Summary:

- It often takes several years for the prices of overvalued or undervalued stocks to reflect today’s earnings-based valuations.

- But usually, once we get out into the 3-5 year time frame, the correlation between earnings trends and stock prices get stronger.

- In this article, I use a simple earnings valuation technique to estimate approximately where Medtronic’s stock price will be 4 years from now if those trends hold.

- I will compare those estimated returns to the S&P 500 index and cash’s expected returns to determine whether to rate Medtronic a buy, sell, or hold.

VallarieE/E+ via Getty Images

Introduction

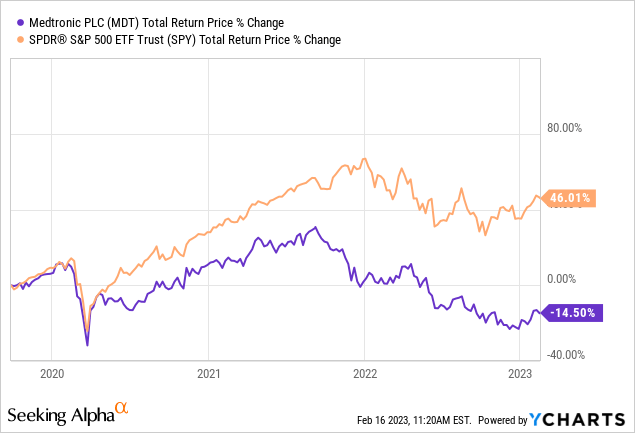

In the immortal words of Bob Dylan, “Times They Are A-Changin'”. After a nearly 40-year run of steadily falling interest rates, a “sea change” is occurring, and interest rates are now rising. Successful investors will need to adapt to this change. While we don’t know at what level interest rates will ultimately settle, the odds are, 10-year rates will be closer to 5% than 0% over the medium term. If this occurs, it will be a headwind for many businesses that are not used to operating in a ‘normal’ rate environment, and it will likely cause fundamental-based investors to change how they estimate stock valuations as well. For example, as part of my previous valuation coverage of Medtronic (NYSE:MDT) stock, I used a mean reversion assumption for the stock’s valuation based on a period that occurred during the last 15 years when interest rates were held far below the historical norm. This likely produced a higher average P/E ratio for the stock during this time period. So, if interest rates rise and stay higher for some time, it stands to reason, all other things being equal, the stock will trade at a lower average P/E going forward under those conditions. When I first wrote about Medtronic on September 26th, 2019, nearly 3 1/2 years ago, in my article “Medtronic: A 10-Year, Full-Cycle Analysis“, I rated the stock a “Sell”, even using the more generous mean reversion assumptions. It was still the only Medtronic article published in the past decade with a sell rating on Seeking Alpha. Here is how Medtronic stock has performed since then when compared to the S&P 500 index ETF (SPY):

The stock has produced negative returns and massively underperformed the S&P 500 index over this time period.

Often (especially lately for some reason) when I share results of a pretty basic valuation technique like the one I used back in 2019, I’ve received a variety of critiques from readers. Here are some of the most popular:

- Some note, usually after a short period of time (days, weeks, or months) the stock price has risen when I rated it a sell.

- Some note that, even if my expectations were correct, it is a sample of just one stock and therefore is luck.

- Some claim that it is impossible or nearly impossible to estimate the future returns of stocks, and it is futile to try.

- Some claim valuation analysis is “market timing” and will not work over time.

- Some claim that below-market-average returns are “good”.

- Some claim that below-market-average returns don’t matter, and only something like the dividend or dividend growth matters.

While I can’t completely address all of these concerns (like the role of luck), I have decided to start a new valuation experiment that attempts to make the most compelling case I can make, that over the medium-term of 3-5 years, stock valuations based on earnings trends are (1) possible to estimate and roughly correlate to future stock prices either on a relative or absolute basis (2) that valuation analysis is a skill that average investors can learn, and (3) that it can help produce above average returns in an unconcentrated portfolio.

How do I plan to conduct this experiment? I have decided to estimate the 4-year returns for as many as 100 stocks in the S&P 500, on an absolute and relative basis compared to the index itself and compared to cash equivalent returns over the same time period. This analysis, at its core, will be similar to my traditional analysis, except, because of likely interest rate changes, I will use a generic mean reversion expectation based on long-term history instead of a stock-specific one based on recent history. I will also express my 4-year return estimate as a simple total return percentage over that time period (instead of the 10-year CAGR estimate as I typically use). My hope is that the return estimates and time frame will be more clear for readers and the ultimate sample size will be large enough to help control for the role luck can play. I will explain more about this experiment at the end of the article, but for now, let’s get into the new Medtronic stock analysis.

