Summary:

- Investors who followed my last calls on NVDA could top their return at 48% profit over the past month.

- The stock has reached the previously set target, it’s time to reconsider the risk profile and update the contingency plan.

- In this technical article, I discuss important price levels and metrics that investors could consider to gain an edge over the stock’s likely price action.

- By considering multiple outcomes and setting up an adequate contingency plan, investors are less inclined to act driven by emotions, as this could come at a higher cost.

- NVIDIA’s stock has formed wave 3 and is expected to start wave 4, increasing the risk of a retracement, leading me to downgrade NVDA to a hold position.

MicroStockHub/iStock via Getty Images

NVIDIA (NASDAQ:NVDA) has achieved stellar performance over the past month, leading the stock to break out from its downtrend and reach the target I suggested on January 12, 2022, while upgrading NVDA to a buy position. As the stock and the industry benchmark are hinting at a higher likelihood of an upcoming weakness, it’s time for an update of my contingency plan, based on the most likely scenarios I see forming in the coming weeks. In this article, I explain an actionable trading opportunity in the short term; I discuss multiple outcomes, while I always examine the downside risk, by considering appropriate stop-loss levels and actively managing the risk exposure.

A quick look at the big picture

Let’s quickly discuss the relevant overall view as the US technology sector has led the rally set during January and continues to perform relatively stronger compared to the other sectors in the economy. Semiconductor manufacturers could achieve a much better performance in the past month than recorded the month before, building positive momentum, along with companies in the consumer electronics, computer hardware, and software application industries. Most of those have been the biggest losers in the past 12 months, likely showing the greatest necessity for a retracement to offset the negative extension.

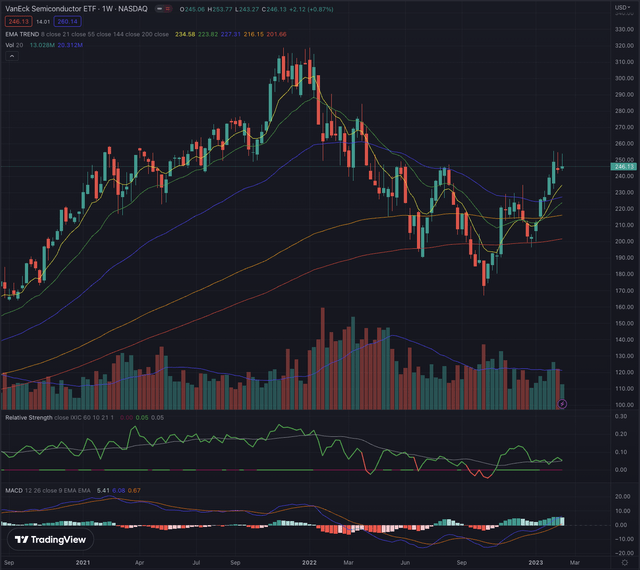

The VanEck Semiconductor ETF (SMH) could continue in its strong rally, by overcoming its EMA55, “the magic line”, leading to a monumental breakout from its downtrend. The industry reference has mitigated its strongest resistance and confirmed its reversal, while after weeks of rallying, the benchmark could be set for some consolidation, as it still faces some minor overhead resistance and lately recorded a slowdown in its relative strength expansion when compared to the broader technology market, the Nasdaq Composite (IXIC), or more narrowly the Nasdaq-100 tracked by the Invesco QQQ ETF (QQQ), while also its momentum indicator, the MACD, is hinting to a peak.

Where are we now?

In my last article “Nvidia: A Setup That Cannot Be Ignored”, published on January 12, 2023, I underscored my view of seeing NVDA performing significantly well over the next weeks, leading me to change my opinion on the stock from the prior negative rating.

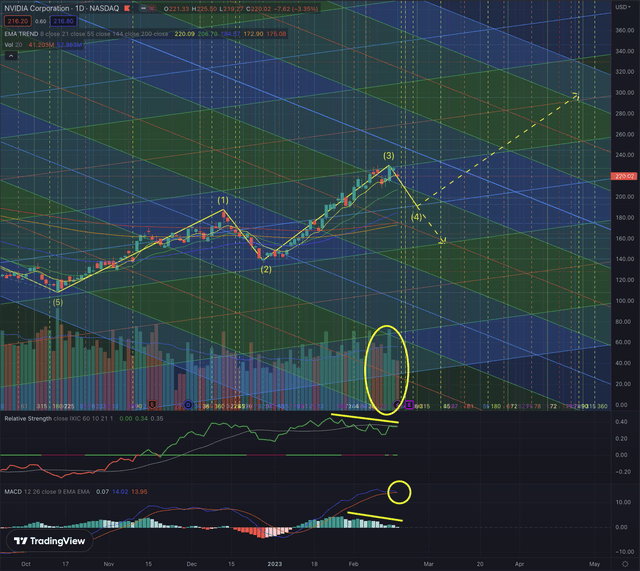

I consider NVDA’s daily chart, where both the relative strength compared to the broader technology market, the Nasdaq Composite (IXIC), and the MACD are signaling the likelihood of more upside potential.

