Disney: 3 Years Ahead Of Schedule

Summary:

- Disney shares jumped after reporting results as investors basked in the restoration of the dividend.

- The company did beat estimates as well and profitability reached a new milestone.

- There is a lot wrong here still and there were good reasons for the price reversal.

- $80 is a likely longer-term outcome.

Mickey & Minnie Bid Farewell To Streaming Growth.

Tomohiro Ohsumi/Getty Images Entertainment

When we last covered The Walt Disney Company (NYSE:DIS) we felt the price point did not make for very strong bets either way. While the street cheered the return of the old guard, we were less sanguine on the prospects of a turnaround. Specifically we said,

As amazing as Iger’s performance was, this comeback story has more room for disappointment than for a heroic ending. Expect some restructuring charges and a lot of internal shuffles. Expect analyst downgrades as the operating margin expansion does not materialize. We would expect Disney to remain rangebound between $70 and $120. At the low end of the range, is where we would consider initiating a buy.

Source: Why The Return Of The Jedi Won’t Work

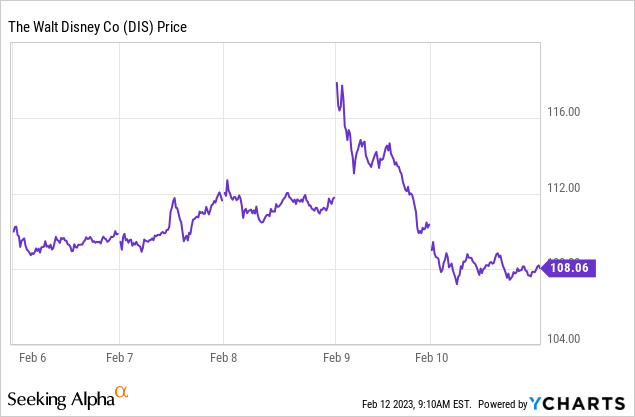

Results for the quarter ended December 31, 2022, which is the first quarter of fiscal year ending in September 2023, were released recently. The market initially cheered the numbers and the stock flew high in the after hours. Ultimately that big gap open was given back and the stock has moved about 4% lower.

We looked at the results to see if the company had indeed disappointed its investors.

Q1-2023

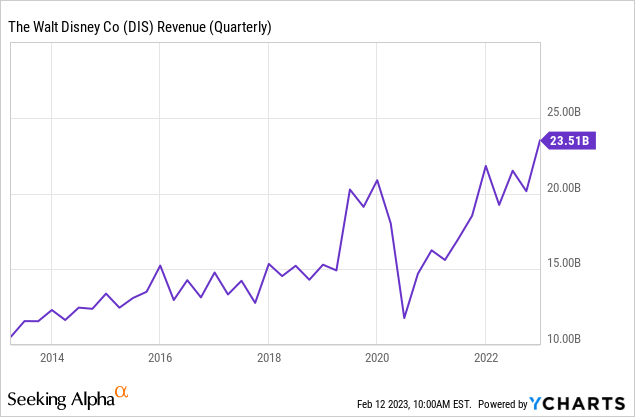

The headlines reported a strong beat on revenues and on earnings with non-GAAP EPS at 99 cents a shares. Disney’s reopening thesis has played out to perfection. $23.5 billion revenue run rate is extremely impressive and surpasses pre-COVID-19 levels by more than $3.0 billion.

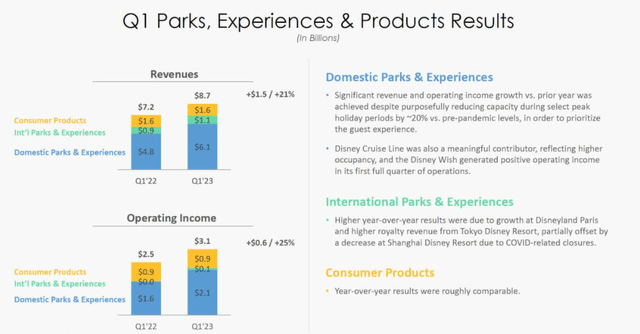

Parks hit it out of the park, again. This segment has been churning out more and more cash and it did surprise us that Disney managed to keep operating margins so strong during a period of high inflation.

