Summary:

- Valuation has detached itself, allowing for the possibility of locking in profits at attractive levels.

- Forward P/E and forward one year P/E between 26 and 27.5 are levels reserved for high growth companies, and McDonald’s isn’t such a company.

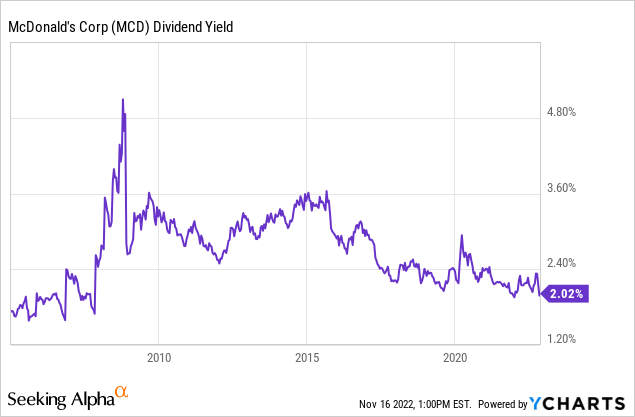

- The stock is trading at close to its lowest yield seen in more than a decade, which I find underlines the fact, that this valuation is a stretch.

- McDonald’s remain a wonderful company, but even quality can become too expensive.

Florent Molinier

Introduction

McDonald’s Corporation’s (NYSE:MCD), an 82-year-old company with one of the most widely recognized brands across the globe. With more than 36,000 outlets across the globe, there are very few places in the developed list of nations where you can’t obtain the classic cheeseburger. The United States is home to more than 13,000 of those outlets, meaning there is one for roughly every 25,000 citizens, while there is one for every 5.5 million citizens in, for instance, India, or roughly one for every 400,000 citizens in China. Point being, McDonald’s isn’t done expanding its footprint as the global middle class continues its expansion and given the growing trend of urbanization in denser areas.

Some naysayers will argue that global health trends will make the company and its offerings obsolete. On the contrary, I would argue that it’s close to impossible to render such a company obsolete, as its incredible reach and brand will ensure it can adjust its course if seen fit, in order to cater to the tastes of time. I believe we’ve already seen the company embark upon this throughout the last decade, having updated its interior in combination with a more balanced offering for those who seek something other than purely the classics.

All those positives, however, didn’t stop me from selling my shares last week. I believed last week, and still do, that McDonald’s is a great company, and one that will be part of the future. However, even great quality can sometimes reach such elevated prices, that it’s too tempting not to sell.

Back in June this year, I published an article covering this company, where I argued it wasn’t time to buy yet. At the time, MCD stock was trading just below $240 per share, and I took the stance that it wasn’t attractive until it went below $190 per share. As one reader noted in the comment section, that wouldn’t happen unless we had a massive selloff. We had one such selloff in September and October, but the stock never made it below $230 per share, and has since appreciated greatly, peaking at $278.4 per share just recently. I pulled the trigger last Friday at $269.9 per share, as I believe McDonald’s is one of the few large blue-chip companies at this time that is overvalued. I’m fortunate enough, to have witnessed the stock appreciate more than 100% since I picked it up on March 18th 2020 during the Covid-19 market crash. This doesn’t mean I’m not interested in holding McDonald’s again, but simply that I’m now on the sidelines, patiently waiting for the stock to cool off, which I believe it will.

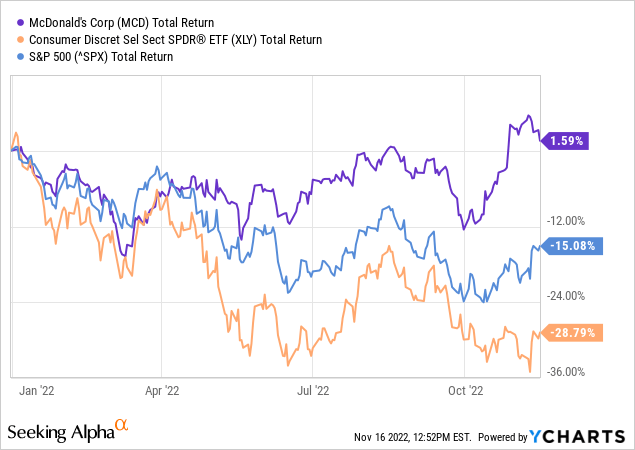

The stock has done great YTD, easily beating both its peer ETF, the consumer discretionary ETF (XLY) as well as the S&P 500 (SPX) from a total return perspective. In fact, McDonald’s is in the green for the year, quite impressive given the market performance as a whole.

I invest by the mindset of letting my winners run, as selling my winners and adding to my losers is the equivalent of cutting the flowers and watering the weeds. But every rule has its exception, and selling McDonald’s was simply too tempting at this point. I’ll elaborate why.

