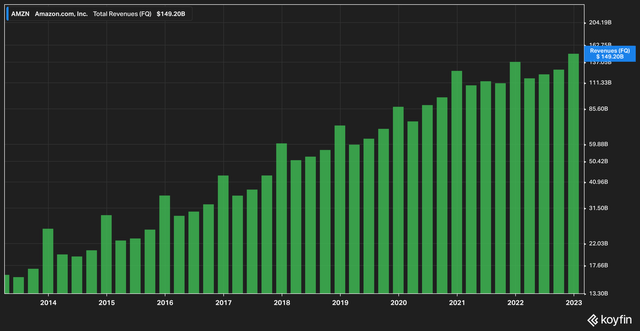

Let’s start at the top. The Everything Store has not had a problem generating revenue over the years, with its 2022 Q4 being the best quarter on record for the company.

AMZN Quarterly Revenue (Koyfin)

The chart of Amazon’s revenue, to that point, looks like a steady stair-step–up and to the right. Like most retailers, Amazon also has a degree of seasonality in its e-commerce business traditionally bumps sales in the holiday-packed Q4.

The problem, as it were, has always been in the company’s ability to generate profit. Long-time bulls will point out that this is by choice. Amazon, they say, could always swing to profitability, but leadership instead simply opts to plow profits back into the business to fuel further growth.

Further, Amazon has always been able to rely on AWS (its resident cash cow) to cover any shortfalls in the e-commerce business (we have addressed this in previous articles, which you can read here).

This story held up for many years, but we believe that Amazon stands at an inflection point. Interest rates are rising, a recession appears to be imminent, and Amazon’s strategy, we believe, needs to shift. The major question is: is the historic bull opinion that Amazon can simply flip the switch to profit mode accurate?

Operating Margins Suffering

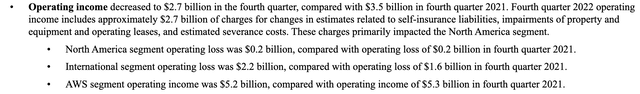

Since generating revenue is not a problem Amazon needs to solve, we must turn to costs. The holiday laden Q4 did not have many bright spots for investors. Consider this snapshot from the Q4 earnings release:

Amazon Press Release

So, to recap: in the busiest quarter of the year–the quarter in which shoppers are supposed to spend money hand-over-fist and in which Amazon posted record-breaking revenue–Amazon’s e-commerce business lost money. The operating income for the company overall was supplied by AWS, which, again, has its own emerging problems.

As investors, this is… disheartening. It’s made all the worse when you consider that Amazon’s e-commerce business has a negative working capital model, which is, in theory, supposed to provide a bit of structural rocket fuel to the business.

What this means is that Amazon’s customers mostly pay at the time of purchase (anytime you buy something from Amazon.com), while Amazon has credit terms to pay its suppliers. As a result, the company is always bringing in cash before its bills are due. This makes what makes the operating loss all the more painful–Amazon has likely not even posted a majority of the cost of goods sold expense for all the sales it made in Q4 (Amazon also posted an operating loss in its e-commerce business in 2021).

Turning The Ship

Everything described above seems to have been the business-as-usual mindset at Amazon for some time–invest in growth at all costs, that losses today are acceptable if we can generate free cash flow in the future.

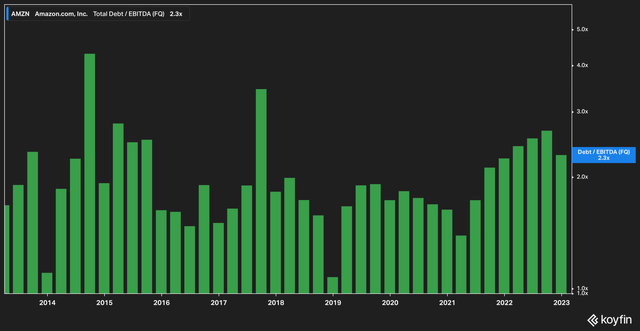

This is going to be all the more critical in the face of rising interest rates. Amazon has been arguably better than almost any other company at leveraging growth against low-interest rate debt.

