Summary:

- Bob Chapek’s firing poses one question: why did it take so long for the Disney board to realize he was not the guy to succeed Robert Iger?

- Disney may be too big to go forward in the new post pandemic world where all entertainment business models face daunting challenges.

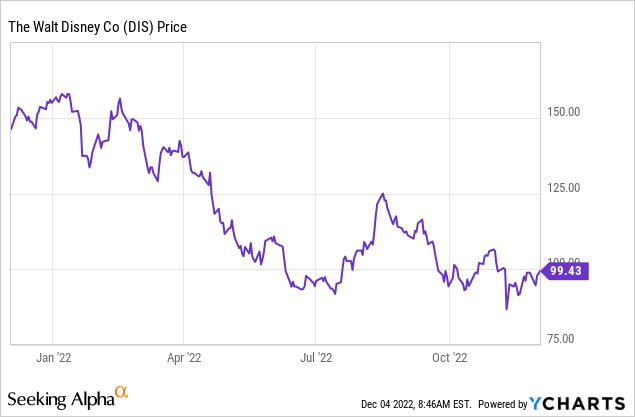

- Even at ~$100, The Walt Disney Company stock may be overvalued until Mr. Market begins to believe in changes that may not materialize for years.

Bastiaan Slabbers

It’s kind of a smelly cliché, but with apologies we invoke it here regarding stock dive of The Walt Disney Company (NYSE:DIS): The fish rots from the head down. No it’s not an aphorism that came from corporate America or the mafia of old. But old it is. The phrase originated from a Turkish philosopher, who in 1273 noted in one of his writings that a fish begins to rot from the head down as indicative of a bad sultanate’s leadership. It has not lost its meaning. Its wisdom as they say, has legs.

The retirement of Robert Iger followed by the appointment of Bob Chapek was not, as many may think, the head of the rotting Disney fish. Those two guys were closer to the gills. The head lies in the comfy, cozy, precincts of the company’s board, insulated by decades of immense success that waned but was then revived by the reigns of Eisner and Katzenberg in the eighties. The board needs fresh blood with strong entertainment chops that sees past the sector crisis.

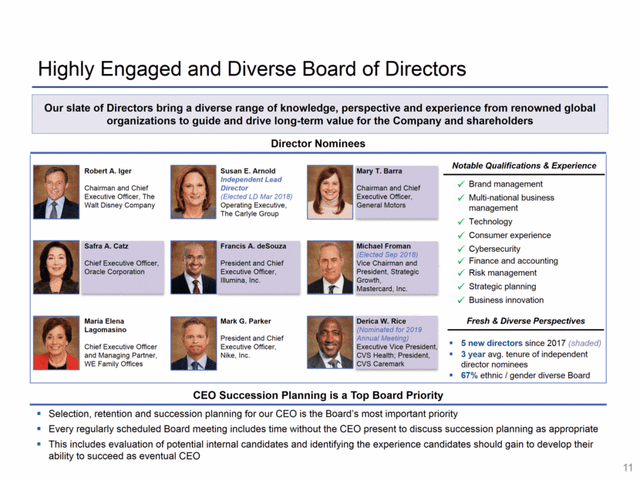

The board that ultimately emerged post-Eisner was constructed to be safely diverse under Iger. It is an assemblage of notables, picked for who they are, vs. how they can represent shareholders best interests. But apparently not one of them has another Mickey Mouse or Spiderman buzzing around in his or her head.

Above: The Disney board that talked a good succession planning game still wound up hiring and firing Iger’s successor, who apparently failed.

The hard edge of truth: this is a stock supported near $100 by investors who refuse to believe its business model is broken by events now and those to come in a not-very-brave, shaky, new world just over the horizon. Compare valuations as to what Mr. Market is paying for competitors in streaming, for example. They all face the same headwinds to a greater or lesser extent going forward. None are as multi-faceted as Disney of course. None have the Disney scale. What is telling here is that the money is now bet on the true purist of play in the sector: Netflix (NFLX). And that faces similar secular headwinds as well.

Netflix, Inc.: at $291.50 –a pure play in streaming.

Paramount Global (PARA): at $19.60, a jumble similar to Disney yet to be rationalized and really understood by the market.

Warner Bros. Discovery, Inc. (WBD): at $11.34, another jumble early in the process of sorting out what it wants to be going forward.

This is not deep-dive analytics for sure, but the valuations appear to be telling us that a pure play in streaming promises the best potential rewards in earnings if and when current headwinds come under control. Disney dwarfs them all on a macro basis, but on a relative value basis, is it a $98 stock? A $150 stock? How much would a slimmed down, cash-rich Disney be worth relative to competitive peers?

