Summary:

- Diversified global entertainment group The Walt Disney Company is one of our more recent additions to the portfolio.

- When we built our stake, Disney was trading at more than a 35% discount to fair value.

- Using conservative profitability assumptions, we expect the stock to re-rate back to a 4-5% free cashflow yield in FY26.

FrozenShutter

The following segment was excerpted from this fund letter.

Walt Disney Co. (NYSE:DIS)

The Walt Disney Company is a diversified media conglomerate operating media networks, theme parks, film and TV studios and direct-to-consumer streaming services. It is the global leader in theme parks with hotels and cruise lines aimed at families. Key assets within Disney are the instantly recognisable entertainment franchises that have multiple avenues of monetisation such as Mickey Mouse, Star Wars, ABC and Marvel’s Avengers.

Disney’s share price declined due to a number of factors in 2022, presenting us the chance to purchase a long-admired business and its unique collection of valuable intellectual property assets at what we consider to be a very attractive valuation. Summarily, the EPS of Disney has declined from US$7 in 2018 to ~US$2.60 in 2022 but we believe that the earnings power of the assets has not diminished to anywhere near this extent.

Disney is currently undergoing a business transition within the Media and Entertainment Distribution division (DMED) from traditional media property distribution via third parties (i.e. cinemas and broadcast networks) to a Direct-To-Consumer (DTC) model via the Disney+ streaming service. A key element of our thesis is that the earnings power of the company is currently being masked by the marketing and content investments within Disney+ and that this will normalise over the next several years.

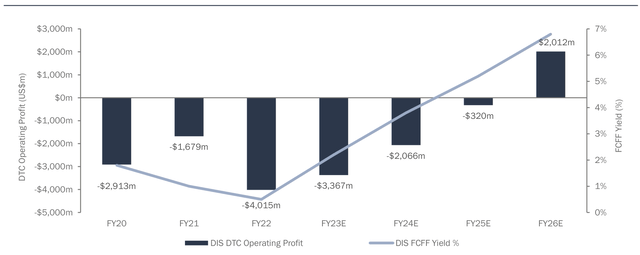

To put this in perspective, Disney+ (DTC sub-segment) currently generates operating losses of over US$3.3bn (a negative 14% operating margin) compared to operating margins at its nearest streaming competitor, Netflix, of +15.5%.

A secondary concern around Disney has been the CEO leadership transition from Bob Iger to Bob Chapek that occurred in February 2020. As well documented in the media, the changes that Bob Chapek made to the organisational structure of the business affecting the creative output at Disney did not resonate with senior executives nor investors and he was ultimately removed by the board.

Hollywood loves a sequel – Bob Iger was sensationally reinstated to the CEO role in November of 2022. During his original tenure as CEO, Mr Iger was a well-respected leader, overseeing successful acquisitions of Pixar, Marvel Entertainment and Lucasfilm. We view the board actions as supportive of long-term shareholder value creation as Mr Iger seeks to unify the executive team and navigate the company through the current challenges.

The resilient cashflows of the Disney components have allowed it to invest heavily in the DTC content space and give the management team the necessary flexibility to prove out the earnings power of the business. In this context, it would be remiss of us to not discuss the Parks, Experiences and Products division (PEP) of Disney, which makes up 35% of revenue and 49% of operating profits (ex DTC losses) but has been overlooked recently given the intense focus on the media business.

PEP is a solid business, with the opportunity to invest alongside the core franchises in a ‘flywheel’ of value creation (i.e. Star Wars and Avengers attractions at Parks). After suffering as a result of COVID, the business has bounced back remarkably well, with operating profit now 8% above the FY19 level. Further upside will come from the full re-opening of International Parks – prior to COVID these represented 10% of operating profit of the division. Contrary to conventional wisdom, Return on Invested Capital (ROIC) in this business is estimated at 18% and there is further opportunity to invest material amounts of capital at high rates of return.