Valuation

The first thing I check with almost every stock before I start the valuation process is the business’s historical earnings cyclicality. I generally require at least one recession as part of the data so I can see how earnings performed during that recession. Because 2020’s recession was so unusual, I place most of the weight on the 2008/9 recession when examining the historical earnings cyclicality. This can also help me assess the long-term earnings trend, which I require to generally be growing over time. (I don’t have any interest in shrinking businesses or turnaround stocks.)

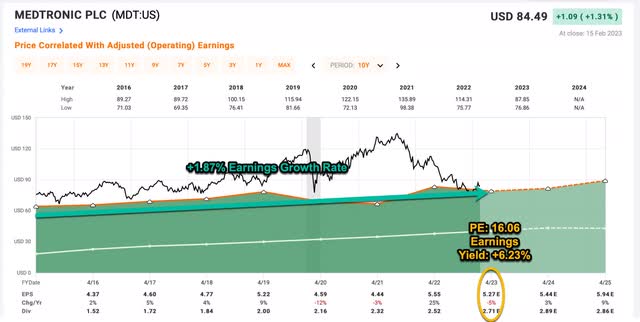

The green shaded area in the FAST Graph above represents Medtronic’s annual earnings per share. The main thing I’m checking for here is whether or not there are any EPS growth declines that are -50% or deeper. If there are, then an earnings-based analysis will likely not be very useful. As it turns out, for most of Medtronic’s history, earnings growth has been extremely stable and growing. The modest declines experienced in 2020 and 2021 can likely at least partially be attributable to the pandemic. And this year’s decline is expected to be modest as well. Putting this all together, Medtronic has the right profile to be a good fit for an earnings-based analysis.

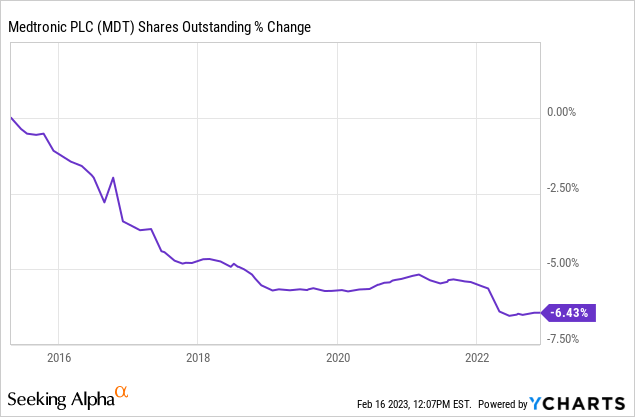

Next, I need to select the historical time frame I want to use in order to estimate the earnings growth rate. The time frame from 2016-2023 looks pretty representative of their most recent trend so that is the time frame I have chosen to use. Because I’m going to use EPS in order to estimate earnings, I also check for any share buybacks that occurred over this period, because those will inflate the EPS growth rate by lowering the share count. (A rising share count, however, will already be incorporated in the EPS figure so I won’t make adjustments if the share count has risen.)

Medtronic has reduced its share count by about 6% during this time period. I will make adjustments for those buybacks.

Above, I have another FAST Graph from the time period 2016 through 2023. I have annotated it with the data I will use for my 10-year collected earnings projections. Note that I am pulling forward 2023’s expected EPS rate of $5.27 per share, which, at the current price translates to a P/E ratio of about 16.06, an earnings yield of +6.23%. The earnings growth rate from 2016 through 2023, has been about +1.87% if we take into account the negative growth years and the buybacks. (This is a little lower than FAST Graph’s calculation of +3.33% EPS growth which does not account for those things.)

The way I think about this is if I bought Medtronic’s whole business for $100, it would earn $6.34 the first year, and that $6.34 would grow at a rate of +1.87% each year, for 10-years.