Stipulation: Taken as possessors of golden resumes, this Disney board is clearly composed of individuals of intelligence, accomplishment, and good intentions. But what does that mean to kids and parents who aren’t impressed by their lofty CVs or their diversity?

But when you assemble this glittering group of corporate high achievers in a board room to endorse a topmost leadership change for a company, the caution light should begin to blink. Irrelevance is what this once great company faces unless we can see a smart U-turn that reflects reality.

No, it’s not the dream world in which these very accomplished board members apparently live as evidence of greenlighting the hiring of Chapek to begin with. His toss from shiny heir to Iger to a place under the bus speaks volumes about this board’s ability to define the Disney future and address its challenges.

Are they no different than many boards these days? A gathering of golden resume leaders, an impressive, diverse, body of people selected to be representative of population groups. Are they not much more than a PR echo chamber in a friendly media cauldron living in an ESG dreamland? The underlying belief that doing well by “doing good” is a nice, but badly flawed idea seem to permeate many policies.

ESG, for all its well-meaning tropes, is an unproven policy initiative by corporations. It’s mostly talk, tough to implement, even harder to measure. Disney is drenched in it, as are many corporations today that are led by the nose by the pied pipers of fancy NGO’s or pressure groups. Chapek’s tussle with Florida and a few woke policies was part of his undoing.

Is the Disney board now exposed as just another body of rubber stampers of decisions by their politically deft operatives who populate the c-suite? That reality to a degree is the palpable ignition that has fired the fortune of Carl Icahn: like a heat-seeking missile, he has always laser-beamed the corporate landscape for boards like this or their hench-people. Chapek was pushed by Iger to a board that should have demanded someone new.

Pre-pandemic, pre-streaming assault, the sector was a different world. And the Disney business model worked. That world is now broken, and the guys at the helm of the old world are not the guys to steer it through the choppy new waters.

That’s where the head of the fish begins to stink. And if Disney is to endure past the current sector crisis, it needs more than a golden resume board to defend and thrive through the mess. It was this board who greenlit Chapek to succeed Iger. It was this board that worshiped Iger during many years of his reign—but then business was good, so who cared?

What is at work here today at the board level, and what has been a prevailing sense of invulnerability built up over decades of outstanding corporate success, is complacency. Hide behind diversity, shelter under the welcome arms of mediocracy. It seems like a current disease run rampant in the sector. Overpay for content, overstuff bureaucracy, reach for conventional wisdom solutions often that have little chance to succeed.

So, we have this board of presumably capable leaders acting as if they are protective of some set of international standards of civic virtue, not what is best for investors as the challenges pile up and the do-do gets deeper in a sector under fire by bored consumers.

Consider the gallery of Disney board member career backgrounds

Investment banking, money management, Nike and Lululuemon, Oracle, Obama lawyer, CVS/Target finance, Cisco, Biotech, etc. You get the picture. Amazing that with all these tech business geniuses on the board, Disney still hasn’t figured out how to make real money consistently in the digital world without spending itself into colossal debt.

Where are the Pixar guys on the board? Yes, their track record lately hasn’t been perfect, but it’s still ranks as a huge producer of winners over time. Periodic dogs are part of the output of any maker of blockbusters over time, especially when social justice delusions infiltrate the creative process, as it has with Disney. Preachiness infiltrated into Disney films and tv shows is probably not what viewers tune in for even in these days.

The Disney tent poles in superheroes, legacy Walt characters, movies, and library were the creation of young cartoonists in the boroughs of New York working for $20 a page 80 years ago. Walt and his top people built money-makers from mice, ducks, dogs, and fairy tales, reimagined and gave them life in theme parks.

But those foundational bricks began to be chipped away by time by the seventies. So, back in the day, Roy Disney reached for the dynamic duo without capes, ABC’s Eisner and Katzenberg, who not only saved Disney, but planted the seeds for an even greater Disney to come. They were to-the-gut, entertainment guys. That’s to a great degree why The Lion King and Toy Story happened and why it remains a tent pole till this day. They handed off to Iger, who built by acquisition.

Its certain the Disney board is given tons of analytics to mull over at presentations. Yet they stand embarrassed to first choose and then gush over Chapek, and before the ink is really dry on his contract, approve his journey under the bus.

The WSJ reports that Iger had been stirring the Disney pot like even after Chapek arrived, implying that the company’s choice of successor was a colossal flop.

No better choice out there? Iger was a good steward, who served during a happy prosperity—not much more. He’s an improvement, not a solution now. Best to him, but we’re not counting the shiny new nickels yet. His own record was mixed to be truthful, but on balance a plus. He had a huge wallet to surf the buffet of available acquisitions.