Disney Q1-2023 Presentation

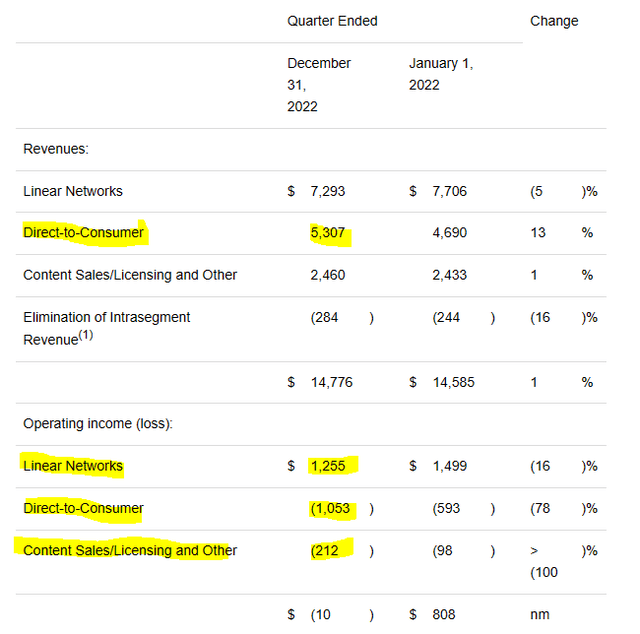

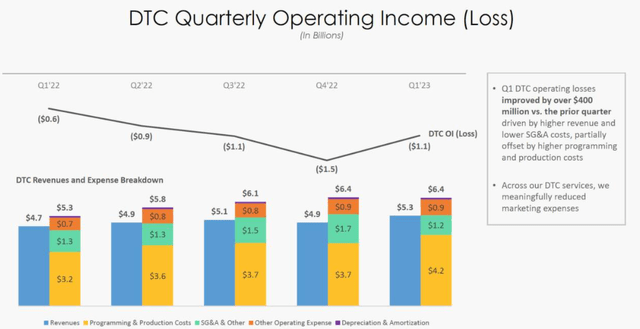

While that looks impressive, investors should keep in mind that the mix has really changed since COVID-19. The direct to consumer segment now accounts for over $5.3 billion in quarterly revenues and also contributes a stunning operating loss of over a $1.05 billion.

Disney Q1-2023 Press Release

That loss expanded by 78% year over year even as revenues moved up 13%. This is a lead anchor here as we are seeing consistent losses. While those were year over year numbers, direct to consumer segment did manage to post a modicum of positive news when seen from quarterly trend point of view. Losses appear to have peaked in Q4-2022 (quarter ending September 2022).

Disney Q1-2023 Presentation

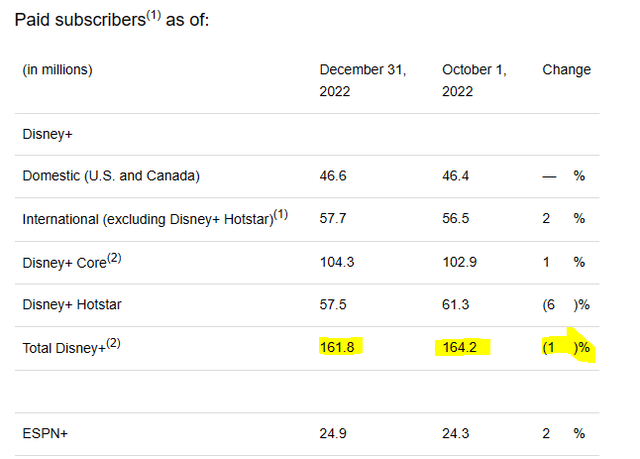

The really big question for every Disney investor is how to view this in a long-term context. We bring this up as total Disney+ subscribers dropped quarter over quarter.

Disney Q1-2023 Press Release

In case you have a brain fog here, this segment was supposed to grow at an extremely brisk rate for 2022-2025. In fact, some earlier estimates were calling for as high as 260 million subscribers just by end of 2024.

Chapek said Disney’s content strategy is about “balance” and meeting consumer demand. Of the around 100 projects that Disney shared to the public Thursday, about 80% are going directly to Disney+.

Because of these content additions, the company said it now expects to see between 230 million to 260 million subscribers to Disney+ by 2024.

Source: CNBC

While that was one of the more optimistic projections, it was pretty much written in stone that we would see at least 250 million subscribers by end of 2025.

