Summary:

- UnitedHealth Group is trading below its 5-Yr average P/E ratio. The stock went down along its healthcare services peers, but UNH is not like any other health provider.

- The company’s Optum businesses provide synergies and profitability its competitors can only dream of.

- The Optum Insight health-tech business surpassed $30B backlog and promises resiliency in the company’s industry-leading margins.

- Not many companies this large can confidently guide 13%-16% EPS CAGR well into the future.

- I find the fair value of the stock to be at $664, a rare 37.0% upside for a blue chip company like UNH.

Anchiy

UnitedHealth Group (NYSE:UNH) is the biggest health care company in the world in terms of market cap and revenues. Its main business is its health care insurance segment in UnitedHealthcare, but its Optum segment, which provides care delivery, pharmacy services and health-tech solutions such as analytics, payments, clinic & hospital management platforms and more, is the major value creator for the company. The company’s shares have declined along with the rest of its health care peers and underperformed the market in 2023. The decline resulted in a rare opportunity to buy UNH at a P/E ratio of 19.43 on its projected 2023 earnings, which is well below the company’s 5-Yr average P/E ratio of 22.3. I find the stock to be fairly valued at $664, based on a DCF model and a multiple analysis. Therefore, I believe UNH is a Strong Buy.

Company Overview

UNH operates as a diversified health care company in the United States. It operates under four segments – UnitedHealthcare, Optum Health, Optum RX and Optum Insight. UnitedHealthcare is an insurer. It provides health care benefits globally, serving individuals, employers, and Medicare & Medicaid beneficiaries. Optum Health is a national health care delivery platform which engages people in clinical sites, in-home and virtually, and provides primary, specialty, surgical and urgent care. Optum Insight operates in health-tech, and provides analytics, payments, and management technologies to the entire health system. Optum Rx provides pharmacy care services through its network of more than 67,000 retail pharmacies.

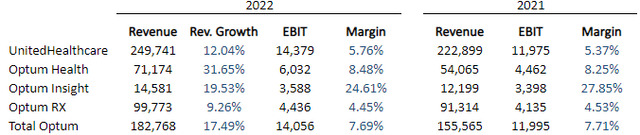

As you can see below, the higher margin segments are outpacing the growth of the lower margin ones:

Created by author based on UNH’s financial reports

Long-Term Guidance & Management

According to the management’s long-term guidance, which was provided on its 2022 investor day, the UnitedHealthcare segment is projected to have margins at around 5.5% in the future. Optum Health and Optum Insight are projected to see double digit revenue growth, with 9.0% and 20.0% operating margins, respectively. Optum Rx is projected to grow revenues by 6.5% at the mid-point, with operating margins of 4.0%. Management also reaffirmed its long-term guidance for consolidated 13%-16% EPS annual growth.

One thing that stands out is the ambition of UNH’s management. I strongly advise investors to watch the company’s investor day webcast. This is a company with a market cap of almost $0.5T, yet its management is as enthusiastic and as innovative as any management I’ve seen. They are not spending 50% of their investor day talking about sustainability efforts or other ESG matters. They are talking about new products and entering new geographies. They are setting very ambitious goals for a company this size and describe in detail the strategy to achieve them. In that regard, I believe the company’s management definitely justify a premium.

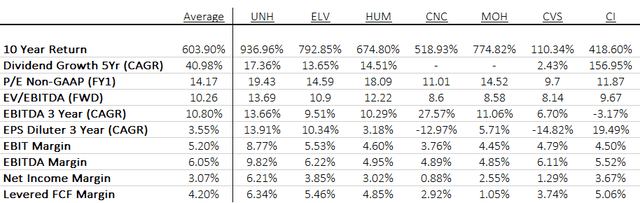

Competitors & Multiple Analysis

UNH is often associated with other large health insurers like CVS Health (CVS), Humana (HUM) or Elevance Health (ELV). The reality is UNH is a unique asset in the healthcare space, because of its scaled diversified business. The group operates the largest health insurer in the United States. It is operating a large-scale health provider network in Optum Health, while its competitors, like CVS, are only beginning to build primary care capabilities through M&A. In addition, UNH owns Optum Rx, one of the largest pharmacy services in North America, while companies like Amazon (AMZN) are only entering the field. More importantly, no other health insurer owns an asset like Optum Insight, with EBIT margins north of 20.0%.

It is necessary to understand the synergies in the UNH enterprise. Not only that the company can provide its customers with the best health care services, but it is also able to do so through a real value-based approach due to its presence in the entire value chain. In addition, it is able to demonstrate its services and products through its own use and acquire third party customers for its Optum businesses.

It is no surprise that when looking at its health care peers, UNH’s multiples appear to be inflated. It is also no surprise that UNH outperformed all its peers in terms of total return in the last ten years.

Created by author using data from Seeking Alpha. Data as of February 26th, 2023

The bottom line here is, I find the premium for UNH to be more than justified. The only real comparable to UNH, is UNH itself. In the last 5 years, the average P/E multiple of UNH was 22.3. During times of rising interest rates and deteriorating economic conditions, multiple contraction is inevitable. That being said, I believe patient investors will be more than rewarded buying UNH at current prices.

