Summary:

- 360 DigiTech, Inc. is a credit-tech platform that financial institutions use to provide better and targeted products and services to a broader consumer base.

- Management believes that QFIN could deliver double-digit origination volume amidst the current macro environment.

- It is quite interesting that clients don’t need a lot of human interaction. Over 83% of collections are executed by robots.

- The company was incorporated in the Cayman Islands, where shareholders are not that protected.

polesnoy/iStock via Getty Images

360 DigiTech, Inc. (NASDAQ:QFIN)’s guidance includes significant business growth in 2022, and analysts are quite optimistic. In my view, with further innovative artificial technology to identify borrowers and more agreements with financial institutions, revenue growth will trend north. With that, in my view, the stock is not for investors who are not specialized in Chinese stocks. Conservative investors may also not be interested in the stock because it was incorporated outside the United States.

QFIN’s Previous Figures Are Impressive, And The Guidance Is Also Beneficial

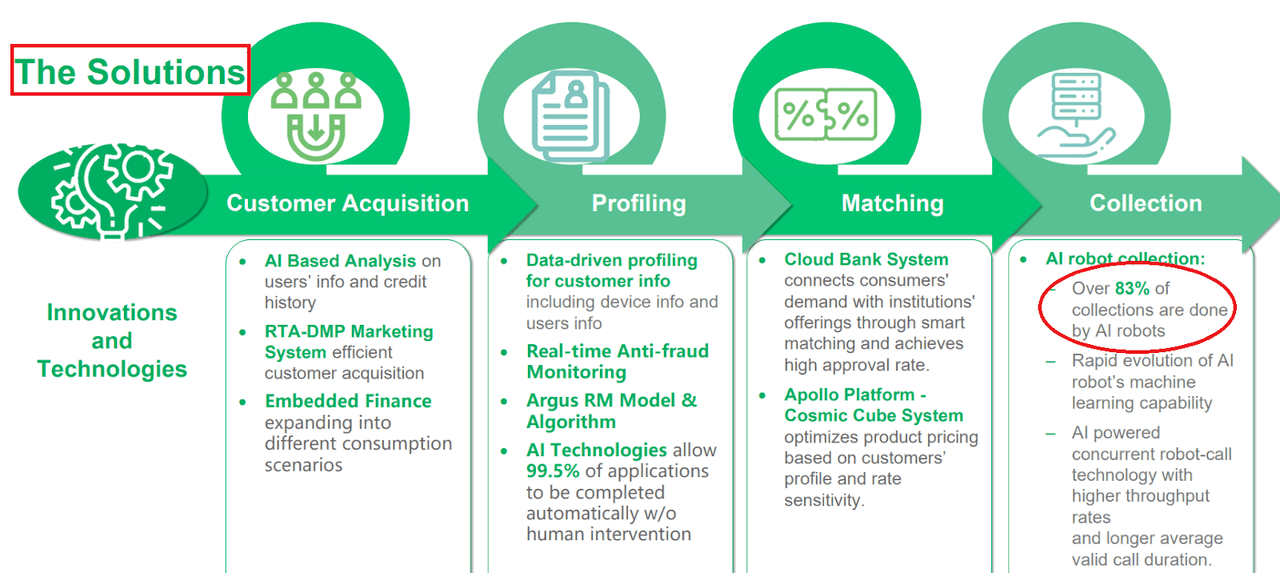

360 DigiTech, Inc. is a credit-tech platform that financial institutions use to provide better and targeted products and services to a broader consumer base. QFIN uses AI based analysis and data-driven profiling to collect and assess information about clients. It is quite interesting that clients don’t need a lot of human interaction. Over 83% of collections are executed by robots:

