Tesla Stock: Get Off The High (Risk) Way

Summary:

- We remain sell-rated on Tesla stock, as we believe the company’s 132% YTD rally is not driven by fundamentals and believe the stock doesn’t present a favorable risk-reward profile in 2H23.

- We expect Tesla’s financials to be under pressure due to the price cut strategy, despite Musk’s recent efforts to raise prices back up.

- The company is also facing increased heat from the competition in Europe and China, and we see Tesla’s market share shrinking toward 2026.

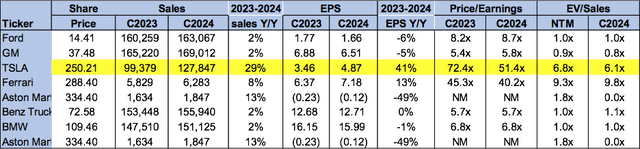

- Additionally, the stock is trading at unjustified premium multiples, trading at 6.1x EV/C2024 sales versus the peer group average of 3.3x.

- We might’ve been early with our sell rating previously, but nevertheless see Tesla stock deflating in 2H23; we recommend investors count their profits and explore favorable exit points out of the stock.

Teamjackson

Tesla, Inc. (NASDAQ:TSLA) is gradually giving back gains from its YTD rally, dropping roughly 9% over the past five days. We maintain our sell rating on the stock; we might’ve been too early to the bearish party with our sell rating late last year, but we continue to see a downside for the stock. We don’t believe fundamentals drove the YTD rally.

Following a fundamental analysis of Tesla, the stock appears to be overvalued, and the company’s margins are contracting due to CEO Elon Musk’s price-cut strategy. The price cut strategy failed to boost demand significantly, and macro pressures continue to weigh on consumer spending. More recently, supply issues have triggered fears of a lithium shortage.

We’re bullish on the electric vehicle (“EV”) alpha in the long run but don’t see the stock working in the near term. We recommend investors explore exit points at current levels.

Can’t ignore the margins, or the threat of shrinking share

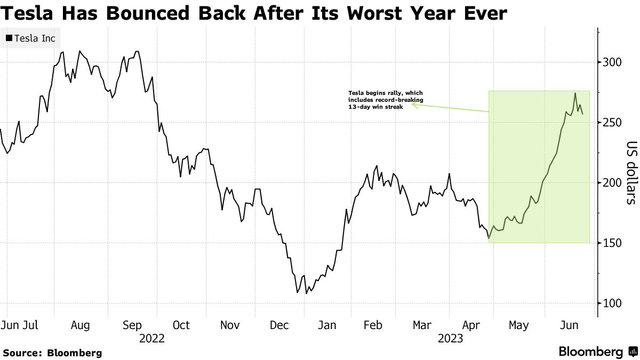

The stock has remarkably bounced back from its worst year, dropping 65% in 2022. Shares have more than doubled this year, with the stock up 131% YTD, outperforming the S&P 500 (SP500) by around 116%. We’re now seeing signs of the company’s rally unraveling, as we believe the stock has become overbought on optimism of Tesla’s A.I. capabilities and share expansion after price cuts.

The following graph outlines Tesla’s stock performance from 2022-2023.

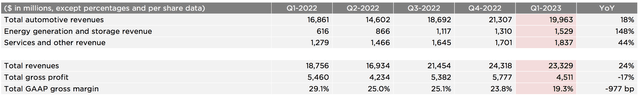

The company’s gross margins are paying the price for Tesla’s price cut strategy; the company reported a total GAAP gross margin of 19.3% compared to estimates of 22.4%, marking the lowest gross profit margin since 4Q20. Musk favored higher sales to higher margins (growth over profits) but has recently been tinkering to raise prices back up. Tesla’s price cuts reduced the costs of buying Model 3 and Model Y vehicles in hopes of boosting consumer demand under macro headwinds constraining consumer spending. In our opinion, the price cut strategy is also Musk’s attempt to retain and expand Tesla’s share in the EV market as competition intensifies and after the S&P forecasted the company’s share to decline to less than 20% by 2025 compared to a share of 79% in 2020.

Interestingly, the company began raising vehicle prices back up in May, including Model 3 and Model Y, in the U.S., Canada, Japan, and China. Still, the price of Tesla’s vehicles remains lower than at the start of the year. The company is visibly modifying prices to react to the macro backdrop, and some analysts believe the company has triggered a price war with competition.