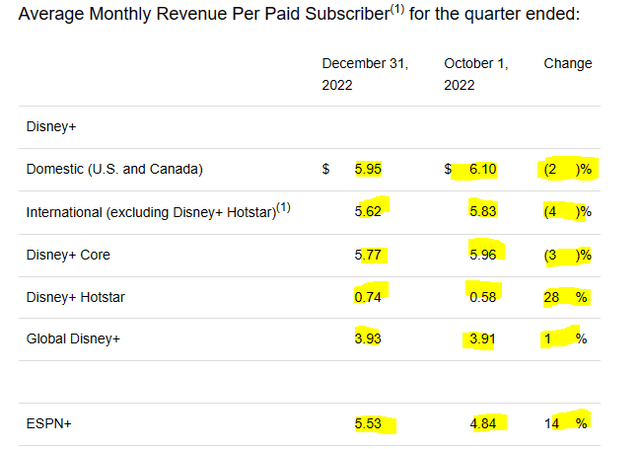

So with current growth rates stalled and possibly peaking at 160 million subscribers, 3 years ahead of schedule, things are looking grim for that side of the business. Worse yet, Disney+ lost pricing as it tried to increase revenues per subscriber.

Disney Q1-2023 Press Release

Sure you got some bounce of those were low rates in the developing countries (Disney+ Hotstar), but the prime bread and butter just fell as subscribers decided they did not need a seventh streaming service. This puts Disney in a very difficult situation. To ensure longer term profits it needs pricing 30-40% higher. Alternatively it needs 30-40% more subscribers while costs stay constant. Neither look particularly promising with the economy likely to hit a recession within 12 months at the most.

Enter The Cost Savings

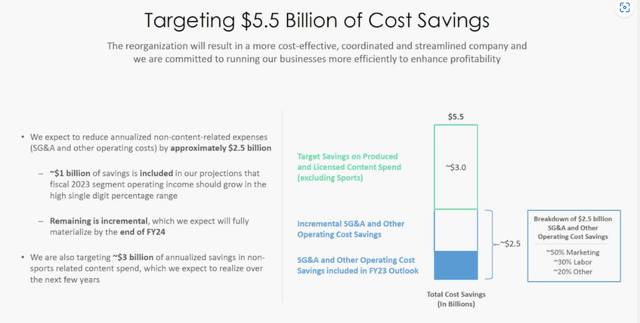

Disney gave another way out for the predicament. $5.5 billion of proposed cost savings.

Disney Q1-2023 Presentation

This is going to be a tough ask, especially if you want to do it without compromising growth. Even on a revenue static basis, this would be very challenging with labor having such high bargaining power today. If Disney could manage to do this, it would be a rather extreme positive outcome. Even on an after-tax savings basis, you would look to add about $4.0 billion of income to the company. That would be worth about $50-$70 billion in market capitalization, depending on what you believe is a fair multiple.

Outlook & Verdict

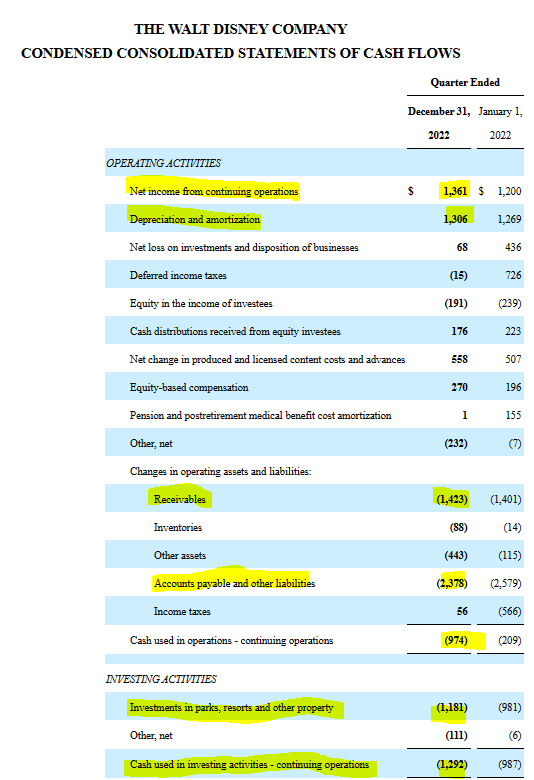

The quarter was solid and not much surprised us. We have been the first bears on the Disney+ story, way before it was cool, and that growth ending in 2023 was just a bit ahead of our own timeline. But Disney is delivering far better overall and the parks sector is thriving. Some investors were concerned about the free cash flow which came in at negative $2.27 billion.