Investor Presentation

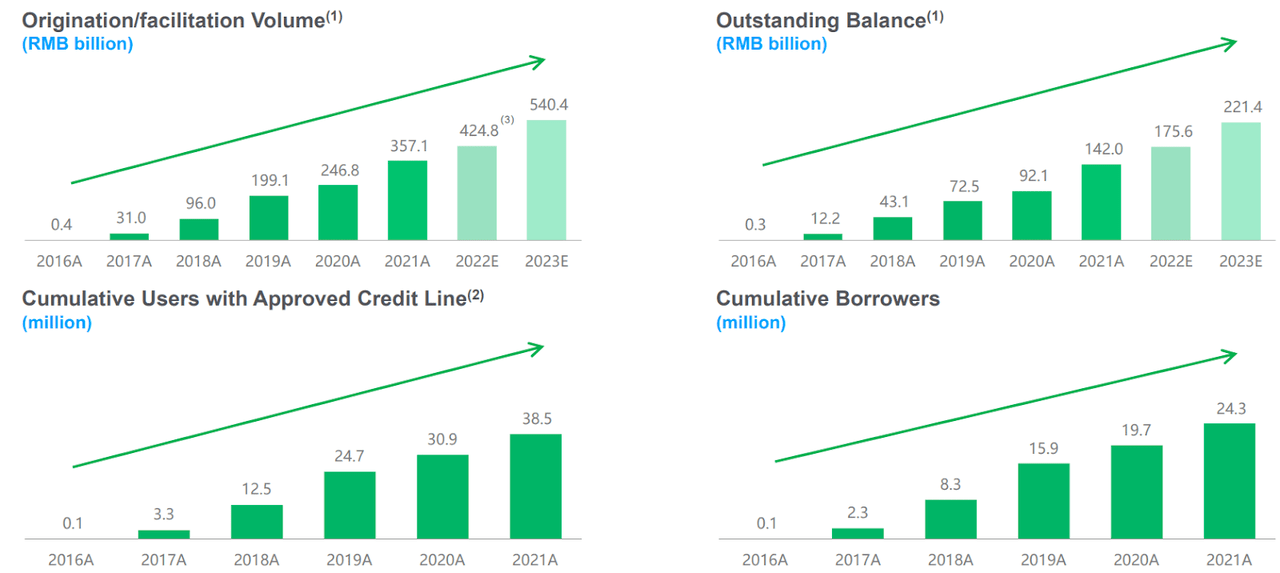

The results of QFIN’s technology include 24.3 million cumulative borrowers by 2021, an impressive increase in the amount of origination volume.

Investor Presentation

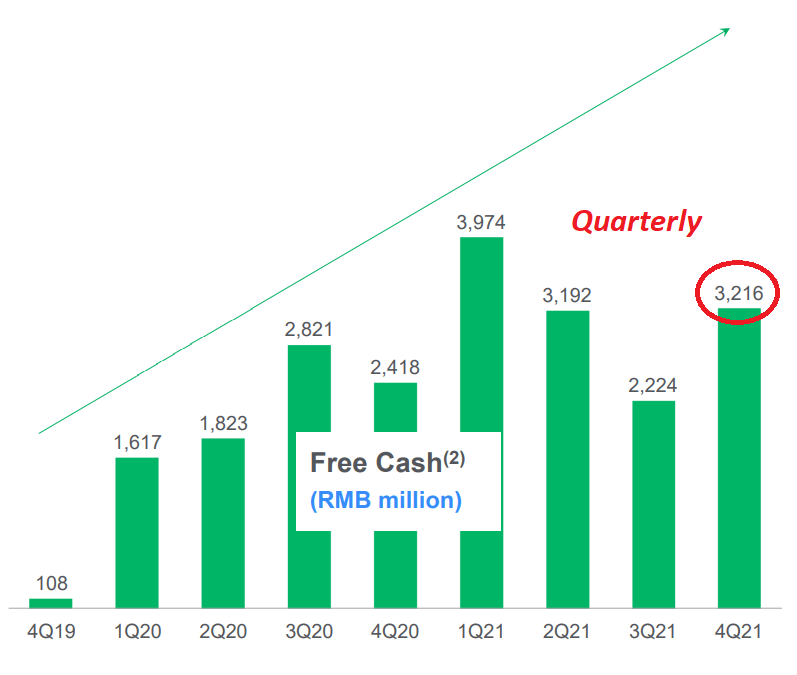

If I can go straight to the point, the free cash flow grew from close to CNY1.6 billion in Q1 2020 to more than CNY3.2 billion in 2021. In sum, the company’s technology seems to be working pretty well for financial institutions.

