Summary:

- Apple’s executive turnover raises concerns about stability and the future, while Intel also struggles to keep up with product growth and market placement.

- Executive turnover is noteworthy and often indicative of major upheavals, but doesn’t reflect Apple’s overall employee trend.

- Despite declining earnings estimates, investors remain confident in Apple’s powerful combination of features, including brand name, great products, reasonable prices, dividend payments, potential growth paths, and strong financial background.

Nikada/iStock Unreleased via Getty Images

Apple Inc.’s (NASDAQ:AAPL) drastic shift in executive leadership has generated much discussion surrounding the company’s future. Intel Corporation (INTC) is facing a similar struggle, striving to keep up with product growth and market placement under current financial conditions. Even though consumer behavior may remain price-sensitive due to these economic times, Apple stands out as an exceptional stock that offers qualities one cannot find elsewhere.

Is Apple Losing Its Core?

Recently, Apple Inc.’s shocking rate of executive turnover has sparked concern regarding the organization’s stability and long-term prospects. The departure of almost 11 upper-level executives, who were responsible for business operations, has triggered inquiries into why they left as well as how their absence will affect Apple in the future.

The exiting executives had a range of salient roles in the functioning of the company, from industrial design to online store management, information systems and cloud efforts, hardware/software engineering, emerging market sales and subscription services procurement.

The departure of key personnel just below the senior vice president level that reports to CEO Tim Cook has undoubtedly dealt a blow to Apple. Despite being unsure as to why they left, speculation suggests it could be due to differences with higher-ups, inadequate work environment or seeking new opportunities. This kind of turnover also begs questions about whether the company is adequately preparing for their succession and how it will affect their innovation and competitive edge within an ever more challenging tech industry.

Apple’s sterling standing as a secure and stable company is also being called into question due to the much higher rate of executive departures in comparison to past years. Not only could this drastic shift lower morale among remaining employees, but it may also lead them to doubt their confidence in the firm’s leadership. Apple has taken measures to fill the gaps left by departing top-level executives, yet it remains uncertain how this shift in leadership will affect the company.

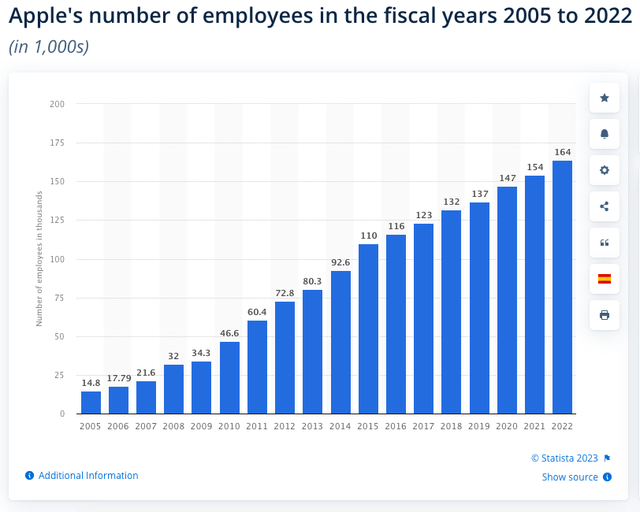

Keep in mind, while this executive turnover is noteworthy, it does not seem to reflect Apple’s overall employee trend.

Additionally, in the past there have been many notable instances where experts were completely off-base when it came to predicting Apple’s current and future state. To briefly illustrate this point from 2012:

Nevertheless, when a company experiences an exodus of executive leaders, it is often indicative that major upheavals are occurring. Basically, the simultaneous departure of many high-ranking officials should not be taken lightly. Certainly Apple isn’t the only business to experience an executive exodus. Intel Corporation serves as another prominent example, and in these cases the consequences may be immense; there’s both the loss of crucial personnel and doubt around what lies ahead for the company.

What We Can Glean from Intel’s Struggles

Intel Corporation’s delay of their 7-nanometer technology chips left a significant impact on the market, and AMD and Nvidia saw it as an opportunity to seize. These two competitors released multiple updated designs with better architectural features to surpass Intel’s long-held monopoly in chip production. The timing couldn’t have been worse for Intel – dragging out this critical progress was seen by many as a major setback in their company history.