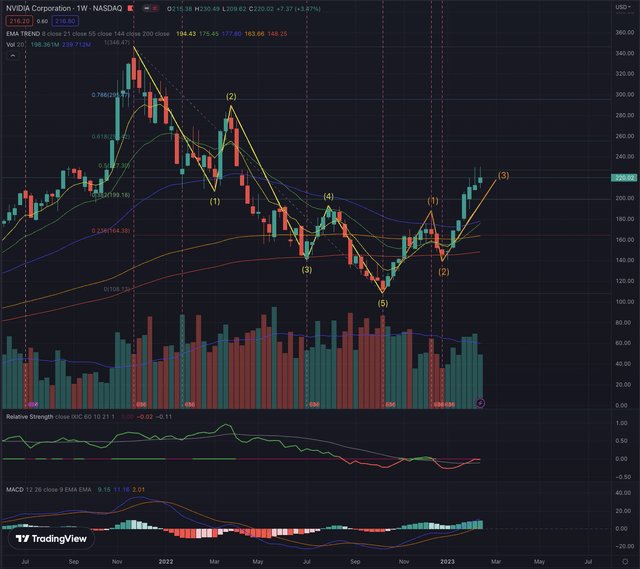

The stock was still hovering under the EMA55 on its weekly and was facing the EMA144 and further the EMA200 on NVDA’s daily chart. However, the buildup in momentum was already remarkable, and I discussed several outcomes I saw as most likely, while I suggested my preference of seeing the stock extending in its wave 3 formation.

The actual uptrend would form wave 3 of the sequence. Here, the most likely targets are seen at $188, $218, or $268.

Investors who followed my call on NVDA and jumped on the train could see their profits peaking at 48% over just one month, while in the past few market sessions, the stock began hinting at a slowdown, which led me to consider my target reached while I also want to update my contingency plan.

NVDA looks quite extended in the short term based on its EMA8, the stock’s MACD seems stretched, and the momentum in buy-side volume is flattening. While I made those observations on NVDA’s weekly chart, it’s important to zoom in and confirm my assumptions on the daily chart, as I will also rely on this time frame to define the next steps in my investment strategy.

What is coming next?

On NVDA’s daily chart, the MACD is confirming the likelihood of exhaustion of the strong positive momentum. The relative strength compared to the broader technology market, the Nasdaq Composite (IXIC) is hovering below its average, but still not signaling a meaningful slowdown, while the momentum in buy-side volume seems to drop, as we observe more distribution days.

While it is certainly possible to see the stock advancing further and retracing above the 50% Fibonacci retracement level measured from the October bottom, I consider a higher likelihood of seeing NVDA reversing, in the attempt of forming wave 4 of what I see as its Elliott upward impulse sequence. Here, the retracement should not extend under the price level of wave 1, which is hinting at a bottom most likely between $188 and $196.

The successful formation of wave 4 would lead NVDA to turn into wave 5, which despite it being early to make any reliable projection, could extend most probably between $275 and $300. This scenario is certainly encouraging and some investors may choose to hold on to their position to not miss the chance to see the stock surging, but what if wave 4 fails and the likely upcoming retracement extends into the territory of wave 1? In this case, the whole formation has to be considered as failed and the chances are high that the stock would either begin a new downward movement, or the movement after wave 5 would follow the failed wave 4 in its negative extension.

Based on my observations, and acknowledging that the stock reached my target, I consider it more rational to be on the sidelines and monitor the upcoming price action. The company is also approaching its upcoming Q4 and FY2023 financial results event, expected on February 22, which could add some volatility. I would certainly not add any new position at this point, as the risk/reward profile is not favorable.

Investors who prefer to keep their position could consider setting a trailing stop-loss under the EMA21, with in mind that if the stock falls below $188, the chances are high to see even more downside. Here I would particularly observe how the stock will close this week and if the momentum may pick up again or continue to weaken.

After the strong recent rally, and by considering the likelihood of the discussed scenarios, I adjust my rating on NVDA downgrading the stock to a hold position. The stock broke out of its downtrend, and long-term-oriented investors may consider it if the assumption of a successful wave 4 formation is confirmed.

The bottom line

Technical analysis is not an absolute instrument, but a way to increase investors’ success probabilities and a tool allowing them to be oriented in whatever security is listed on the markets. One would not drive towards an unknown destination without consulting a map or using a GPS. I believe the same should be true when making investment decisions. I consider techniques based on the Elliott Wave Theory, as well as likely outcomes based on Fibonacci’s principles, by confirming the likelihood of an outcome contingent on time-based probabilities. The purpose of my technical analysis is to confirm or reject an entry point in the stock, by observing its sector and industry, and most of all its price action. I then analyze the situation of that stock and calculate likely outcomes based on the mentioned theories.

The semiconductor industry has recorded a strong month leading the industry benchmark to break out from its downtrend, while the most recent development may hint at the temporary exhaustion of this trend. NVDA has formed wave 3 of its Elliott impulse sequence and I expect the stock to backtrack into wave 4. The achieved upward movement led NVDA to reach my target and based on the observed situation, I now decide to take my profits from the table and wait on the sidelines. I would certainly not add any new position, while investors who want to keep their exposure to NVDA, may consider the discussed stop-loss prices as it would be a pity to give back the achieved performance. The recent developments led me to reevaluate my contingency plan and NVDA’s rating, which I now consider to be a hold position.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: All of my articles are a matter of opinion and must be treated as such. All opinions and estimates reflect my best judgment on selected aspects of a potential investment in securities of the mentioned companies, as of the date of publication. Any opinions or estimates are subject to change without notice. I am not acting in an investment adviser capacity, and this article is not financial advice. I invite every investor to do their research and due diligence before making any investment decisions. I take no responsibility for your investment decisions but wish you great success.