Summary:

- AbbVie is a global biopharmaceutical company with a large portfolio of drugs and therapies.

- Its most successful drug, Humira, is facing a loss of exclusivity in 2023.

- Investors have heavily penalized AbbVie on Humira without giving much attention to the fast growth of Skyrizi and Rinvoq that can potentially replace Humira by 2025.

vzphotos

A few months ago, I wrote a positive article on AbbVie, Inc. (NYSE:ABBV), arguing the company has been over penalized for the upcoming Humira loss of exclusivity (“LOE”). Since my article, ABBV has provided close to 10% total return, outperforming the S&P 500 Index.

Recently, the company reported its Q3 earnings. Have my views changed post the report?

After carefully reviewing the quarterly earnings report, I am reaffirming my bullish view on AbbVie. Investors continue to over-penalize AbbVie for the upcoming U.S. LOE on Humira, without giving enough attention to the rapid growth of its other therapies like Skyrizi and Rinvoq that can potentially replace peak Humira sales by 2025.

In-line Quarter

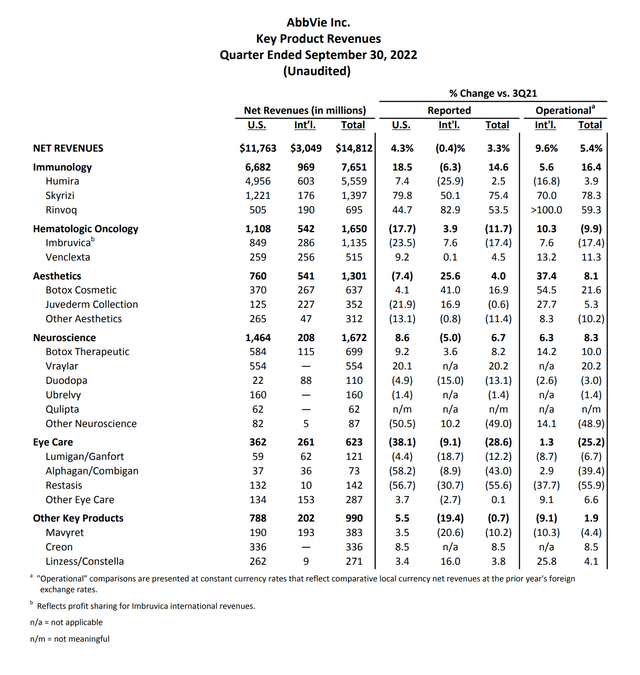

Recently, AbbVie reported its Q3 earnings, with revenues of $14.8 billion (+3.3% YoY) and adj. EPS of $3.66 (+29.3% YoY). Although revenues were a slight miss to estimates, adj. earnings came in ahead by 2.7%.

International Humira Sales Continue Declines

Humira, AbbVie’s blockbuster drug, continued to deliver strong sales, with global revenues of $5.6 billion, a 2.5% YoY increase (Figure 1). However, international sales of Humira dropped 25.9% YoY, an acceleration from a 13.8% decline in Q2. The accelerated decline spooked markets, and AbbVie’s stock fell 4% pre-market on the earnings announcement.

Figure 1 – AbbVie Q3/2022 product sales (AbbVie Q3/2022 press release)

