Summary:

- American Tower is well positioned to continue growing based on the growing data usage across the globe.

- AMT is the largest and most geographically diversified tower REIT.

- 5G continues to roll out across the globe and American Tower is providing the infrastructure.

Iryna Dobytchina

As new mobile devices, like the Apple (AAPL) iPhone 14, roll out on an annual basis, wireless carriers step up their fight against one another to earn the business of consumers. This equates to the likes of AT&T (T), Verizon (VZ), and T-Mobile (TMUS) subsidizing cost for new devices. Because of this, consumers are bouncing from one carrier to the other every few years.

This is where American Tower (NYSE:AMT) comes in. American Tower Corporation is a leading tower REIT within the communications sector. As carriers fight over customers, they still need proper data and wireless coverage, and how they do this is through leasing space on a cell tower, most likely an American Tower cell tower.

AMT currently has a portfolio of ~223,000 communication sites.

AMT

5G Increases The Demand For More Cell Towers

5G has been the latest and greatest mobile network to date. The thing that makes 5G more superior than 4G, is its ability to carry a lot more data at much faster speeds than 4G. However, there is a catch, and that catch is a major tailwind for a company like American Tower.

4G is expected to have a range of roughly 10 miles, but when it comes to 5G wavelengths, they only have a range of roughly 1,000 feet, less than 2% of the range of 4G. What this means is there is a greater need for more cell towers to support 5G.

Wireless carriers have spent billions building out infrastructure to support 4G and now 5G rolls around and the need has come yet again. 5G is available in many big cities and nearby towns, but 4G still rules in more rural areas in America.

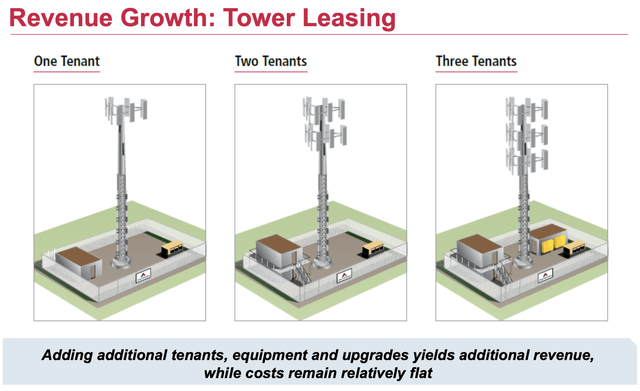

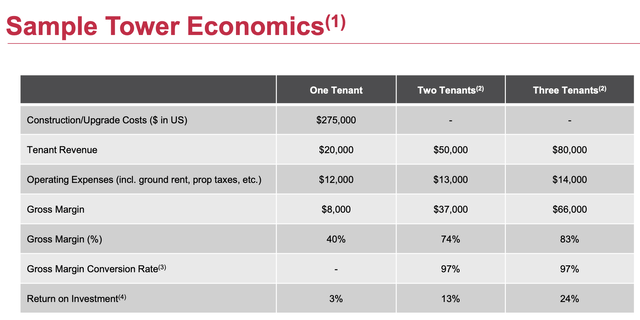

Currently, a cell tower can hold between one or three different tenants, as seen in the slide below.

AMT Investor Presentation

However, single tenant towers yield a return on capital of just 3%, but when additional tenants are added, those returns explode. Reason being is that the costs to add additional equipment is not all that much more as the majority of the construction has been completed.

As such, when AMT is able to add two tenants to a cell tower, returns jump to 13%, and when a third tenant is added, returns jump to 24%.

AMT Investor Presentation

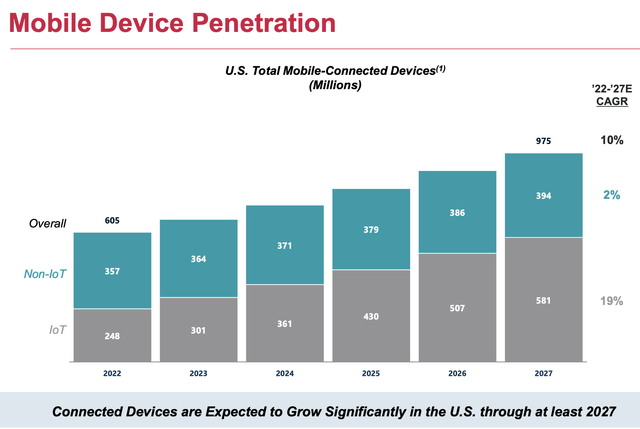

5G is not the only driver for AMT moving forward, as you can imagine, more mobile devices are another, as this points to the need for a greater number of cell towers as well.