Investor Presentation

In the most recent 10-Q, management released a very beneficial outlook. Management believes that QFIN could deliver double-digit origination volume amidst the current macro environment. QFIN also believes that asset quality will likely improve gradually later in 2022.

Given the current macro environment and the resurgence of COVID-19, the company would like to maintain its outlook for loan facilitation and origination volume for 2022 at between RMB410 billion and RMB450 billion, representing year-on-year growth of 15% to 26%.

Overall, we believe asset quality will gradually improve later in the year, particularly in the second half, primarily due to our further penetration into better user segments. Source: 10-Q

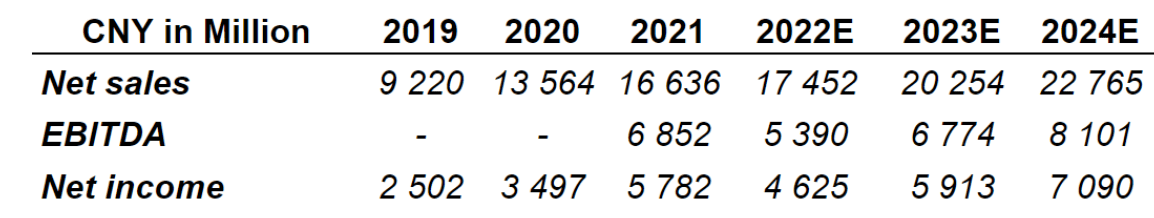

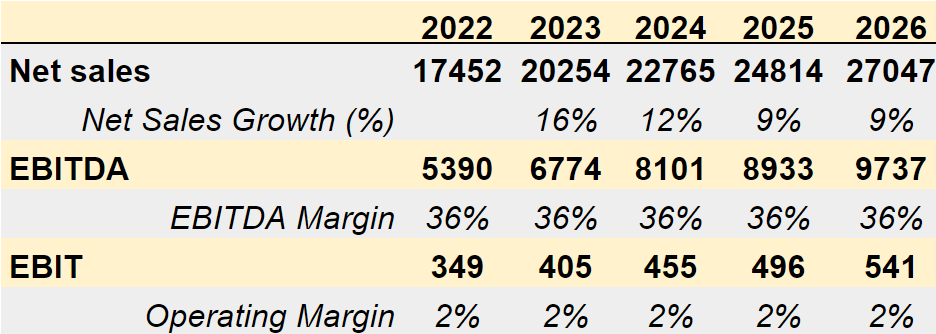

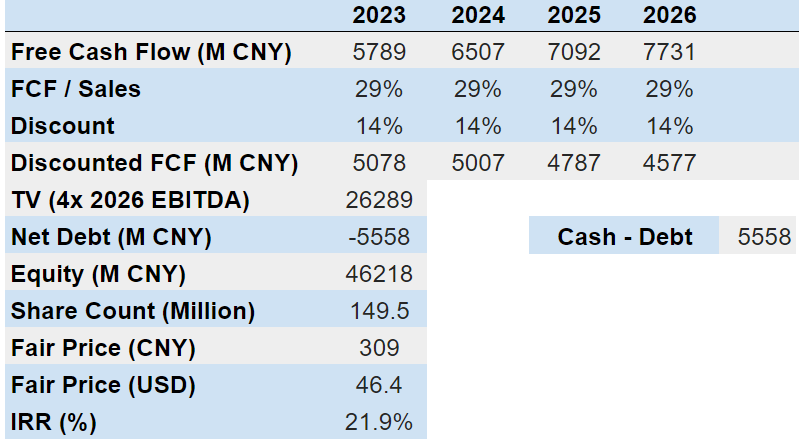

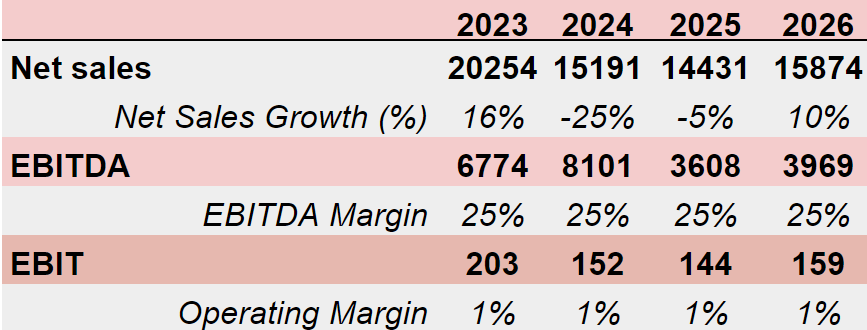

Investment analysts are quite optimistic about the next three years. Analysts expect sales growth until 2024, revenue of CNY22 billion in 2024, and 2024 EBITDA of CNY8.1 billion.

marketscreener.com

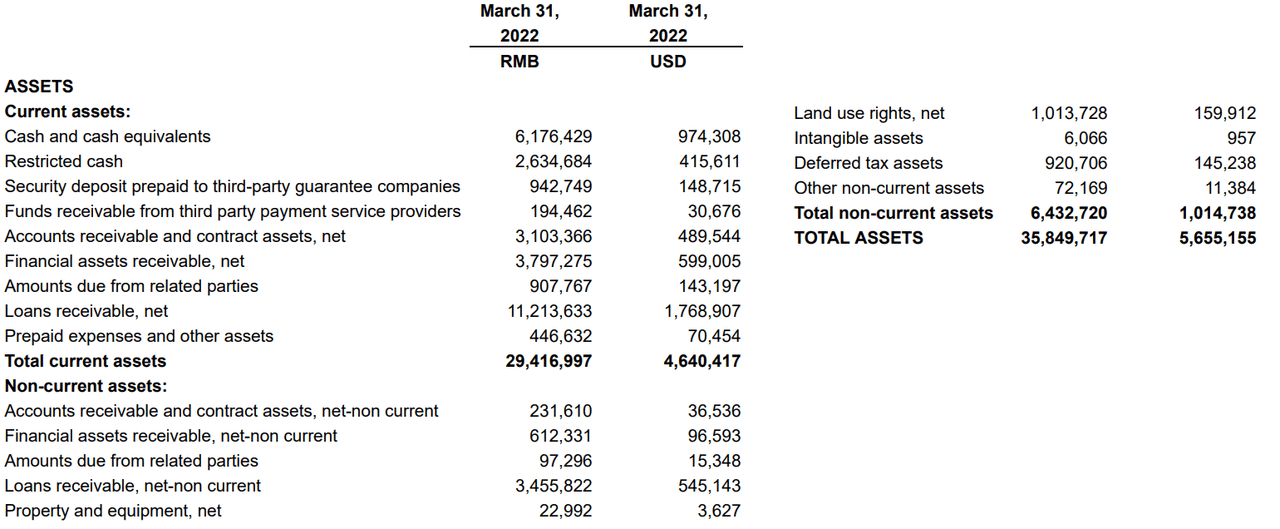

Balance Sheet

With $5 billion in total assets and $3 billion in total liabilities, QFIN appears to have a healthy balance sheet. The company also reports $974 million in cash and $4.6 billion in current assets. In my view, management owns sufficient liquidity to finance further innovative technology as well as to invest in new loans.

