Summary:

- Shares of 2U fell more than 5% after reporting Q2 results and issuing lackluster guidance, adding to a painful >50% correction year to date.

- The company is massively restructuring its business to unite under the edX brand, which the company bought last November for $800 million.

- Meanwhile, 2U’s revenue-generating degree programs are seeing declining enrollment.

- The company plans to slash marketing spend to save profitability, which may lead to more enrollment declines.

damircudic

The good part about an all-encompassing market correction: wheat gets separated from chaff. 2U (NASDAQ:TWOU), in my view, has long been an overvalued and overhyped ed-tech stock (if we can even call it that, instead of a for-profit university!) that was long in need of a correction. This year, with investors’ sentiment toward growth stocks turning more skeptical, 2U has fallen cleanly off its pedestal with its declining fundamentals moving to the spotlight.

For investors who are unfamiliar with the latest in 2U: 2U began as a company that set up graduate degree programs on behalf of universities. It digitized course content for these programs, took on the responsibility of marketing these programs to potential students, and then took a cut of the tuition fee that it splits with universities (in its current structure, 2U’s cut of tuition begins at a base of 35%, per CEO Chip Paucek’s remarks on the Q2 earnings call).

This business model came under fire over the past year. No less than the Wall Street Journal published a critique of 2U and its partner universities for marketing expensive degree programs that saddled students with crippling debt with limited prospects for higher income. In an effort to try to re-steer its brand, last November 2U spent $800 million to acquire edX, previously a non-profit open online course website began by Harvard. It’s now doubling down on edX and proposing to move its entire business to a “platform” model under the edX umbrella.

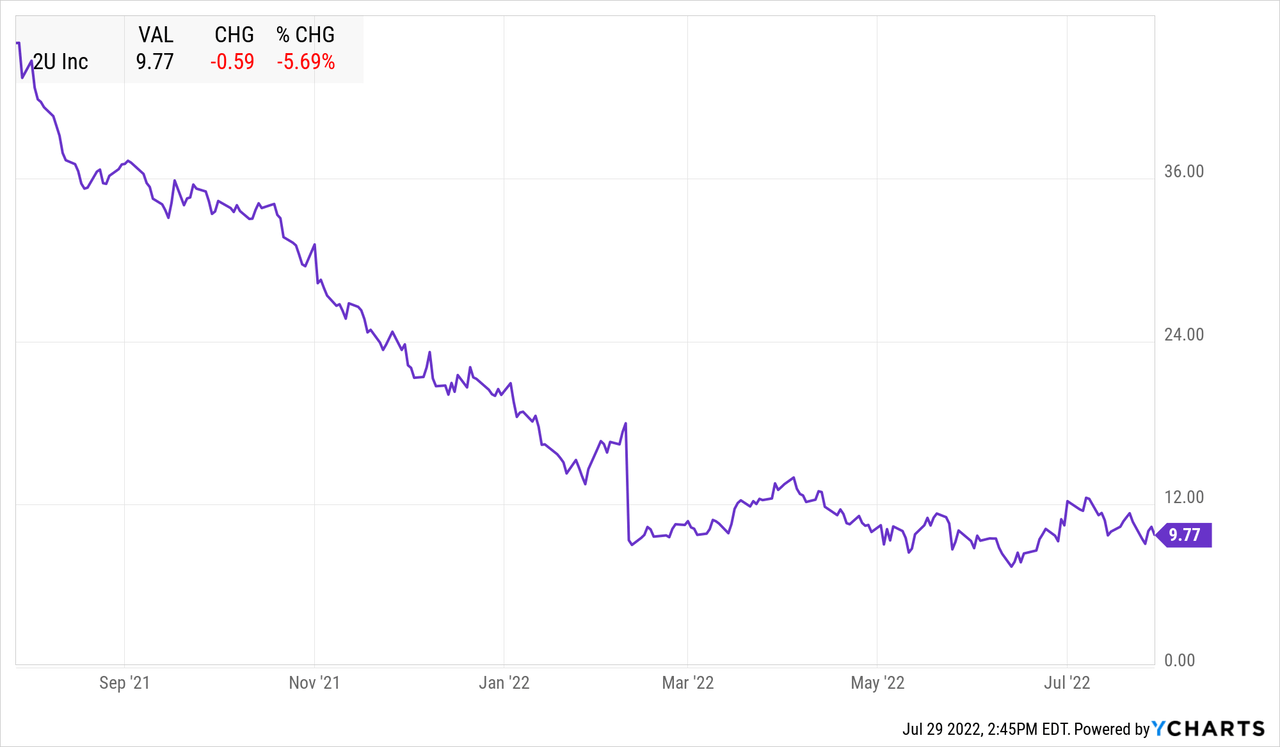

Year to date, shares of 2U have shed more than 50% of their value, and losses picked up steam after the company reported dismal Q2 results. The market’s faith in 2U’s ability to rebound is slipping heavily:

Data by YCharts

2U is restructuring itself in crisis mode

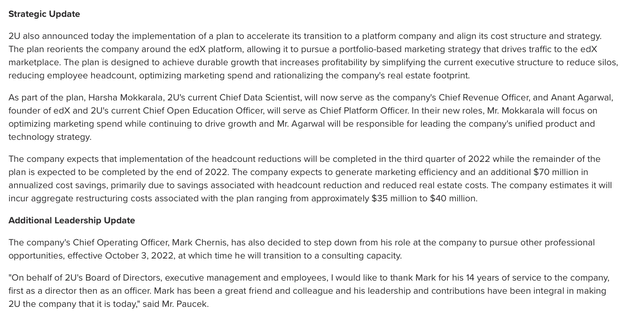

We’ll get into 2U’s latest numbers and declining enrollment stats shortly, but let’s review the forward-looking situation first. 2U is fighting to shore up the strength of its brand name, and its strategy for doing that is to convert into a “platform” company under the stronger edX brand. As part of this change, 2U is moving the prior CEO of edX, Anant Agrawal, into a “Chief Platform Officer” role, among other management reshuffles. The key benefit of one platform, aside from the unified branding, is consolidating operating expenses and marketing expenses under one umbrella. The company is also planning on reducing headcount by about 20% in Q3, as it eliminates redundancies between the two groups.

2U strategic update (2U Q2 earnings release)

That’s all fine and well, but there are a number of risks that we should be mindful of:

- Integration complexity. Integrating two vastly different businesses is never an easy task, and 2U’s share price decline is a signal that Wall Street’s faith in the company’s ability to do so is questionable.

- Diluted branding. edX has always had a strong reputation for mostly free online course content (with smaller tuition fees for courses that offer credentials). Putting 2U’s degree programs under this umbrella may sacrifice the goodwill the company spent significant money to acquire.

- Macro pressure. With inflation heating up and hiring seeming to tighten, and with 2U already under pressure for incredibly expensive degree programs with low proven yield, enrollment trends may continue to decline.

The bottom line here: I remain quite bearish on 2U’s prospects. This was always a weak model to begin with: the company shoulders all the costs of setting up and marketing its degree programs, and with bad press nailing 2U over the past few years, the return on that significant upfront investment is dwindling.

Resist the temptation to buy the dip here – 2U’s chances to rebound look murkier with every passing quarter.

Q2 is the continuation of a disappointing story

As previously mentioned, 2U’s second-quarter results failed to inspire any new confidence in the stock, and it dropped a fresh ~5% after results were released. Let’s now talk through some of the key highlights and red flags:

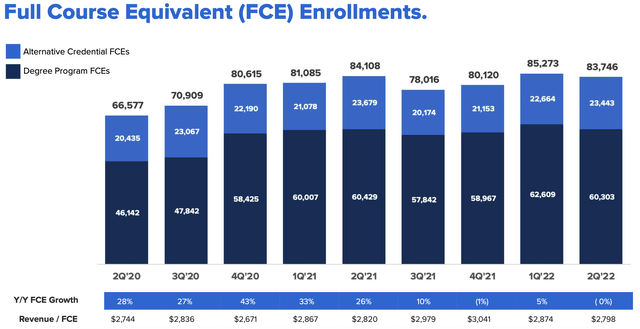

2U enrollment trends (2U Q2 investor presentation)

2U’s full-course equivalent enrollments dropped by ~1.5k to 83.7k in the second quarter flat to last year. Note that this is unusual seasonality for 2U, which last year saw enrollment growth between Q1 and Q2.

The company admitted to seeing tremendous pressure during the quarter. Per CEO Chip Paucek’s prepared remarks on the Q2 earnings call:

Simultaneously, while that was going on during the current quarter, the macroeconomic environment that we talked about on the Q1 call deteriorated further. This put additional pressure on our normal way of doing business, and also on organic demand, within all of online education, with some particular challenges in higher education.

The combination of these three things, one, increasing confidence in our strategy; two, a realization of the need to fully reorganized to unlock; and three, a deteriorating macro environment drove us to make more immediate transition to the platform strategy. We believe that accelerating our transition to a platform company will strengthen our foundation and long-term sustainability by driving long-term profitability and cash flow.”

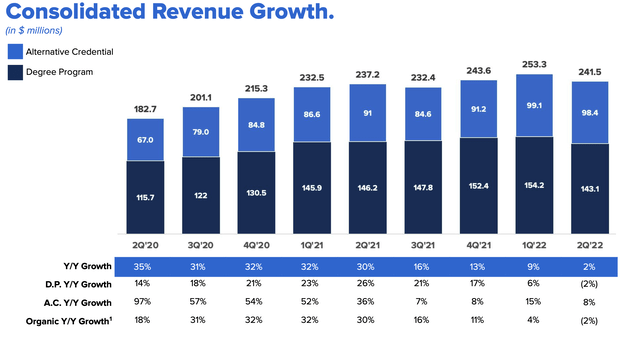

Similarly, revenue growth slowed to 2% y/y, hitting $241.5 million in the quarter – missing Wall Street’s mark of $254.3 million (+7% y/y) by a wide five-point margin, while also decelerating seven points versus 9% y/y growth in Q1. This was, in addition, the fifth straight quarter of revenue declaration for 2U.