His much lauded tenure had ups and downs mostly hidden beneath the macro good times rolling for all. Most of all, the massive debt rolled up during his reign that still eludes solution. It is a legacy not easily borne by whomever ultimately succeeds his second time around trip. Example: he bought Pixar, great move, but where is a single Pixar creative brain sitting on the board? Are they stalling out? Do they need leadership from above? Very pesky, these geniuses. Apparently there was no room at the inn for anyone who has actually created anything.

The Iger track record: a few highlights and lowlights

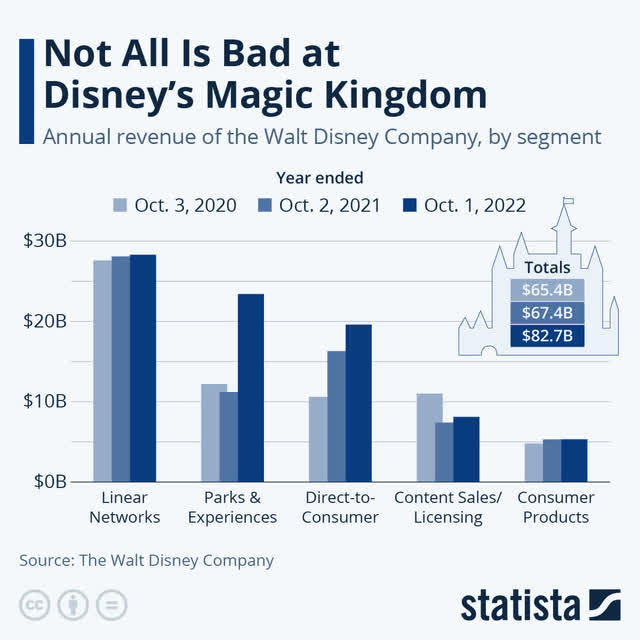

Above: Disney needs to seriously consider compressing its business into a more manageable, focused core entertainment entry.

Star Wars buy: Questionable long-term value. Too far from original 1977 debut of first film. Over-marketed, bad results.

Shanghai Disney: in 2016, a natural, but a long-coveted market by successive Disney executives at many levels. Debuted when China per capita GDP was at a high. Hostage to covid for years to come thanks to Xi Jinping’s dictatorship. It’s a waiting game.

21st Century Fox: Overpaid by a wide margin $71.3b for assets that included regional sports networks of so-so value.

Disney+: a great launch, but high cost of content production remains a long-term stake in the heart for all streamers.

Hulu: a good move. However, flush in the middle of the great unresolved issues of streaming, ad pollution needed to compensate for limits of subscriber fees goes against the very soul of what created streaming: freedom from ads among them.

Black Panther tent pole: a solid win. Note that U.S. attendance numbers overweight dependence on African-American audiences, which accounted for over 31% of U.S. ticket sales from a population segment of 13.6%. That’s good marketing, to be sure. It’s a great franchise in the making, but in the longer run might begin to be confronted by big-time copycat productions.

Chapek inherited $45b in debt and $13b in liabilities mostly accrued during the Iger era, but to be fair, strong earnings growth during the period were probably bought at far too high a price in terms of what has happened to the business model. Gigantism in the media/entertainment business began in the 1990s and has outlived its business model value. The board watched mute as internal struggles between cost-cutters and content chiefs erupted into warfare and was clearly one of the situations that triggered the return of Iger.

What makes more sense today is a more compact, lower gross revenue, higher operating profit company with fewer fingers in fewer pies. As a denizen once of the c-suite, I attest to one prevailing truth in scale: it’s all about span of control. Bigness is Disney’s biggest asset and its worst enemy. In fairness, nobody saw the pandemic coming. But once it came, succor was not to be found in putting old wine in new bottles.

There is no easy answer, but: selling ESPN is priority one, and two, possibly unloading the cruise business as well are the only realistic moves to get out from under oppressive debt at a faster pace.

Activist investor Dan Loeb saw the clear writing on the wall, made his pitch, but caved before he could lead the much-needed rebellion among many key holders. It’s time to sell not only ESPN, but consider unloading Disney Cruises as well. Sell and use the proceeds for a frontal attack on the lingering disease of excess debt that inhibits its ability to generate more profits from its core, businesses.

We’ve heard more than enough conventional wisdom about investing a tidal wave of billions into content people “will love” as the cant of earnings calls plays out. How does anyone know what the people will love until those people vote with their wallets? The content junk pile of all entertainment giants continues to grow higher by the year.

It seems a better idea to go for the gusto here. Rather than wait three years of a runaway cost development cycle from idea to screen on most streaming content projects, you pick up the phone, call your nearest investment banker, and hang up the for-sale sign on the sports media giant.

