Summary:

- Over the past two months, Nvidia Corporation’s market capitalization has ballooned over $300 billion.

- Geopolitical and regulatory risks introduce uncertainty about whether or not the company will be able to sell products unimpeded overseas.

- We believe the market is current pricing Nvidia Corporation stock under a best-of-all-worlds scenario.

Justin Sullivan

How High?

As even a casual reader of the financial press knows, artificial intelligence [AI] is the current thing. Other things in the recent past have occupied the top spot (cryptocurrency, augmented and virtual reality, etc.), but today, AI takes the top spot. As such, any company even peripherally associated with AI enjoys prominence among investors, and it’s difficult to come across a conference call transcript from companies in tech that doesn’t contain gratuitous mentions of the new technology.

Enter Nvidia Corporation (NASDAQ:NVDA), the American chip-designing company that has been thrust squarely into the AI spotlight due to the (somewhat accidental) ability of its chips to power the new technology. We say somewhat accidental because the primary chip designed by Nvidia–the H100–was originally designed for graphics processing (known as a Graphics Processing Unit, or GPU) in games, and was found to be particularly well-suited for executing AI applications. The unit itself is an engineering marvel for sure, containing more than 80 billion (yes, billion with a b) transistors.

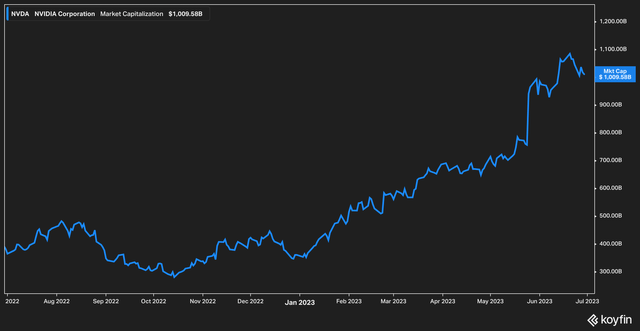

The market has handsomely rewarded Nvidia’s newfound business application, pushing its market cap near $1 trillion in recent weeks.

A close look at the chart reveals that investors piling into the company have pushed the company’s market capitalization up by about $300 billion since March 2023.

Forward valuations have also exploded over the last year, with the company currently traded at around 45x forward earnings and 50x EV/EBITDA (we should mention these figures are down from their trailing twelve-month highs of 69x and 75x, respectively).

Putting the hype aside, prudent investors should ask whether or not the fundamentals of the business justify these sky-high metrics. Let’s dive in.

The Business

First, some basics. Nvidia is a fabless semiconductor company, which means that it does not actually manufacture any of its products. Page 9 of the company’s most recent 10-K spells this out:

“We do not manufacture semiconductors used for our products. Instead, we utilize a fabless manufacturing strategy, whereby we employ key suppliers for all phases of the manufacturing process, including wafer fabrication, assembly, testing, and packaging.”

Of course, there is nothing wrong with running a fabless operation–to the contrary, it allows Nvidia to focus on what it does best, which is the design of semiconductors, while also freeing the company from having to tie up precious capital in costly manufacturing plants. The downside, of course, is that the company is reliant on third-party manufacturers, which can expose the company to a number of risks, including geopolitical ones (more on that later).

For its actual business, Nvidia reports two segments: Compute & Networking, which includes products for data centers, the automotive industry, and AI applications, and Graphics, which includes GPUs for gaming PCs, as well as could be based and virtual computing applications. (Note: neither of these lists are exhaustive).

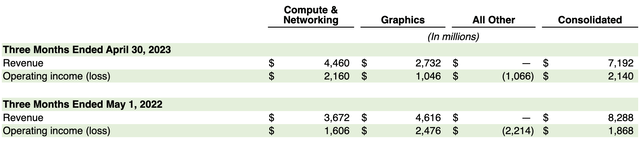

Until recently, Graphics was the prominent business unit at Nvidia and was only recently displaced by Compute & Networking.

As the above revenue by segment graph from the company’s most recent 10-Q illustrates, the two business units have essentially traded places over the last year. The primary reason for the decline in Nvidia’s Graphics business has been decreases in revenue generation from China as well as an inventory glut that Nvidia has had to (and continues to) work through.

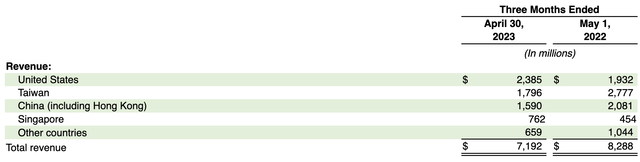

Important for investors to know as well is Nvidia’s geographical revenue mix.

As the above chart illustrates, Nvidia derived only 33% of its sales from the United States in the first quarter, with the other 67% coming from other countries, primarily Taiwan and China.

This, of course, matters since the United States government has grown increasingly worried about the transfer of sensitive technologies (which includes semiconductors) overseas, and to China in particular. Unfortunately for Nvidia, some of its products (specifically the A800 chip) are in the crosshairs of U.S. regulators.

Although Nvidia’s CFO believes that the proposed regulations will not propose a material impact to Nvidia’s revenue, we are not so sanguine. Around the world, governments are reassessing the benefits and drawbacks of globalization, with the recent memory of COVID and the first ground war in Europe in over eighty years–in our view, it is likely that countries will behave more stingily with critical technologies in the future than in decades past. We also want to reiterate that a majority of Nvidia’s revenue is derived from international business. It is unclear to us exactly how Nvidia could escape a substantial impact to its revenue should regulators clamp down on the company.

Even as we wonder whether or not the entire global economy will be open for Nvidia, we must also consider whether the potential market for its products is enough to justify the current valuation and market capitalization.

In a recent Barron’s article, NYU professor of finance Aswath Damodaran commented on his thoughts regarding Nvidia’s recent ballooning market capitalization and the outlook for its business:

[Damadoran] estimates that Nvidia has an 80% share of a $25 billion AI chip market today, and the most bullish assumptions put the size of the market at $350 billion in a decade. Even assuming 100% future market share, he wasn’t able to get to a value closer than 20% below Nvidia’s recent price. “I love Nvidia as a company,” he says. “But as an investment at $400-plus per share, I just can’t get there.”

The Bottom Line

For Nvidia, we take a version of the old investing adage that a great company can present a bad investment. While it is indisputable, in our view, that Nvidia possesses the most cutting edge in the design of chips for AI applications today, we believe that the current valuation reflects a world in which no competition could emerge to challenge its place, that no government or geopolitical risks (whether those be regulatory, war, etc.) could disrupt their operations, and that no technological disruption will unseat AI as the current ‘thing’ in the markets and impede the future growth of the addressable market.

In short, it seems to us that the market has priced a best-of-all-worlds scenario into Nvidia’s stock, and so we are staying away for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.