2U revenue trends (2U Q2 investor presentation)

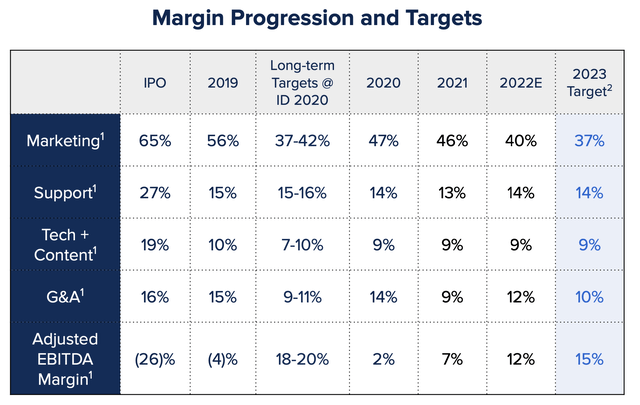

Note that aside from the 20% headcount reduction, 2U’s big plan for resuscitating its profitability is to consolidate and simplify marketing spend. As shown in the chart below, in 2023 it intends to reduce marketing spend by three points as a percentage of revenue.

2U margin targets (2U Q2 investor presentation)

It also intends to eliminate product-level marketing spend and focus more on advertising the edX brand. Per Paucek’s earnings call remarks on his vision for brand marketing going forward:

Marketing investment decisions will be made at the platform level, aggregated across business lines with the goal of increasing the lifetime value of each learner. This does not mean that there’ll be no more product level marketing, but we now have a world-class platform that allows us to do so more efficiently and as part of a unified strategy.”

While consolidating under one brand will certainly help streamline the company’s spend, there may be risk that the strategy shift may further exacerbate recent enrollment declines (as heavy upfront marketing has always been core to 2U’s playbook for drawing in enrollees).

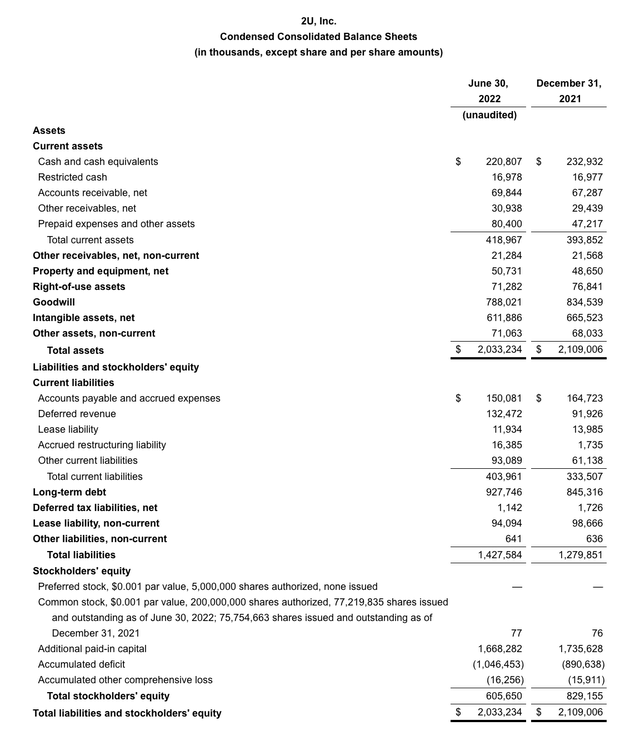

Lastly, a note on 2U’s balance sheet: as of the end of Q2, the company has $220.8 million of cash against $927.7 million of debt, or $706.9 million of net debt.

2U balance sheet (2U Q2 earnings release)

Guidance for 2022, meanwhile, calls for adjusted EBITDA of between $105-$115 million – which means at the midpoint, 2U is levered at a 6.4x net debt/FY22E adjusted EBITDA ratio. Needless to say, that’s an incredibly high leverage profile, especially for a company whose business is undergoing such seismic change.

Key takeaways

The sand is shifting under 2U’s feet, and investors are rightly pulling out of this name as enrollment declines and the company embarks on a sweeping business re-org that may or may not produce the intended results. There are far better beaten-down tech stocks to invest in at the moment. Stay on the sidelines here.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

For a live pulse of how tech stock valuations are moving, as well as exclusive in-depth ideas and direct access to Gary Alexander, subscribe to the Daily Tech Download. Highly curated focus list has consistently netted winning trades of 40%+.