10-Q

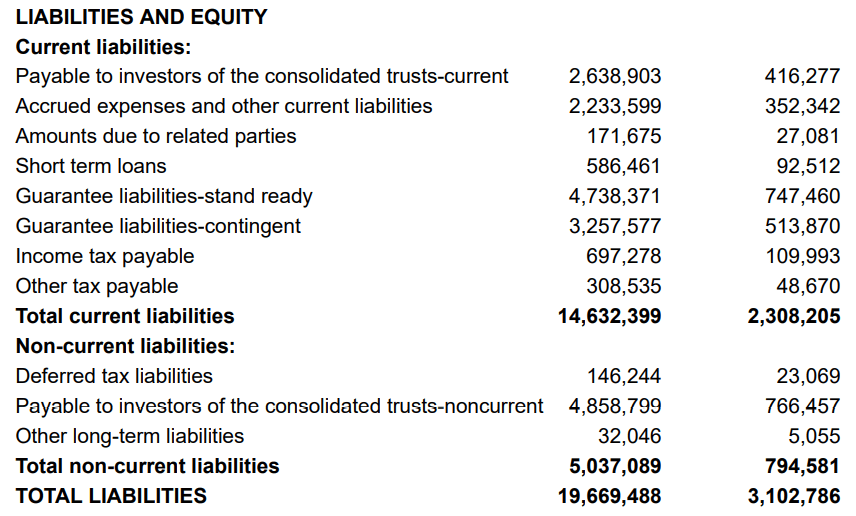

With regards to the loans received, QFIN reports short-term loans worth $92 million and $766 million payable to investors. Considering the information reported in the last balance sheet, I believe that most investors will not be afraid of the company’s financial debts.

10-Q

More Machine Learning And More Financial Partners Implied A Stock Price Of $34

Under this case scenario, I expect that the company’s system for fraud detection, Argus Engine, will continue to be effective. Let’s note that management uses a significant number of automated approaches to detect and assess credit scores.

Our ability to effectively segment borrower risk profiles impacts our ability to attract and retain borrowers, as well as our ability to offer financial institution partners attractive risk-adjusted returns. We have developed and deployed the Argus Engine to conduct fraud detection and risk assessment and to create personalized collection strategy, which will scrutinize the data we collected in a highly automated approach and output credit scores to our Cosmic Cube Pricing Model to price each drawdown. Source: 10-K

In my view, QFIN’s machine learning capabilities will help analysts prevent asset losses:

Thanks to the strong machine learning and analyzing capability of our Argus Engine, we can draw profiles of our prospective borrowers and effectively prevent potential asset losses. Source: 10-K

Furthermore, if QFIN manages to enter into new collaboration agreements with institutions, revenue growth would be substantial. Management has successfully signed agreements with 119 financial institution partners. I don’t see why new banks wouldn’t be willing to work with QFIN:

We have established cooperative relationships with a wide array of financial institution partners, and are further diversifying the financial institution partner pool. As of December 31, 2021, we had entered collaboration agreements with 119 financial institution partners. Source: 10-K

I believe that QFIN could report sales growth between 16% and 9% from 2022 to 2026. If we also assume an EBITDA margin of 36%, 2026 EBITDA would stand at CNY9.7 million.

