Summary:

- Meta and MercadoLibre announced a potential partnership last week.

- MercadoLibre would provide payment services for WhatsApp Business in Brazil.

- Brazil is a very attractive market for WhatsApp Business.

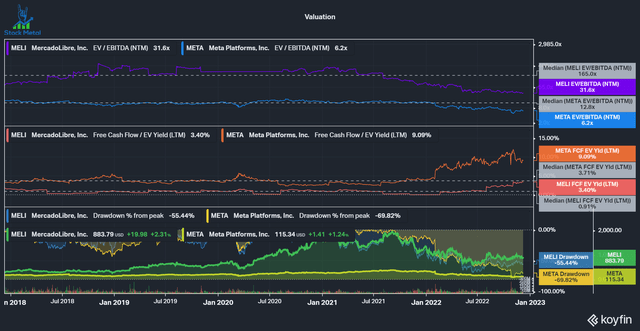

- Both companies trade significantly below their five-year valuation multiples.

pixelfit

Commerce and how customers interact with sellers and brands keep evolving fast in our rapidly digitalizing world. Yesterday LATAM E-Commerce giant MercadoLibre (NASDAQ:MELI) and social media giant Meta Platforms (NASDAQ:META) announced talks about cooperation between the two companies in Brazil. This article will discuss what this cooperation could mean for both companies.

Mercado Pago + WhatsApp

In a Reuters news article from the 7th of December, MELI’s CFO stated that the company is in talks with Meta to process payments for its WhatsApp messaging service starting in Brazil. A few weeks ago, when Meta announced an 11,000-worker layoff, Mark Zuckerberg also told employees that WhatsApp and Messenger would drive growth for the company, despite their heavy investments in its metaverse ambitions.

We talk a lot about the very long-term opportunities like the metaverse, but the reality is that business messaging is probably going to be the next major pillar of our business as we work to monetize WhatsApp and Messenger more

Investment into metaverse via the company’s Reality Labs division has resulted in an operating loss of $12.74 billion over the last twelve months. This, combined with the shrinking Family of Apps operating income, resulted in overall Operating margins shrinking from 36% to 20%.

I am delighted with the recent announcements Meta has made regarding cost-cutting and redirecting focus to the business’s cash-flowing parts.

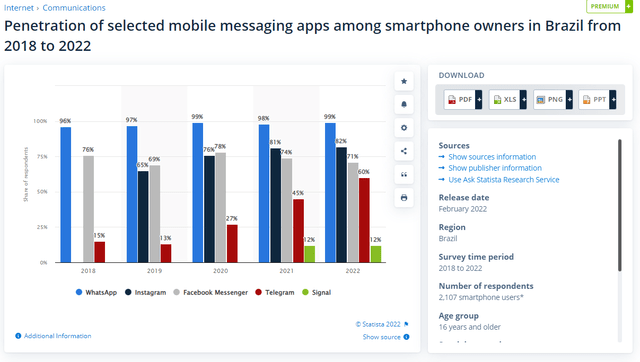

Brazil is a great market for WhatsApp Business

Brazil is a prime market for WhatsApp business. The graphic below shows the penetration of selected mobile messaging apps among smartphone owners in Brazil. We can observe that basically, every smartphone owner uses WhatsApp, with Instagram and Messenger both above 70% as well. The dominance of WhatsApp makes it a very accessible and easy way for businesses to communicate and onboard customers.

Messaging services market share Brazil (Statista)

Another reason Brazil is an excellent market for WA Business is its population size. With an estimated 148 million users in 2021, the country ranks number 2, just behind India with 390 million.

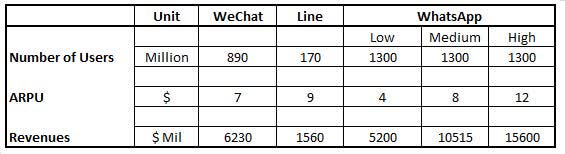

In 2017 Forbes estimated that WhatsApp could generate between $4-12 annual revenue per user (ARPU). Since then, the number of users has climbed from 1300 million to 2400 million. With Forbes estimates, WhatsApp should contribute between $9.600 billion and $28.800 billion today. Although Meta doesn’t break apart its WhatsApp revenues, we can safely say this hasn’t come to fruition. Business of apps estimates 2021 revenues to be a mere $790 million, representing a $0.33 ARPU.

