3M Company Stock Still Overvalued

Summary:

- While 3M has lost about 29% of its market value year-to-date, we still believe that the company’s stock is overvalued.

- The macroeconomic headwinds, the potential costs related to legal claims and the latest news about the firm potentially becoming an activist target may not be fully priced in yet.

- We reiterate our “sell” rating.

jetcityimage

The 3M Company (NYSE:MMM) operates as a diversified technology company worldwide. It operates through four segments: Safety and Industrial; Transportation and Electronics; Health Care; and Consumer.

The aim of our writing today is to determine what the fair value of 3M’s stock could be, with a particular focus on their dividends and dividend growth.

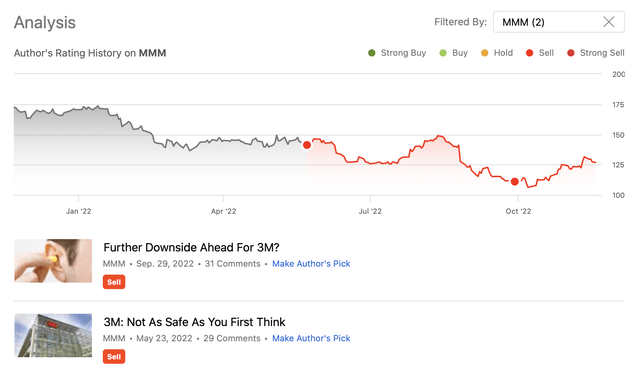

We have published two articles on Seeking Alpha this year, rating the company’s stock as a “sell” both times.

Rating history (Author)

In our first article, we focused on the increasing raw material prices and decreasing manufacturing productivity combined with the downward trending margins and the potentially significant costs that may be associated with the ~ 280,000 pending legal cases.

In the second writing, we have given an update on the steps that the firm is planning to take/ has taken to mitigate (at least partially), while we also gave an update on the development of macroeconomic environment, 3M’s full year guidance and their quarterly results.

Now, to value 3M’s stock, we will be using the Gordon Growth Model.

Valuation of 3M’s stock

Gordon Growth Model

The Gordon growth model (‘GGM’) is a simple and well-recognised dividend discount model, used to value the equity of dividend paying firms. The main assumption of this model is that the dividend grows indefinitely at a constant rate. Due to this criterion, the growth model is particularly appropriate for firms that are:

1.) Paying dividends

2.) In the mature growth phase

3.) Relatively insensitive to the business cycle

A strong track record of steadily increasing dividend payments at a stable growth rate could also serve as a practical criterion if the trend is expected to continue in the future.

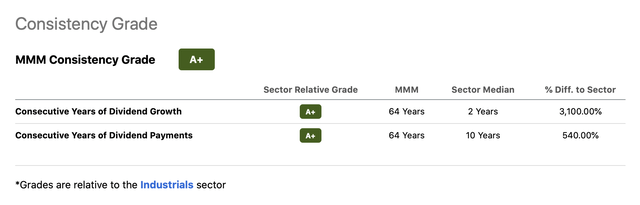

Is 3M fulfilling these criteria?

Well, the firm has a been paying dividends each year in the last 64 years and they have even managed to increase these payments each year. Many investors are interested in 3M for their solid track record of dividend payments and this is the reason why we decided to focus on these payments today for our valuation today.

Dividend history (Seeking Alpha)

3M is also in the mature growth phase, which makes it a suitable candidate to be valued, using a dividend discount model; however, it is not entirely insensitive to the business cycle (even, if the dividend payments so far have been).

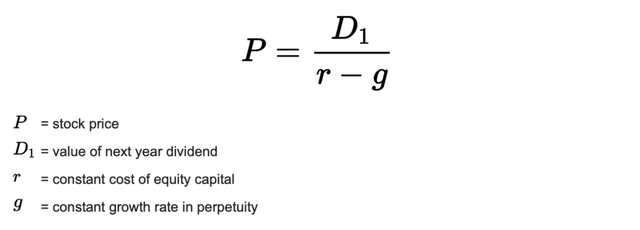

Now, to go forward, we also have to understand what is exactly behind the Gordon Growth Model. The model can be described by the following formula:

GGM (wallstreetprep.com)

In order to make a meaningful evaluation, we have to make sure that the assumptions with regards to the input data are realistic and relevant. The two main input assumptions are the required rate of return and the constant growth rate in perpetuity.