Koyfin

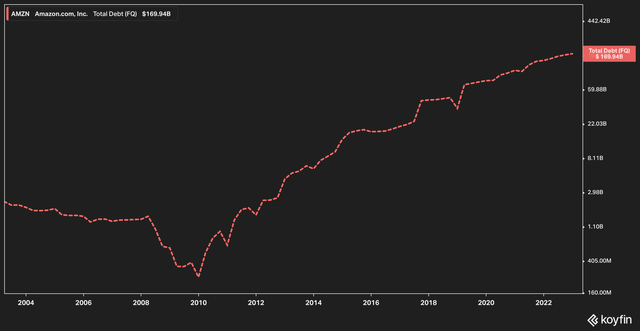

Amazon has kept its leverage levels relatively constant over the years, which is of course positive, but overall debt has grown substantially.

Amazon Total Debt (Koyfin)

This debt will become more and more expensive to service, and new debt will be more costly to raise. This will squeeze margins and–we think–force a decision in the business on how to respond.

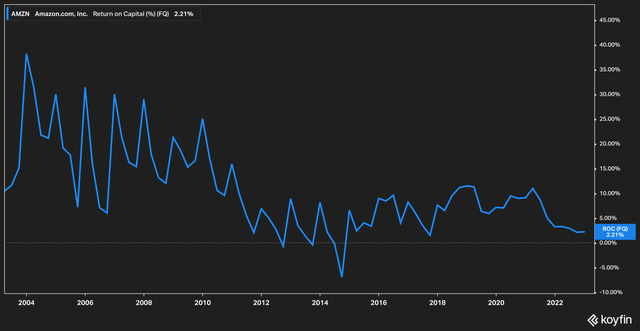

Something else that has been on our radar is Amazon’s falling return on capital [ROC]. Followers will know that we place a high emphasis on this metric, as we are firm believers that companies must consistently generate a return on capital that exceeds their cost of capital if they want to generate returns for shareholders in the long run.

Amazon ROC (Koyfin)

Amazon’s debt is rated AA by Standard & Poor’s, and the current options-adjusted spread on AA corporate debt is 71 basis points. Given that the WSJ prime rate currently sits at 7.75%, we can conservatively estimate that Amazon’s current cost of capital is 8.5%. Earning a 2.3% yield on invested capital simply won’t cut it over the long haul.

To that end, we ask…

Will the Growth Continue?

Let’s return to the long-standing bull argument that Amazon can essentially become profitable whenever it wants to, and that its narrow margins and minimal profits are a strategic choice.

As mentioned before, Amazon is a growth-at-all-costs type of company. CEO Andy Jassy laid out some perspective for analysts on the fourth quarter call regarding past growth at Amazon:

As I addressed directly the North American stores questions, I think our — probably the #1 priority that I spent time with the team on is reducing our cost to serve in our operations network… it’s important to remember that over the last few years, we’ve — we took a fulfillment center footprint that we’ve built over 25 years and doubled it in just a couple of years. And then we, at the same time, built out a transportation network for last mile roughly the size of UPS in a couple of years. And so when you do both of those things to meet the huge surge in demand, you’re going to — just to get those functional, it took everything we had. And so there’s a lot to figure out how to optimize and how to make more efficient and more productive.

There’s a lot to unpack here. Off the top, it’s good to hear Jassy addressing cost as the elephant in the room. His comment at the end, however, is what raises our antennae. The admission that “there’s a lot to figure out how to optimize” tells us that the fulfillment network Amazon has built out over the years may have gotten a little ahead of its skis, so to speak, in terms of cost and manageability.

It also seems to us to be fairly clear admission that a lot of work will be required, and that Amazon will not simply be able to switch to ‘profit mode’ overnight.

The Bottom Line

Amazon needs to impress investors for its stock to have a successful 2023. Here are the things that we want to see going forward from the company. Given that AWS headwinds seem here to stay for at least a few quarters, it is time in our opinion for the other businesses to shine.

- A smart reduction in cost and expansion in margin for the North America e-commerce business (and a free cash flow, to boot).

- Some kind of rationalization in the International segment, where losses seem to be the norm rather than the exception.

- A successful launch of RxPass and a subsequent boost to Prime membership as we expect household Prime sharing to reduce as this feature rolls out (we covered RxPass here).

Full disclosure: we are long Amazon, but we have concerns about the company’s ability to execute in arguably the most challenging environment its faced since the dot-com crash.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.