Below is a table that shows the expected cumulative collected earnings over 10 years.

| Year | Earnings for Year | Cumulative Earnings |

|

1 |

$6.34 | $6.34 |

| 2 | $6.46 | $12.80 |

| 3 | $6.58 | $19.39 |

| 4 | $6.70 | $26.09 |

| 5 | $6.83 | $32.92 |

| 6 | $6.96 | $39.88 |

| 7 | $7.09 | $46.97 |

| 8 | $7.22 | $54.19 |

| 9 | $7.36 | $61.55 |

| 10 | $7.49 | $69.04 |

| Total | $69.04 | $100 + $69.04 = $69.04 |

So, if you bought Medtronic at the current valuation for $100 and collected all the earnings for yourself you would have started with $100 and ended 10 years later with $169.04. This is a compound annual growth rate of about +5.39%.

Next, what I will do is take that long-term average earnings CAGR of +5.39% and figure out what that works out to after four years’ time, since our goal is to estimate the returns over that time period. When I do that, it works out to a basic total return of +23.37%. So, over the next four years, if we disregard market sentiment and assume it stays the same, treating MDT more like a private business, we could expect our total return in collected earnings after four years to be valued at about +23.37% if we assume the earnings trend will continue for 10-years total.

This return is the absolute return expectation if we assume that market sentiment for the stock is similar to what it is right now. But I think it’s also worth comparing this expected 4-year total return to alternative investments. The two alternatives I will compare it to are the S&P 500 index ETF (SPY), and the iShares Treasury Floating Rate Bond ETF (TFLO), which is what I’m currently using as my cash equivalent for investment money. The reason we compare to alternatives is to see if there are better simple alternatives that don’t require a lot of skill to analyze, which basically anyone could own instead of the individual stock.

Using a similar method that I used with MDT’s earnings, I also track about half of the S&P 500 stocks using this method, which represents about 2/3rds of the S&P 500 weighting. If I use that group of stocks to estimate their 4-year expected returns I get an absolute expected total return for the index of +27.48%. And, I generally expect TFLO, or short-term treasuries to yield about 4% per year over this time, or to produce a 17.00% total return in four years. Let’s see what sort of return MDT is likely to produce compared to these alternatives given these estimates.

| 4-Year No Mean Reversion | 4-year total return expectation |

4-year return expectation minus SPY’s +27.48% |

4-year return expectation minus TFLO +17.00% |

| MDT | +23.37% | -4.11% | +6.37% |

Overall, if sentiment remains the same for MDT and the wider market, MDT should be expected to return similar returns as the wider market (23.37% vs. +27.48%).

It’s always good to start with steady sentiment as a base for a valuation, but I’ve found that over the longer-term (and four years is starting to get into the “longer term”) stock earnings valuations tend to revert toward a mean of about a +7.00% 10-year earnings CAGR. (For a stock with the same earnings growth expectations as MDT of +1.87%, we would expect an average P/E ratio of about 11.46 to be the “normal” P/E the market would be likely to pay.)

In order for MDT’s expected +5.39% 10-year CAGR expectation to get up to a 7.00% 10-year CAGR and a P/E of 11.46, the stock price needs to come down because the price one pays for a stock has an inverse relationship to future returns. For this reason, my preferred way to estimate future total returns once we get out to four years is one that includes this generic 7.00% CAGR mean reversion expectation. So, next, I will examine what would happen to the stock price if the P/E reverted from its current 16.06 level, to a more reasonable 11.46 level over the course of four years.

| With a Generic 7% 10-year Mean Reversion Assumption | 4-year total return expectation | 4-year return expectation minus SPY’s +13.62% | 4-year return expectation minus TFLO’s +17.00% |

| MDT | -4.93% | -18.55% | -21.93% |

For comparison, if the S&P 500 index were to revert to a 7.00% CAGR expectation over four years it would produce a +13.62% total return based on my estimates. TFLO’s returns would be expected to remain about the same as before with a +17% return. If MDT’s business earnings produce an average return valuation by the market, it is likely to lose about -4.93% over the next four years on a total return basis. This is -18.55% (or -1,855 basis points) of difference between the S&P 500’s +13.62% expected 4-year return. That’s a pretty big difference, but not as big as the loss compared to TFLO with a -21.93% (or -2,193 basis point) spread. This implies that over the medium term on a relative basis, MDT is probably a little overvalued compared to the S&P 500 and a little more overvalued compared to likely returns from a cash equivalent.