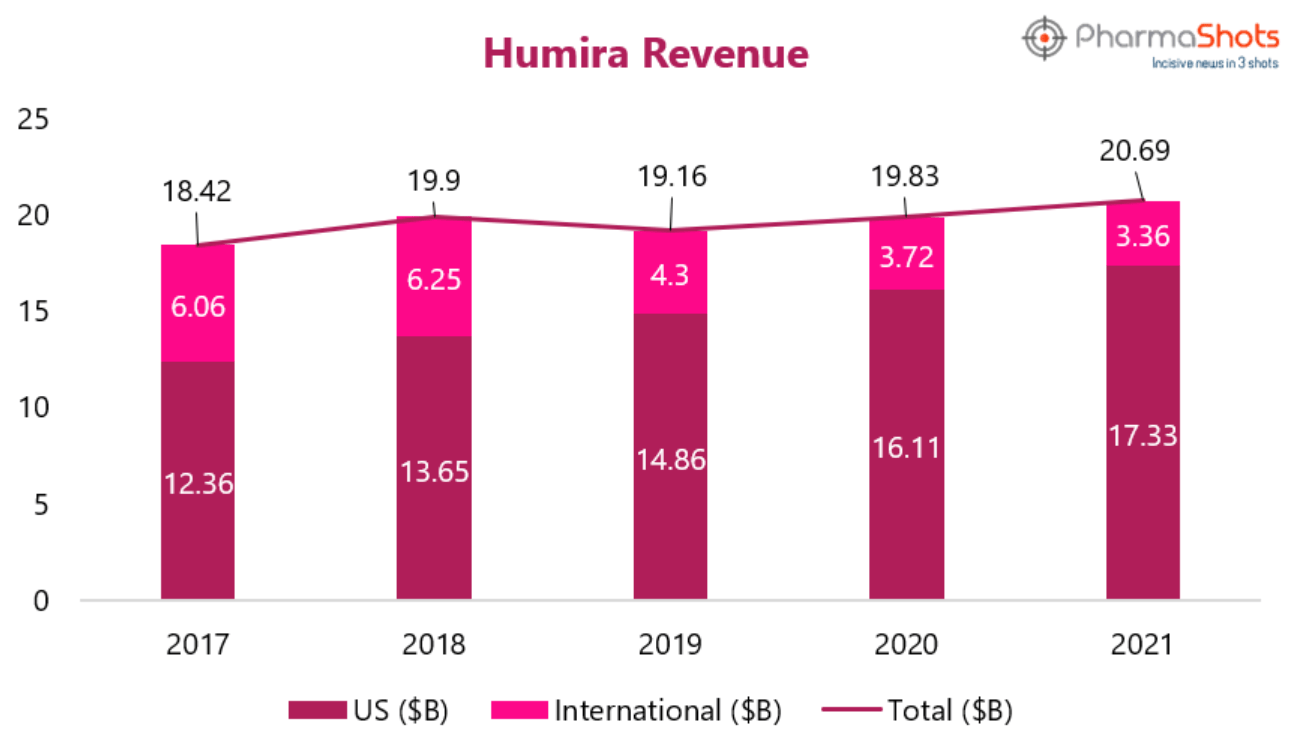

The international Humira sales decline was not unexpected, as biosimilars were introduced in Europe in 2018. In fact, YTD, international Humira sales have been over $2 billion (down 20.9% YoY from $2.6 billion in 2021). If international sales continue to follow trend, 2022 will end up at over $2.6 billion in sales, still a blockbuster drug by any definition. The key question is, after 4 years of declines, at what level will international Humira sales stabilize at, if ever (Figure 2)?

Figure 2 – Historical Humira sales (pharmashots.com)

Full Year Guidance Maintained

Despite the negative headlines on international Humira sales, the 3rd quarter was actually fairly uneventful. AbbVie tightened its full year adj. EPS guidance to $13.84 – $13.88 / share (from $13.76 – $13.96 previously), with the midpoint in line with consensus at $13.86.

