Micron: I Remain On The Sidelines

Summary:

- Micron recently reported its Q3 FY 2023 results, showing a slight improvement from the previous quarter.

- The market dynamics in the chip memory industry remain challenging, and a recovery is highly uncertain over the next twelve months.

- China’s recent ban on the company’s chips is another headwind for Micron’s revenue and earnings growth in the future.

vzphotos

Micron Technology (NASDAQ:MU) reported its quarterly results, which remain weak even though it seems to have found a bottom, but the pace of its recovery is highly uncertain.

As I’ve analyzed in previous articles, Micron’s business profile is quite cyclical and despite the semiconductor’s good growth prospects over the long term and recent boost related to Artificial Intelligence (AI), Micron remains very exposed to ups and downs of the semi cycle and its long-term growth prospects aren’t particularly impressive.

While the bottom of the current down cycle may have been hit already, the prospects of a rapid recovery are weak and Micron is likely to maintain a relatively weak financial performance in the coming quarters. In this article, I analyze its most recent quarterly results and update its investment case, to see if there is potential as a cyclical play or the prospects of a potential recovery are already priced-in.

Q3 FY 2023 Earnings Analysis

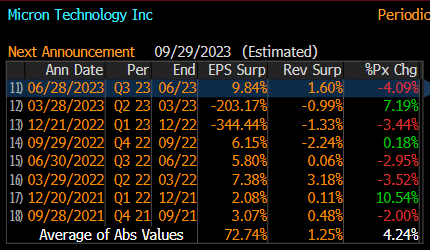

Micron recently reported its financial results related to the third quarter of the full fiscal year (FY) 2023, which were above market expectations both at the top and bottom lines, as shown in the next graph. After several quarters of delivering numbers below expectations, Micron was able to beat the Street’s expectations, which can be a positive for better investor sentiment in the coming weeks.

Earnings surprise (Bloomberg)

During Q3 FY 2023, its revenues amounted to $3.8 billion, up by 2% compared to the previous quarter, but down by 57% YoY. This reflects the challenging situation in the memory market, with excess supply taking a toll on pricing and volumes, negatively impacting the company’s revenues compared to the same quarter of last year. While there was a slight improvement from the previous quarter, showing that the demand-supply situation in the market has stabilized, but a rapid recovery is unlikely.

Moreover, DRAM reported a quarterly drop in revenue of 2%, which is Micron’s largest segment representing 71% of total revenue. This means that NAND, which only accounts for 27% of total revenue, was the major driver of higher revenue in the quarter, up by 14% QoQ. This positive performance was justified by higher volumes, while average selling prices declined quarterly in both segments.

As I analyzed in a previous article, one of the main weak points in my opinion is Micron’s pricing risk, given that customers can change pricing conditions from the moment of order to delivery. Therefore, Micron does not have much control in pricing, being heavily exposed to the supply-demand situation in the industry.

Due to its cyclical nature, pricing conditions can change quite dramatically in the memory industry, as shown over the past eighteen months, with a potential recovery being mainly due to external factors rather than the company’s efforts.

While Micron has cut wafer production in recent quarters, in order to better adapt its supply to current challenging market conditions, pricing remains weak and its previous guidance of improvement by mid-2023 now seems to be too optimistic.

Indeed, Micron’s end-market expectations regarding the PC and mobile markets remain somewhat downbeat, which does not bode well for a rapid recovery in the coming quarters. Furthermore, economic conditions remain tough as central banks maintain their interest rate hiking pace, which is likely to result in a continuation of subdued consumer demand.

On the other hand, higher demand from data centers related to AI is a positive for Micron’s revenue growth, even though, as shown by NVIDIA’s (NVDA) blowout guidance for the next quarter that was way above expectations, Micron doesn’t have much exposure to this trend in the short term, even though AI is also a tailwind for its revenue and earnings growth over the medium to long term.

Beyond industry dynamics, another issue affecting Micron’s business prospects was the recent decision by the Cyberspace Administration of China to ban Micron from key infrastructure projects. While the company says the potential impact on its business is still uncertain, some of its customers have been contacted about the use of Micron’s products in the future, being a major blow to Micron’s prospects. In the last quarter, there wasn’t any impact of this decision, with the company expecting to start feeling the impact over the next two quarters.

Micron generates about 25% of its revenue in the country, and even though not all revenue is at risk, the company estimates that about 10-12.5% of its total revenue may be at risk. This situation is more related to U.S.-China tensions, in my opinion, than being specifically targeted to harm Micron, but the potential impact on its revenues is quite significant and does not help to boost investor confidence in its ability to grow its business in the near future.

