Summary:

- Visa is an incredible business.

- V stock’s metrics are enviable at the scale the company operates.

- Despite that, the company is fairly valued today, with a significant margin in its cash flows for continuous compounding. It’s a strong buy and a cornerstone in my kids’ portfolios.

Nature

Visa (NYSE:V) is one of the most-followed companies in the market. Writing about a company like Visa, or Apple (NYSE:AAPL) or Alphabet (NYSE:GOOG), I’m not going to show you some earth-shattering revelation or deliver hot takes that the entire rest of the market has missed. However, sometimes it doesn’t take a contrarian view or finding some undiscovered gem to beat the market.

Visa has crushed the market over time. The company has compounded away with likely one of the best business models you can find today. When you look at the company’s market position and metrics, sometimes it’s best just not to overthink it.

Although it’s pretty well a foregone conclusion in most developed markets, card penetration in emerging markets is still early in its growth story. Visa’s main growth trajectory from here will rest with emerging markets and cross-border transactions, although the company also has irons in the fire with various fintech initiatives.

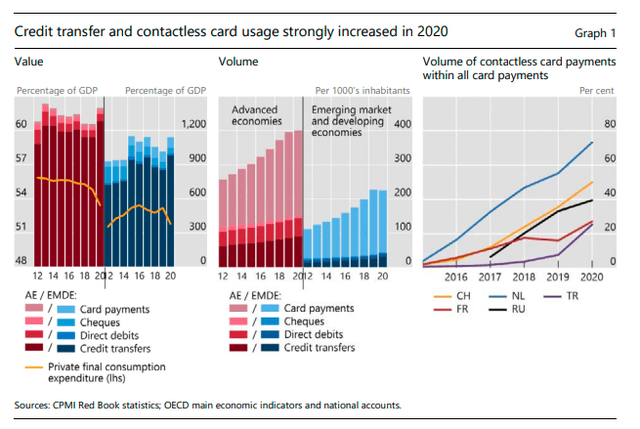

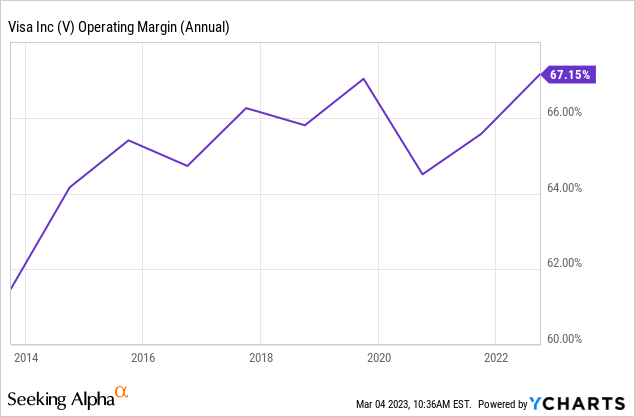

Digital payments only recently surpassed cash payments globally, and looking above, the shift continues worldwide. This presents long-term growth prospects for Visa, which ties directly into growth in the overall world economy. As the toll-booth for a huge portion of transactions worldwide (around half), Visa is tied directly into economic growth. Macroeconomic pressures will impact Visa’s results, but the company is asset-light and maintains impressive operating margins, so shorter-term impacts to operating results are not going to lead to any existential threats to the business.

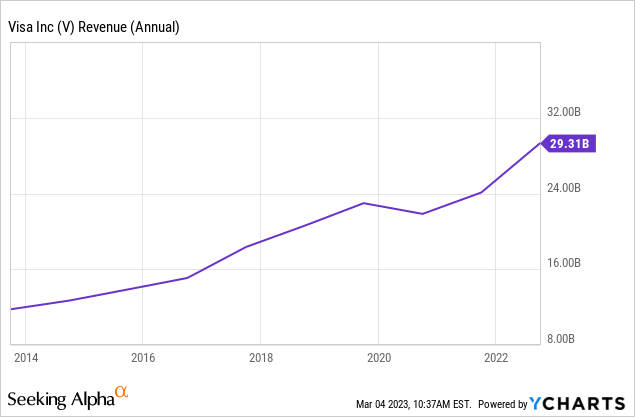

Visa’s revenues have been up and to the right over the past decade, with a dip from the pandemic. That’s to be expected, considering economies shut down globally along with travel. Visa Europe was acquired in 2016 for $20B in what appears to be a smart move, and other tuck-in acquisitions along the way have helped keep the company’s technology at the forefront. Visa is one of those companies that makes me think of the Buffett quote:

“I try to invest in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.”

That’s likely true in this case. However, if Visa hadn’t continued to maintain the pace in things like tap-to-pay, mobile transactions, and other fintech initiatives, it’s likely the business would have suffered. With that, the company’s CEO has recently turned over. I don’t have any concerns specific to the new CEO, who has been with the company since 2013, but changes at the top always introduce some risk.

