Summary:

- OpenAI ChatGPT has taken the world by storm, stirring conversions on whether the AI chatbot will displace Google’s position in search.

- While ChatGPT does provide a better user experience, it’s unlikely to present any near-term risks to Google’s core search business.

- That said, Google is under pressure to improve its overall search experience while investments in “Other Bets” should be reconsidered.

- Maintain Buy on a compelling risk/reward once markets exit the current downturn.

imaginima/iStock via Getty Images

What is ChatGPT?

ChatGPT is an AI chatbot developed by OpenAI, a non-profit research lab founded by Elon Musk, Sam Altman, and several other investors in 2015. GPT stands for Generate Pre-trained Transformer, which is a large language model developed by OpenAI that can understand natural language and generate fluent, coherent human-like texts. The word “Transformer” is a type of deep learning architecture that helps the model (1) understand the meaning of natural language and (2) generate a text response that is relevant and easy to understand.

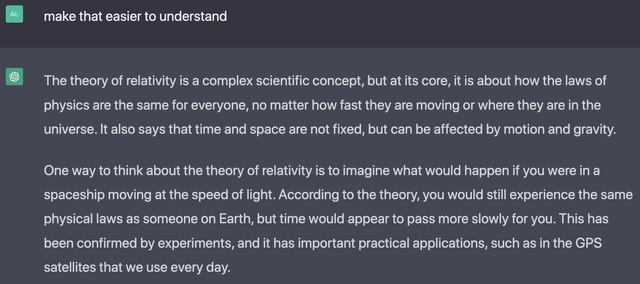

The first version of GPT was released in 2018, followed by GPT-2 in 2019 and GPT-3 in 2020. ChatGPT is based on GPT-3.5 and reached 1 million users within a week, according to a tweet by CEO Sam Altman. While not perfect, ChatGPT is able to respond to a wide range of requests, including explaining complex topics in layman’s terms, summarizing long paragraphs, and generating fully functional python code. For example, here’s what I received after telling ChatGPT to make the theory of relativity easier to understand:

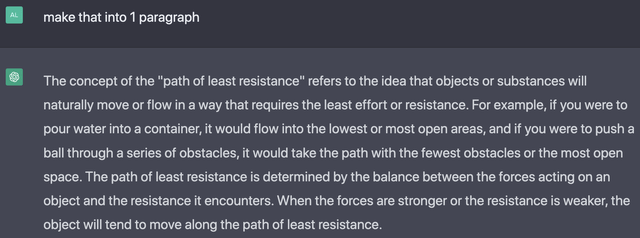

And here’s another example of telling ChatGPT to explain the path of least resistance in one short paragraph:

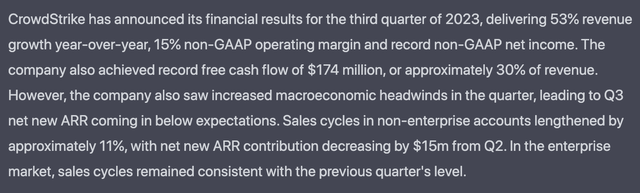

When I ask ChatGPT to summarize CrowdStrike’s (CRWD) FY3Q23 results (analysis here) by pasting the earnings call transcript, I received a quick overview that’s frankly not too shabby.

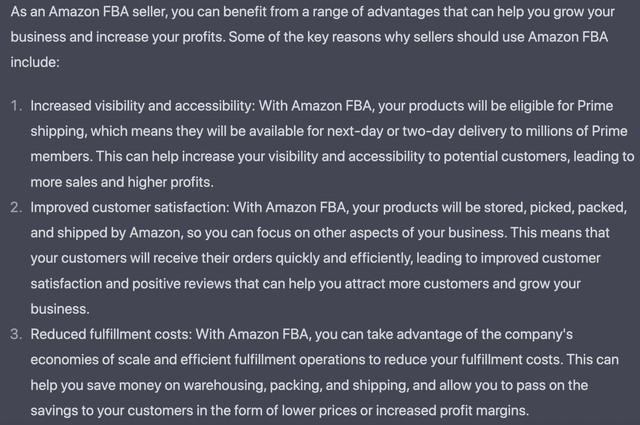

For copywriters out there, I asked ChatGPT to explain why sellers should join Amazon FBA (AMZN). This result is honestly quite impressive.

Out of curiosity, I followed up with a question on whether I should consider Shopify (SHOP). The result clearly pointed out how Shopify gives me full control over my store while Amazon provides better visibility and lower fulfillment costs.

I can go on about this, but here are some of the key takeaways after spending a few hours with ChatGPT:

- The search experience certainly feels more human than Alphabet Inc.’s (GOOG, GOOGL) Google Search, considering users can follow up on their queries without having to restate the original context. This is currently not possible with Google Search when I subsequently input terms like “make that easier to understand” following an initial search on a complex subject.

- The answers are directly provided in plain text vs. Google Search which provides links that will require users to filter through various sources in order to find the most relevant answers. This significantly reduces the time it takes to understand something quickly.

- Search queries related to current events (e.g., Russia’s invasion of Ukraine in 2022) do not work, as the current model’s training only goes up to 2021. But this could be easily addressed with news APIs.

- Results could oftentimes be inaccurate. For example, it incorrectly stated both Taiwan Semiconductor Manufacturing Company Limited (TSM) and Samsung (OTCPK:SSNLF) as Taiwan-based companies and referred to Kevin Plank (former Under Armour CEO) as former CEO of Lululemon (LULU). This, however, will likely to be improved with crowdsourced feedback.

Is Google Search at risk of obsolescence?

I don’t see any near-term financial impact to Google’s >$160 billion search business (~58% of total revenue) given it’s unclear how ChatGPT will achieve successful monetization as a competing search engine. For now, I see ChatGPT as a superior AI product that can organize and deliver information in a more effective way than Google, but not necessarily a potentially bigger search engine that will cause both publishers and advertisers to leave Google altogether. Google by far has the largest search index in the world and, therefore, the most data to work with. It just needs a better way to help users find information in a more relevant and coherent way, in my view.

That said, I believe OpenAI has every reason to keep Google on the edge, considering it has demonstrated how search could and should be in the future. In other words, I see an immediate need for Google Search to offer a similar product that makes the overall search experience more conversational and human-like. From a data perspective, Google clearly has the upper hand with a massive search library and highly attractive assets like Google Maps, which can be easily integrated into search results including directions and user-generated ratings of various destinations.

All told, I believe the key takeaway from the viral popularity of ChatGPT is that Google Search does not have a data problem, but a user experience problem, considering what ChatGPT has been able to demonstrate. Given search is Google’s bread and butter, this is the time for management to rethink its investment priorities. Google is yet to announce any layoffs similar to what large tech peers have done, but the team should consider getting rid of non-core and resource-draining projects like Waymo within “Other Bets” (analysis here) and instead focus on the core advertising business as well as ventures that could potentially be margin accretive within the next 3 years (e.g., Google Cloud).

What to do with the stock?

Google’s stock has recently been selling off due to the negative sentiment around ChatGPT but I see the risks as overblown. The stock is very reasonably priced at 17x forward earnings, with incremental upside from buybacks. While ChatGPT does not present immediate risks to Google’s search business, investors should carefully monitor Google’s investment priorities to see whether more money is spent on building its search moat or non-core moonshots that continue to damage the bottom line. Given the current macro environment, I believe management will likely embrace a more defensive attitude and focus on the core business and shareholder returns. Therefore, I’d maintain a Buy rating on Google stock given a compelling risk/reward profile and believe investors will still be rewarded once markets get over the current downturn.

Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.