Skyrizi And Rinvoq On Track To Grow

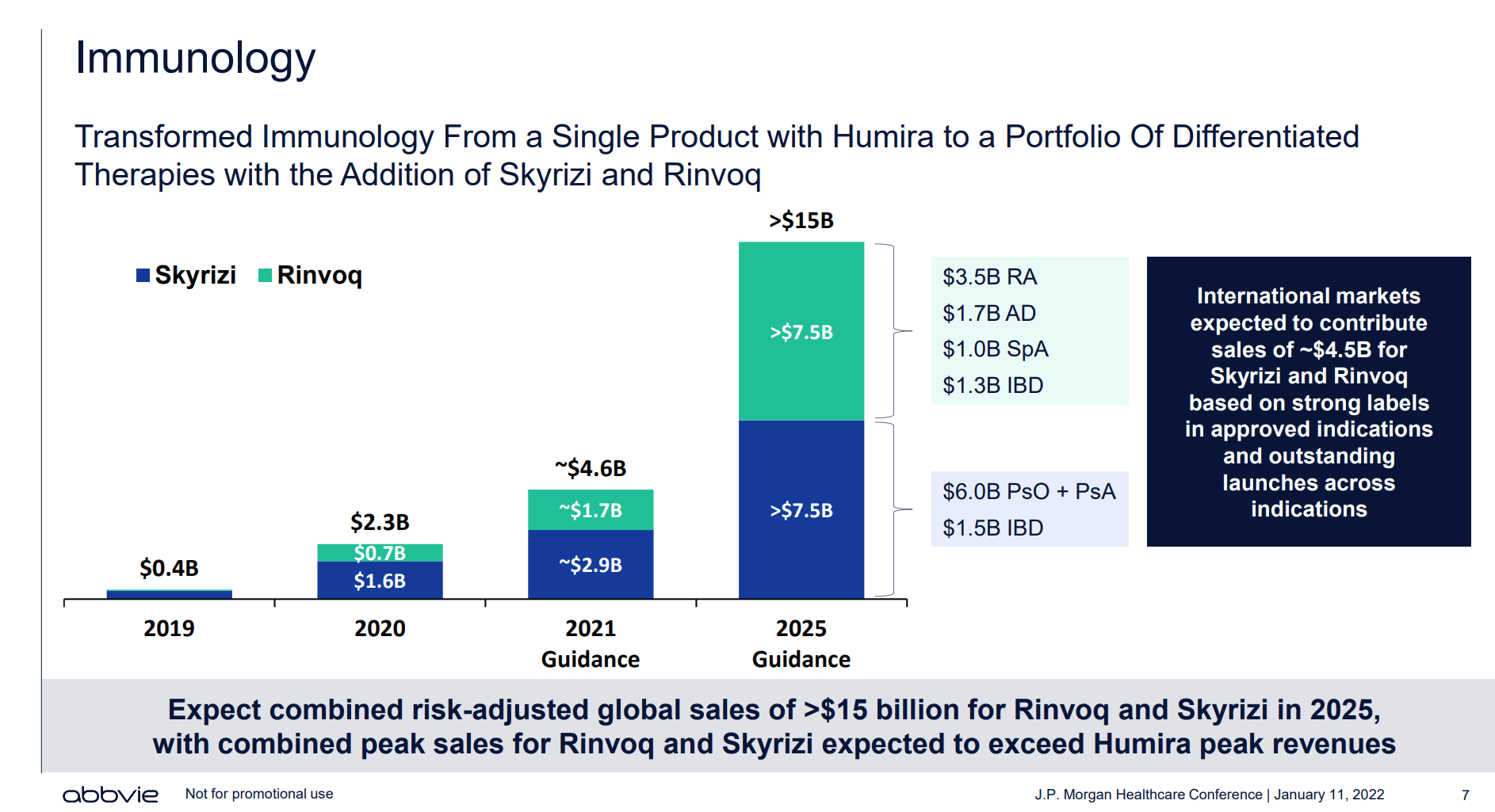

My bullish thesis partly rests on the underappreciated nature of AbbVie’s growth pipeline. In particular, the company had previously highlighted the possibility of immunology therapies Skyrizi and Rinvoq combining to replace Humira by 2025 (Figure 3).

Figure 3 – AbbVie expects Skyrizi and Rinvoq to replace Humira (ABBV investor presentation)

So far, that thesis continues to be on track as Skyrizi reported $1.4 billion (+75.4% YoY) in Q3 sales and Rinvoq saw $0.7 billion (+53.5% YoY). Combined, the two therapies recorded $5.3 billion in YTD sales, +68.1% YoY vs. $3.2 billion in the first 3 quarters of 2021. Mathematically, to go from $4.6 billion in 2021 to $15 billion by 2025 requires 34.4% CAGR growth, so AbbVie is well on track with YTD growth of 68%.

Dividend Increased By 5%

Another small positive in the quarter was a 5% increase in the dividend to $1.48 per quarter, beginning in February 2023. This reflects the company’s strong commitment to returning cash to shareholders.

Shareholders are paid a 3.8% dividend yield to wait until the company returns to growth in 2025.

Wall Street Coming Around To My Thesis

Also encouraging is the fact that UBS recently added AbbVie to its 2023 stock focus list with the essentially the same thesis that I had months ago:

“We believe the market is over penalizing ABBV for the expected decline to its leading Humira franchise – as biosimilars launch in 2023 in the US – and underappreciates ABBV’s growth potential from its diverse product mix.”

Risk

The biggest risk continues to be the upcoming U.S. LOE on Humira. If U.S. Humira sales fall faster than expected following LOE, there is risk to overall revenues and earnings until pipeline products like Skyrizi and Rinvoq can grow enough to backfill lost sales.

Conclusion

I am reaffirming my bullish view on AbbVie shares after the inline Q3 earnings report. Investors continue to over-penalize AbbVie for the upcoming U.S. LOE on Humira, without giving enough attention to the rapid growth of its other therapies like Skyrizi and Rinvoq that can potentially replace peak Humira sales by 2025.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.