Valuation & Near-Term Projections

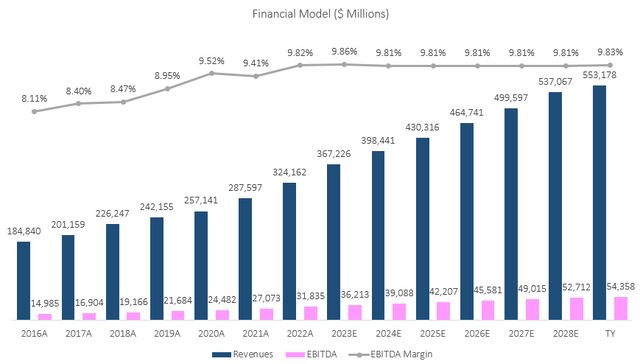

I used a discounted cash flow methodology to evaluate UNH’s fair value. I assume UNH will see revenues grow at a CAGR of 8.78% between 2022-2028, which is according to the company’s long-term guidance per segment. I believe revenues will grow at this pace due to backlog fulfillment at Optum Insight, and the company’s ability to keep or grow its market share in all the other segments. I project EBITDA margins to remain steady at around 9.8% due to higher MCR ratios offset by revenue mix and growth in the higher margin segments. Overall, my assumptions result in EBITDA growth at the same pace of revenues. This is slightly below management’s guidance on investor day of 10.0% operational growth in profits. In my opinion, the management’s long term 13.0%-16.0% EPS guidance will be met, though I forecast buyback contribution to be higher than 3.0%.

Created by author based on UNH’s financial reports and author’s projections

Taking a WACC of 8.75%, I estimate UNH’s fair value at $620.1B, which represents a 37.0% upside compared to its market value at the day of writing. While this does represent a high P/E multiple on 2023 earnings (26.6), I believe UNH is due for a significant multiple expansion based on the quality of its growth drivers, and the stability its traditional businesses provide.

Near Term Projections

In the near term, I believe the consensus is slightly off. For some reason, UNH does not get enough credit for constantly beating its own guidance and market expectations, which the company has done every year since 2008. While management is guiding for revenues of $360.0B at the high point, the consensus according to Seeking Alpha is $359.2B. In my opinion, UNH is going to beat its guidance once again. Specifically, I forecast 2023 revenues of $367.0B ($7.0B above guidance), and Q1-23 revenues of $90.1B, compared to the consensus of $89.7B. My EBIT forecast for the year is $32.3B, compared to the guidance mid-point of $31.8B. My earnings forecast for Q1-23 is $5.7B, compared to the consensus $5.4B. My forecast is mainly based on historical seasonality, using Q4-22 and Q1-22 as a baseline, and my assumption margins will improve in Q1-23 due to the earlier flu season. After its May earnings, we’ll find out who came closer to actual results, and I’ll update my model accordingly.

Risks

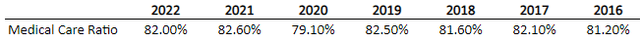

Increase in MCR ratios is always a concern when talking about health insurers. We can see based on the attention MCR received in UNH’s latest earnings call and investor day that this is a worry for some market participants. In that regard, I’d respectively advise investors to ignore quarterly fluctuations in MCR. It’s true that the Q4-22 MCR of 82.8% is higher than the company’s historical levels:

Created by author using data from UNH’s 10-K reports

However, MCR is higher during flu spikes. The 2022 flu season came a little early, which resulted in the aforementioned increase. As per the company’s management, this is neither surprising nor a cause for concern:

Throughout the pandemic, we’ve been making these references to baselines, et cetera. I think, now being three years into this pandemic, I’d like to just ground an anchor more to our expectations as COVID has waned. And what I’m most encouraged by is that the fourth quarter played out as we had expected. And what we had set out inside our pricing trends are lining up really nicely as we look forward to 2023.

To your comments around the flu, as I had suggested at our investor conference, we certainly saw that spike. We have now seen that start to wane for, I think, five consecutive weeks here as we’re moving forward. So to put it out like we had expected, really not a meaningful impact as I’m looking forward versus what we’ve planned for.

— Brian Thompson, CEO, UnitedHealthcare, Q4-2022 Earnings Call

Another cause for concern is the growing competition in the health care segments UNH currently dominates. We see outsiders like Amazon trying to enter the field, and old competitors like CVS trying to diversify their capabilities. While I do believe competitive pressures are increasing, it’s important to note that most of what we’re seeing is really consolidation via M&A. UNH has grown its operations tremendously along the likes of Oak Street Health (OSH) and Signify Health (SGFY), which are being acquired by CVS, and already is competing with 1Life Healthcare (ONEM) which is being acquired by Amazon. I do not believe UNH is expected to lose market share in the near term, and I believe the health care “pie” is going to grow larger and larger.

Conclusion

UnitedHealth Group is not only the leading health insurer in the United States. Its ancillary health operations under its Optum segment are growing fast with better margins and are what differentiates UNH from its competitors. Compared to its peers, UNH might look overvalued. However, compared to itself, the P/E ratio is signaling the stock is undervalued at the moment. As a very high quality and ambitiously managed blue chip, I find UNH to be a Strong Buy, with a fair value of $664, which is 37.0% above its price at the time of writing.

Disclosure: I/we have a beneficial long position in the shares of UNH, CVS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.