By 2027, AMT expects there to 975 million connected devices in the US alone, and with more devices means a need for more data.

AMT Investor Presentation

A Strong Business Model That Keeps Growing

One of the great things about AMT is not only the continued growth in the industry, but also the consistency from the company as well. The company enjoys a very low churn rate of 1% to 2% annually because it is hard for rivals to compete on price and moving to different towers is not an easy process for carriers. In addition, the moving process could disrupt network coverage, which is something these carriers try to avoid at all costs.

Acquisition has been a way for the company to expand its portfolio as well. At the end of 2021, American Tower announced a $10.1 billion acquisition of former REIT CoreSite, which helped expand AMTs data center coverage as well.

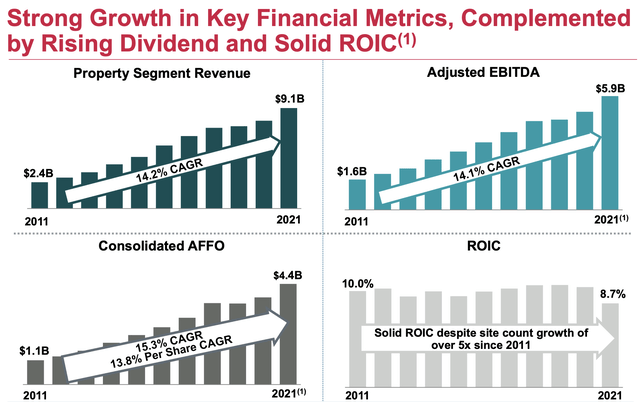

Over the past 10 years, AMT has shown exceptional growth in not only revenues, but up and down the income statement. Revenues and adjusted EBITDA have grown at a 14% CAGR, while AFFO has grown at a 15% CAGR.

AMT Investor Presentation

A Dividend Growth REIT

REITs are often known for paying high-yield dividends, which is largely due to the makeup of the REIT. REITs are required to pay at least 90% of their taxable income to shareholders in the form of dividends.

As such, strong dividend growth is not something that is seen often when it comes to REITs. However, AMT has bucked that trend, which is a testament to how strong the business model is.

Management has said it on numerous occasions in that their “our first priority remains our dividend.” Management has a goal of increasing the dividend at a rate of 10% per year over the next few years.

Since 2012, the company has increased the dividend at an average annual rate of more than 20%, which is incredible. Over the past five years, the company’s 5-year DGR sits at 18%, which is in-line with where analysts forecast through 2025.

The dividend is also well covered with a payout ratio of only 64%.

Investor Takeaway

American Tower is one of the highest quality REITs you will find on the market. They have a stable business that continues to grow and a management team that continues to prioritize returning money to shareholders.

AMT is also backed by a BBB rated Balance Sheet, but one area of concern has been the rising debt levels. As of Q3 ’22, net debt levels sat at $36.2 billion. The company has a net debt to EBITDA ratio of 5.5x, which is something they will need to lower if they hope to increase their credit rating in the future.

Given that the company has maintained strong free cash flow, I have confidence that the company will be able to chip away at their outstanding debt and secure their investment grade credit ratings.

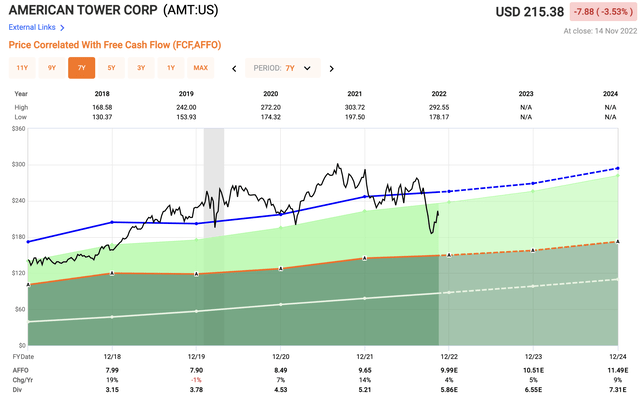

In terms of valuation, due to the consistency of the company, AMT has largely traded at a premium when compared to the overall REIT market. Over the past five years, shareholders have paid an average of 25.5x AFFO for shares of AMT.

Today, shares of AMT trade at an AFFO multiple of 21.6x, well below their five year average, and look quite intriguing at these levels.

Fast Graphs

Along with a reasonable valuation, you receive a 2.7% annual dividend that is growing at an 18% annual clip and one that has been increased for 10 consecutive years and counting.

I much prefer a company like American Tower over carriers like AT&T.

Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No marketing to add