Carnival Corp.’s 15% Yielding Bonds Still Not Worth The Risk

Summary:

- Carnival saw several quarters of total shutdown related to the pandemic.

- The company has made good strides in recovery during 2022.

- Cash flow generation is still not strong enough to justify an investment in debt.

NicoElNino

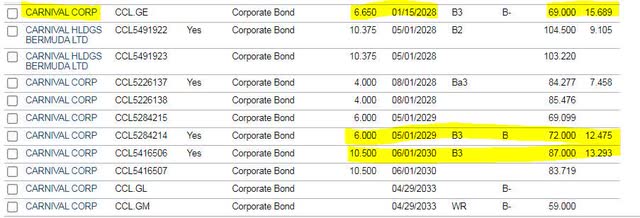

Perhaps no company was more negatively impacted by COVID-19 than Carnival Corp. (NYSE:CCL). At one point during the pandemic, the company reported no quarterly revenue. Yet, even though they are currently functioning, Carnival’s 2028 maturing debt is priced lower than during the pandemic. The 15% yield to maturity is also higher than the company’s longer-maturing debt and much higher than the average B rated corporate debt. Upon examination, it is apparent as to why Carnival’s debt is trading at more distressed levels than its credit rating.

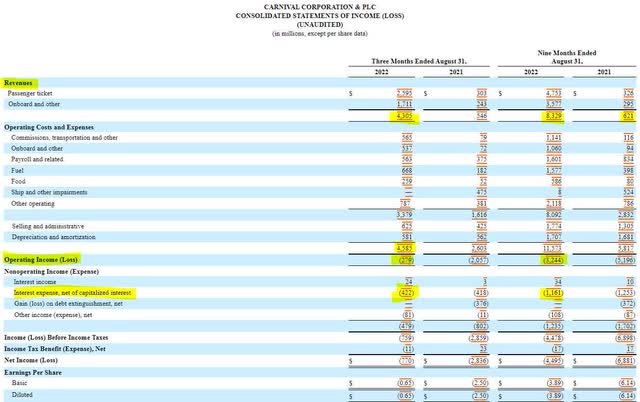

Carnival’s income statement shows just how deep of a hole the company is in. While they were able to improve their year-to-date operating loss by $2 billion, it required an additional $7.6 billion in revenue to do so. This is one of those rare cases where looking at the quarterly data may help paint a better picture. The third quarter accounted for most of the year-to-date revenue, and the operating loss was only $279 million. Using the operating loss, combined with interest expense and operating costs, I believe that Carnival needs revenues of $6.5 billion per quarter to cover operations and interest.

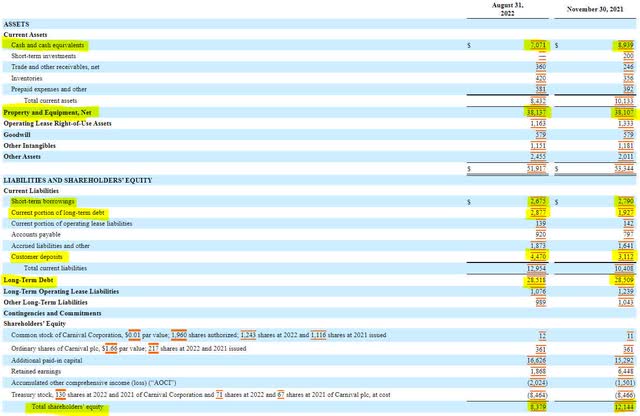

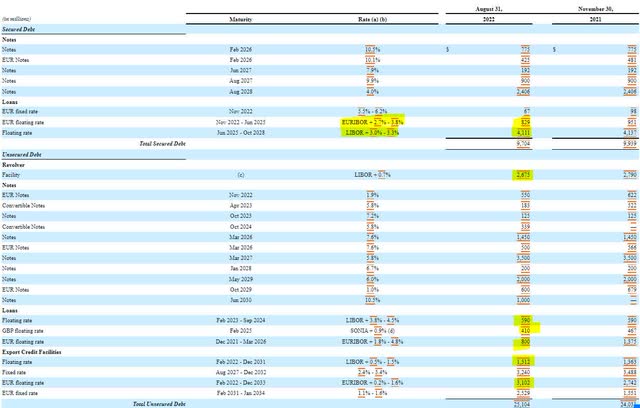

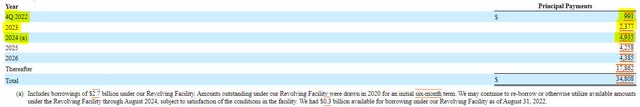

There’s a lot to unpack when examining Carnival’s balance sheet. The company’s assets have remained relatively the same this year, apart from a nearly $2 billion decrease in cash. The company’s current cash balance of $7 billion is enough to weather the current storm. While on its face it appears that long-term debt has not increased, the company has taken on $2.6 billion in short-term borrowings (which require frequent refinancing) and has nearly $3 billion in long-term debt coming due within the next 12 months.

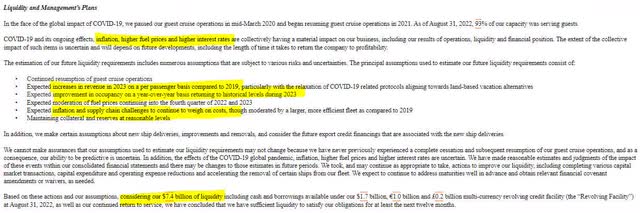

With $5.5 billion in debt needing to be refinanced in the next 12 months, Carnival could come into trouble should they find the debt markets inaccessible. One bright spot on the balance sheet is the $1.3 billion increase in customer deposits so far this year. These deposits represent future sales and should be a short-term tailwind to revenue.

While Carnival is showing significant improvement, the cash flow statement highlights how far the company must go. Compared to the nine-month period of a year ago, Carnival has improved its free cash flow by $1.5 billion but remains below negative $5 billion. The company has buoyed its cash flow drain by issuing $1 billion in new shares and borrowing a net of $2 billion in long-term debt. As it stands, the company is still dependent on financing activities by $3.2 billion year to date.

As for the outlook, Carnival management appears to be rather optimistic about its prospects in 2023. In the company’s last 10-Q, management indicated that it forecasted 2023 occupancy returning to pre-pandemic levels. However, the inflationary environment is impacting its ability to control fuel prices and higher interest rates are expected to negatively impact profitability in 2023.

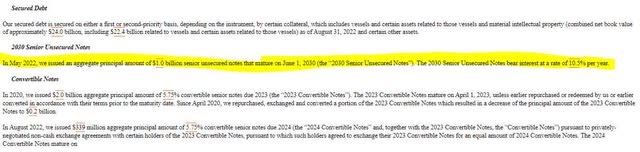

In terms of interest rate risk, Carnival’s borrowing costs are significantly impacted as more than half of the company’s $25 billion in unsecured debt has a variable interest rate. Each 100-basis point increase in interest rates will increase Carnival’s interest expense by approximately $130 million. Carnival also needs to refinance more than $8 billion of debt between now and the end of 2024. Refinancing will create additional interest expenses as highlighted earlier this year when Carnival issued a $1 billion note at a 10.5% coupon.

Overall, there are too many risks to justify an investment in Carnival’s high-yield debt. I am avoiding the company’s notes while monitoring their put options for a possible position. The company appears to be in a position where inflationary pressures and high interest rates on enormous amounts of debt could erode the margins of practically any level of revenue. Should inflation persist and revenue headwinds remain, I expect Carnival to turn to distressed debt exchanges to avoid bankruptcy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may take a position in Carnival Corp put options in the next 72 hours.