The company’s network was founded by Bank of America (NYSE:BAC) in 1958 and was rebranded Visa in 1976. In 2007, regional businesses were combined to form Visa, Inc., which went public in 2008 and now accounts for around half of global transactions.

A key risk to highlight in Visa’s investment worthiness is likely a good problem to have. The company’s position as a leader in global transactions can lead to regulatory pressure as well as governments in some countries attempting to push the company out. China’s Union Pay actually accounts for more transaction volume than Visa or Mastercard (NYSE:MA) but remains a domestic card program with minimal international volumes. If additional countries introduced something similar, notably somewhere like India, with a huge population and growing economy, it could result in a nasty impact to the company’s long-term growth prospects. It wouldn’t kill the business, by any means, but an investment in Visa today is forward looking to growth in payment volumes in emerging markets.

One of the keys to why Visa is so successful lies in the operating margin above. The company is asset-light, although it does maintain significant processing power to facilitate the $10T in transactions from 3.4B cards in 2021. As the company grows and improves its scale, it generally increases the company’s operating margin. That pushes Visa into a tier with the best SaaS companies in that overall operating expenses aren’t directly tied to the company’s growth. You can see above, a 67% operating margin is incredible at the scale Visa operates on.

In the most recent quarter, the company discussed effectively the end of the domestic recovery from the pandemic. Revenues were up 12%, with EPS up 21%. Looking forward, Visa projects tailwinds from the reopening of China and improvements in cross-border transactions as the world normalizes. However, the company ceased operations in Russia and that combined with China remains headwinds for overall revenue growth.

Transaction volumes worldwide grew strongly, with Latin America up 25% yoy, CEMEA without Russia up 25% yoy, Europe up 10% yoy, and Asia Pacific up 16% yoy. Adding on to that, Visa Direct, the company’s network for sending payments to a specific card, had 1.9B transactions, up 39% yoy.

Visa continued to strike deals as well, for example co-branding with Flipkart in India and its 450M users and bKash in Bangladesh. There are many more examples on the call, and it’s good to see overall the company is continuing to maintain its position globally in new card issuance.

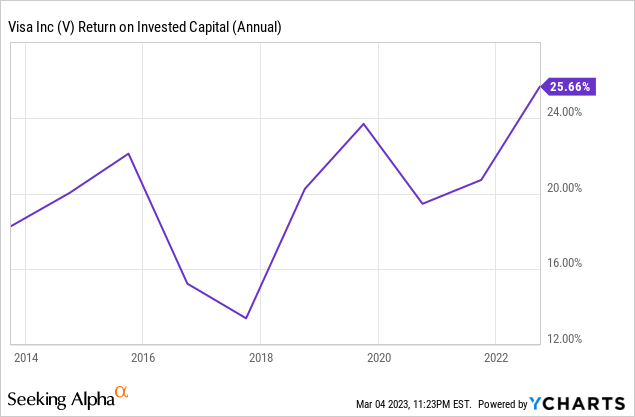

Returns on invested capital have been strong, and show shareholder value creation over time. It dipped following the Visa Europe transaction, but the overall trend appears right in line with what I’d expect from a compounder like Visa.

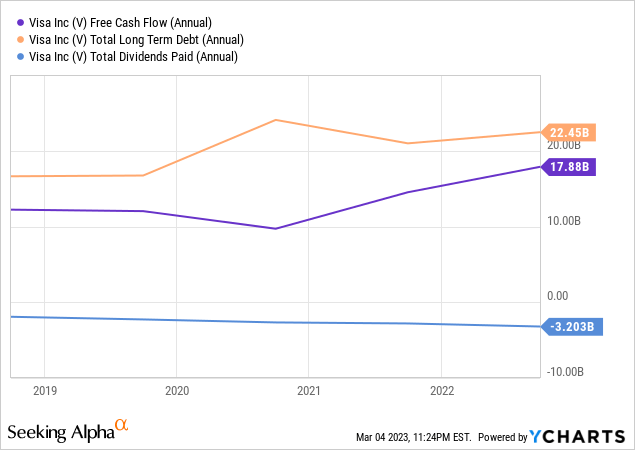

The company’s balance sheet is in a great spot. You’re looking at about 6X coverage of the dividend by free cash flow, and long-term debt is also easily serviceable. The company repurchased $3.1B in shares in the most recent quarter at an average price of $198.74, below the current share price. I’d personally like to see the dividend grow into the company’s free cash flow sum, considering its overall consistency.