Arie Investment Management

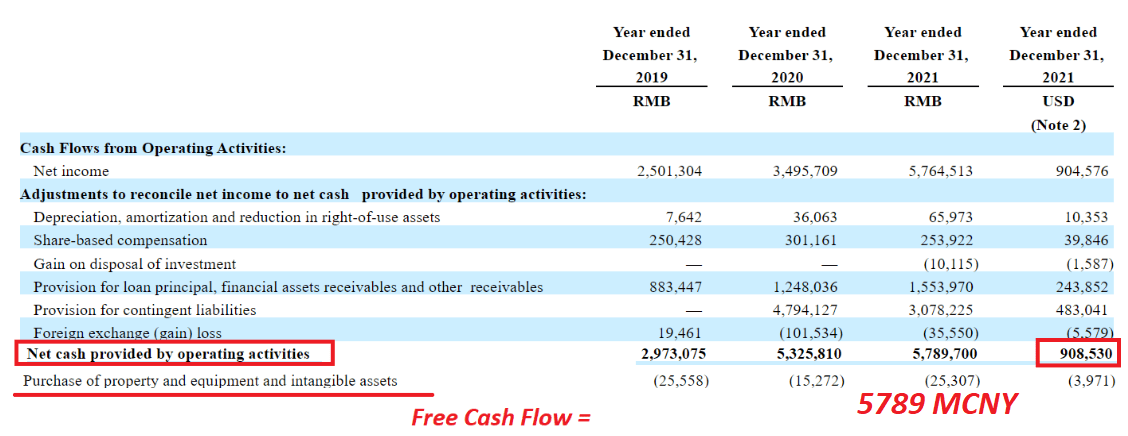

In 2021, QFIN reported a net income of CNY5.764 billion and free cash flow close to CNY5.789 billion. Given that the total amount of capital expenditures is not significant because QFIN is an online business, the CFO is close to the free cash flow.

10-K

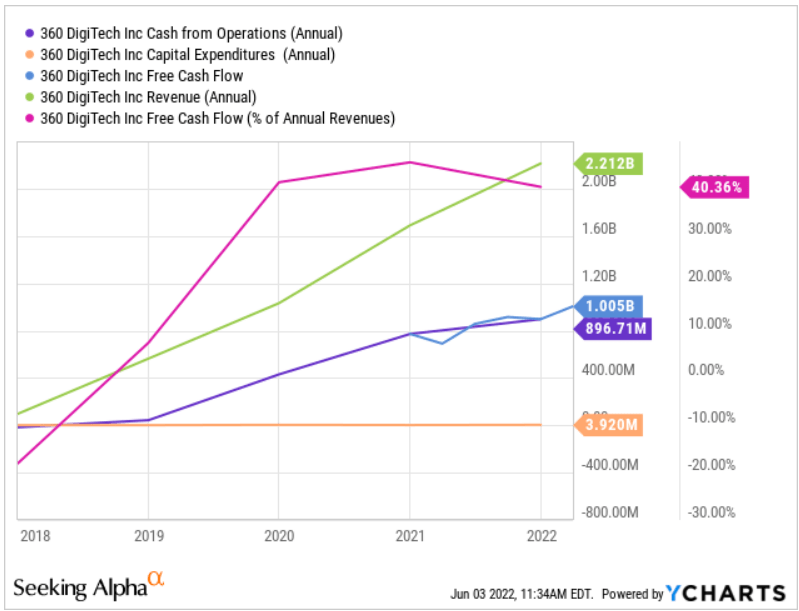

In order to understand what future financial statements would look like, I took a look at QFIN past financials and estimates by the analysts. In the past, QFIN reported an FCF/Sales ratio close to 40%, revenue growth sometimes close to double-digits, and small capital expenditures.

YCharts

If we assume a conservative free cash flow/sales of 29%, I believe that QFIN could report 2026 free cash flow close to CNY7.7 billion. I tried to be as conservative as possible as QFIN has been a volatile stock. With a discount of 14% and an exit multiple of 4x, the implied price would be close to $46.4 per share.

Arie Investment Management

My Worst-Case Scenario Implied A Valuation Of $12.40

QFIN could suffer significant damage if PRC government authorities change the regulatory framework that governs the industry. As a result, QFIN’s business model could not be profitable because it may need more financial resources. The company could also lose its licenses and permits to operate. In sum, the results would include a decline in revenue, free cash flow, and the stock price:

We conduct our business primarily through our subsidiaries, our VIEs and their subsidiaries in China. Our operations in China are governed by PRC laws and regulations. As of the date of this annual report, our PRC subsidiaries, our VIEs or their subsidiaries have obtained the requisite licenses and permits from the PRC government authorities that are material for the business operations of our holding company, our PRC subsidiaries and our VIEs in China, including, among others, financing guarantee business license owned by Fuzhou Financing Guarantee and Shanghai Financing Guarantee, value-added telecommunications license owned by Shanghai Qiyu, the incorporation approval of Fuzhou Microcredit. Source: 10-K

QFIN sells shares through a company incorporated in the Cayman Islands, where the securities regulation is very different from that of the United States. Shareholders are not as protected as investors of companies incorporated in the United States. If a sufficient number of investors notice, I believe that QFIN’s cost of equity would increase. As a result, in my view, the discount could increase, which would lower the company’s stock valuation.

