3M: This Is What A Bargain Looks Like

Summary:

- 3M is now trading at a very low valuation and pays a historically high dividend yield.

- The less-than-impressive guidance and litigation overhang appear to be more than baked into the share price.

- It’s investing in high-growth areas, and patient value and income investors could see potential strong long-term returns.

MarsBars

Having read many comments here on SA over the years, a common thread is “I would love to buy stock X at Y Price”, with the price target usually being significantly lower than where the stock is currently trading.

What often gets missed, however, is that no stock is going to plunge by such a material amount without having some macro or microeconomic headwinds that pressure its revenue and earnings.

That’s why it’s important to put a value hat on during those times, and evaluate whether the company is truly a bargain or a value trap.

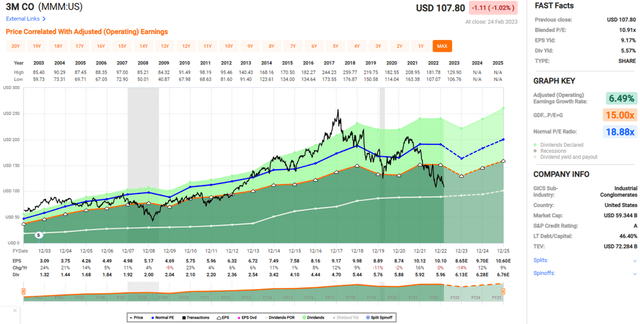

This brings me to 3M (NYSE:MMM), which as shown below, is not only trading at a 1 year low, but also a decade low at the current price of $107.80.

While there are legitimate reasons for why 3M is cheap, in this article, I explore why sentiment is too pessimistic, setting up long-term value investors for potentially strong returns from here.

Seeking Alpha

Why 3M?

3M is a diversified industrial conglomerate with operations in more than 60 countries. The company’s businesses include industrial adhesives/abrasives, health care, safety and security, transportation, and electronics. Notably, 3M has paid an uninterrupted dividend for over 100 years, and raised it for 64 consecutive years, making it a member of the elite S&P 500 (SPY) Dividend Aristocrats index.

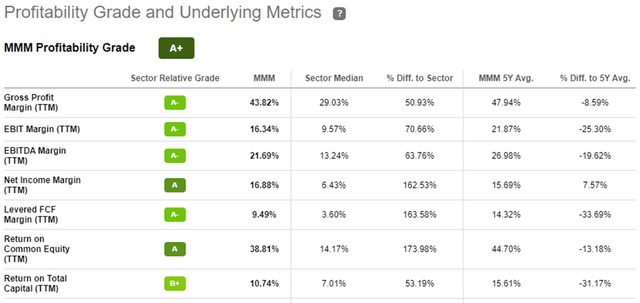

3M is sometimes known as a “GDP plus” company, as it derives a moat from its track record of research and development which has led to a great number of innovations that drive growth. This is reflected by the over 100,000 patents that it has to its name, and despite recent cost inflation pressures, it still maintains an A+ profitability grade with gross, EBITDA, and net income margins that sit well ahead of the sector median, as shown below.

Seeking Alpha

It goes without saying that 3M, as an industrial company, has faced margin pressures in the current cost inflationary environment. This is reflected by adjusted operating margin being down by 90 basis points YoY to 19.1% during the fourth quarter.

Moreover, sales dropped by 6% YoY, to $8.1 billion during Q4. Much of this, however, was due to divestures including 3M’s exit from Russia, and a negative 5% impact from foreign currency translation due to strength of the U.S. dollar. Encouragingly, organic sales still grew, albeit slowly, at 0.4% YoY.

Market sentiment, however, appears to still weigh negatively on 3M’s share price, as management guided for negative 3% to flat adjusted organic sales growth for the full year 2023, due to decline from disposable respirators (coming off the Omicron surge last year) and from its exit from Russia.

While the near-term appears to be unimpressive for 3M, I believe the long-term thesis remains intact, as it retains leadership positions in its core lines of business and seeks to unlock value for shareholders through spin-off of its healthcare segment. This was highlighted by management’s comments during last week’s Global Industrial Conference, noting streamlining (which is often a euphemism for restructuring/workforce reduction) and high potential areas, as shown below:

We’re looking at all the things that we can do to simplify streamline and get closer to the customer. And we expect to take additional actions as we go through the year. At the same time, we continue to invest in innovation and growth.

And we’ve got a number of large commercial platform areas that we talked about as we went through the last couple of years that we’re investing in organic growth. And driving that organic growth areas like automotive electrification. It got to be a $0.5 billion business last year with 30% growth. So that’s an example of where we can invest and drive market growth and create value for our customers.

We have other areas that we are investing in electronics, safety. In health care, we have areas like biopharma processing, which I mentioned, but also advanced wound care. These are all significant commercial platforms that leverage 3M innovation and enable us to add up more of the portfolio that can help us drive GDP plus and deliver above the macro growth.

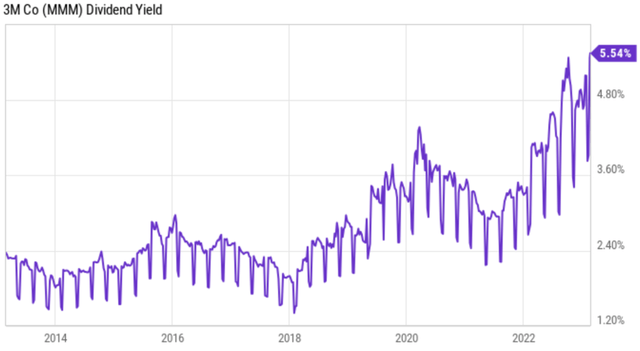

Meanwhile, 3M maintains a strong A rated balance sheet, and currently yields a high 5.6% that’s supported by a 59% payout ratio and 64 years of consecutive dividend raises. As shown below, 3M’s dividend yield is now at its highest level in over a decade.

(Note: the following chart shows TTM dividend yield, while the forward yield is 5.6%)

YCharts

Of course, 3M also has headwinds stemming from PFAS and combat earplugs litigation, but those are “old news” from a market standpoint, and appears to be more than baked into the share price.

At the current price of $107.80, 3M stock trades at a forward PE of just 12.5, sitting well under its normal PE of 18.9. Analysts expect a resumption to mid- to high-single digit EPS growth starting next year, and have an average price target of $124, which implies a potential 21% total return over the next 12 months.

FAST Graphs

Investor Takeaway

3M’s share price has materially sold off on less than impressive forward guidance and general macroeconomic concerns. However, the long-term thesis remains intact, with its streamlining efforts as well as continued investment in high growth areas such as automotive electrification. Given its historically high dividend yield and low valuation, it appears that headwinds are more than baked into the share price, offering long-term value and income investors an attractive entry point at present.

Disclosure: I/we have a beneficial long position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!