Whatsapp ARPU and revenue estimates (Forbes )

Adding payment to a large market like Brazil could prove very lucrative for Meta and its potential partner MercadoLibre.

Mercado Pago as a payment processor

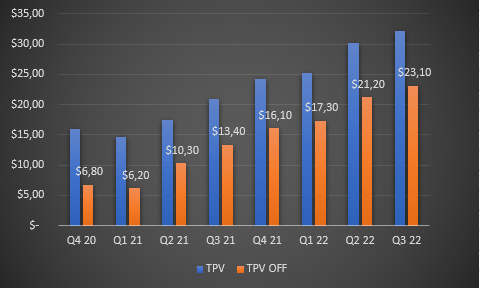

Mercado Pago is the fintech division of MercadoLibre and has been taking LATAM by storm. In the chart below, you can see the growth rate of Mercado Pago. TPV means Total Payment Volume, and TPV OFF describes the portion of TPV spent outside the MercadoLibre marketplace. We can see that TVP OFF is outgrowing TPV ON, now accounting for 70% of TPV. We see the same thing that happened with PayPal (PYPL) when it started offering its payment solutions outside eBay (EBAY). At a TPV OFF run rate of $84.8 billion, MELI is a big player in the LATAM digital payments space and a great partner for Meta’s WhatsApp Business ambitions. This way, MELI can benefit from, besides increased TPV and revenues, locking in more customers in its ecosystem (check out my previous article about the ecosystem).

Mercado Pago Total Payment Volume (Authors Model, Data from MELI IR)

Cryptocurrencies, EVs and Ad revenues

The Reuters article also mentioned two other topics I briefly want to cover regarding MELI. First, the CFO commented about MELI’s 2021 Bitcoin investment of $30 million, which is now worth just $11 million. This is what the CFO had to say regarding the matter:

The market timing was wrong but it had a lot to do with learning about crypto storage, purchasing and selling. No more purchases and we are not selling either, we are still holders of those assets.

He also commented that MercadoLibre’s logistics network Mercado Envios now contains 1,000 electric vehicles.

More interesting was his comment about the ads business, which “should be able to grow multiple times over the next few years.” In my article about last quarter’s earnings, I noted that ads could be a significant boost to profits and FCF going forward, similar to Amazon (AMZN), where ads generated $22 billion in EBIT this year. Ads could grow into a $billion business with an 80% EBIT margin over the following years.

Two very different valuations

Meta and MercadoLibre are businesses in different growth cycles. Let’s take a look at the table below. We can see that Meta generates 12 times as much revenue and 16 times as much Free cash flow while only trading at six times the EV.

| Revenues($ billion) | Revenues(5y growth) | FCF($ billion) | FCF(5y growth) | Enterprise Value($ billion) | |

| Meta | $118.11 | 190.5% | $26.4 | 51% | $290.46 |

| MercadoLibre | $9.67 | 694.5% | $1.61 | 728% | $47.37 |

We can see that MELI has significantly higher valuation multiples, but we can also see that both companies trade considerably cheaper than their five-year median valuation. One could argue that Meta trades at a bargain level, while MercadoLibre is still a richly valued company. Over the last year, MercadoLibre has performed significantly better on an operational level than Meta, with revenues and profits continuing to grow at double digits while Meta saw its revenues stagnate and profits dwindle. Nonetheless, I believe both companies are attractively valued at the current level: MELI has a lot of operating leverage ahead, especially with its high-margin ad business. Meta is priced with a lot of pessimism, while the company starts to control its costs better, which should improve cash flows.

What do you believe about this potential partnership? Let’s continue the discussion in the comments.

Disclosure: I/we have a beneficial long position in the shares of MELI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice.