Summary:

- Acuity Brands recently reported fiscal Q3 earnings and has seen a dip in net sales and potential over-reliance on mergers and acquisitions for growth. However, it has strong operating profit margins, impressive cash flow, and low debt levels.

- Acuity Brands’ valuation metrics indicate that the stock might be undervalued, but the company’s dividend yield is low.

- Despite risks, Acuity Brands stock presents an opportunity.

ipopba/iStock via Getty Images

Thesis

In this article, I examine Acuity Brands, Inc. (NYSE:AYI) stock performance, valuation metrics, and recent fiscal Q3 2023 earnings results. I am also considering potential headwinds, including a dip in net sales and a possible over-reliance on mergers and acquisitions for growth. Despite some concerns, Acuity’s robust operating profit margins, impressive cash flow, and low debt levels suggest a promising future, thus presenting an intriguing investment opportunity amidst current undervaluation.

Company Overview

Acuity Brands, Inc., is a leading international provider of lighting and building management solutions. This company is divided into two specialized segments: Acuity Brands Lighting and Lighting Controls (ABL) and the Intelligent Spaces Group (ISG).

ABL is a prolific segment that offers a wide range of lighting solutions, spanning commercial, architectural, and specialty applications, as well as corresponding controls and components.

On the other side, we have ISG, a segment that centers on the tech-driven field of building management. ISG provides a top-tier building management platform and location-aware applications, riding on the reputation of the Distech Controls and Atrius brands. The target market for ISG’s solutions includes system integrators, retail stores, airports, and enterprise campuses, revealing a discernible pivot towards smart, interconnected environments.

AYI’s Bullish Q3 2023 Earnings Takeaways

In Q3, Acuity Brands managed to pump up its operating profit margins, even as its net sales took a tumble with an EPS of $3.75 beating by $0.02 with a revenue of $1.00B. Adjusted operating profit margin? Swelled up to 16.3%, keeping costs on a tight leash and their shrewd knack for negotiating advantageous prices.

Along those lines, CEO Neil Ashe noted:

First, around strategic pricing, so that’s where on the Contractor Select portfolio, we can compete with anyone that wants to enter the market through those channels, which is very effective. And we can choose which projects we want to participate in based on pricing. So we’re significantly more strategic about how we’re pricing.

Second is that we’re really working hard, and our teams have done a nice job on the combination of productivity improvements and material cost savings. That’s a combination of our product vitality efforts and the work that we’re doing in our supply chain to level load. And then finally, I’d emphasize that the continued growth of ISG is growth accretive, margin accretive and returns accretive.

On the subject of cash flow, Acuity stacked up an eye-popping $472 million from operating activities in the first three quarters of fiscal 2023 alone. That’s a $306 million leg-up compared to the same period in 2022.

It’s clear that the swell in cash flow isn’t accidental but the fruit of the company’s heightened management of working capital, including savvy inventory reduction and the astute handling of accounts receivable. Karen Holcom, SVP and CFO, explained during the call:

…we’ve continued to bring inventory down by 22 inventory days from the peak in February 2022, and we’ve also brought inventory levels down by over $36 million sequentially from the second quarter of fiscal 2023. Year-to-date, we invested $48 million in capital expenditures and allocated $219 million to repurchase approximately 1.3 million shares.

Moreover, by pouring resources into research and development (R&D), capital expenditures (CapEx), and key acquisitions such as Optronics and KE2 Therm, they’ve expanded their portfolio and carved out avenues for future revenue generation.

Lastly, since Q4 of 2020, they’ve repurchased a jaw-dropping $1.2 billion worth of shares. This move isn’t just about confidence in the company’s trajectory, it’s a boon to shareholder returns. By shrinking the number of outstanding shares, each remaining share gets a value boost.

Risks & Headwinds

Although they’ve demonstrated a commitment to enhancing operational efficiencies, the 6% dip in their annual net sales cannot be disregarded. This reduction in sales volume, precipitated by an amalgamation of lower demand and macro-environmental influences, invites a serious examination of the company’s growth trajectory. Along this macro front, CEO Ashe added:

While our order rates and our shipment rates are returning into closer alignment with each other, we have not yet returned to normal sequential seasonality. In ABL, we’re going to focus on strategic pricing, continued productivity improvements and managing material costs. In ISG, we’re going to focus on the continued growth of Distech and Atrius and the successful integration of KE2 Therm.