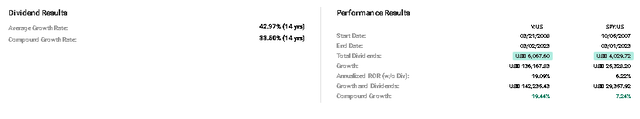

One thing to notice that really puts a fine point on Visa’s advantages as a business is free cash flow conversion. In the most recent year, Visa converted 61% of revenues down to free cash flow. That’s incredible, and shows the company should be an absolute cash cow for years to come. Management appears committed to dividend growth, having hiked the dividend for 14 consecutive years. The current yield is minimal, but dividend growth has been outstanding. The most recent increase was around 17%, and the 10-year average is closer to 21%. There’s plenty of room for that to continue.

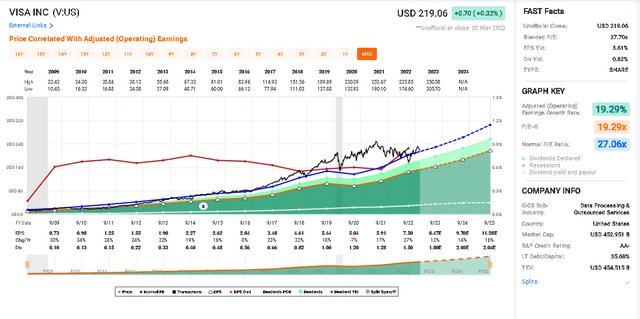

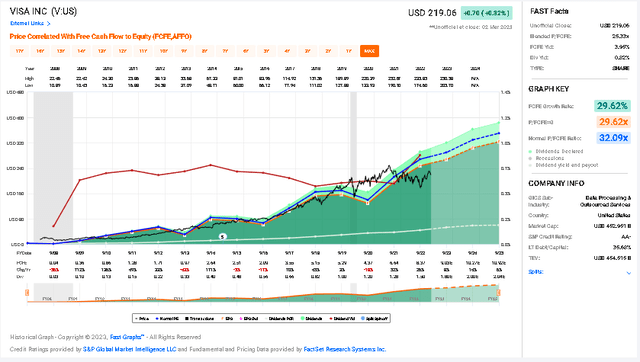

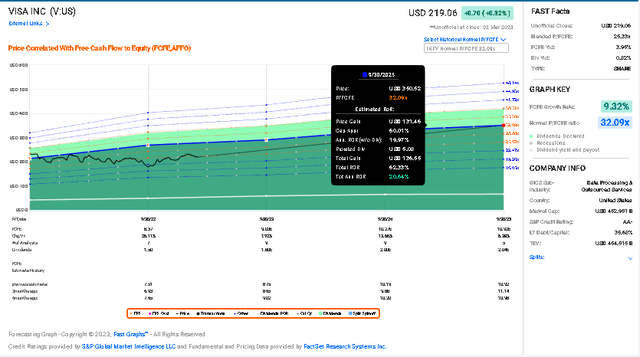

Looking at earnings growth over time, outside of the pandemic it’s straight up and to the right. Since the financial crisis, you’re looking at a CAGR of 19%. Late last year as a great time to buy the company, but it’s around fair value today, as well.

Based on analyst estimates for earnings growth and maintaining its average valuation, an investment today could yield around 14% annualized.

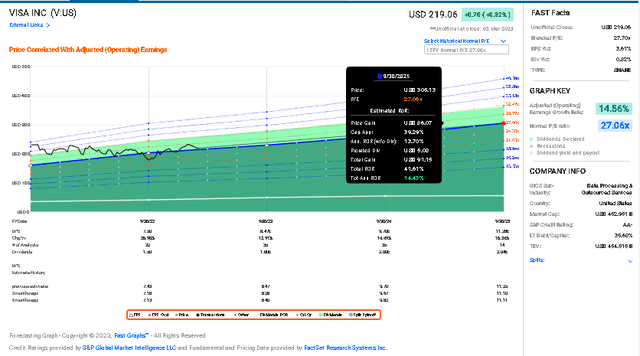

Looking at free cash flow, the company appears undervalued. The company has compounded free cash flows at close to 30% per year, and is trading below that growth rate as a multiple today, close to a 4% FCF yield.

Based on free cash flow growth and some multiple expansion, you’d be looking at closer to 20% annualized total returns from here.

Again, the purpose of this article wasn’t to break new ground or deliver a hot take on Visa. This company is the bluest of the blue chips, and has a place in most investors’ portfolios. What I really wanted to show was sometimes it’s worth stepping back and looking at just how impressive the business really is. Don’t overthink it. Visa is tied directly into the health of the overall economy, with growth in card payments globally as a massive tailwind. There are risks, of course, as there are with any company. However, the company appears to be fairly valued and has a long runway to continue compounding shareholder wealth. Visa is a strong buy, it’s one of the companies in my kids’ long-term portfolios.

Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.