Meanwhile, Intel unveiled an extensive reworking of its infrastructure, which included the resignations of several notable executives including the Chief Engineering Officer, General Manager of Data Platforms Group, and Chief Marketing Officer – signaling a major shift in their corporate strategy moving forward.

Bob Swan, who had been at the helm of Intel since 2019, faced widespread criticism for delaying its CPU launch. Analysts and investors weren’t certain his leadership had fostered enough development in an ever-evolving industry. Particularly, his decision not to outsource production like other leading companies are doing was highly contentious.

And right on cue, once the market began to digest the news, the stock started its downward trend.

But how does Apple compare?

Ross Hendricks of the Ross Report started noticing in January 2022 that Apple’s high valuation multiple could be a huge risk if demand for their main iPhone products decreases due to people having less disposable income. This large reliance on the iPhone for profits and its premium pricing meant that it was quite likely for Apple’s stock price to take a notable hit as well should these conditions persist.

It was a good call:

Furthermore, there were indications that a decrease in financial and monetary stimulus measures could bring about reduced economic growth and weaker earnings. Subsequently, news emerged as early as February 2022 that Apple would soon be introducing “RealityOS,” their mixed-reality device. Analysts predicted that future growth for the device won’t be able to keep up with its current stock valuation, and its high price point may cause meager sales in the early days. Furthermore, competition in the AR/VR sector is fierce; Facebook’s Oculus Quest 2 already dominates, leaving little room for Apple to take a share of success.

As the pessimistic reports stacked up, analysts issued more serious alerts, advising that Apple (and Alphabet’s) earnings per share could prove to be way under the forecasted $6.60 for 2023 – maybe even as low as $5. One analyst further professed that both companies’ stock prices have become overvalued and predicted a bust following that period of heightened profits.

Back to the source: The State of the Consumer

As the world economy continues to be unsteady, consumers are unsurprisingly engaging in “trade-down” conduct. A survey conducted last September showed that 70% of respondents have traded down from more expensive products to less costly alternatives with a view to saving money. With high inflation and low growth rates still persistent, it is predicted that people will continue this practice throughout 2023 as they look for ways to counterbalance their dwindling real incomes.

Yet despite apprehensions over a decrease in Apple’s Services segment, perhaps due to “trading down,” some investors are confident that it is simply a cyclical occurrence. The slump in marketing has had an impact on the Services division; however, digital advertisements remain competitive to conventional advertising. Furthermore, Apple has been successful at driving revenue growth within its Services section through attaching services with products like the Apple Watch and thereby increasing user loyalty.

Besides that, Apple has been able to raise prices of its services (such as App Store, Apple TV+, and Music) without bearing the full brunt of customer complaints. Moreover, the enterprise sector is still in its nascent phase – presenting plenty of scope for growth within Apple’s Services segment.

Undoubtedly, expectations of Apple’s stock have been on the decline due to decreasing earnings estimates. Yet this could be beneficial if actuals come in better than what was predicted. Moreover, with a lucrative dividend yield and an imminent 10th consecutive annual dividend increase announcement from Apple, investors should find solace that their long-term returns may ultimately benefit. While the immediate effect of such a raise might not be felt right away, consistent increases over time can make all the difference in terms of overall returns down the line.

Overall, I concur with Tradevestor’s analysis that investors must ponder the missed opportunities if they opt to sell Apple’s stock now. Few other stocks can match its power combination of features, including a prestigious brand name, great products (at least a dozen in my home) reasonable prices, dividend payments, potential growth paths and selling high-value products with a strong financial background. With all these advantages in one package it’s no surprise that Apple is such an attractive option for users looking to get maximum returns from their investments.

Takeaway

Hold it if you own it; buy it if it goes on sale. By the way, the “daily” RSI is always a great indicator if you’re interested in timing the market; but the “weekly” is even better.

Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.