Turning my gaze towards the ABL segment of Acuity’s operations, a tangible 7% contraction in net sales from the previous year is apparent. This downturn stems primarily from a reduction in independent sales network activities and a slump in Original Equipment Manufacturer (OEM) sales. While isolated data points should not be overemphasized, this trend does require attention. The segment’s underperformance could suggest structural issues or might simply reflect a temporary blip in a generally positive trajectory; however, we can’t ignore this as a potential sign of deeper issues.

Finally, another noteworthy observation is Acuity’s dependence on mergers and acquisitions for growth, highlighted by the recent acquisition of KE2 Therm. While M&As can be a legitimate strategy for expansion, they aren’t without risks. Integration challenges, culture clashes, and the sheer unpredictability of realizing anticipated benefits all pose potential pitfalls. This aspect of Acuity’s growth strategy may be a double-edged sword, with both the potential to significantly bolster growth or, conversely, inject volatility into their financial performance.

Expectations

Currently, Acuity is covered by nine Wall Street analysts, with an average weighted “buy” rating for the stock that projects a 12.38% upside price potential.

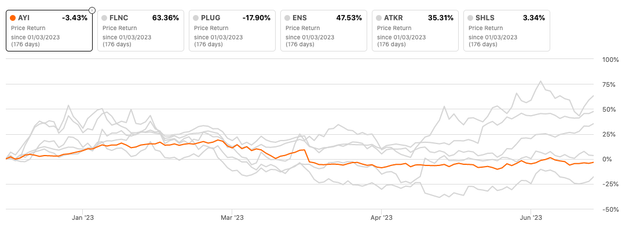

Performance

The year-to-date (YTD) performance of Acuity’s price pales when juxtaposed with its peers. This contrast becomes even more pronounced when viewed in the context of the exceptional returns delivered by companies like Fluence Energy (FLNC), a significant player in the construction of renewable-energy grids. EnerSys (ENS) is another such high-performing peer, capitalizing on megatrends such as 5G, IoT, grid stabilization, electric vehicle charging, and renewable energy storage. Lastly, Atkore’s (ATKR) robust financial health and successful growth strategy, encompassing both organic growth and strategic acquisitions, underscore the marked disparity in performance.

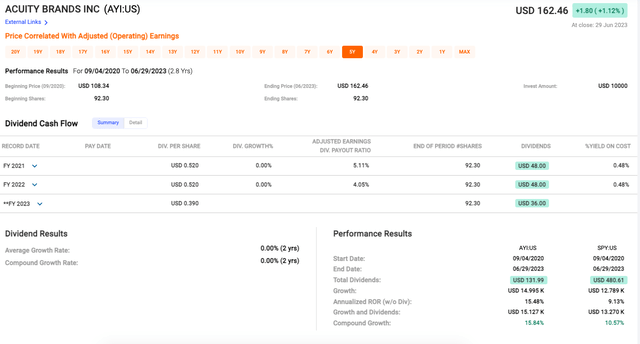

However, AYI benefits to shareholders are evident from its share price’s impressive appreciation since September 2020 (see data below)- jumping from an initial price of $108.34 in September 2023 to $162.46 by June 2023 at an astounding compound annual growth rate of 15.84%. This clearly outpaces that of the S&P 500 (SP500) rise of 10.57% for this same time frame.

From a pure price appreciation standpoint, Acuity has been a strong performer for investors. On an investment of $10,000, we’re seeing growth to nearly $15k, suggesting AYI is punching above its weight.

Valuation

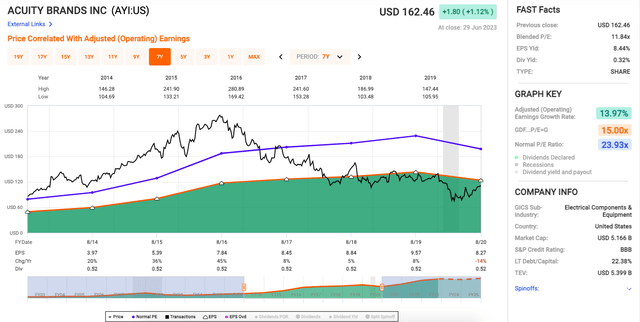

The current blended P/E (see data below) for Acuity Brands is reported at 11.84x, which is considerably below the normal P/E of 14.54x. This deviation suggests that the stock might be undervalued, thereby presenting an enticing opportunity for value investors, who may view this as a chance to purchase the stock at a discount.