Disney Q1-2023 10-Q

We thought it looked fine as working capital changes subtracted $4.3 billion from operating cash flow. That will likely reverse at some point and the overall numbers seemed fine. In general, as long as investments and capex are running around depreciation and amortization, net income should equate to free cash flow over the long run.

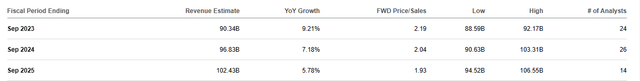

Disney’s future is where the valuation will have to deliver. Analysts are expecting modest revenue growth here for the next 3 years.

Seeking Alpha

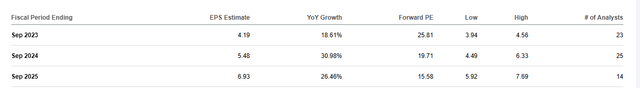

That seems a bit optimistic with Disney+ peaking and a high possibility of a recession. Nonetheless the numbers are achievable. What is highly unlikely though, is Disney hitting all those earnings growth numbers. You can see that earnings are supposed to keep growing far faster than revenues.

Seeking Alpha

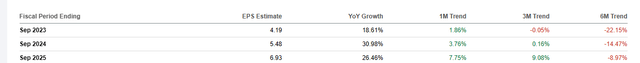

We just don’t see where operating margin expansion will come from. Some might argue that this may be driven by the cost savings outlined. Sure, that can be incrementally positive, but as seen below, that accounts for only a small bump in the EPS estimates recently.

Seeking Alpha

Color us pessimistic on Disney achieving anywhere in the ballpark of these numbers over the next 3 years.

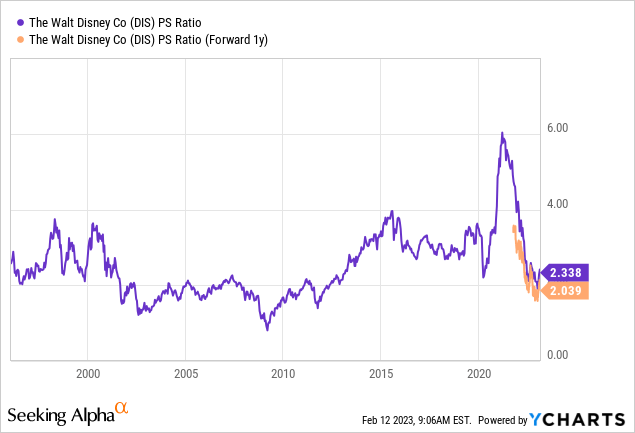

What Disney has going for it is that valuation has compressed to 2X sales.

This is a number that we have been looking forward to for some time.

The median sales multiple for Disney is actually close to 2.0X and that includes years when it was leaner and faster-growing company.

Source: Princess Still In A Valuation Castle

When investors get disenchanted with growth rates, Disney is likely to trade close to 1.5X revenues. Even using an optimistic $110 billion revenue outlook, the losses can be substantial.

Source: Best Short Hedge On The Market

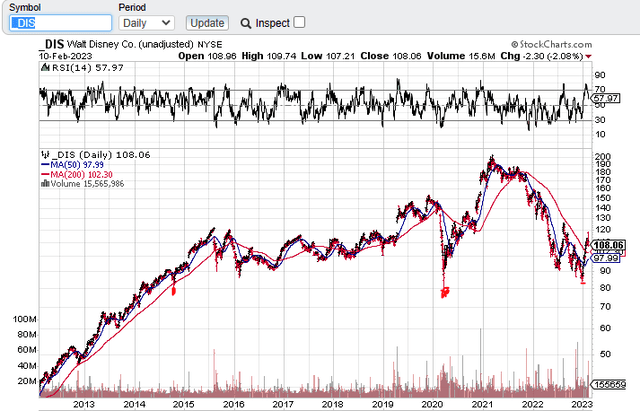

But Disney’s 2X sales multiple pre-COVID-19 was a far more profitable company with no sinkholes like Disney+. So we think we go lower based on that. Technically speaking the $80 mark has been an important bastion of support and marked the COVID-19 lows as well as the 2014 lows.

Stock Charts

In the recent drop we came close but did not quite breach through. At a minimum we think that $80 number will be tested and likely we will go through that. We see no issues with the stock trading at even 12-14 times earnings, especially with risk free interest rates so high and the magic of Disney+ now in the rearview mirror. Look lower and look to buy under $80.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.