We are an exempted company incorporated under the laws of the Cayman Islands with limited liability. As a result, it may be difficult or impossible for you to effect service of process within the United States upon these individuals, or to bring an action against us or against these individuals in the United States in the event that you believe your rights have been infringed under the U.S. federal securities laws or otherwise. The rights of shareholders to take action against the directors, actions by minority shareholders and the fiduciary duties of our directors to us under Cayman Islands law are to a large extent governed by the common law of the Cayman Islands. In addition, Cayman Islands companies may not have standing to initiate a shareholder derivative action in a federal court of the United States. Source: 10-K

QFIN could also suffer significantly if the company cannot sell shares in the United States. Let’s note that the SEC is generating large trouble for companies listed in the United States, but not audited by PCAOB-registered audit firms. If QFIN cannot sell shares in large exchanges, it may hold less cash in hand, which may damage the business.

In accordance with the HFCAA, the SEC shall prohibit a company’s shares or American depositary shares from being traded on a national stock exchange or in the over-the-counter trading market in the United States if the company has been identified by the SEC for three consecutive years due to PCAOB’s inability to inspect the registered public accounting firm’s working paper. The Company will continue to monitor the process of the resolution of such issues between regulators in China and the United States and comply with applicable laws and regulations in both China and the United States. Source: Press Release

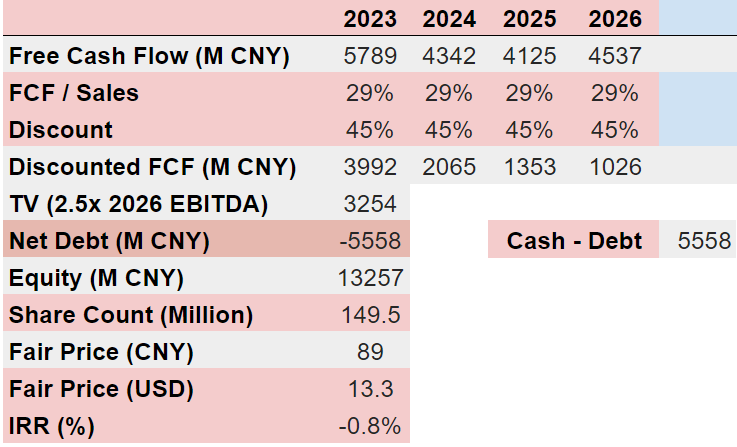

I assumed a decline in sales growth; -25% in 2024 and -5% in 2025. I also assumed a rebound in 2026. I obtained net sales of CNY15 billion and an EBITDA close to CNY40 billion with an EBITDA margin of 25%.

Arie Investment Management

Considering a free cash flow margin of 29%, I obtained 2026 free cash flow of CNY4537 million. Now, with an exit multiple of 3.5x and a weighted average cost of capital of 45%, the implied fair price would be close to $12.5. I believe that my figures are conservative.

Arie Investment Management

Conclusion

QFIN owns sophisticated machine learning technology and close to 119 agreements with financial institutions. I believe that management will most likely continue to deliver cumulative borrowers growth and net revenue. Both management and analysts are optimistic about the future. With that, the stock is not for everybody as it involves significant risks. The SEC is threatening to push for the delisting of Chinese stocks. The company was incorporated in the Cayman Islands, where shareholders are not that protected. In sum, QFIN is undervalued, but the company is not for conservative investors.

Disclosure: I/we have a beneficial long position in the shares of QFIN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.