Ratings & Explanations

Assuming my estimates are reasonably close, there are several ways to interpret these results. The things we don’t know, even if the earnings return estimates end up being fairly accurate, is what sort of mood the market will be in and how the wider economic conditions might influence the returns in four years. If we are in a deep recession at that particular time, then we would naturally expect the earnings to be lower, while if we are in some sort of economic boom, we would expect them to be higher. So, using relative returns is a way to somewhat control for macroeconomics. If we are in a recession, then it’s likely SPY will perform poorly as well, so the difference between those returns is what we care about if we want to control for macro conditions.

Using mean reversion, on the other hand, helps to account for how people feel about certain stocks at certain times and what sort of returns investors are willing to accept. If interest rates and inflation are low, then getting +5.39% per year from earnings might be acceptable to many investors. But if inflation and interest rates rise, then a +5.39% annual return may not be acceptable for most investors. My mean reversion expectation of a 7.00% 10-year CAGR from earnings is roughly the same as the market being willing to pay an 18 P/E ratio with earnings growing 10% per year for the average stock in the market.

Different investors might have different assumptions and expectations about sentiment and macro conditions will be, so that’s why I also provided the expectation without assuming mean reversion. That said, I do generally assume that after a period of four years, the chances are good that mean reversion will take place for most stocks, so, personally, I care about the mean reversion estimates the most. Additionally, I aim for a 4-year mean reversion expected return that is about 75% before I buy a stock based on earnings valuations. If I write about a stock (and earnings are not expected to drop because of a near-term recession) and it has a 75% 4-year return expectation, I will buy it, and those stocks will earn a “Strong Buy” rating from me.

Because I know I’m aiming for higher returns than many other market participants, I will rate stocks a “Buy” if the 4-year mean reversion total returns are 25% (2,500 basis points) higher than both SPY and TFLO, because these will likely be above market average returns and above cash average returns.

If the 4-year mean reversion returns are within 25% (+/- 2,500 basis points) of SPY, then I would consider that stock a “Hold”. I don’t consider any of my estimates superbly precise. They are meant to work as a rough guide, where we can take action if they reach extremes. So, within this range, I don’t have a strong opinion about the stock one way or the other.

If the 4-year mean reversion returns are likely to underperform SPY or TFLO i.e. cash, by -25% (-2,500 basis points) or more, then that stock would get a “Sell” rating from me.

And, finally, if a stock is likely to underperform both SPY and TFLO by more than -25% or (-2,500 basis points) over the course of 4 years then the stock would be a “Strong Sell”.

I use -25% as the threshold because it’s enough of a difference that a person could sell a stock, pay a full 20% long-term capital gains tax on the sale, and still come out ahead. If a person is dealing with a bigger tax bill than 20%, then they should do the math and figure out what that level is and use that as a guide for their selling threshold.

At today’s price, Medtronic is expected underperform cash (TFLO) by -21.93% (-2,193 basis points) over the next four years if mean reversion occurs. That makes it overvalued today relative to cash, but it does not cross my -25% threshold to become a “Sell”. So, even though it is close, I still rate Medtronic stock a “Hold” at today’s price.

Please read the next section if you would to like learn more about my valuation experiment and how I will measure the results of my predictions over the next four years. If you aren’t interested in that information, skip to the conclusion where I summarize my expectations and share the price at which MDT would become a “Buy” or a “Strong Buy” for me.

Measuring The Results of This Valuation Experiment

Writing about investing and the stock market can be useful to readers in several different ways. Articles can share strategies, discuss investing philosophy, analyze businesses and their prospects. Articles can also make predictions about future stock prices, conduct experiments, and share valuation techniques. With such a wide scope of possibilities there is a lot that could be covered within any given investing universe. Typically, my preferred approach is to focus on a given individual stock rather than the macro with my articles because I am committed to primarily sharing articles and ideas that are clearly actionable for readers. One reason I do this is so the outcomes can be measured. I tend to avoid telling stories in my articles, which can sometimes make them less compelling for readers unless I offer something more valuable than a story (like the prospect of above average returns). My goal is to offer actionable stock analysis that produces market-beating returns in the aggregate.