Moving to the EPS yield, it is reported at a high 8.44%, which often signifies a company’s strong financial health. Higher EPS yield can be interpreted as the company generating higher profits per dollar of investment, emphasizing that the company might be undervalued.

Furthermore, the reported adjusted (Operating) earnings growth rate is a modest 7.05%. While this is a positive indicator of the company’s performance, it isn’t necessarily dazzling.

The dividend yield, though, is less than thrilling at just 0.32%. It’s fairly low, indicating that income-focused investors might not find Acuity Brands attractive.

Sector Valuation

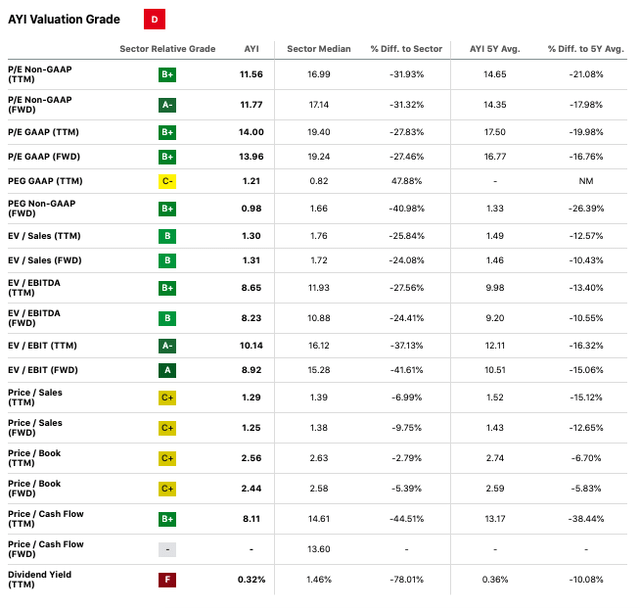

AYI’s performance is lackluster with an overall grade of D (see table below), which indicates an undervaluation relative to its sector and historical averages. That said, it’s notable that AYI’s forward and trailing P/E, both GAAP and non-GAAP, are well below the sector median and its 5-year averages. A similar pattern persists in the EV/EBIT and EV/EBITDA ratios, which hints at a company that could be seen as a good bargain, given that these ratios are generally less susceptible to accounting manipulations.

Nevertheless, the PEG GAAP (TTM) value seems troubling as it is significantly higher than the sector average. An above-average PEG might suggest overvaluation from a growth perspective, which is confirmed by the poor grade of C- for Growth.

Contradictorily, Acuity Brands also shows some strong metrics. The company’s profitability is stellar, with a grade of A-, showing it to be a standout performer in the Industrials sector. The company’s strong cash flow performance is also commendable, with its Price/Cash Flow ratio, both trailing and forward, significantly lower than the sector, indicating its ability to generate healthy cash flows.

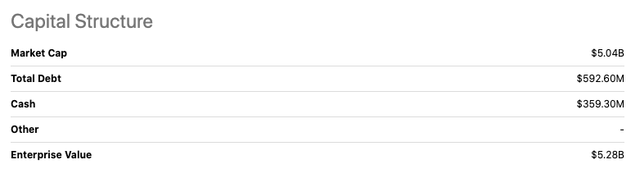

The company’s capital structure shows a relatively low level of debt, with a total debt of $592.60M against a market cap of $5.04B. This low debt, coupled with its cash position of $359.30M, gives AYI a solid financial footing.

Final Takeaway

In spite of some headwinds and the underperformance of the ABL segment, Acuity Brands has demonstrated impressive financial management, with robust operating profit margins, an elevated EPS yield, and a stunning surge in cash flow. Furthermore, the company’s stellar profitability and low debt, along with its focus on strategic pricing, productivity improvements, and growth in the ISG segment, solidify its strong footing in the industry.

Hence, despite some risks, I think Acuity Brands, Inc. stock offers considerable undervaluation. AYI presents a mildly enticing investment opportunity, justifying my final analytical call to hold the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.