ESPN has a perceived value of $50b against its annual $4b in revenues. Other formulae are less generous using a 3X revenue valuation ($12b). The sports network is currently still a viable media property. But that isn’t likely to last. Their subscriber base has been slowly eroding over the last several years. If it continues to erode, bit by bit, its value to a buyer will drop, so the time to move now is essential. It’s also become a woke megaphone. That might be one reason some segments of viewers have fled.

The long shilly-shally of ESPN rolling up their sleeves and getting into the mud wrestling of sports betting is long overdue. They’ve got a built-in gold mine that will take a lot of digging but eventually yield EBITDA gold. Profit is still elusive in the sector, but there is little doubt an ESPN sports betting site can join the top tier ranks of platforms in the space. Get the cash, call the banks, prepay the debt big time. Through the sports betting explosion since 2018, Disney has been in “hamada hamada hamada” mode. The board hasn’t seemed to press the issue enough to move management.

There are only a few priorities here that Iger and his new hench people need to wrestle to the ground before any big time “restructuring.” Before anything, replace a handful of board members with Pixar folk and other pixies who know what kids love most.

Sell ESPN and the cruise businesses. Perhaps ABC as well. Needed: a hard decision about the future, if any, of broadcast TV as we know it now. Alternatively, consider spinning off the verticals. Selling, spinning, or closing all fringe businesses with the objective of creating a new Disney comprised of the studio, the theme parks and the streaming channel. Everything else can go no matter how much revenue they may contribute. Getting the massive $46b in debt repaid on the speed lane. The company has been chipping away since 2020—fine. But it’s too little, too late to bring it down to a really viable level against free cash flow trimmed down to produce growing EBITDA in the next five years.

We think we could set a goal of getting the debt down within three years under $25b if – and I repeat if – assets can be sold or spun off. Use the proceeds to reduce debt rather than stuff the content channels with an ever-rising pile of electronic garbage hoping the periodic appearance of a blockbuster will compensate for all the development misfires. It’s the nature of the business that you can spend yourself into the fiscal grave in pursuit of blockbusters.

Hits are the relief pitchers of the media league and have saved many a game. Good going to those green lighters of blockbusters. But sorry, your golden era is passing fast. Hard to compete with a funny cat video on You Tube that’s free and attracts 15 million views in a matter of seconds. Or a full 90-minute movie two fifteen-year-old kids with imagination can shoot in an iPhone in a matter of days. Cast, sets, props: high school buddies, the neighborhood, and dad’s lawnmower the cost. Sorry, but that’s the new world we live in. And it’s coming on fast.

Anatomy of a great company to come: Simple math

LT debt at writing: $45b.

Liabilities $13b.

Annual interest cost: $1.3b, average cost 3%. Good, but not great by any measure considering maturities if free cash flow does not grow in sectors with rapidly rising costs from competitive battles for streaming eyeball subscriptions.

Current ratio: 1.06, okay but a bit iffy long term.

Disney has lost $1.5b on streaming to date. Stopping the bleeding on that alone would constitute a triumphal return for Iger for openers. It won’t be a cakewalk for him, but in fairness, nor will it be any easier for Disney competitors.

Cleaning out the Augean stables of excess labor and tightening the span of control is a great place to begin. Selling off assets like ESPN and the cruise businesses, and perhaps even ABC, can produce proceeds that are then diverted to pay down debt at triple the speed – this is job two. Job three is figuring out how to make money in streaming that does not come and go with the latest free trial or low-priced promotion when hot new content arrives.

Lastly, a frontal attack on content costs and the process of creating it needs to begin with a cool assessment of the time and money factor against real-world eyeball limitations. That process overseen by a board with a handful of members with entertainment chops seems like the best odds on creating a new Disney that once more will dazzle on the bottom line and value the stock at a level it deserves.

Iger’s return has evoked applause by employees despite the fact that much of what ails Disney at the moment is rooted in events and trends that began under his stewardship. Betting on Disney stock under Iger has its positives. It is not a band-aid, nor is it a certain cure. We presume Iger has enough smarts to give a good hard look at the board and accept a few resignations so he can replace those worthies with ground-rooting pros in the business of “telling stories” people want to hear and costs that make sense for the bottom line.

Our real world Disney price target: $78–$80 going into a recession. On the recovery side, perhaps a new act emerges with clarity that Mr. Market will believe in long range. And then the shares begin to look as good as they did in a pre-pandemic world.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

For in-depth and deep dive research on the casino and gaming sector, subscribe to The House Edge. New: Free excerpts from our book in progress "The Smartest ever Guide to Gaming Stocks" – free to existing members and new subscribers.