When we built our stake, Disney was trading at more than a 35% discount to fair value, and we could underwrite the valuation if the streaming business simply broke even. On our FY26 estimates, Disney is trading on a 7% FCFF (free cashflow) yield, despite profitability still being depressed and continuing to reinvest aggressively as highlighted. Using conservative profitability assumptions, we expect the stock to re-rate back to a 4-5% free cashflow yield in FY26.

Walt Disney (DIS) DTC Operating Profit and FCFF Yield

Source: Company filings, VGI Partners analysis.

DisclaimerThis newsletter is provided by Regal Partners Marketing Services Pty Ltd (ACN 637 448 072) (Regal Partners Marketing), a corporate authorised representative of Attunga Capital Pty Ltd (ABN 96 117 683 093) (AFSL 297385) (Attunga). Regal Partners Marketing and Attunga are businesses of Regal Partners Limited (ABN 33 129 188 450) (together, referred to as Regal Partners). The Regal Partners Marketing Financial Services Guide can be found on the Regal Partners Limited website or is available on request. VGI Partners, is a business of Regal Partners Limited, which is the investment manager of VGI Partners Global Investments Limited (VG1). The information in this document (Information) has been prepared for general information purposes only and without taking into account any recipient’s investment objectives, financial situation or particular circumstances (including financial and taxation position). The Information does not (and does not intend to) contain a recommendation or statement of opinion intended to be investment advice or to influence a decision to deal with any financial product nor does it constitute an offer, solicitation or commitment by VG1 or Regal Partners. It is the sole responsibility of the recipient to consider the risks connected with any investment strategy contained in the Information. None of VG1, Regal Partners, their related bodies corporate nor any of their respective directors, employees, officers or agents accept any liability for any loss or damage arising directly or indirectly from the use of all or any part of the Information. Neither VG1 nor Regal Partners represents or warrants that the Information in this document is accurate, complete or up to date and accepts no liability if it is not. Past performance The historical financial information and performance figures given in this document are given for illustrative purposes only and should not be relied upon as (and are not) an indication of VG1 or Regal Partners’ views on the future performance of VG1 or other Funds or strategies managed by Regal Partners or its related bodies corporate. You should note that past performance of VG1 or Funds or strategies managed by Regal Partners or its related bodies corporate cannot be relied upon as an indicator of (and provide no guidance as to) future performance. Forward-looking statements This document contains certain “forward-looking statements” that are based on management’s beliefs, assumptions and expectations and on information currently available to management. Forward-looking statements can generally be identified by the use of forward-looking words such as, “expect”, “anticipate”, “likely”, “intend”, “should”, “could”, “may”, “predict”, “plan”, “propose”, “will”, “believe”, “forecast”, “estimate”, “target” “outlook”, “guidance” and other similar expressions. Indications of, and guidance or outlook on, future earnings or financial performance are also forward-looking statements. You are cautioned not to place undue reliance on forward-looking statements. Any such statements, opinions and estimates in this document speak only as of the date of this document and are based on assumptions and contingencies and are subject to change without notice, as are statements about market and industry trends, projections, guidance and estimates. Forward-looking statements are provided as a general guide only. The forward-looking statements contained in this document are not indications, guarantees or predictions of future performance and involve known and unknown risks and uncertainties and other factors, many of which are beyond the control of VG1 or Regal Partners, and may involve significant elements of subjective judgement and assumptions as to future events which may or may not be correct. There can be no assurance that actual outcomes will not differ materially from these forward-looking statements. No representation, warranty or assurance (express or implied) is given or made in relation to any forward-looking statement by any person (including VG1, Regal Partners, their related bodies corporate or any of their respective directors, officers, employees, agents or advisers). In particular, no representation, warranty or assurance (express or implied) is given that the occurrence of the events expressed or implied in any forward-looking statements in this document will actually occur. Except as required by law or regulation, VG1 and Regal Partners disclaim any obligation or undertaking to update forward-looking statements in this document to reflect any changes in expectations in relation to any forward-looking statement or change in events, circumstances or conditions on which any statement is based. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Additional disclosure: Copyright © VGI Partners