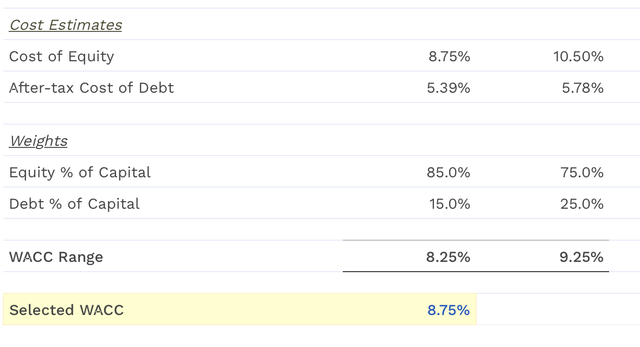

1.) Required rate of return

Most of the time, we prefer using the firm’s weighted average cost of capital as our required rate of return. 3M’s WACC is estimated to be 8.75%.

WACC (finbox.com)

2.) Constant dividend growth rate in perpetuity

We will take a look at 3M’s historic dividend growth figures to try to come up with a reasonable range of potential dividend growth.

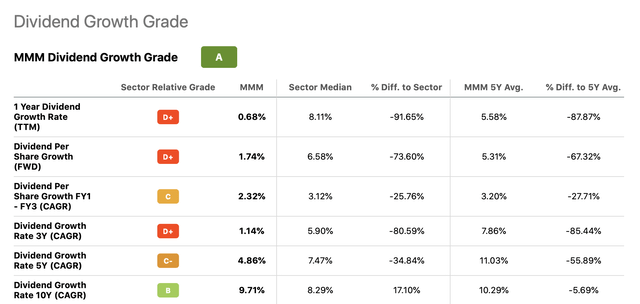

Dividend growth (Seeking Alpha)

While the 10Y CAGR and 5Y CAGR values are relatively high, growth has substantially slowed in the recent years.

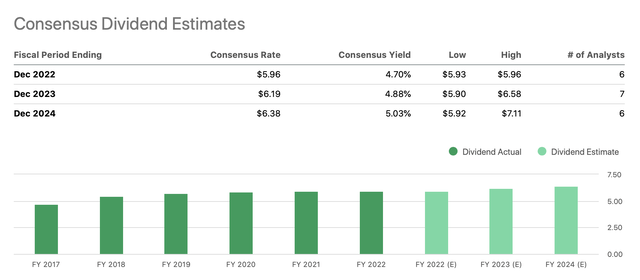

Analysts for the next two years are expecting that dividend will grow to $6.19 in 2023 and $6.38 in 2024. This represents a roughly 3.5% growth, annually.

Dividend estimates (Seeking Alpha)

In our opinion, a reasonable range could be 2% to 4%.

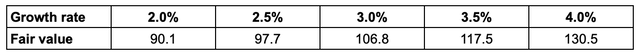

The following table shows the results of our fair value calculation (in USD per share) using an 8.75% required rate of return and the above defined range of constant sustainable dividend growth rate.

Fair value per share in USD (Author)

Currently, 3M’s stock is trading around $127, which is at the higher end of this range, indicating that there is potentially substantial further downside for the stock.

Uncertainties at 3M

While in the dividend discount model we can account for risk and uncertainty by changing the required rate of return and dividend growth assumptions, it does not directly take into account the risk and uncertainty related to specific issues.

We would like to highlight three of these now:

1.) How will legal claims impact 3M’s ability in the future to pay dividends?

For our calculation we have assumed that the firm will be able to pay dividends forever and that these payments would even grow forever. However, taking into account the recent developments, especially that the firm has been once again sued, it may not be the case.

2.) How will macroeconomic factors impact 3M’s ability in the future to pay dividends?

In general, we believe that the macroeconomic headwinds are likely to be temporary in nature. While in the near term we expect that they will be negatively impacting the firm’s margins and overall financial performance, in our opinion they should not have a lasting effect on the firm’s ability to pay dividends. Also 3M’s current dividend covered ratios is 1.71, which means that they can easily afford the dividend, even if earnings declined slightly due to the headwinds. (While 1.71 is substantially below the sector median, it is in line with the firm’s 5Y average)

3.) Is 3M an activist target?

According to the latest 13-F filings, many have started speculating that maybe 3M has become a potential activist target. The impact of such a development also needs to be taken into consideration, when investing in 3M’s business.

For these reasons, we would like to see 3M’s stock to drop to our lower end of the range, before we would consider investing. While a 20% to 25% drop seems a lot now, the stock price as actually dropped about 29% year-to-date and has been on a declining trend in the last 5 years, losing more than 45% in the period. Therefore, we believe that another 20% to 25%, especially considering the recent developments, is not unlikely.

Key takeaways

Despite the 29% drop in share price year-to-date, we believe that 3M’s stock is still overvalued based on its dividends and potential dividend growth.

In our opinion, the macroeconomic headwinds, the potential costs related to legal claims and the latest news about the firm becoming an activist target are not yet fully reflected in the stock price.

We reiterate our “sell” rating.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.