Reason Number 1: The Valuation

McDonald’s is a mature and stable blue-chip company with an easy-to-portray outlook given its target customer group. It’s considered a discretionary company, but I wouldn’t quite agree to that in the purest meaning of that description. A car manufacturer is a discretionary company and so is the home improvement segment, but McDonald’s, while discretionary, is leaning heavily towards a consumer staple given that consumers cut back on many things before they cut back on their visit to the golden arches. However, there comes a point where consumers do indeed cut back, even on a visit to the golden arches, more about that later.

Coming back to valuation, the point is that this stock can be observed through the lens of traditional valuation metrics such as the price to earnings multiple.

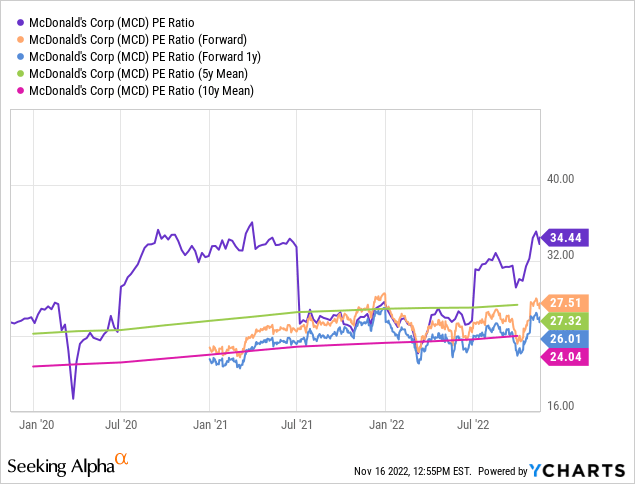

The stock is trading at a forward P/E ratio of roughly 27.5 and a forward one-year P/E ratio of 26, while the ten-year mean currently stands at 24, having trended upwards in the most recent years as the market has continued to allow a multiple expansion for the stock. Similarly, the five-year mean comes in at above 27.

If I didn’t know which company I was observing, I would suspect it was a high-growth company, but if we look at the consensus estimates for the coming years, revenue is expected to grow 3.1% in FY2023 and 5.5% again in FY2024. Going beyond 2024, and analyst coverage gets thin, but it indicates that this is indeed not a high growth company.

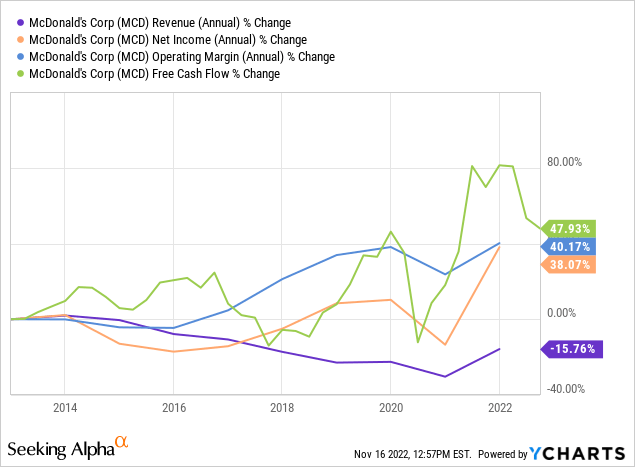

If we observe the income statement, it becomes evident that McDonald’s has been experiencing declining revenue during the past decade, which, however, has been more than compensated for by streamlining the operations to increase margins, allowing for a 38% expansion in net income. The operating margin, however, has plateaued. In this inflationary environment, it’s highly unlikely the company should be able to accelerate that trend once more.

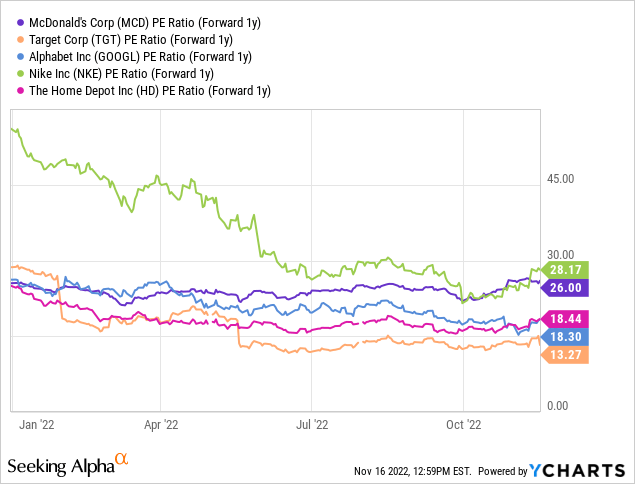

Here is a basket of companies who’ve grown their revenue between 24.8% to 59.2% in the past three years, while McDonald’s during that same period has grown its revenue by 8.7%. Interestingly enough, all of those companies, except for Nike (NKE), trade at lower forward one year P/E multiples – and yes, they aren’t one-to-one comparable, but that’s not the point. The point is, that P/E ratios hovering in the mid 20’s, are reserved for high growth companies, always has been, and McDonald’s isn’t such a company.