The bottom line, however, is that Musk’s price cuts have failed to boost demand significantly; production still outweighed delivery last quarter. The company’s share of the EV market is also unsafe; Bank of America (BAC) analysts estimate the company’s share to drop to 18% by 2026, a substantial drop from Tesla’s share of 62% just last year. Tesla has a surplus of supply issue as production levels outpace deliveries for the past four quarters. The following chart outlines Tesla’s production versus deliveries for 1Q23.

Tesla 1Q23 Production and Deliveries

Additionally, the price cuts put pressure on margins per vehicle. The company’s total gross margin profit has dropped Y/Y and sequentially. Total revenue from automotive sales dropped sequentially to 19,963M from 21,307M despite the price cuts. Based on these numbers, we continue to believe the stock’s rally is not driven by the fundamentals but by market noise and see the stock giving back gains in 2H23. The following chart outlines Tesla’s earnings for 1Q23.

All eyes on the Chinese market

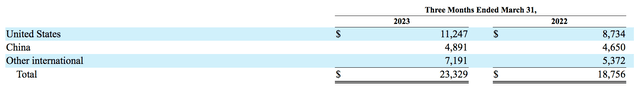

Tesla’s commercial opportunity expands as EV adoption snowballs and regulations encourage the public to transition from the Internal Combustion Engines (ICE) to EVs. Revenue from the EV market is projected to grow at a CAGR of 10.07% between 2023-2028; the market expansion means more demand for Tesla but also more competition. The company faces the stiffest competition in the Chinese markets from BYD Company (OTCPK:BYDDF), NIO (NIO), Li Auto (LI), XPeng (XPEV), and other EV startups. Tesla derived around 21% of total revenues by geography from China in 1Q23, so intensifying competition in the Chinese market – currently the largest market for EVs – requires investors’ attention.

The following chart shows revenues by geographic area based on the sales location (in millions):

Musk is also eyeing India; the company’s management met with India’s Prime Minister to discuss expansion, with India “pushing the car market to make a ‘significant investment’ in the country.” The move could be highly fruitful for Tesla and reduce the cost of car production, aiding in maintaining a positive cash flow, but we still don’t see saving the stock from near-term headwinds in 2H23.

Valuation

Tesla stock is overvalued and trading at unjustified premium multiples. On a P/E basis, the stock is trading at 51.4x C2024 EPS $4.87 compared to the peer group average of 19.7x. The stock is trading at 6.1x EV/C2024 sales versus the peer group average of 3.3x. We don’t believe Tesla is being fairly valued as a growth stock, with the high valuation factoring in future earnings under a rough macro environment and as Tesla’s margins are under pressure. We believe the market is giving Tesla too much credit for its longer-term prospects. We see favorable exit points at current levels and recommend investors exit the stock and revisit toward the end of the year once macro headwinds have been factored in.

The following chart outlines Tesla’s valuation against the peer group.

Word on Wall Street

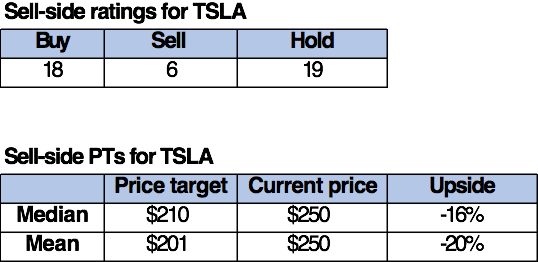

Wall Street is surprisingly bearish on the stock. Of the 43 analysts covering the stock, 18 are buy-rated, 19 are hold-rated, and the remaining are sell-rated. We’re seeing analysts shift to a more bearish sentiment on Tesla over the past month; Goldman Sachs Group (GS) became the fourth to join the bears as Mark Delaney downgraded his recommendation to neutral from buy. We see the market sentiment on Tesla turning less bullish, further confirming our expectations of downside for the company in 2H23.

The stock is priced at $250 per share. The median sell-side price target is $210, while the mean is $201, with a potential downside of 16-20%.

The following charts outline Tesla’s sell-side ratings and price targets.

TSP

What to do with the stock

We continue to be sell-rated on Tesla, Inc. stock – we’re bullish on Tesla in the longer run, but we see a downside in 2H23 and recommend investors count their profits at current levels and explore exit points out of the stock. We recognize we were too early in our sell rating but still see the stock coming down due to fundamental issues pressuring margins, intensifying competition, and macro headwinds weighing on end-market demand. We also expect potential lithium shortages ahead as the EV market expands due to “delays in mine permitting, labor shortage, and high inflation.” We recommend investors take advantage of the YTD rally and explore Tesla’s favorable exit points at current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2-week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2-week free trial, so we hope to see you in our group soon.