This creates a variety of difficulties, but I’ve noticed several of them which have been occurring with more frequency with my articles. Perhaps the most common, are investors who aren’t focused on achieving above average total returns. At the portfolio level I generally aim for 15% annual returns over the long-term. My estimate is right now the S&P 500 will likely deliver less than half that rate of return over the next 5-10 years. So, there is a big gap between my goals and where I estimate the current valuation of the market is at. One way to think about this is I aim for a 400% 10-year return while the market is likely to only produce a 100% 10-year return from today going forward. This means I either need to buy stocks when they are very cheap relative to current earnings, or I need to buy stocks that will grow faster than expected for longer (thereby being very cheap, too, just in a different way).

There is a large space between market average 10-year returns of 100% and my goal of 400% where investors could successfully buy stocks at higher prices than I am willing to pay and also outperform the market. Historically, I have only written “Buy” articles when I actually purchased a stock myself. That was a way for me to “eat my own cooking”, so to speak. But because I aim for very high returns, it meant my “buy prices” were much lower than other investors would be happy with, and when an investor aims for low prices, they get fewer opportunities to buy. I actively monitor hundreds of stocks in my marketplace service, The Cyclical Investor’s Club, so it’s rare that an easy opportunity to buy a high quality stock at a cheap price slips past me unnoticed. But there are investors who don’t have a stock monitoring system like I do, so they are going to be more likely to miss opportunities, and that means they need to be willing to pay higher prices in order to get enough opportunities for their portfolio unless they are super concentrated (which I don’t recommend for most investors).

So, with this article series, I have created a new category of stock “Buys”, that I expect to outperform the S&P 500 by 2,500 basis points at some point during the next four years. So if the S&P 500 returns 10% over a given time period, I expect the buy-rated stock will return 35% or better. Or, if compared to cash, if cash returns 15%, then I would expect the buy-rated stock will return 40%. “Buy” rated stocks should outperform SPY or Cash by 2,500 basis in order to be considered a successful rating. Importantly, that spread can happen at any time during the 4-year period. Because if that spread opens up, a person could then rotate back into the index or cash if they chose and be 25% better off than before. The investment would have met it’s medium-term goal based on the valuation.

In order for my “Strong Buys” to be considered successful we will want them to return 75% at some point over four years or to outperform the S&P 500 index and Cash over four years.

Having two categories of “Buys” will create some room in my analysis for stocks that are likely to outperform the market, but are not as likely to produce the really big returns I’m looking for myself.

My plan is to track the success or failure of my stock ratings and 4-year total return estimates each quarter. Over time, I expect I’ll have at least an 80% success rate for each category of rating using the standards I described above. This means that there will be some stocks that don’t do as I expect. But I won’t know which ones will fail ahead of time, which is why when it comes to my personal portfolio I use an equal-weighted unconcentrated approach when it comes to starting initial positions, and I usually weight each position 1%. If a person has a really concentrated portfolio of less than 30 stocks, they will need to do deeper work on each business before trying to implement a numbers-based strategy like mine. I make up for lack of deep work by working quickly and monitoring a very large number of potential positions, sometimes being overly conservative, and then playing the odds. Sometimes this means I’ll miss a big winner because I’m too cautious and don’t understand something that makes that businesses special, and sometimes I buy a big loser because I don’t understand a danger that doesn’t show up in my preferred metrics. That’s okay. I usually have four out of five positions produce positive returns over four years, and many of my winners are big winners. This is how I make up for my lack of deep, time-consuming work on an individual business. So, I will be tracking to see what percentage of stocks meet my expectations and what percentage do not over time.

The ultimate goal is to provide useful data to readers whether I achieve my goals or not.

Conclusion

Medtronic is expected to announce earnings next week. It is possible that earnings could cause the stock price to move a lot in either direction. This has been a weird earnings season in terms of the immediate market reaction to expectations so far, with the market generally being pretty forgiving when it comes to disappointments. If earnings are mostly in line with expectations, and the stock bounces a lot higher, it could push the stock into “Sell” territory again. If the earnings estimates remain the same, above about $88 per share Medtronic stock would become a “Sell” again. The price would need to fall below $62 to become a “Buy”. And, assuming all the same earnings metrics, in order for the stock to become a “Strong Buy”, and for me to buy it, it would need to fall below $45 per share.

Disclosure: I/we have a beneficial long position in the shares of TFLO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you have found my strategies interesting, useful, or profitable, consider supporting my continued research by joining the Cyclical Investor’s Club. It’s only $30/month, and it’s where I share my latest research and exclusive small-and-midcap ideas. Two-week trials are free.