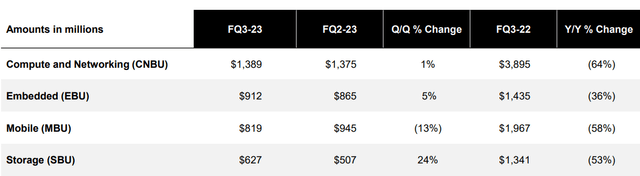

By business segment, revenue weakness was broad-based with all business units reporting collapsing revenue, another sign that weakness is due to external factors rather than some potential weakness in a specific end-market. On the other hand, on a quarterly basis, mobile remained quite weak, while storage is showing improving trends, much likely driven by data centers, but its weight on total revenue remains somewhat low.

In addition to lower revenues, Micron has also made an inventory write-down of $400 million in the quarter, putting further pressure on its profitability. This explains why its gross margin in Q3 was minus 16%, compared to minus 32% in the previous quarter and 46% in Q3 FY 2022.

Due to its relatively sticky cost base and high weight of fixed costs, Micron does not have much room to maneuver when making cost cuts during downturns, explaining why its earnings can change quite dramatically in a relatively short period of time. In Q3, its operating expenses amounted to $866 million and its operating loss was close to $1.5 billion (vs. more than $2 billion in the previous quarter).

Regarding cash flow, its operating cash from operations was slightly positive, amounting to only $24 million, while its capital expenditures were $1.4 billion. This means that Micron continues to burn cash, a situation that is not expected to change in the near future, even though Micron’s guidance is for capex to be about $7 billion in FY 2023 (down more than 40% from the previous year).

Beyond that, Micron has also decided to maintain its dividend, but suspended share buybacks, which means that dividend outflows imply further cash reduction of about $500 million per year.

Regarding its guidance, Micron expects revenue to be between $3.7-$4.1 billion in Q4, gross margin should remain negative (minus 8-13%), and operating expenses should be relatively stable from the previous quarter. This shows a slight improvement from the most recent quarter, but not particularly bullish, showing that market conditions remain quite poor in the chip memory industry.

Medium-Term Estimates & Valuation

Micron is guiding for a potential recovery in the coming quarter and that the bottom of the current down cycle is likely behind us, but investors should note that Micron’s management is usually upbeat regarding business prospects and has been wrong throughout the past eighteen months. Therefore, while operating trends are showing some sign of improvement, the company is still loss-making, and negative free cash flow is expected to last, at least, over the next year.

Due to the company’s business profile and uncertain market conditions currently, medium-term estimates are prone to revisions in the coming months and have a high degree of uncertainty.

Nevertheless, according to analysts’ estimates, Micron is expected to generate some $15.4 billion in revenue during FY 2023 (-50% YoY), and to recover to more than $20 billion in FY 2024, followed by $28 billion in FY 2025, and more than $36 billion by FY 2026. Investors should note that in previous peak years (2018 and 2022), Micron generated some $30 billion in annual revenues, thus an estimation of $36 billion by FY 2026 seems to be quite optimistic.

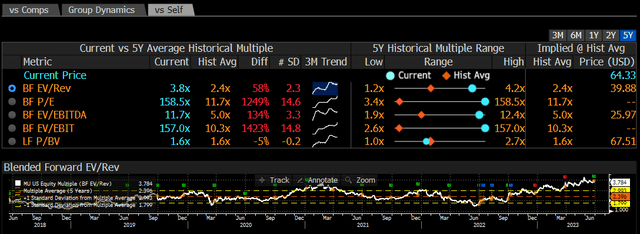

Regarding its valuation, given that Micron is currently reporting losses and this is estimated to also happen in FY 2024, its forward price-to-earnings ratio is not meaningful. Therefore, the best metric currently to value its shares is EV/revenue, which is now trading at some 3.8x forward revenue, which is above its historical valuation over the past five years (2.4x forward revenue).

Considering that a potential recovery is not certain and current medium-term estimates are quite bullish, plus the impact of China’s ban on its chips is still uncertain but can be quite significant, I don’t see Micron’s current valuation as being attractive right now.

Conclusion

Micron’s operating momentum remains weak and the prospects of recovery are highly uncertain, despite the company’s talk about a potential bottom in the cycle, with China’s ban being potentially another headwind that can have a significant impact on Micron’s revenue and earnings growth ahead. Given that its valuation is not particularly attractive right now, I’ll remain on the sidelines regarding Micron stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you are a long-term investor and want to be exposed to several secular growth trends, check out my marketplace service focused on different secular growth themes, namely: Digital Payments/FinTech, Semiconductors, 5G/IoT/Big Data, Electric Vehicles, and the Metaverse. If this is something that you may be interested in sign up today.