Having hiked its dividend for twenty consecutive years, the management team has long-since established McDonald’s as a reliable provider of regular income for its shareholders. The company is committed and will most likely think twice before considering not hiking that dividend in a given year. Therefore, it’s also interesting to observe the current dividend yield in a historical context, especially if you consider the idea of dividend yield mean reversion – the concept that a given stock trades in a more-or-less fixed band centered around its long-term average dividend yield.

Observed from this vantage point, the market’s willingness to apply a premium to MCD stock becomes evident. As can be seen, the dividend yield hasn’t been lower in almost fifteen years than what has been the norm in the past year. In an environment of substantial single-digit inflation, I’d not expect the stock to hold its own at these levels for a significant time.

Observing the valuation, and I find it difficult to find another conclusion, than this stock is trading at the upper levels of its long-term trading range. There isn’t really any room for the valuation to expand, and that brings me to the next reason.

Reason Number 2: The Macro Outlook And EPS Impact

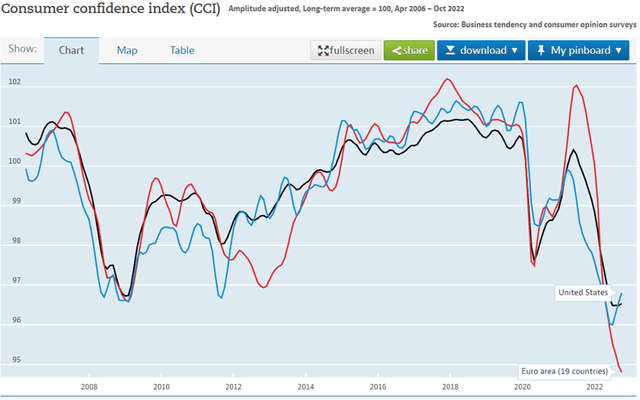

The illustration below shows the consumer confidence index provided by the OECD, a highly recognized publisher of economic data.

OECD Consumer Confidence Index (www.data.oecd.org)

The consumer confidence has been plummeting globally, to a point where it’s worse than back in the days of the financial crisis or during the onset of Covid-19. That doesn’t really bode well for company earnings in general, and that’s why I want to allocate new funds to companies that do not trade at peak valuations.

McDonalds EPS Consensus Estimates (Seeking Alpha)

While the EPS outlook has been downwards revised for McDonald’s during this year, there is still a consensus that the company will increase its EPS eight out of the nine coming quarters. I’m not saying that can’t become reality, but I remain skeptical, and this is, of course, important, as EPS is what fuels the valuation. Contracting EPS results in an expansion in valuation, which further drives up the price to earnings multiple compared to its historical mean levels.

Given the current consumer sentiment, general inflation and spike in mortgage- and interest rates, I believe we are witnessing the early innings of an environment where companies will begin to lay off employees, causing consumers to hold back and the economy to contract. I personally allocate funds to investments every month, and I’ll continue to do so as time in the market beats timing the market, but that doesn’t change the fact that we as investors have to be smart about our allocation. We can only allocate our savings once, and here I’m steering clear of companies trading at what I consider the edge of their valuation.

Concluding Remarks

McDonald’s is a wonderful company, but everything comes with a price tag on the stock market. Sometimes, that price tag can become too tempting not to act. Back in the summer, I thought the likelihood of getting the chance to add to one’s position at attractive levels were higher, but then the stock continued to appreciate, to a level where it would be tempting to head for the exit. Four months later, and I know what door I’m heading for.

Dealing with a situation with two forces pulling in opposite directions, I prefer to lock in the profit and look elsewhere for more favorable tradeoffs between valuation and economic outlook. McDonald’s is currently trading above its historical mean P/E levels, with forward P/E level in the mid-twenties, levels I’d say belong to high growth companies, or at the very least companies who hold the potential for substantial margin expansion. McDonald’s is neither of those two things, while holding some element of being a discretionary company, meaning that customers will continue to shop groceries. However, if they used to visit McDonald’s once every fortnight, perhaps they’ll keep it to once every month in favor of cooking at home.

Whether that turns out to be the case, we still don’t know, but we are starring down a potential recession with MCD stock trading above its typical average valuation, and its lowest dividend yield since the financial crisis.

I’m sure I’ll be an investor in McDonald’s in the future, but the current situation is simply too temping to pass for my sake, as I doubt it’ll last.

Disclosure: I/we have a beneficial long position in the shares of NKE, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.